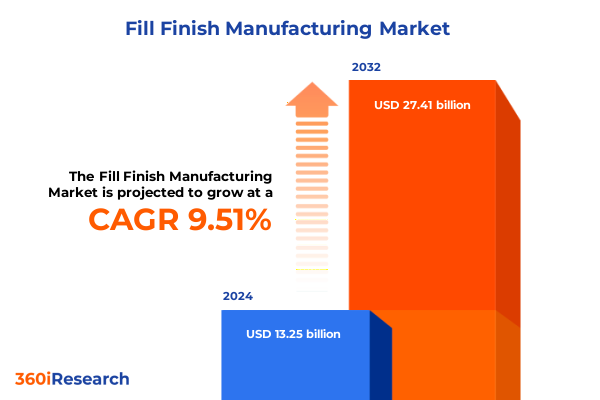

The Fill Finish Manufacturing Market size was estimated at USD 14.45 billion in 2025 and expected to reach USD 15.78 billion in 2026, at a CAGR of 9.57% to reach USD 27.41 billion by 2032.

Exploring the Critical Role of Fill-Finish Manufacturing and Its Evolving Significance in Modern Pharmaceutical and Biologic Production

The fill-finish manufacturing sector represents the crucial final phase of pharmaceutical and biologic production, wherein sterile drugs are prepared for patient delivery through meticulous filling, sealing, and inspection processes. This segment has grown in strategic importance as the global healthcare industry intensifies its focus on precision dosing, regulatory compliance, and time-to-market pressures. In response, fill-finish service providers have expanded capabilities to meet demands for small-batch runs, clinical trial volumes, and full-scale commercial production.

Over the past decade, the convergence of advanced biologics development and stringent regulatory standards has elevated fill-finish operations from back-end chores to strategic assets. Contract service organizations and in-house manufacturing teams alike must invest in high-containment isolators, single-use technologies, and robust quality management systems to ensure aseptic conditions. As a result, companies are prioritizing strategic partnerships that offer end-to-end solutions, encompassing formulation, fill-finish, and packaging.

Looking ahead, the industry must reconcile the push for personalized therapies with the need for scalable, flexible manufacturing infrastructures. Continuous innovation in automation, digital process control, and real-time release testing will be paramount. In doing so, stakeholders can accelerate development pipelines, reduce production risks, and ultimately enhance patient access to critical therapies.

Navigating Transformative Shifts in Fill-Finish Manufacturing Driven by Advanced Technologies Regulatory Evolution and Biologics Proliferation

The landscape of fill-finish manufacturing is undergoing transformative shifts driven by technological innovation, evolving regulatory frameworks, and the proliferation of complex biologics. Automation platforms equipped with robotics and artificial intelligence are increasing throughput while minimizing human intervention in sterile environments. This shift not only enhances consistency but also reduces contamination risks and operational costs. Moreover, single-use systems have unlocked new levels of flexibility, enabling rapid changeovers between product lines without extensive cleaning or sterilization procedures.

Concurrently, regulatory agencies worldwide are updating guidance to address the unique challenges of cell and gene therapies, necessitating adaptive manufacturing solutions. This evolution is prompting service providers to develop modular cleanroom designs and digital batch records that support both compliance and agility. The integration of digital twins and advanced analytics is further enabling real-time monitoring and predictive maintenance, ensuring consistent product quality.

Finally, the rise of oncolytic viruses, mRNA vaccines, and other novel modalities has intensified demand for specialized fill-finish capabilities. Companies are forging strategic alliances with technology vendors to incorporate blow-fill-seal equipment, lyophilization units, and precision dosing innovations. These collaborations are redefining the contours of the market, merging deep scientific expertise with cutting-edge engineering to deliver scalable and compliant fill-finish solutions.

Analyzing the Comprehensive Impact of United States Tariffs in 2025 on Fill-Finish Operations Supply Chains and Industry Resilience

The United States’ tariff policies in 2025 have had a multifaceted impact on fill-finish manufacturing operations, disrupting global supply chains and altering sourcing strategies. In April, a blanket 10% global tariff on nearly all imports was instituted, though pharmaceutical products and listed active pharmaceutical ingredients currently remain exempt under specific Executive Order provisions. This baseline tariff increased landed costs for critical components such as glass vials, plastic containers, and filtration assemblies sourced from Europe and Asia, compelling companies to reassess supplier contracts and inventory buffers.

Tariffs on Chinese imports have been particularly acute. A reciprocal tariff structure commenced with a 125% duty on goods from China, which was swiftly raised to 145% in response to reciprocal measures. These duties encompass key fill-finish inputs such as packaging materials and processing equipment, escalating procurement costs and creating acute pressure on margins for organizations reliant on Chinese manufacturers.

In parallel, targeted tariffs under Section 301 and Section 232 investigations are poised to impose 25% duties on large-scale pharmaceutical machinery-including lyophilizers and isolator systems-and 20–25% on active pharmaceutical ingredients from China and India. Additional levies of up to 50% have been scheduled on medical gloves and disposable syringes, while a 100% tariff on syringes and needles effective September 27, 2024, remains in force. Such sweeping measures have driven accelerated reshoring initiatives, investments in domestic production lines, and the exploration of nearshoring alternatives to mitigate tariff exposure.

As stakeholders navigate this evolving tariff environment, they must balance short-term cost management with long-term strategic relocation of critical operations. Companies that proactively diversify supply chains and invest in flexible manufacturing platforms are positioned to absorb tariff shocks and maintain operational continuity.

Uncovering Key Market Segmentation Insights Based on Service Container Technology and End User Dynamics Within Fill-Finish Manufacturing

A nuanced understanding of market segmentation is essential for illuminating growth pockets and customizing service offerings in fill-finish manufacturing. Based on service type, some providers specialize exclusively in cartridge filling, delivering high precision for high-volume biologics, while others focus on injection filling to accommodate complex formulations requiring meticulous volumetric accuracy. Meanwhile, vials and ampoules filling services dominate certain clinical trial programs, leveraging established sterile processes to support early-stage drug development.

Container type segmentation reveals further differentiation, with ampoules often chosen for high-potency drugs, and bags selected for large-volume parenteral solutions. Cartridges continue to gain traction in respiratory and anesthetic applications, whereas syringes-both prefilled and disposable formats-are driving innovation in patient-centric delivery and self-administration. Vials, crafted in glass or increasingly in durable, lightweight plastic, remain the standard for many injectable drugs and vaccines, underscoring the importance of material science advancements within fill-finish operations.

The selection of technology underscores another critical dimension. Aseptic filling remains fundamental for maintaining sterility, while automated filling platforms enhance throughput. Blow-fill-seal technology is experiencing rapid uptake in ophthalmic and high-volume liquid products, delivering closed-system assurance. Liquid filling lines continue to evolve with precision pumps and vision inspection systems, and lyophilization capabilities are indispensable for freeze-dried biologics, extending product stability and enabling global distribution.

End user segmentation further sharpens market strategies, encompassing both cosmetics and pharmaceuticals. Within the pharmaceutical sphere, the growing emphasis on biologics, injectable drugs, ophthalmic formulations, and vaccines calls for specialized fill-finish processes. Cosmetic applications, such as serums and nutrient blends, also benefit from sterile filling and packaging solutions, driving cross-industry technology transfers.

This comprehensive research report categorizes the Fill Finish Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Container Type

- Technology

- End User

Examining Regional Dynamics in Fill-Finish Manufacturing Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional market dynamics in fill-finish manufacturing are shaped by local regulatory landscapes, infrastructure maturity, and strategic industry investments. In the Americas, the convergence of strong contract service demand and government incentives for domestic production has bolstered capacity expansion. Key initiatives in the U.S. and Canada focus on bioprocessing facilities capable of handling both clinical and commercial volumes, with a particular emphasis on single-use technologies to accelerate development timelines and reduce contamination risk.

In the Europe, Middle East & Africa region, stringent EU regulations and harmonized quality standards drive adoption of advanced aseptic filling and dry-filling systems. This landscape also benefits from a dense network of specialized engineering firms and proximity to innovation hubs, which fosters continuous improvement in cleanroom design and process control. Emerging markets within the Middle East and Africa are increasingly partnering with European fill-finish specialists to address local vaccine production needs and regional supply security.

The Asia-Pacific region presents a dynamic mix of mature and rapidly emerging markets. Japan and South Korea lead in high-precision automated filling solutions, while China and India are investing heavily in large-scale vials and blow-fill-seal capabilities to serve growing domestic pharmaceutical markets. Regional trade agreements and tariff incentives are encouraging nearshoring, and the Asia-Pacific’s expanding biopharmaceutical pipelines are driving demand for fill-finish capacity aligned with global cGMP standards.

Across all regions, digitalization and sustainability considerations are becoming universal drivers of facility design and operational excellence, signaling a shift toward greener, more connected fill-finish ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Fill Finish Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Fill-Finish Manufacturing Players Their Strategic Initiatives Partnerships and Innovation Trajectories

The competitive landscape in fill-finish manufacturing is defined by a blend of global contract development and manufacturing organizations (CDMOs) and specialized regional service providers. Leading multinational players have differentiated themselves through significant capital investments in high-containment isolators, integrated quality management platforms, and proprietary automation suites. These organizations are further enhancing their value propositions by offering modular facilities and end-to-end solutions, encompassing formulation, fill-finish, and secondary packaging.

At the same time, regional specialists are carving niches by focusing on specific technologies-such as blow-fill-seal systems for ophthalmics or lyophilization services for freeze-dried vaccines-and forging partnerships with academic and research institutions to accelerate innovation. These companies often emphasize agility and local regulatory expertise, enabling rapid responses to changing clinical trial timelines and bespoke product requirements.

Strategic alliances between technology vendors and fill-finish providers are also on the rise, aimed at co-developing turnkey solutions that reduce time to market. Furthermore, mergers and acquisitions continue to reshape the landscape, as large CDMOs absorb niche service providers to broaden their technology portfolios and geographic reach. This consolidation wave is expected to persist, driven by the ongoing need for scale, specialized capabilities, and integrated supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fill Finish Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aseptic Technologies by SKAN Group

- BAUSCH Advanced Technologies, Inc.

- Becton, Dickinson and Company

- Curia Global, Inc.

- Eurofins Scientific SE

- Gerresheimer AG

- Grand River Aseptic Manufacturing

- Groninger & Co. GmbH

- IDT Biologika GmbH

- Industria Macchine Automatiche S.p.A.

- Mabion

- Maquinaria Industrial Dara, S.L.

- Marchesini Group S.p.A.

- Nipro Corporation

- Optima Packaging Group GmbH

- Recipharm AB

- Schott AG

- SGD S.A.

- Sharp Services, LLC

- Simtra BioPharma Solutions by Baxter International, Inc.

- Steriline S.r.l.

- Stevanato Group

- Syntegon Technology Gmb

- Vanrx Pharmasystems, Inc. by Cytiva

- West Pharmaceutical Services, Inc.

Actionable Strategies for Industry Leaders to Enhance Competitiveness Supply Chain Resilience and Innovation in Fill-Finish Manufacturing

Industry leaders seeking to maintain competitive advantage in fill-finish manufacturing should prioritize capacity flexibility and supply chain diversification. By investing in single-use systems and modular facility designs, organizations can reduce lead times for line changeovers and scale operations to match evolving demand patterns. Similarly, expanding dual sourcing arrangements-both geographically and by technology platform-will provide buffers against tariff volatility and raw material shortages.

Emerging digital solutions offer additional levers for optimization. Implementing real-time analytics and predictive maintenance across filling lines can minimize downtime and ensure consistent product quality. Adopting digital batch records and electronic quality management systems also streamlines regulatory compliance, facilitating faster approvals and reducing audit risks.

Finally, forging collaborative partnerships with technology providers and academic research centers can accelerate the adoption of innovative filling methodologies, such as high-speed blow-fill-seal or continuous lyophilization. These strategic alliances not only enhance technical capabilities but also foster knowledge transfer and co-investment in emerging therapies. By embracing these actionable strategies, industry leaders can build resilient, agile operations poised to navigate the complexities of the global fill-finish landscape.

Detailing the Rigorous Research Methodology Employed Including Data Triangulation Expert Interviews and Secondary Analysis Approaches

This research integrates a comprehensive blend of primary and secondary methodologies to ensure robust and reliable insights. Primary data was collected through structured interviews and in-depth discussions with senior executives from leading fill-finish service providers, pharmaceutical manufacturers, and technology vendors. These conversations provided firsthand perspectives on capacity planning, technology adoption, and regulatory challenges.

Secondary research encompassed a meticulous review of industry publications, regulatory agency guidance documents, and peer-reviewed journals. Trade association reports and public financial filings were analyzed to validate market trends and to contextualize competitive dynamics. Where possible, data triangulation was applied, cross-referencing multiple credible sources to confirm key findings.

Quantitative data was synthesized through a bottom-up analysis of facility capacities, technology investments, and historical adoption rates. Qualitative insights were derived from thematic coding of interview transcripts, capturing nuanced considerations such as customer preferences, operational bottlenecks, and strategic priorities. This mixed-methods approach ensures that the report delivers actionable intelligence rooted in both empirical evidence and expert opinion.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fill Finish Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fill Finish Manufacturing Market, by Service Type

- Fill Finish Manufacturing Market, by Container Type

- Fill Finish Manufacturing Market, by Technology

- Fill Finish Manufacturing Market, by End User

- Fill Finish Manufacturing Market, by Region

- Fill Finish Manufacturing Market, by Group

- Fill Finish Manufacturing Market, by Country

- United States Fill Finish Manufacturing Market

- China Fill Finish Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Critical Findings and Strategic Implications for Stakeholders in the Evolving Fill-Finish Manufacturing Landscape

In summary, the fill-finish manufacturing sector is at a pivotal juncture, shaped by accelerating technological innovation, evolving regulatory demands, and shifting global trade dynamics. Stakeholders must navigate an increasingly complex environment marked by tariff uncertainties, regional capacity expansions, and emerging modalities such as cell and gene therapies.

By understanding key segmentation dimensions-ranging from service types like cartridge and injection filling to container technologies and end-user applications-companies can tailor their strategies to capitalize on high-growth niches. Regional insights highlight the importance of localized expertise and regulatory alignment, while competitive analysis underscores the role of strategic partnerships and M&A in driving scale and capability enhancements.

Ultimately, success in this dynamic arena will depend on proactively investing in flexible manufacturing platforms, digital quality systems, and diversified supply chains. Armed with these insights, industry participants can better position themselves for sustained growth, operational excellence, and accelerated delivery of life-changing therapies to patients worldwide.

Engage with Ketan Rohom to Access the Comprehensive Fill-Finish Manufacturing Market Research Report and Drive Strategic Decision Making Today

To explore the full depth of insights on fill-finish manufacturing markets and to empower strategic decision-making, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing). A brief conversation will provide you with tailored guidance on accessing the comprehensive market research report that addresses the evolving dynamics, competitive landscape, and actionable strategies poised to shape your organization’s growth and resilience.

- How big is the Fill Finish Manufacturing Market?

- What is the Fill Finish Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?