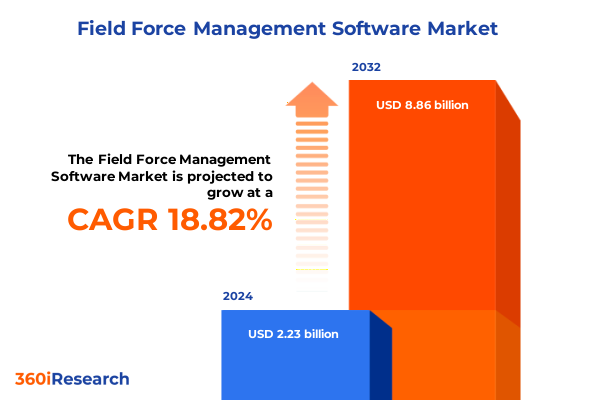

The Field Force Management Software Market size was estimated at USD 2.65 billion in 2025 and expected to reach USD 3.11 billion in 2026, at a CAGR of 18.82% to reach USD 8.86 billion by 2032.

Discover How Innovative Field Force Management Software Is Redefining Operational Efficiency and Enhancing Customer Engagement Across Industries Worldwide

In today’s fast-paced business environment, field force management software has emerged as a critical enabler of operational excellence and seamless customer engagement. Organizations of all sizes are increasingly relying on digital platforms to streamline workforce scheduling, track on-site activities, and deliver real-time updates to both back-office teams and end customers. As companies grapple with distributed teams and heightened service expectations, the adoption of modern workforce management solutions has moved from a competitive advantage to a fundamental necessity.

This report offers an in-depth executive overview of the current field force management software landscape, blending qualitative insights with empirical observations drawn from industry stakeholders. It examines how emerging technologies-such as mobile-native applications, cloud-based dashboards, and integrated analytics-are reshaping traditional service models. Moreover, it outlines the strategic shifts that industry leaders are embracing to stay agile amid evolving regulatory, logistical, and economic pressures.

By laying the foundational context for market dynamics, this introduction sets the stage for a deeper exploration of transformative trends, segmentation insights, regional nuances, and actionable recommendations. Those seeking to optimize field operations, enhance decision-making, and maintain regulatory compliance will find targeted analyses that illuminate practical pathways forward. Ultimately, this section underscores the critical role that field force management software plays in driving efficiency and sustaining competitive differentiation across sectors.

Uncover the Major Technological and Strategic Shifts Transforming Field Force Management Into a Catalyst for Operational Agility and Customer Satisfaction

The field service landscape is undergoing a profound transformation driven by the convergence of advanced automation, data intelligence, and mobile-first solutions. In recent years, organizations have shifted from manual dispatch and paper-based documentation toward automated scheduling engines that leverage artificial intelligence for predictive maintenance and dynamic route optimization. Consequently, real-time visibility into technician locations, skills, and workload has become the cornerstone of operational agility and service excellence.

Furthermore, the integration of Internet of Things devices with field force platforms is enabling proactive issue detection, which reduces downtime and enhances first-time-fix rates. As mobile applications equip service personnel with interactive work orders, digital checklists, and instant photo uploads, back-office teams gain immediate access to field data. This seamless data flow fosters collaboration across departments and accelerates billing cycles, thereby improving cash flow and customer satisfaction.

Another notable shift is the growing emphasis on unified platforms that integrate seamlessly with CRM and ERP systems. By connecting service histories, inventory levels, and customer preferences in a single interface, organizations can anticipate needs, personalize service interactions, and optimize asset utilization. In addition, sustainability considerations-such as minimizing travel distances and leveraging electric vehicles-are increasingly baked into route planning algorithms. Together, these transformative shifts underscore a broader movement toward intelligent, fully integrated field service ecosystems that drive measurable business value.

Analyze How the 2025 United States Tariff Measures Have Reshaped Supply Chains and Operational Costs for Field Force Management Providers and Users

In 2025, new tariff measures imposed by the United States government introduced additional layers of complexity for field force management software providers and end users. These tariffs, targeting components essential to IoT sensors, mobile devices, and network infrastructure, triggered cost escalations and supply chain recalibrations. Providers faced pressure to absorb higher import duties or pass costs along to customers, while service organizations experienced increased capital expenditures for device renewals and network upgrades.

As a result, many solution vendors reevaluated their manufacturing and sourcing strategies, exploring nearshore partnerships to mitigate duty impacts and ensure more predictable lead times. In parallel, a subset of service-centric organizations accelerated their transition to subscription-based and cloud-hosted software models, thereby reducing reliance on locally stocked hardware and shifting capital expenses to operational budgets. This move not only spread costs but also facilitated more frequent software updates to address evolving compliance requirements.

Moreover, tariff-related price fluctuations prompted end users to scrutinize total cost of ownership more closely, prioritizing platforms that offered modular pricing structures and flexible upgrade paths. Consequently, vendors that demonstrated agility in renegotiating component agreements, designing leaner hardware bundles, and offering robust managed services found themselves better positioned to retain existing customers and win new contracts. In this way, the cumulative impact of the 2025 U.S. tariffs has reshaped strategic priorities and spurred innovation across the field force management ecosystem.

Examine How Segmentation by Component, Interface, Pricing, Deployment, Organization Size, Application, and End-User Industry Unveils Core Adoption Patterns

Examining market segmentation reveals how different criteria collectively drive solution adoption and customer satisfaction. The delineation by component shows that while services-spanning managed services and professional engagements-address consulting, implementation, and ongoing support needs, the software itself bifurcates into mobile workforce management systems and web-based workforce management platforms that cater to on-the-go technicians and centralized planners, respectively. Transitioning to the domain of user interfaces highlights how mobile applications empower field teams with offline capabilities and GPS-enabled routing, whereas web-based dashboards furnish executives with high-level overviews, advanced analytics, and customizable reporting tools.

Meanwhile, pricing model segmentation offers insights into customer preferences: pay-per-use structures appeal to organizations with fluctuating field volumes, perpetual licensing attracts enterprises seeking fixed long-term investments, and subscription-based models align with businesses prioritizing scalability and predictable expense profiles. Deployment model segmentation further differentiates the market by contrasting cloud-hosted platforms-offering hybrid, private, or public cloud configurations-with on-premise installations that address data sovereignty and localized compliance mandates. When considering organizational size, larger enterprises often demand high-touch integration and extensive customization, whereas small and medium businesses look for turnkey solutions that deliver rapid time-to-value.

Application-based segmentation underscores the breadth of functional use cases, ranging from customer relationship and inventory management to sophisticated reporting, routing, navigation, and workforce optimization workflows. Finally, end-user industry segmentation brings into focus vertical sectors such as construction, energy and utilities, healthcare and life sciences, manufacturing, and transportation and logistics, each presenting distinct operational challenges and regulatory environments. Together, these multi-dimensional segmentation insights form a comprehensive portrayal of the varied drivers influencing field force management software adoption.

This comprehensive research report categorizes the Field Force Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- User Interface

- Pricing Model

- Deployment Model

- Organization Size

- Application

- End User Industry

Understand the Distinct Regional Dynamics Shaping Field Force Management Adoption in the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regional analysis illuminates how distinct market forces shape field force management adoption across three key areas. In the Americas, high digital maturity and extensive investment in cloud infrastructure have fostered rapid uptake of subscription-based platforms, with North American organizations often leading in early AI-enabled feature rollouts. Conversely, Latin American businesses place a premium on services and managed support to navigate localized regulatory requirements and connectivity constraints. This creates an environment where hybrid deployments frequently balance cost, performance, and compliance needs.

Across Europe, the Middle East, and Africa, regulatory diversity and varying economic maturity levels contribute to nuanced demand patterns. Western European markets emphasize data privacy and integration with existing enterprise systems, resulting in a strong preference for private and hybrid cloud solutions with advanced encryption and role-based access controls. In the Middle East, large-scale energy, utilities, and infrastructure projects drive investments in end-to-end workforce optimization, while select African regions leverage mobile-centric platforms to overcome inconsistent network availability and support expanding service networks.

Meanwhile, the Asia-Pacific region reflects a dual narrative of hyper-growth and digital leapfrogging. Developed markets such as Japan and Australia demonstrate maturity in analytics-driven dispatch optimization, whereas emerging economies like India and Southeast Asia prioritize cost-effective, pay-per-use offerings that minimize upfront hardware investment. This dichotomy creates a fertile landscape for flexible deployment models, localized professional services, and modular pricing schemes that accommodate a spectrum of organizational capabilities and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Field Force Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain Strategic Visibility into Leading Field Force Management Solution Providers and Their Competitive Approaches to Innovation, Partnership and Market Positioning

Leading companies in the field force management space differentiate themselves through a combination of technological innovation, strategic partnerships, and targeted acquisitions. Established enterprise software vendors have focused on infusing artificial intelligence into scheduling engines, while niche providers emphasize deep functionality for specific verticals such as utilities or field-based medical services. In doing so, they cater to clients seeking tailored workflows and regulatory compliance features that address critical industry pain points.

These top-tier solution providers often leverage robust partner ecosystems to enhance service delivery, collaborating with telematics firms, device manufacturers, and mobile network carriers to create integrated offerings. Their competitive approaches vary: some prioritize low-code customization capabilities that allow rapid adaptation to unique organizational requirements, while others concentrate on delivering turnkey managed services that bundle software, infrastructure, and ongoing support into a single contract. Pricing strategies further distinguish these companies, with select vendors introducing consumption-based models to capture market share among smaller enterprises and rapidly scaling midmarket segments.

To sustain growth and foster innovation, many of these solution providers have established in-house innovation labs and forged alliances with academic institutions and research centers. By piloting emerging technologies such as augmented reality-enabled field assistance and predictive analytics based on machine learning algorithms, they position themselves at the forefront of the next wave of operational efficiency gains. These combined initiatives underscore how leading players are shaping the future of field force management through a balanced emphasis on platform extensibility, customer success, and continuous technological advancement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Field Force Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ClickSoftware Technologies Ltd.

- Commusoft Ltd.

- Field Force Tracker

- FieldAware

- FieldEdge

- FieldEZ Technologies Pvt. Ltd.

- FieldNation, Inc.

- GeoOp Ltd.

- GorillaDesk

- Housecall Pro

- IFS AB

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Service Fusion

- ServiceMax, Inc.

- ServiceNow, Inc.

- ServiceTitan, Inc.

- Trimble Inc.

- WorkWave LLC

- Zoho Corporation Pvt. Ltd.

Adopt Data-Driven Practices That Empower Leaders to Boost Field Force Efficiency, Elevate Customer Experiences, and Accelerate Growth Through Innovation

Industry leaders can accelerate field force transformation by adopting a series of actionable strategies that align technology, process, and people objectives. First, organizations should prioritize data-driven decision making by integrating advanced analytics modules into core service platforms. Consequently, leaders gain predictive insights on technician performance, asset health, and customer satisfaction trends, enabling proactive resource allocation and service-level optimization.

In addition, investing in mobile-first design principles ensures that field technicians have seamless, offline-capable access to work orders, parts catalogs, and knowledge bases. This approach reduces data entry errors and enhances first-time resolution rates. Furthermore, businesses should consider shifting from capital-intensive hardware procurement to flexible pricing models-such as pay-per-use or subscription structures-that align software consumption costs with operational workloads and budget cycles.

To mitigate the effects of tariff-driven cost volatility, procurement and IT teams must forge strategic relationships with component suppliers and explore diversified supplier pools. This proactive sourcing approach helps stabilize costs and maintain device availability. Concurrently, developing comprehensive training initiatives will equip field personnel with the skills to adopt new software features rapidly, creating a culture of continuous improvement. Finally, forging cross-functional governance frameworks that connect service operations, finance, and IT stakeholders promotes accountability and accelerates the adoption of best practices across the enterprise.

Unveil a Robust Research Methodology Merging Qualitative and Quantitative Approaches to Deliver Accurate and In-Depth Analysis of Field Force Management Patterns

This research endeavor employs a blended methodology to ensure rigorous and comprehensive coverage of the field force management software landscape. Primary research instruments included in-depth interviews with C-suite executives, operations managers, and technical leads across a spectrum of industries, yielding nuanced perspectives on adoption drivers, deployment challenges, and service delivery models. These qualitative insights were complemented by structured surveys administered to a global sample of field service professionals, capturing key metrics on usage patterns, feature priorities, and satisfaction levels.

Secondary research encompassed extensive review of company whitepapers, peer-reviewed journals, patent filings, and industry publications to contextualize emerging technologies and regulatory developments. Publicly available financial statements and press releases provided additional validation of strategic initiatives and partnership announcements. To enhance data reliability, all findings underwent a robust triangulation process, wherein conflicting data points were reconciled through follow-up inquiries and expert panel reviews.

Throughout the analysis, standardized scoring frameworks assessed vendor capabilities across functional, technical, and strategic dimensions. The iterative research cycle included periodic validation workshops with independent consultants and domain experts, ensuring that the final insights reflect both current realities and anticipated market trajectories. This comprehensive approach guarantees that stakeholders accessing the report receive balanced, actionable intelligence to guide decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Field Force Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Field Force Management Software Market, by Component

- Field Force Management Software Market, by User Interface

- Field Force Management Software Market, by Pricing Model

- Field Force Management Software Market, by Deployment Model

- Field Force Management Software Market, by Organization Size

- Field Force Management Software Market, by Application

- Field Force Management Software Market, by End User Industry

- Field Force Management Software Market, by Region

- Field Force Management Software Market, by Group

- Field Force Management Software Market, by Country

- United States Field Force Management Software Market

- China Field Force Management Software Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarize the Strategic Implications of Advanced Field Force Management Solutions Highlighting Critical Insights and Future Pathways for Industry Evolution

In summary, the modern field force management software market is propelled by a convergence of technological advancements, strategic service models, and dynamic economic influences. As companies navigate the dual pressures of tariff-induced cost fluctuations and rising customer expectations, solution providers continue to innovate through AI-driven dispatch, integrated IoT capabilities, and flexible deployment architectures. These developments not only enhance operational efficiency but also enable organizations to deliver differentiated service experiences and foster long-term customer loyalty.

Segmentation insights underscore the multifaceted nature of adoption, revealing that success hinges on aligning components, interfaces, pricing, deployment, organizational scale, applications, and industry-specific requirements. Meanwhile, regional nuances demonstrate how regulatory frameworks, infrastructure maturity, and macroeconomic conditions shape market trajectories in the Americas, Europe Middle East and Africa, and Asia Pacific.

For decision makers, the intersection of these factors signals a clear imperative: to harness data-driven practices, cultivate ecosystem partnerships, and adopt adaptive pricing and deployment strategies. By embracing these strategic pillars, organizations can not only mitigate current challenges but also position themselves to capitalize on emerging opportunities as field service evolves. Ultimately, the insights presented in this executive summary lay the groundwork for informed, forward-looking strategies that drive sustained competitive advantage.

Connect with Associate Director Ketan Rohom Today to Secure Your Comprehensive Field Force Management Software Market Research Report and Gain a Competitive Advantage

To obtain a comprehensive understanding of the field force management software landscape and position your organization for sustained growth, reach out to Associate Director Ketan Rohom. He will guide you through the wealth of insights contained in the full market research report and discuss how tailored analyses can address your specific business needs. By collaborating closely with Ketan, you can secure an authoritative resource that not only highlights emerging trends and competitive benchmarks, but also delivers actionable intelligence on pricing structures, regional dynamics, and deployment strategies. Engage with him to schedule a personalized briefing, explore customized data extracts, or arrange a direct consultation to align the report’s strategic findings with your organizational objectives. Empower your leadership and field teams with the knowledge required to accelerate decision-making, mitigate risks related to tariff-induced cost pressures, and harness the latest technological innovations in mobile and web-based workforce management. Connect with Ketan Rohom today to acquire the full market research report and gain a critical competitive advantage in the rapidly evolving field force management ecosystem.

- How big is the Field Force Management Software Market?

- What is the Field Force Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?