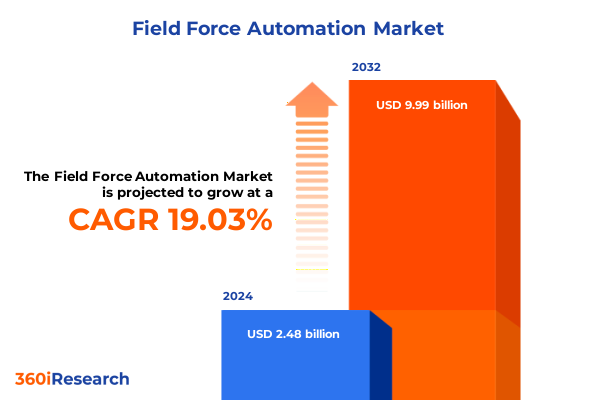

The Field Force Automation Market size was estimated at USD 2.92 billion in 2025 and expected to reach USD 3.45 billion in 2026, at a CAGR of 19.18% to reach USD 9.99 billion by 2032.

Unlocking the Critical Role and Strategic Imperatives of Field Force Automation in Driving Operational Excellence and Customer Satisfaction Across Industries

Field force automation has emerged as a pivotal enabler for organizations seeking to optimize field worker productivity, elevate customer satisfaction, and streamline business processes. At its core, this discipline leverages digital tools, mobile connectivity, and integrated workflows to orchestrate everything from scheduling and dispatch to real-time data capture and performance analytics. By embracing field force automation, companies can ensure that frontline teams operate with precision, equipped with up-to-date information that guides every task and interaction.

In recent years, the urgency to modernize field operations has only intensified. Global shifts toward remote service delivery, rising customer expectations, and the imperative to reduce operational costs have compelled enterprises to adopt solutions that connect disparate systems and disparate teams. Moreover, the proliferation of mobile devices and cloud-native platforms has democratized access to advanced capabilities, enabling businesses of all sizes to harness the power of automation and data-driven insights.

Furthermore, field force automation is redefining how companies measure success. Traditional metrics such as time-to-complete tasks and travel miles are now complemented by qualitative indicators like customer feedback, first-time fix rates, and upsell opportunities generated in the field. Consequently, leaders are recognizing that a strategic investment in field force automation not only supports cost optimization but also drives revenue growth and strengthens competitive positioning.

Navigating How Digital Integration Artificial Intelligence and Mobile Solutions Are Driving a Paradigm Shift in the Field Force Automation Ecosystem

The field force automation landscape is undergoing a profound transformation, driven by the convergence of advanced digital integration, artificial intelligence, and mobility innovations. Organizations are now integrating their field tools directly with enterprise resource planning and customer relationship management platforms, creating end-to-end workflows that reduce manual handoffs and accelerate decision-making. In parallel, AI-driven scheduling engines are optimizing technician assignments, leveraging historical data and real-time conditions to anticipate delays and dynamically reallocate resources.

Moreover, the rise of mobile applications equipped with augmented reality overlays and IoT-enabled sensors is enabling field technicians to diagnose complex equipment issues remotely. These capabilities not only improve first-time fix rates but also limit downtime and minimize safety risks. Meanwhile, predictive analytics platforms are forecasting service needs before breakdowns occur, allowing companies to transition from reactive maintenance to proactive, condition-based strategies that extend asset lifecycles and lower total cost of ownership.

In addition, low-code development environments are empowering business analysts to tailor field workflows rapidly, creating custom forms, checklists, and approval chains without extensive IT involvement. This agility is complemented by robust cloud architectures that scale elastically, ensuring uninterrupted performance during peak periods. Altogether, these transformative shifts are redefining the expectations for field service delivery, positioning automation as a strategic linchpin for enterprises aiming to achieve operational resilience and superior customer experiences.

Assessing the Cumulative Effects of Renewed Section 232 and Expanded Import Levies on United States Field Force Automation Operations and Supply Chains

The cumulative impact of renewed Section 232 steel and aluminum tariffs alongside expanded import levies is exerting significant pressure on field force automation operations and their underlying supply chains. With the reinstatement of a true 25% tariff on steel and aluminum imports and the elimination of prior exemptions, hardware components such as rugged tablets, wearable devices, and telematics sensors have become more expensive to procure. This escalation in input costs is forcing equipment manufacturers and technology providers to reevaluate pricing strategies, margin structures, and supplier arrangements to maintain profitability and competitive positioning.

Across the automotive sector, original equipment manufacturers reported substantial first-half earnings hits due to these tariffs. General Motors recorded a $1.1 billion tariff-related expense in the second quarter, translating into a nearly halved profit margin of 4.8%, down from almost 10% the prior year. Although some of this burden has been partially mitigated through cost-cutting measures, analysts warn that sustained high import levies could drive automotive prices upward by late 2025 if manufacturers defer raising consumer prices for too long. Similarly, RTX has reported a $125 million hit in the current year, with expected total tariff-related costs of $500 million in 2025, despite maintaining strong demand in aerospace and defense markets.

The broader industrial equipment market is also feeling these pressures. When minor changes in steel and aluminum costs are magnified across thousands of units, the per-unit manufacturing cost can climb by hundreds of dollars. For instance, S&P Global Mobility estimates that the average per-vehicle increase due to tariffs on imported steel and aluminum could add approximately $240 to manufacturing expenses, taking into account import exposure of 15% for steel and 60% for aluminum alongside rising domestic price trends. Moreover, service providers that maintain fleets of specialized vehicles for field deployments now face higher maintenance and replacement costs, intensifying the need to enhance operational efficiency and extend asset lifespans.

Despite these challenges, many companies are absorbing the additional costs for now, leveraging long-term supplier contracts and inventory buffers to delay price increases for end users. However, as inventories deplete and domestic production capacities tighten, the true cost burden may become visible in service fees and equipment leasing rates by mid-2025. Consequently, organizations must proactively explore supply chain diversification, local sourcing options, and technology investments that offset hardware inflation by optimizing field team productivity and reducing overall downtime.

Unlocking Strategic Growth Opportunities Through Analysis of Solution Types Organization Sizes Industry Verticals and Diverse End User Segments

A nuanced segmentation analysis unveils the distinct dynamics shaping adoption and investment across solution types organization sizes industry verticals and end user categories. Within the solution type landscape hardware offerings remain essential for equipping field personnel with durable tablets smartphones sensors and telematics units while professional services and managed services deliver the implementation customization and ongoing support necessary for sustained utilization. Cloud-based software is accelerating deployment cycles enabling continuous updates and remote configuration, whereas on-premise platforms retain appeal in highly regulated environments that demand strict data sovereignty.

Organizational scale further influences procurement and deployment priorities. Large enterprises often embrace fully integrated field force automation suites tied directly to ERP and asset management systems, reflecting their complexity and distributed workforce. Medium enterprises tend to balance cost considerations with feature requirements by adopting modular solutions that can scale in line with growth trajectories. Small businesses frequently favor subscription-based cloud software that minimizes upfront investments and leverages vendor-managed infrastructure to reduce internal IT burdens.

Industry verticals present unique use cases and regulatory imperatives that drive tailored feature sets and service levels. Healthcare organizations prioritize compliance tracking secure data capture and telehealth integrations, while manufacturing firms seek seamless connectivity to production lines enabling predictive maintenance and digital twin overlays. In the retail sector the apparel vertical leverages visual merchandising workflows and inventory reconciliation, whereas grocery chains optimize perishable goods delivery and restocking schedules. Transportation and logistics operators differentiate between bulk cargo routes requiring temperature control monitoring and passenger services prioritizing real-time schedule updates. Utility providers mandate rigorous safety inspection protocols for high-risk assets such as pipelines substations and distribution networks.

End users within these environments exhibit specialized demands. Bulk delivery teams focus on route planning and load optimization to maximize asset utilization, whereas last mile couriers emphasize proof of delivery technologies and customer notifications. Field sales teams require robust mobile CRM tools to capture orders opportunities and customer feedback on the go, whereas service technicians depend on diagnostic interfaces and parts inventory management to ensure first-time resolutions. Inspection teams differentiate between quality inspections that verify product conformity and safety inspections that enforce regulatory adherence creating layered requirements for checklist management automated reporting and incident escalation.

This comprehensive research report categorizes the Field Force Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Organization Size

- End User

Evaluating Unique Market Dynamics and Adoption Trends Across the Americas Europe Middle East Africa and Asia Pacific for Field Force Automation Success

Regional variations in regulatory frameworks infrastructure maturity and market demand are reshaping field force automation strategies across the Americas Europe Middle East Africa and Asia-Pacific. In the Americas the United States and Canada have driven early adoption through incentives for digital transformation and robust cloud infrastructures while Latin American markets are increasingly integrating mobile field platforms to enhance service reach in dispersed geographies. Moreover cross-border collaborations in North America are fostering standardized compliance and data-sharing protocols that streamline multi-nation deployments.

Across Europe the Middle East and Africa a heterogeneous regulatory landscape necessitates adaptable solutions capable of meeting GDPR and data residency requirements alongside localized safety and labor standards. European utility providers are investing in smart grid integrations and remote inspection modules, whereas Middle Eastern logistics conglomerates leverage telematics and AI-powered analytics to optimize fleet operations under extreme climatic conditions. In Africa expanding mobile networks are catalyzing field automation uptake in mining construction and emerging e-commerce deliveries despite ongoing connectivity challenges.

The Asia-Pacific region is witnessing rapid growth driven by rising industrial automation investments and government-sponsored digital initiatives. Developed markets like Japan Australia and South Korea are adopting AR-enabled maintenance tools and digital twin platforms for complex asset management, while Southeast Asian nations are scaling mobile-first field systems to support burgeoning logistics and retail networks. India’s national push toward digital services is boosting demand for cloud-based field solutions among utilities and healthcare providers, and China’s manufacturing renaissance is fueling in-house deployments of AI-enhanced scheduling and quality control modules.

This comprehensive research report examines key regions that drive the evolution of the Field Force Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscapes with Profiles of Leading Innovators Driving Technological Advancements in Field Force Automation Solutions

Leading technology providers in the field force automation arena are differentiating through strategic investments in artificial intelligence extended reality and open-architecture integrations. One category of innovators is expanding their platforms with AI-driven scheduling and predictive maintenance modules that anticipate service needs and dynamically adjust technician assignments. Another group is focusing on creating highly configurable low-code development environments that empower enterprise teams to design custom workflows, forms and approval chains without deep IT involvement.

Meanwhile, hardware specialists are forging partnerships with device manufacturers to deliver purpose-built tablets wearable devices and IoT sensors optimized for harsh field conditions. These collaborations ensure that devices seamlessly integrate with core software platforms, guaranteeing consistent performance and centralized management. In the professional services domain some consultancies are extending their offerings to include business process reengineering and change-management support that enables faster adoption and higher return on investment.

Additionally, select players are forging alliances to embed field force automation capabilities directly into broader enterprise ecosystems. This includes pre-built connectors with ERP CRM asset management and customer engagement platforms, enabling real-time data exchange and holistic visibility across the organization. Through mergers acquisitions and strategic co-development agreements these companies are building end-to-end suites that unify front-office and back-office operations.

Overall the competitive landscape is characterized by a dual focus on deep domain functionality for specialized use cases and broad platform extensibility that supports diverse industry requirements. Organizations evaluating these vendors should consider technology roadmaps AI maturity and the depth of professional services to align with both immediate operational needs and long-term digital transformation objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Field Force Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astea International, Inc.

- Bizom

- IFS AB

- Infor, Inc.

- Microsoft Corporation

- Oracle Corporation

- Pegasystems Inc.

- ProntoForms Corporation

- PTC Inc.

- Salesforce, Inc.

- SAP SE

- ServiceMax

- Trimble Inc.

- Zebra Technologies Corporation

Implementing Future-Proof Strategies to Leverage Digital Tools Optimize Field Operations and Enhance Customer Engagement in Field Force Automation

Industry leaders should prioritize the integration of AI-driven scheduling and predictive analytics into their field force automation strategies to maximize resource utilization and minimize downtime. By implementing machine learning models that forecast service requirements based on historical and real-time data, companies can shift from reactive to proactive maintenance, reducing emergency repairs and optimizing inventory levels.

Furthermore, organizations must invest in cloud-native architectures that support elastic scalability and continuous delivery. This approach ensures that field personnel always have access to the latest features and security updates without lengthy upgrade cycles, while also enabling centralized IT teams to manage user permissions and compliance requirements efficiently.

To enhance workforce engagement and operational safety, decision makers should incorporate augmented reality overlays and wearable sensors into their field toolkits. These technologies provide step-by-step guidance for complex procedures reduce onboarding time for new technicians and offer remote experts the ability to troubleshoot issues in real time. As a result, first-time fix rates improve, and risk exposure is mitigated.

Equally important is the development of a robust data governance and analytics framework. Organizations should establish clear protocols for capturing, storing and analyzing field data, applying standardized KPIs such as task completion times, customer satisfaction scores and incident resolution rates. By doing so, leaders can gain actionable insights that drive continuous process refinement.

Lastly, strategic partnerships with device manufacturers, systems integrators and telecom providers can unlock bundled solutions that simplify procurement and support. By collaborating across the ecosystem, companies can negotiate favorable terms, ensure interoperability and accelerate time to value for field force automation initiatives.

Detailing Rigorous Methodological Frameworks Data Collection and Analytical Techniques Employed in Crafting the Field Force Automation Market Research Report

Our research methodology employed a rigorous, multi-phase approach encompassing both primary and secondary research to ensure data integrity and actionable insights. Initially, we conducted detailed secondary research by reviewing publicly available corporate filings, white papers, industry journals and credible news sources to map the competitive landscape, technology trends and regulatory influences.

Subsequently, we engaged in extensive primary research through structured interviews and surveys with chief information officers, field operations managers and solution vendors across North America Europe Middle East Africa and Asia-Pacific. These discussions provided nuanced perspectives on adoption drivers, feature priorities and deployment obstacles, enabling us to contextualize quantitative findings.

Quantitative data collection included an anonymized survey of more than one hundred end users, capturing metrics on implementation timelines total cost of ownership user satisfaction and measured returns. We applied statistical techniques to validate our segmentation framework across solution type, organization size, industry vertical and end user category, ensuring that each market segment is supported by robust sample sizes and statistical confidence.

Our analytical framework incorporated scenario modeling and trend extrapolation to assess the impact of emerging technologies such as augmented reality, AI-driven analytics and 5G-enabled connectivity. We cross-verified findings through a triangulation process that synthesized insights from expert interviews, survey data and secondary sources.

Throughout the research cycle, all data points and analytical conclusions were subjected to oversight by an expert advisory panel, including industry veterans and academic specialists. This governance structure guaranteed methodological rigor, unbiased interpretation and the highest level of editorial integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Field Force Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Field Force Automation Market, by Solution Type

- Field Force Automation Market, by Organization Size

- Field Force Automation Market, by End User

- Field Force Automation Market, by Region

- Field Force Automation Market, by Group

- Field Force Automation Market, by Country

- United States Field Force Automation Market

- China Field Force Automation Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Implications to Empower Decision Makers and Stakeholders in Navigating the Evolving Field Force Automation Landscape

In summary, the field force automation market is experiencing a paradigm shift driven by the integration of artificial intelligence, cloud architectures and immersive technologies like augmented reality. Organizations that harness these capabilities are achieving higher first-time fix rates, reduced operational costs and improved customer satisfaction. However, rising input costs due to expanded tariffs on steel and aluminum present tangible challenges for hardware-dependent segments, underscoring the importance of supply chain resilience and diversification.

Our segmentation analysis reveals that while large enterprises continue to lead in comprehensive suite deployments, medium and small organizations are rapidly adopting cloud-based and modular offerings to balance agility with budget constraints. Industry-specific requirements-from compliance in healthcare to digital twin integrations in manufacturing-further shape solution roadmaps and vendor strategies.

Regionally, early adopters in North America and mature European markets are setting benchmarks for advanced analytics and data governance, while emerging Asia-Pacific and Latin American markets are focusing on mobile-first implementations to overcome infrastructure limitations. Competitive dynamics center on AI maturity, extensibility of low-code platforms and depth of professional services, making vendor evaluations increasingly complex.

Ultimately, decision makers must align technology investments with clear performance metrics, robust governance and strategic partnerships to navigate the evolving landscape. By applying the insights and recommendations provided, organizations can position themselves to thrive amid disruptive trends and unlock the full potential of field force automation.

Discover How Field Force Automation Insights Can Propel Your Business Growth and Connect with the Associate Director of Sales and Marketing Today

By exploring these insights and leveraging the strategic recommendations we have outlined, you can transform your field force operations, accelerate digital adoption, and drive sustainable growth. If you are ready to deepen your understanding of the field force automation market and gain exclusive access to comprehensive data on technology trends, vendor strategies, and adoption benchmarks, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise can help you tailor the research to your organization’s specific needs, ensuring that you receive actionable intelligence and hands-on guidance.

Contact Ketan Rohom today to discuss how the full report can empower your business with clarity, confidence, and a competitive edge in an ever-evolving landscape. Take the next step toward optimizing your field force operations and unlocking the full value of automation solutions by partnering with an industry research specialist who understands your strategic goals and can guide your decision-making process.

Reach out to schedule a personalized briefing and begin a collaborative journey to transform your field engagements, enhance operational efficiency, and achieve exceptional customer satisfaction in 2025 and beyond.

- How big is the Field Force Automation Market?

- What is the Field Force Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?