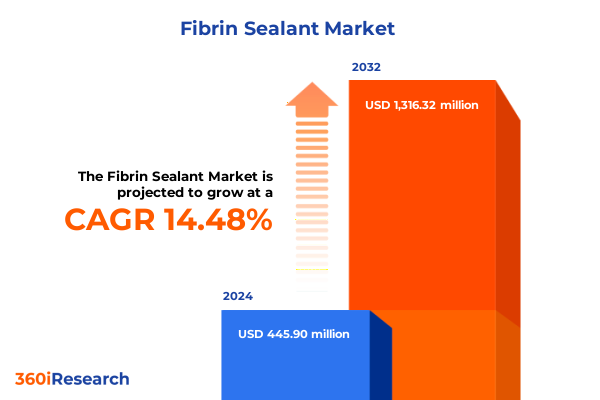

The Fibrin Sealant Market size was estimated at USD 510.03 million in 2025 and expected to reach USD 584.59 million in 2026, at a CAGR of 14.50% to reach USD 1,316.32 million by 2032.

Discover the evolving world of fibrin sealant and its clinical significance as a revolutionary hemostatic agent reshaping surgical outcomes and recovery trajectories worldwide

Fibrin sealant has emerged as a cornerstone of modern hemostatic management, offering surgeons a biologically inspired solution to control bleeding and promote tissue adhesion with precision. Unlike traditional mechanical methods, this advanced bioadhesive leverages the body’s native clotting cascade through fibrinogen and thrombin interaction, resulting in a stable fibrin matrix that facilitates rapid hemostasis and wound healing. Over the past decade, incremental refinements in formulation chemistry and delivery methodologies have propelled fibrin sealant beyond niche indications into mainstream surgical protocols, reflecting its capacity to reduce operative time, minimize transfusion requirements, and enhance patient safety profiles.

As the healthcare environment places an increasing premium on value-based outcomes, fibrin sealant aligns with the twin imperatives of clinical efficacy and cost containment. Its adaptability across various procedural contexts, coupled with mounting clinical evidence supporting superior hemostatic performance, has solidified its role in multidisciplinary care pathways. Furthermore, ongoing innovation in pre mixed ready-to-use kits and two component systems has streamlined intraoperative workflows, enabling surgical teams to integrate fibrin sealant without compromising procedural efficiency or sterility. Ultimately, this introduction lays a foundation for understanding how scientific innovation has transformed fibrin sealant from a specialized adjunct into a fundamental component of contemporary surgical practice.

Explore how innovation in formulation and delivery platforms has catalyzed expansion of fibrin sealant applications across diverse surgical specialties

In recent years, the fibrin sealant domain has undergone a profound metamorphosis, driven by technological breakthroughs and expanding clinical applications. The transition from manual application devices to advanced spray application platforms has granted clinicians unparalleled control over deposition patterns, enabling uniform coverage across complex anatomical surfaces and reducing product wastage. Concurrently, the maturation of two component kits has enhanced stability and shelf life, while pre mixed formulations have streamlined operating room logistics.

Beyond formulation and delivery innovation, the landscape has been reshaped by cross-disciplinary adoption. Once confined to cardiovascular and general surgery, fibrin sealant has penetrated neurosurgical and orthopedic specialties, where precision hemostasis is critical to preserving delicate neural structures and supporting robust tissue regeneration. Parallel gains in dental surgery applications underscore the sealant’s versatility, as practitioners leverage its adhesive properties to facilitate soft tissue management and expedite postoperative recovery. Collectively, these shifts highlight an ecosystem in flux, characterized by converging technological refinement and a broadening scope of clinical utility.

Analyze how 2025 United States tariff adjustments on key raw materials have catalyzed strategic supply chain realignment in fibrin sealant production

The cumulative effect of the United States implementing tariff adjustments in early 2025 has reverberated through the fibrin sealant supply chain, influencing procurement strategies and pricing dynamics. Tariffs levied on imported raw materials, notably high-purity human fibrinogen and recombinant thrombin components, elevated manufacturing input costs, prompting several global producers to reassess sourcing paradigms. In response, leading manufacturers have accelerated vertical integration initiatives, forging partnerships with domestic bioproduct suppliers to mitigate exposure to import duties and secure critical reagents at stable cost structures.

Moreover, end users have navigated these regulatory shifts by recalibrating inventory management practices. Hospitals and ambulatory surgical centers have increasingly favored two component kits produced within the United States to circumvent cross-border expense volatility. Clinics focused on elective procedures have similarly adapted purchasing cycles, allotting strategic buffer stocks to absorb tariff-induced price fluctuations. Though tariff pressures have introduced short-term margin compression, the market has exhibited resilience through adaptive supply chain realignment and collaborative engagement between producers and healthcare providers.

Uncover critical fibrin sealant segmentation dimensions spanning modality, procedure type, end user, formulation complexity, and delivery technology in clinical practice

Insights into fibrin sealant market segmentation reveal multifaceted adoption patterns shaped by product modality, clinical application, end user preference, formulation approach, and delivery technology. Liquid, patch, and spray formats each address unique clinical scenarios, with liquid sealants excelling in deep cavity hemostasis, patch systems offering structural reinforcement on larger defect sites, and spray configurations providing uniform coverage in minimally invasive procedures. These format distinctions inform purchasing decisions, as surgical teams align sealant selection with procedural complexity and anatomical considerations.

Clinical application divides further into cardiovascular interventions, where bypass and valve repair demand robust adhesion under high-pressure blood flow; dental operations that benefit from localized soft tissue management; general surgery contexts such as abdominal and thoracic procedures requiring rapid sealing of vascular beds; delicate neurosurgical fields prioritizing minimal tissue trauma; orthopedic joint reconstruction and trauma fixation protocols necessitating stable scaffold formation; and wound care environments seeking to reduce contamination risk and accelerate epithelialization. Each application domain drives tailored innovation in kit composition and delivery mechanisms.

End users spanning ambulatory surgical centers, clinics, and hospitals exhibit differentiated procurement behaviors. Volume-driven institutions favor pre mixed kits to optimize OR throughput, while smaller clinics may opt for two component systems that balance shelf stability with cost efficiency. Finally, manual application devices and spray technologies cater to practitioner preferences, with manual syringes offering tactile feedback and spray systems delivering precise atomization. Together, these segmentation lenses illuminate a complex ecosystem where product design and clinical demand coalesce to define strategic opportunities.

This comprehensive research report categorizes the Fibrin Sealant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation Type

- Technology

- Application

- End User

Examine how healthcare infrastructure, regulatory frameworks, and reimbursement dynamics drive distinct adoption patterns across Americas, EMEA, and Asia-Pacific regions

Regional variation in fibrin sealant utilization underscores the influence of healthcare infrastructure maturity, regulatory landscapes, and evolving clinical guidelines across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, advanced reimbursement frameworks and high procedural volumes in cardiovascular and orthopedic surgery have fostered robust demand for both pre mixed and two component kits. North American hospitals in particular have integrated spray application technologies into minimally invasive suites, accelerating adoption in thoracic and neurosurgical applications.

Conversely, in Europe Middle East & Africa, regulatory harmonization under the European Medicines Agency has standardized approval pathways for novel sealant formulations, while Middle Eastern investments in tertiary care facilities have spurred demand for high-performance patch systems in complex surgical cases. Sub-Saharan African markets, though nascent, display growing interest in cost-effective manual application devices, reflecting resource constraints and the need for scalable hemostatic solutions.

Meanwhile, Asia-Pacific markets present a heterogeneous landscape. Japan and Australia have rapidly embraced recombinant thrombin-based kits to align with stringent safety regulations, whereas emerging economies in Southeast Asia and India demonstrate strong uptake of liquid sealants and patch modalities, driven by increasing surgical volumes and expanding private healthcare networks. Across all regions, the interplay between reimbursement policies, clinical training initiatives, and local manufacturing capabilities shapes adoption trajectories and long-term market evolution.

This comprehensive research report examines key regions that drive the evolution of the Fibrin Sealant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover how market-leading and emerging players leverage innovation partnerships, manufacturing expansion, and integrated service offerings to enhance fibrin sealant portfolios

Leading global stakeholders in the fibrin sealant arena continue to innovate through strategic alliances, product enhancements, and targeted market expansion. Company A has fortified its market position by expanding manufacturing capacity for pre mixed two component kits domestically, while Company B recently launched an ultra-rapid spray application platform designed for minimally invasive procedures. Simultaneously, Company C has pursued collaborations with academic institutions to validate next-generation formulations featuring enhanced adhesive strength under hemodynamic stress.

Emerging entrants have also disrupted traditional paradigms by introducing cost-optimized liquid sealants tailored for high-volume general surgery applications, enabling greater accessibility in resource-constrained environments. Partnerships between established medical device conglomerates and biotech innovators have accelerated development cycles for recombinant product lines, underscoring a broader shift toward biologically engineered sealants with reduced immunogenic risk. As competition intensifies, organizations are differentiating through workflow integration tools, digital training modules, and comprehensive service offerings that bundle sealant products with procedural support and postoperative outcome tracking.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fibrin Sealant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Baxter International Inc.

- Bayer AG

- CryoLife, Inc.

- CSL Behring GmbH

- Ethicon Inc.

- FzioMed Inc.

- Haemacure Corporation

- Hemarus Therapeutics (India) Pvt. Ltd.

- Hemostasis LLC

- Hualan Biological Engineering Inc.

- Hunan Kelun-Biotech Co., Ltd.

- Integra LifeSciences Corporation

- LFB Group

- Mallinckrodt Pharmaceuticals Holdings Inc.

- Omrix Biopharmaceuticals Ltd.

- Omrix Biopharmaceuticals, Inc.

- Sanofi S.A.

- Shanghai Haoyuan Biological Manufacturing Co., Ltd.

- Shanghai Haoyuan Biological Manufacturing Co., Ltd.

- Shanghai Hualan Biological Engineering Inc.

- Shanghai RAAS Blood Products Co., Ltd.

- Shanghai RAAS Blood Products Co., Ltd.

- Tissuemed Ltd.

Implement a holistic strategic framework combining research collaborations, supply chain diversification, surgeon education, and value-based contracting to drive fibrin sealant growth

Industry leaders seeking to capitalize on the transformative potential of fibrin sealant should prioritize a multifaceted strategic roadmap. First, investing in collaborative research with academic and clinical centers can accelerate the validation of novel formulations and broaden indications into emerging surgical specialties. Second, organizations should optimize supply chain resilience by diversifying sourcing of fibrinogen and thrombin inputs, including partnerships with domestic biotech suppliers to mitigate tariff and regulatory exposures.

Furthermore, scaling digital education platforms for surgeons and perioperative staff can drive product adoption by demonstrating application best practices and sharing real-world evidence on clinical outcomes. Integrating sealant delivery systems into hospital inventory management and digital procurement platforms will streamline reorder processes and highlight cost-effectiveness. Lastly, forging value-based contracting agreements with payers can align reimbursement incentives with demonstrated reductions in transfusion rates and procedural times, reinforcing the compelling value proposition of fibrin sealant across diverse care settings.

Explore the robust combination of primary clinical expert engagements and secondary literature analysis underpinning this comprehensive fibrin sealant study

This research leveraged a comprehensive methodology integrating primary insights and secondary data sources to ensure analytical rigor and currency. Primary research included in-depth interviews with key opinion leaders across cardiovascular, orthopedic, neurosurgery, dental, and general surgery disciplines, complemented by surveys of procurement officers in hospitals, ambulatory surgical centers, and clinic networks. These engagements provided nuanced perspectives on clinical priorities, adoption barriers, and procurement dynamics.

Secondary research encompassed systematic review of peer-reviewed clinical studies, regulatory filings, and white papers from health technology assessment agencies, supplemented by analysis of trade association publications and industry conference proceedings. Additionally, technology patents and intellectual property databases were examined to track innovation trajectories in formulation chemistry and delivery platforms. Data triangulation across these sources underpinned segmentation analyses and regional comparisons, ensuring conclusions are grounded in both empirical evidence and real-world practice patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fibrin Sealant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fibrin Sealant Market, by Product Type

- Fibrin Sealant Market, by Formulation Type

- Fibrin Sealant Market, by Technology

- Fibrin Sealant Market, by Application

- Fibrin Sealant Market, by End User

- Fibrin Sealant Market, by Region

- Fibrin Sealant Market, by Group

- Fibrin Sealant Market, by Country

- United States Fibrin Sealant Market

- China Fibrin Sealant Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Reflect on the convergence of technological innovation, supply chain resilience, and clinical integration shaping the future trajectory of fibrin sealant use

Fibrin sealant stands at the cusp of sustained growth as surgical disciplines continue to demand precise hemostatic and adhesive solutions that enhance patient outcomes and streamline operative workflows. Technological advances in spray application, recombinant formulations, and integration with digital surgical platforms have broadened the utility of sealants across cardiovascular, orthopedic, neurosurgical, and general surgery domains. Moreover, adaptive strategies to navigate regulatory and tariff landscapes have reinforced supply chain stability and spurred domestic production initiatives.

As market participants refine their portfolios and intensify collaboration with clinical stakeholders, the fibrin sealant landscape will evolve toward more specialized formulations and seamless delivery systems tailored to specific procedural needs. With regional adoption dynamics influenced by reimbursement structures and infrastructure maturity, organizations that align strategic investments in innovation, supply chain agility, and stakeholder education will be best positioned to lead the next phase of growth. Ultimately, fibrin sealant’s convergence of biological efficacy and procedural efficiency underscores its enduring value proposition in modern surgical care.

Unlock decisive intelligence on fibrin sealant market dynamics with personalized consulting support led by an experienced associate director

To secure your comprehensive insight into the dynamic fibrin sealant market and empower strategic decision-makers with fully tailored data, reach out today to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, for exclusive access to the market research report and customized consulting support that catalyzes your competitive edge

- How big is the Fibrin Sealant Market?

- What is the Fibrin Sealant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?