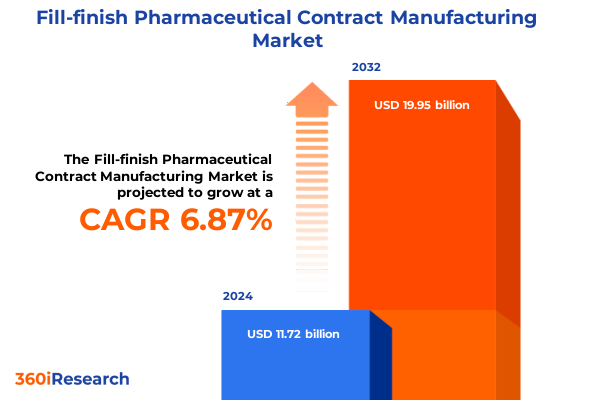

The Fill-finish Pharmaceutical Contract Manufacturing Market size was estimated at USD 12.48 billion in 2025 and expected to reach USD 13.31 billion in 2026, at a CAGR of 6.92% to reach USD 19.95 billion by 2032.

Exploring the Critical Role of Fill-Finish Contract Manufacturing in Accelerating Biopharmaceutical Product Development and Market Launch

The fill-finish segment of pharmaceutical contract manufacturing has emerged as a pivotal point in the biopharmaceutical value chain, where precision, compliance, and scalability converge to determine the pace of new therapy introductions. In recent years, the industry has witnessed an unprecedented surge in biologic product approvals and an expansion of complex drug modalities, placing fill-finish capabilities under intense scrutiny. As such, organizations embarking on clinical or commercial launches increasingly rely on specialized contract manufacturers to navigate stringent regulatory frameworks, mitigate risk, and optimize time-to-market. Moreover, the intricacies of aseptic processing, coupled with continuous pressure to maintain cost efficiency, have underscored the importance of strategic partnerships that can seamlessly integrate labeling and packaging workflows with terminal sterilization or lyophilization operations.

Against this backdrop, the capacity to adapt to bespoke vial formats, prefilled syringe configurations, and advanced delivery systems distinguishes leading contract manufacturers from legacy service providers. Beyond technical competencies, operational excellence in fill-finish demands a synergistic blend of cross-functional expertise-from quality assurance and validation engineering to supply chain resilience and digital process control. Consequently, decision-makers are compelled to evaluate potential collaborators not only on equipment footprint but also on robust project management frameworks that can scale production volumes without compromising on yield or compliance. This introduction sets the stage for a deeper exploration of the transformative shifts, regulatory headwinds, and strategic imperatives redefining this critical manufacturing domain.

Identifying the Transformative Shifts Reshaping the Fill-Finish Landscape Including Technological Advancements and Evolving Regulatory Demands

Over the past decade, the fill-finish landscape has undergone transformative shifts driven by technological innovation and evolving regulatory expectations. Initially dominated by manual operations, the segment is now embracing automation solutions that integrate robotics, single-use technologies, and digital monitoring systems to enhance throughput and reduce contamination risks. This shift has been accelerated by the growing complexity of large molecule therapeutics, which require stringent environmental controls and specialized aseptic processing capabilities. Meanwhile, regulatory bodies have responded to these technological advancements with updated guidance emphasizing process validation, data integrity, and risk-based approaches, prompting contract manufacturers to invest heavily in quality management systems and real-time analytics platforms.

Simultaneously, the rise of personalized medicine and cell and gene therapies has catalyzed demand for flexible, small-batch fill-finish solutions. In contrast to traditional high-volume runs, these novel modalities necessitate agile frameworks capable of rapid changeover and nuanced handling protocols. Smart facility designs now prioritize modular cleanrooms and configurable production lines that can pivot between pre-filled syringes, vials, or specialized delivery devices with minimal downtime. Moreover, as sustainability becomes a focal point, companies are exploring solvent-free lyophilization cycles and energy-efficient terminal sterilization methods. These converging trends have collectively reshaped the competitive landscape, rewarding contract manufacturers who can marry technical innovation with regulatory foresight and operational agility.

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Global Fill-Finish Supply Chains and Cost Structures

The introduction of new tariff measures by the United States in early 2025 has yielded a cumulative impact across global fill-finish supply chains, influencing raw material sourcing, equipment procurement, and service pricing. As levies on critical components such as single-use assemblies, stainless steel tubing, and specialized filtration media took effect, contract manufacturers faced steeper input costs that reverberated through project budgets and capital expenditure plans. In response, many stakeholders initiated strategic buffering of inventory and embarked on nearshoring initiatives to mitigate exposure to import tariffs. These efforts, while beneficial for supply continuity, often resulted in elevated working capital requirements and complex vendor qualification processes.

Furthermore, the ripple effects of tariff-induced cost inflation have extended to collaborative partnerships between pharmaceutical innovators and contract manufacturers. Clients have become more rigorous in contract negotiations, seeking transparent pass-through mechanisms and shared risk models to preserve margin stability. This environment has heightened the emphasis on operational efficiency and lean manufacturing principles, as both partners strive to absorb or offset incremental expenses. Looking forward, some industry players anticipate further regulatory adjustments, underscoring the need for dynamic sourcing strategies that optimize domestic suppliers, leverage free trade agreements, and embrace digital procurement tools. Ultimately, the cumulative impact of these tariff policies underscores a broader imperative: building resilient, cost-effective fill-finish networks capable of adapting to fluctuating trade landscapes.

Uncovering Key Segmentation Insights Across Service Type Molecule Type Product Type Automation Scale and End-User Dynamics

A nuanced understanding of service type segmentation reveals distinct growth trajectories for aseptic fill-finish, labeling and packaging, lyophilization, and terminal sterilization. In particular, aseptic fill-finish continues to command premium investment as biologic therapies proliferate, while turnkey labeling and packaging solutions gain traction among companies seeking end-to-end reliability. Lyophilization services are likewise expanding, reflecting the stability needs of temperature-sensitive formulations, whereas terminal sterilization remains indispensable for small molecule injectables requiring validated lethality cycles.

When considering molecule type, large molecules have emerged as a dominant force, driven by the therapeutic advantages of monoclonal antibodies and recombinant proteins. However, small molecule injectables retain significant volumes, underscoring the continued relevance of cost-effective high-throughput capabilities. In the context of product type, vials maintain widespread adoption for both clinical and commercial phases, though pre-filled syringes and cartridges are rapidly gaining share due to patient convenience and dose accuracy. Ampoules persist in select regions where legacy infrastructure and regulatory frameworks favor established glass formats.

Automation segmentation highlights the clear delineation between automatic and manual fill-finish operations. Automatic fill-finish platforms are increasingly preferred for large-scale commercial runs, where cycle consistency and contamination control are paramount, while manual fill-finish remains relevant for small-batch clinical programs requiring bespoke handling. The scale of operation segmentation further distinguishes the clinical services landscape-characterized by flexible capacities and rapid batch turnover-from commercial scale, where economies of scale and validated processes drive facility design. Finally, end-user segmentation illustrates divergent needs between biopharmaceutical companies emphasizing biologic modalities and traditional pharmaceutical companies focused on small molecule injectables, each seeking tailored service models to align with their pipeline priorities.

This comprehensive research report categorizes the Fill-finish Pharmaceutical Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Molecule Type

- Product Type

- Automation

- Scale of Operation

- End-Users

Analyzing Regional Fill-Finish Dynamics Revealing Diverse Growth Drivers Challenges and Opportunities Across Global Markets

Regional dynamics in fill-finish manufacturing reflect diverse market drivers, regulatory frameworks, and capacity landscapes. In the Americas, a robust biotech ecosystem and mature contract manufacturing infrastructure have fostered significant demand for sophisticated aseptic processing and advanced delivery systems. The availability of local raw materials and a supportive regulatory environment have further cemented North America’s position as a strategic hub for both clinical and commercial fill-finish operations. Nonetheless, rising labor costs and facility saturation have prompted some stakeholders to explore complementary footprint strategies in emerging markets.

Across Europe, Middle East and Africa, fill-finish providers benefit from a complex tapestry of regional incentives, stringent quality requirements, and an established pharmaceutical heritage. European nations continue to lead in cell and gene therapy fill-finish, buoyed by regulatory harmonization under the European Medicines Agency. Meanwhile, Middle East markets are investing in biotech clusters to reduce reliance on imports, and select African nations are upgrading sterile manufacturing capacity to address local public health needs. These regional nuances create a patchwork of opportunity for contract manufacturers capable of customizing service portfolios to meet exacting standards across multiple jurisdictions.

In the Asia-Pacific region, rapid healthcare modernization, expanding generics markets, and favorable labor arbitrage have catalyzed fill-finish expansion. Countries such as China, India, and Singapore are actively scaling up aseptic production lines, attracted by government incentives and growing domestic pipelines. Furthermore, a rising emphasis on quality enhancement and regulatory convergence has elevated service expectations, encouraging providers to adopt advanced process monitoring and digital quality management systems. As a result, Asia-Pacific is evolving from a low-cost manufacturing alternative to a center of technological innovation and capacity for global fill-finish programs.

This comprehensive research report examines key regions that drive the evolution of the Fill-finish Pharmaceutical Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Contract Manufacturers Highlighting Competitive Strategies Partnership Models and Value-Added Service Offerings

Leading contract manufacturers have strategically positioned themselves through targeted facility expansions, technology licensing agreements, and collaborative partnerships. Several top players have announced greenfield investments in modular cleanroom suites, enabling rapid scaling of both clinical and commercial fill-finish lines. Others have focused on forming alliances with suppliers of single-use assemblies and automated inspection systems to enhance process reliability and reduce time to validation. In parallel, technology transfer initiatives have become a cornerstone of value propositions, as clients demand seamless knowledge exchange and consistent product quality across global sites.

Moreover, selective acquisitions have allowed prominent CMOs to broaden their service portfolios, integrating specialized lyophilization capacity or allergen-free packaging solutions. These transactions not only diversify revenue streams but also reinforce capabilities in niche segments, such as high-containment fill-finish for cytotoxic drugs or complex combination products. Beyond capacity and equipment investments, top-tier contract manufacturers are differentiating through digital platforms that offer real-time batch analytics, remote process reviews, and predictive maintenance. This convergence of physical infrastructure and digital oversight underscores a competitive imperative: delivering holistic fill-finish solutions that accelerate client timelines while safeguarding compliance and quality.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fill-finish Pharmaceutical Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Ajinomoto Bio-Pharma Services

- Argonaut Manufacturing Services

- Baxter International, Inc.

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Chemtech International, Inc.

- Eurofins Scientific SE

- Federal Equipment Company

- Fresenius Kabi Contract Manufacturing

- Gerresheimer AG

- Goodwin Biotechnology Inc.

- Grand River Aseptic Manufacturing

- Groninger & Co. GmbH

- Jubilant HollisterStier CMO

- Novartis AG

- OPTIMA Packaging Group GmbH

- Pfizer Inc.

- Piramal Pharma Solutions

- Recipharm AB

- Syngene International Ltd.

- Syntegon Pharma Technology

- Vetter Pharma International

Crafting Actionable Recommendations for Industry Leaders to Navigate Disruption Drive Innovation and Enhance Operational Resilience

Industry leaders seeking to navigate the evolving fill-finish landscape should prioritize strategic investments in digital transformation and modular facility architectures. By embedding advanced process control systems and leveraging data analytics, companies can achieve real-time visibility into batch performance and proactively mitigate quality deviations. Furthermore, adopting flexible, single-use cleanroom designs will enable rapid conversion of production lines, reduce validation timelines, and accommodate a broader range of product types-from vials to prefilled syringes and cartridges.

Equally important is the establishment of collaborative risk-sharing frameworks with pharmaceutical sponsors, fostering transparency in cost structures and aligning incentives for on-time delivery. Negotiated agreements that include performance-based milestones and joint inventory management can strengthen partnerships and distribute financial risk equitably. Additionally, diversifying supplier networks through near-shoring strategies and free trade agreement jurisdictions can insulate operations from tariff volatility and transportation disruptions. Finally, embedding sustainability metrics into project planning-such as minimizing water footprint in lyophilization cycles and optimizing energy consumption in terminal sterilization-will not only satisfy emerging regulatory expectations but also enhance brand reputation and long-term cost efficiency.

Detailing the Rigorous Research Methodology Employed Including Secondary Research Data Triangulation and Expert Interviews

The findings presented throughout this report are underpinned by a multi-layered research methodology designed to ensure accuracy, relevance, and depth. Initially, comprehensive secondary research was conducted, drawing on peer-reviewed journals, regulatory guidelines, proprietary industry databases, and technical white papers. This phase established a foundational understanding of market dynamics, technological advancements, and key regulatory changes. Subsequently, a series of in-depth interviews with senior executives, process engineers, and quality assurance professionals from both contract manufacturing organizations and pharmaceutical sponsors provided qualitative insights into operational challenges and strategic priorities.

Data triangulation techniques were employed to validate quantitative inputs and reconcile discrepancies across sources. Third-party financial reports, capital expenditure filings, and clinical trial registries were cross-referenced to corroborate investment trends and capacity expansions. In addition, site visits and virtual facility tours facilitated firsthand observation of cleanroom configurations, automation integration, and process control systems. Finally, all insights were subjected to rigorous peer review by an internal panel of industry specialists, ensuring that conclusions are robust, actionable, and reflective of the current state of fill-finish contract manufacturing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fill-finish Pharmaceutical Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Service Type

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Molecule Type

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Product Type

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Automation

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Scale of Operation

- Fill-finish Pharmaceutical Contract Manufacturing Market, by End-Users

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Region

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Group

- Fill-finish Pharmaceutical Contract Manufacturing Market, by Country

- United States Fill-finish Pharmaceutical Contract Manufacturing Market

- China Fill-finish Pharmaceutical Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Drawing Conclusions That Synthesize Market Trends Technological Innovations and Strategic Imperatives for Fill-Finish Stakeholders

In synthesizing the multifaceted trends shaping fill-finish contract manufacturing, it is evident that technological innovation, regulatory evolution, and supply chain agility are the defining pillars of competitive advantage. The sustained growth of biologic pipelines and advanced delivery systems has elevated aseptic processing to a premium service, while automation and single-use technologies are driving efficiency gains across volume tiers. Meanwhile, the cumulative impact of trade policy shifts, particularly recent tariff adjustments, has reinforced the importance of resilient sourcing strategies and collaborative risk-sharing models between sponsors and service providers.

The segmentation analysis underscores a clear divergence in service demand, with large molecule therapies, prefilled syringes, and modular automation capturing disproportionate investment. Regional insights further reveal that North America and Europe continue to lead in high-complexity modalities, whereas Asia-Pacific is rapidly ascending as a center of scalable, cost-effective capacity complemented by elevating quality standards. Through strategic facility expansions, technology partnerships, and digital platform deployments, leading contract manufacturers are framing the future of fill-finish as a seamless, data-driven extension of the biopharmaceutical value chain.

As stakeholders navigate this dynamic environment, the integration of sustainability imperatives-such as reduced energy footprints in lyophilization and eco-friendly packaging-will increasingly factor into decision-making alongside traditional metrics of time-to-market and cost containment. Ultimately, success in this arena will be defined by an organization’s ability to harmonize cutting-edge processing capabilities with adaptive business models, ensuring that emerging therapeutics can reach patients safely, efficiently, and within regulatory guardrails.

Engaging with Associate Director Ketan Rohom to Secure Comprehensive Fill-Finish Market Research Insights and Drive Informed Decisions

To gain deeper visibility into critical fill-finish dynamics and equip your organization with timely strategic intelligence, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will enable you to explore tailored purchasing options, access customized executive briefings, and secure the comprehensive market research report that addresses your specific objectives. Make the informed choice to partner with an expert resource and empower your teams with actionable analysis covering market drivers, competitive benchmarks, regional nuances, and regulatory implications. Reach out today to accelerate your strategic planning, optimize supplier relationships, and drive sustained growth in the rapidly evolving fill-finish contract manufacturing landscape.

- How big is the Fill-finish Pharmaceutical Contract Manufacturing Market?

- What is the Fill-finish Pharmaceutical Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?