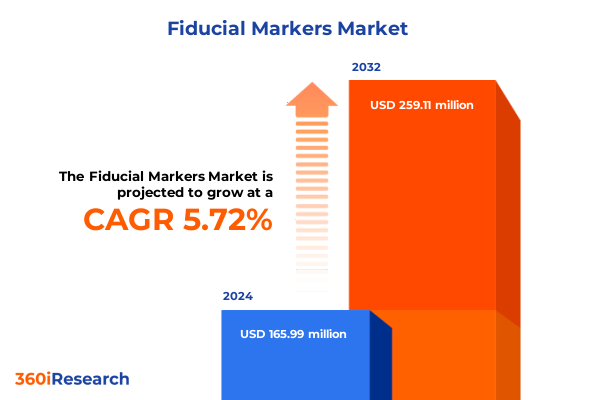

The Fiducial Markers Market size was estimated at USD 174.56 million in 2025 and expected to reach USD 188.34 million in 2026, at a CAGR of 5.80% to reach USD 259.10 million by 2032.

A Comprehensive Overview of Fiducial Markers Revealing Their Evolution, Applications, and Critical Role in Precision Technologies

Fiducial markers serve as indispensable reference points that enable accurate measurement, alignment, and tracking across a multitude of high-precision applications. Originating as simple crosses etched onto photographic plates in early photogrammetry, these markers have evolved into sophisticated patterns and technologies that underpin advanced computer vision systems, surgical navigation, and industrial automation. By providing known spatial landmarks within an image or scene, fiducial markers facilitate the fusion of physical and digital domains, helping machines and practitioners interpret and interact with the world with pinpoint accuracy.

Over the past decade, the transformation of fiducial markers has been driven by breakthroughs in digital pattern design and detection algorithms. Open-source libraries such as AprilTag have introduced high detection robustness, while optical marker systems like ArUco deliver rapid pose estimation for robotics and augmented reality environments. Meanwhile, electromagnetic tracking markers have gained traction in medical instrumentation, offering line-of-sight–independent localization crucial for minimally invasive procedures and image-guided interventions.

Today’s marker solutions blend materials science, sensor innovation, and computing power to meet stringent demands in fields as diverse as surgical navigation, film entertainment, and warehouse robotics. The increasing miniaturization of sensors, coupled with enhanced camera resolutions and real-time processing, has accelerated adoption across industries seeking to streamline workflows and reduce human error. As such, fiducial markers have transcended their historical role, becoming foundational enablers of the precision age.

Examining the Technological Breakthroughs and Market Shifts That Are Rapidly Redefining the Global Landscape of Fiducial Marker Applications and Adoption

Recent technological breakthroughs have elevated fiducial markers from simple reference points to dynamic enablers of immersive experiences and autonomous systems. Advanced computer vision algorithms, leveraging machine learning–driven detection filters, now recognize complex marker patterns in challenging lighting and occlusion scenarios. Concurrently, electromagnetic marker systems have been miniaturized to integrate seamlessly with catheters and surgical tools, providing six degrees of freedom tracking without requiring visual line of sight.

Market dynamics have likewise shifted as end users demand deeper integration across sectors. Entertainment studios combine high-speed optical marker capture with virtual production pipelines to streamline on-set workflows, while manufacturing facilities embed passive markers within parts to facilitate automated assembly and quality verification. This confluence of industries is fostering cross-pollination of marker technologies, with innovations in one domain accelerating capabilities elsewhere.

Regulatory and standardization efforts are also reshaping the landscape, as bodies such as ISO and the IEEE work to codify marker performance criteria and interoperability guidelines. The proliferation of open-source marker families, including AprilTag 3 and ArUco’s tag36h11, has prompted a broader community consensus on detection accuracy metrics and pattern uniqueness. Consequently, stakeholders can more confidently adopt multi-marker systems, knowing that industry standards will support scalability and device compatibility.

Unpacking the Broad Economic and Strategic Consequences of 2025 Tariff Measures on Fiducial Marker Supply Chains and Stakeholders

The United States’ 2025 tariff measures have introduced significant cost pressures across the supply chains that underpin fiducial marker manufacturing. Electronic subcomponents-such as camera sensors, microcontrollers, and integrated circuits used in active marker systems-are now subject to baseline duties of 10 percent on many imports, with cumulative levies reaching up to 54 percent on Chinese-origin goods. These increases have escalated production expenses for marker-enabled devices, driving some OEMs to reevaluate their sourcing strategies.

Printed circuit boards, essential to both optical and electromagnetic tracking platforms, face a 25 percent tariff on imports from China, while raw materials-including plastics, metals, and specialty substrates used in passive markers-are now burdened with additional duties ranging from 20 to 25 percent. Class I and II medical devices incorporating fiducial markers have seen renewed Section 301 tariffs, prompting medical technology firms to hedge against supply disruptions by diversifying component suppliers and securing tariff exclusions where possible.

In response to tariff-induced uncertainties, manufacturers are accelerating regional realignment efforts. Many companies are relocating assembly operations to Mexico and Southeast Asia to leverage nearshoring benefits, while others are investing in domestic production lines to circumvent high import duties. Although these shifts promise greater resilience, they also introduce challenges related to workforce training, quality control, and initial capital expenditure, underscoring the strategic complexity of navigating the post-tariff environment.

Revealing How Diverse Application, End User, Type, Technology, and Material Segments Shape the Fiducial Marker Market Dynamics

A nuanced understanding of how different application segments drive marker demand reveals critical variations in technology requirements and product design. Within augmented and virtual reality environments, high-contrast optical patterns are prioritized to ensure rapid camera detection, whereas in film entertainment, durable passive markers withstand high-speed motion capture under variable lighting. In manufacturing, markers printed or embedded in components function as alignment guides for robotic arms and automated quality control systems, while aerial and terrestrial photogrammetry demand markers resilient to environmental factors. Industrial robotics rely on retro-reflective sphere markers for calibration and navigation, service robotics employ smaller planar markers for object manipulation, and surgical robotics integrate sterilizable marker studs to maintain precision during procedures. Meanwhile, cardiology, neurosurgery, and orthopedic navigation systems leverage hybrid electromagnetic-optical marker designs tailored to each specialty’s anatomical constraints.

End user diversification has also shaped product evolution, as aerospace commercial divisions embrace markers for drone and UAV positioning, and defense units demand military-grade robustness. The automotive aftermarket integrates markers to calibrate ADAS cameras and lidar systems, while OEM production lines embed markers to streamline assembly and error detection. Film studios deploy printed fiduciary patterns for on-set AR overlays, and VR parks incorporate both active LED markers and passive printed tags to anchor virtual content. Healthcare settings from ambulatory centers to research institutes require biocompatible marker materials, and warehouses adopt reflective markers to optimize inventory robots and streamline order fulfillment.

The classification of markers into active electromagnetic, optical, and passive two-dimensional or three-dimensional variants highlights the trade-offs between power consumption, detection range, and environmental susceptibility. Technologies spanning electromagnetic, infrared, optical, and ultrasound tracking further diversify the landscape, offering solutions for scenarios where line-of-sight or signal interference presents challenges. Material selection-whether metal for durability, plastic for cost-effectiveness, or paper for disposable applications-completes the segmentation matrix, guiding stakeholders toward the right marker configuration for their technical and economic objectives.

This comprehensive research report categorizes the Fiducial Markers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End User

- Type

- Technology

- Material

Analyzing the Regional Variations in Adoption, Innovation, and Growth Prospects Across Americas, EMEA, and Asia-Pacific Markets

Regional adoption patterns reflect distinct operational priorities and infrastructure capabilities. In the Americas, the United States and Canada leverage robust manufacturing ecosystems to innovate marker-integrated robotics and medical navigation solutions, supported by established standards bodies and well-funded research institutions. Life sciences organizations extensively pilot fiducial-enhanced imaging modalities, while aerospace and automotive sectors embed markers within quality assurance workflows to boost precision in component assembly and vehicle safety systems. The region’s emphasis on nearshoring and reshoring has also spurred investments in domestic marker production facilities to mitigate global supply chain risk and leverage tariff advantages.

In Europe, Middle East, and Africa, marker technologies are being integrated across diverse healthcare settings, from leading neurosurgical centers in Germany and Switzerland to emerging oncology clinics in the Middle East, which adopt hybrid optical-electromagnetic markers for image-guided therapy. Film studios in the United Kingdom and UAE capital markets are pioneering virtual production techniques that combine printed fiduciary backdrops with real-time AR capture, while manufacturing hubs in Eastern Europe employ passive and 3D printed markers for automated assembly lines. Across Africa, sustainable marker designs are emerging for agricultural drone mapping and infrastructure surveying, driven by local needs for rapid geospatial data acquisition.

Asia-Pacific adoption is accelerated by expansive electronics supply chains and governmental support for advanced manufacturing. Japan and South Korea excel in high-precision optical marker fabrication, while China’s “dual circulation” strategy fuels domestic marker innovation to replace imported components. India’s growing medtech sector trials cost-effective disposable markers for low-resource surgical environments, and Southeast Asian nations serve as manufacturing bases for marker-embedded IoT devices. Australia’s mining and defense industries leverage electromagnetic markers for subterranean navigation and unmanned vehicular applications, demonstrating the region’s broad spectrum of marker use cases.

This comprehensive research report examines key regions that drive the evolution of the Fiducial Markers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships Driving Progress and Competition in the Fiducial Marker Industry Today

Northern Digital Inc. has established itself as a leading provider of optical navigation solutions, with its Polaris® product suite delivering sub-millimeter accuracy and reliability for OEM surgical navigation systems. The Polaris Vega® and Lyra® cameras, in combination with passive sphere and Radix™ lens markers, facilitate real-time tool tracking within the operative field, while offering diversified mounting and measurement volume options to suit complex clinical workflows. This deep integration into neurosurgery, orthopedics, and radiation therapy underscores the company’s commitment to precision and developer-friendly customization.

In electromagnetic tracking, NDI’s Aurora® system competes alongside legacy players such as Polhemus, offering customizable field generators and miniaturized sensors that integrate into image-guided surgery platforms. The acquisition of Ascension Technology expanded this portfolio, enabling dual optical-electromagnetic configurations that support dynamic registration and navigation in soft tissue environments, such as hepatic and renal interventions, with localization errors under one millimeter.

Open-source systems have also propelled innovation, with AprilTag’s visual fiducial library gaining widespread adoption in robotics research and industrial automation. Its flexible tag families and robust detection algorithms, deployed via ROS wrappers and integrated with OpenCV pipelines, have empowered developers to embed reliable pose estimation in autonomous vehicles and factory inspection stations. This collaborative ecosystem contrasts with proprietary offerings, highlighting a trend toward accessible, customizable marker frameworks for experimentation and rapid prototyping.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiducial Markers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AngioDynamics, Inc.

- Becton, Dickinson and Company

- Best Medical International, Inc.

- Boston Scientific Corporation

- Carbon Medical Technologies

- CIVCO Radiotherapy

- Cook Group Incorporated

- Eckert & Ziegler BEBIG

- IBA Dosimetry GmbH

- IBA Worldwide

- IsoAid LLC

- Medtronic plc

- Mizuho Medical Co., Ltd.

- Nanovi A/S

- QFix

- SOMATEX Medical Technologies GmbH

- Stellar Medical

Presenting Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities in the Fiducial Marker Ecosystem

Industry leaders should prioritize the adoption of multi-standard marker solutions to ensure interoperability and future-proofing. By supporting both open-source families like AprilTag and proprietary formats such as ArUco and Polaris, organizations can mitigate vendor lock-in and harness community-driven improvements. Embracing standards-based performance metrics will also streamline integration across AR/VR platforms, robotics cells, and medical navigation suites, reducing development timelines and fostering cross-industry collaboration.

To navigate evolving tariff landscapes and supply chain uncertainties, companies are advised to establish diversified procurement networks. Nearshoring assembly to Mexico and Asia-Pacific manufacturing hubs, supplemented by strategic inventory reserves and dual-sourcing agreements, will enhance resilience against geopolitical disruptions. Concurrent investment in automation for marker fabrication can offset labor cost disparities and preserve margin integrity in the face of import levies.

Finally, fostering partnerships between marker innovators, software developers, and end users will catalyze tailored solutions and accelerate technology transfer. Collaborative pilot programs with research hospitals, aerospace integrators, and automated fulfillment centers can surface real-world performance insights and inform iterative product refinements. By aligning R&D roadmaps with domain-specific use cases, stakeholders can achieve faster validation cycles and deliver high-impact marker applications that resonate with their target markets.

Detailing the Rigorous Research Approach and Methodological Framework Underpinning the Insights into Fiducial Marker Technologies

This research leverages a triangulated methodology combining primary interviews, secondary literature analysis, and proprietary data synthesis. Expert discussions with engineers and decision-makers in medical device manufacturing, robotics, and entertainment provided firsthand perspectives on unmet needs and technology adoption priorities. Concurrently, an exhaustive review of technical journals, patent databases, and regulatory filings informed a nuanced understanding of performance benchmarks and compliance frameworks.

Quantitative segmentation and thematic mapping ensured that application, end user, and technology categorizations reflect real-world deployment scenarios. Cross-referencing supplier catalogs with case study outcomes allowed for rigorous validation of product capabilities against environmental and operational constraints. Where data gaps emerged, supplementary expert panels and targeted surveys refined the intelligence pool, ensuring both breadth and depth of insight.

Finally, iterative peer reviews and accuracy checks against public domain research fortified the report’s conclusions. Adherence to established market research standards-statistical rigor, transparency in data sources, and clarity in analytical assumptions-has underpinned the credibility of the findings, delivering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiducial Markers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiducial Markers Market, by Application

- Fiducial Markers Market, by End User

- Fiducial Markers Market, by Type

- Fiducial Markers Market, by Technology

- Fiducial Markers Market, by Material

- Fiducial Markers Market, by Region

- Fiducial Markers Market, by Group

- Fiducial Markers Market, by Country

- United States Fiducial Markers Market

- China Fiducial Markers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing Key Takeaways and Future Outlook for Stakeholders Engaged with Fiducial Marker Innovations and Applications

The multifaceted evolution of fiducial markers underscores their expanding relevance across precision-driven industries. From the advent of digital visual fiducials like AprilTag to hybrid optical-electromagnetic systems, the technology has adapted to diverse operational imperatives, enabling breakthroughs in surgical accuracy, autonomous navigation, and immersive storytelling.

Transformative market shifts-shaped by tariff reconfigurations, open-source innovation, and regional manufacturing realignments-have created both challenges and opportunities for stakeholders. Strategic segmentation reveals the nuanced performance and design trade-offs that must guide product selection, while regional analyses highlight the localized forces influencing adoption and investment.

By aligning innovation roadmaps with actionable recommendations-ranging from supply chain diversification to collaborative pilot programs-industry participants can harness the full potential of fiducial markers. As marker technologies continue to converge with AI-driven vision systems and next-generation tracking modalities, the insights presented here will serve as a navigational compass, guiding stakeholders toward sustainable growth and competitive differentiation.

Discover How Expert Insights and Customized Analysis Can Empower Strategic Decisions in Fiducial Marker Markets for Maximum Impact

Are you ready to leverage deep industry expertise and tailored analysis to drive strategic success in the evolving fiducial marker landscape? For personalized insights and direct support in securing the full comprehensive report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Our team will guide you through premium research deliverables, ensuring you gain the intelligence needed to navigate emerging opportunities and make data-driven decisions with confidence.

- How big is the Fiducial Markers Market?

- What is the Fiducial Markers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?