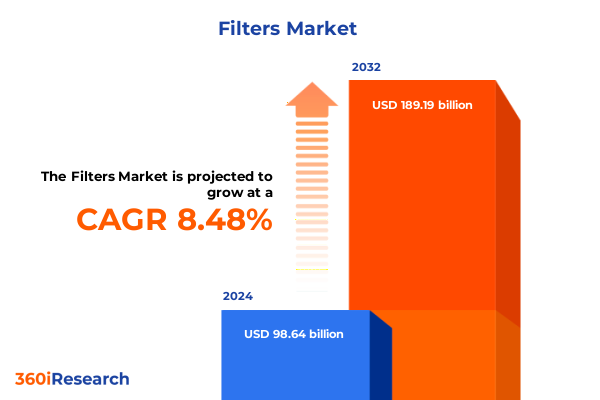

The Filters Market size was estimated at USD 106.86 billion in 2025 and expected to reach USD 115.46 billion in 2026, at a CAGR of 8.50% to reach USD 189.19 billion by 2032.

Unveiling the Modern Filtration Ecosystem: Key Drivers, Disruptions, and Strategic Imperatives Shaping Industry Transformation in 2025 and Beyond

The filtration industry is experiencing an unprecedented convergence of technological, regulatory, and market forces that are collectively redefining traditional approaches to contamination control. The surge in environmental compliance mandates, coupled with an accelerated adoption of digital capabilities, is challenging manufacturers to innovate at the nexus of materials science and data-driven operations. Concurrently, geopolitical shifts and escalating trade measures have compelled supply chains to become more resilient and responsive, ensuring continuity of critical metal-based components amid rising import barriers.

This executive summary distills the most pressing trends, tariff implications, segmentation dynamics, regional priorities, and competitive landscapes that are shaping the global filtration market in 2025. By synthesizing expert insights with rigorous analysis, it provides a strategic compass for decision-makers seeking to navigate evolving demands and capitalize on emerging opportunities across product lines, materials, applications, and distribution channels.

Navigating the Next Frontier in Filtration with AI, Sustainability, Shifting Regulations and Supply Chain Resilience Driving Industry Renewal

The digital revolution has permeated every facet of filtration, with intelligent sensor arrays and AI-powered analytics transitioning from novel applications to foundational capabilities. Advanced monitoring systems generate real-time performance metrics-tracking variables like pressure differentials, contaminant levels, and flow rates-and leverage machine learning algorithms to predict maintenance needs and dynamically adjust operational parameters. Early adopters report significant reductions in unplanned downtime and optimized maintenance schedules, unlocking new levels of process reliability and cost efficiency.

Sustainability mandates and circular economy principles are concurrently driving a wave of innovation in filtration materials and lifecycle management. Manufacturers are integrating bio-based and recycled fibers into filter media, deploying recyclable metal meshes, and experimenting with biodegradable polymer substrates. These eco-focused approaches not only align with stringent air and water quality regulations but also contribute to reduced waste footprints and improved lifecycle economics, thereby enhancing brand value in increasingly eco-conscious markets.

Regulatory and trade landscapes have undergone dramatic shifts, particularly in the U.S., where steel and aluminum tariffs have doubled from 25% to 50% since June 4, 2025. Filter systems reliant on metal framing, mesh, and housings are confronting elevated raw material costs, prompting companies to reconfigure sourcing strategies, nearshore production, or pass through modest price adjustments to preserve margins amid volatile import tariffs.

Finally, supply chain resilience and supply-network diversification have emerged as critical imperatives. The unpredictability of protectionist policies has accelerated investments in domestic manufacturing capacity, strategic vendor partnerships across Asia and Latin America, and agile procurement models. These measures collectively fortify continuity of supply for essential filter components while enhancing responsiveness to rapid demand changes.

Assessing the Cascading Effects of 2025 U.S. Steel and Aluminum Tariffs on Filtration Supply Chains, Production Costs, and Market Dynamics

In early March 2025, Section 232 tariffs expanded to cover all imported steel and aluminum at a 25% duty rate, followed by a Presidential proclamation escalating these measures to 50% on June 4, 2025. This marked the most aggressive tariff escalation in modern U.S. trade policy, aimed at bolstering domestic metal production and deemed necessary for national security and industrial competitiveness.

The filtration sector, heavily reliant on steel cages, aluminum frames, and metallic mesh, has absorbed significant cost pressures as raw material expenses rose accordingly. Corporate disclosures reveal that leading industrial conglomerates have reported multi-million-dollar hits to earnings, with some corralling price increases in mid-year product rollouts to offset the tariff burden. The heightened duties have disrupted established procurement agreements, compelling renegotiations and the pursuit of metal-alternative technologies where feasible.

Analysis by major financial institutions indicates that U.S. importers are shouldering the bulk of these duties through margin compression rather than full pass-through to end users. While consumer prices have yet to rise precipitously, upward pressure is building, especially in sectors such as HVAC and automotive filtration where volume demand remains robust. Anticipated downstream price adjustments could lead to shifts in customer purchasing patterns and potential demand elasticity challenges for filter manufacturers.

In response, firms are accelerating local production investments and revising supply chain footprints to circumvent punitive tariffs. Many are exploring foreign direct investment in U.S. filter media and component fabrication, leveraging federal incentives under recent infrastructure legislation. This strategic realignment underscores the cumulative impact of tariffs as both a cost disruptor and catalyst for reshoring and capacity expansion within the filtration industry.

Decoding Filter Market Segmentation: Product Variants, Material Innovations, Application Demands, and Evolving Sales Channels Shaping 2025 Strategies

Product insights reveal that contemporary filtration markets encompass a broad spectrum, from pleated air and panel filters designed for HVAC and cleanroom environments to specialized gas filters deployed in chemical and petrochemical operations. Meanwhile, liquid filters-including fuel, pressure, return-line, and suction variants-are integral to automotive powertrains and hydraulic systems across industrial machinery. Technological progress has fostered self-cleaning cartridges and multi-stage assemblies that extend service intervals while meeting exacting performance criteria.

Material segmentation underscores a dynamic landscape where activated carbon media are evolving through renewable sourcing and regeneration processes for water and odor control, and fiberglass substrates continue to command industrial and commercial air filtration installations thanks to their dust-holding capacity and regulatory compliance. Membrane technologies, from ultrafiltration to reverse osmosis with graphene and biomimetic enhancements, are revolutionizing food, beverage, and biotech sectors. Concurrently, metal mesh solutions deliver unparalleled durability for high-temperature and corrosive applications, with paper media persisting as a cost-effective baseline in general-purpose settings.

Application studies highlight that advanced filtration is now indispensable across automotive engine systems, where stringent emission standards demand precise fuel and oil separation, and in electronics manufacturing, where ultra-pure air and liquid filtration safeguard semiconductor yields. Food and beverage processors rely on hygienic membrane and paper filters for product safety, while HVAC systems integrate antimicrobial and high-efficiency particulate air (HEPA) solutions. Critical medical and pharmaceutical processes demand sterile, multi-stage filtration with real-time monitoring to maintain quality and patient safety.

Sales channel analysis shows a dual trajectory: OEM direct engagements enable bespoke design integration and aftermarket technical support, distributors and dealer networks maintain regional service capabilities, and digital commerce platforms are democratizing access while enforcing greater transparency on performance certifications, fueling strategic evolution in procurement and inventory management practices.

This comprehensive research report categorizes the Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Products

- Material Type

- Application

- Sales Channel

Unearthing Regional Filtration Dynamics: Comparative Demand Drivers, Regulatory Landscapes, and Infrastructure Priorities Across Americas, EMEA, and Asia-Pacific

In the Americas, the convergence of robust automotive and aerospace manufacturing hubs with rigorous Environmental Protection Agency standards sustains strong filtration demand for performance-critical applications. Substantial investments in municipal water treatment and industrial wastewater infrastructure reinforce the requirement for advanced membrane and carbon-based systems, while the emergence of smart home air purification solutions demonstrates the region’s appetite for integrated, digitally connected filter technologies.

Europe’s filtration landscape is shaped by ambitious European Union environmental directives, such as the Industrial Emissions Directive and EU Clean Air Package, which compel industries from cement and chemicals to power generation to deploy high-efficiency filtration systems. The region’s automotive sector further intensifies demand for cabin and powertrain filters, and renewable energy projects are escalating requirements for specialized particulate removal in wind and solar equipment operations.

Middle East & Africa confront pronounced water scarcity and oil & gas production demands, elevating the prominence of produced-water treatment technologies like zero-liquid discharge and advanced membrane filtration. Despite financing constraints, government incentives and public-private partnerships are propelling modular treatment solutions across MENA, underpinning growing installations of ultrafiltration and desalination pre-treatment systems that lean on both polymer and ceramic media.

Asia-Pacific remains a powerhouse for filtration adoption, driven by rapid industrialization in China, India, and Southeast Asia along with urban air quality initiatives. Investments in high-capacity air and water filtration equipment are further bolstered by stringent environmental regulations, rising disposable incomes, and large-scale infrastructure expansion. Innovations like graphene-enhanced membranes and nanofiber air media are gaining footholds as regional manufacturers and research institutes accelerate collaborative development efforts.

This comprehensive research report examines key regions that drive the evolution of the Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Confronting Competitive Currents: Strategic Positioning and Innovation Tactics of Leading Filter Manufacturers Navigating a Protectionist and Tech-Driven Environment

Several leading organizations have leveraged distinct strategic imperatives to navigate the evolving filtration ecosystem. Industrial stalwarts such as Donaldson Company and Parker Hannifin field comprehensive portfolios that span air, gas, and liquid filtration, capitalizing on economies of scale and integrating advanced materials science into robust metal and polymer assemblies. Simultaneously, Cummins Filtration and Bosch are directing R&D toward membrane innovations and sustainable carbon media, targeting high-purity water treatment and emissions control applications.

Material specialists like Mann+Hummel and Ahlstrom-Munksjö emphasize differentiated media technologies-ranging from high-efficiency fiberglass layers to eco-friendly paper and polymer substrates-while Moore advanced players in the activated carbon space, such as Hayward, 3M, and Pentair, are integrating smart sensing capabilities for real-time performance diagnostics and predictive maintenance alerts. This fusion of media expertise with digital platforms is setting new benchmarks in lifecycle management and service contracts.

Regional champions in water and wastewater treatment-exemplified by Veolia Water Technologies and PureLine-have scaled modular membrane and electrocoagulation solutions that address both municipal and produced-water challenges, harnessing local partnerships and operational service models to secure prominent footholds in Middle East & Africa. Across the board, strategic M&A activity, joint ventures, and vertical integration initiatives underscore the competitive drive to consolidate market positions and accelerate time-to-market for next-generation filter technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. O. Smith Corporation

- AAF International

- Ahlstrom-Munksjö Oyj

- Bosch Rexroth AG

- BRITA SE

- Camfil AB

- Caterpillar Inc.

- Clarcor Inc.

- Cummins Inc.

- Danaher Corporation

- Denso Corporation

- Donaldson Company, Inc.

- Eaton Corporation plc

- Eureka Forbes Ltd

- Filtration Group Corporation

- Freudenberg Filtration Technologies SE & Co. KG

- Hengst SE

- Hollingsworth & Vose Company

- Honeywell International Inc.

- K&N Engineering, Inc.

- Kent RO Systems Ltd.

- Lydall, Inc.

- MAHLE GmbH

- Parker Hannifin Corporation

Empowering Industry Leadership: Recommended Strategic Actions for Filter Manufacturers to Capitalize on Technological Advances, Tariff Shifts, and Sustainability Imperatives

Industry leaders should diversify procurement by establishing multi-regional supplier networks and securing tariff-exempt component sources, mitigating exposure to fluctuating trade measures. Simultaneously, channeling capital into next-generation materials-such as biodegradable polymers, graphene-enhanced membranes, and nanofiber composites-can differentiate product portfolios while aligning with sustainability mandates.

Digitalization efforts must prioritize AI-driven performance monitoring and IoT-enabled remote management, enabling predictive maintenance, reducing operational costs, and fostering data-centric service models. Firms that embed smart sensors and analytics into filter systems gain real-time insights and reinforce customer retention through value-added maintenance contracts.

Advocacy for favorable regulatory frameworks remains essential; industry coalitions can lobby for tariff exemptions on critical raw materials and incentivize domestic production through tax credits. Meanwhile, proactive investment in local manufacturing capacity-supported by infrastructure incentives-will enhance supply chain resilience and shorten lead times.

Finally, embedding circular economy principles through the adoption of reusable, recleanable filter elements and regeneration processes not only reduces waste but secures cost advantages over the long term. Companies that integrate end-of-life recovery programs and closed-loop material flows will capture new revenue streams while solidifying sustainability credentials.

Elucidating Our Rigorous Research Framework: Methodological Foundations, Data Triangulation, and Expert Engagement Approaches Underpinning Our Filtration Industry Analysis

This analysis employed a multi‐pronged research framework, commencing with an exhaustive review of secondary data sources, including regulatory filings, government proclamations, industry whitepapers, and corporate disclosures. Quantitative trade data was triangulated with tariff schedules and import‐export records to quantify policy impacts.

Primary research comprised structured interviews with filter OEM executives, supply chain practitioners, and materials scientists, supplemented by targeted surveys across manufacturing, energy, and environmental service sectors. These engagements yielded qualitative insights into strategic responses, material innovation roadmaps, and localized regulatory compliance tactics.

Data validation ensued through cross‐comparison of technical specifications, patent filings, and financial filings against market intelligence, ensuring consistency and accuracy. The segmentation framework was constructed using hierarchical clustering of product, material, application, and distribution criteria, thereby facilitating nuanced analysis of submarket dynamics.

Expert workshops and peer review sessions convened industry authorities to critique findings and refine forecasts, culminating in a robust, action‐oriented synthesis that underpins the strategic recommendations and executive insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Filters Market, by Products

- Filters Market, by Material Type

- Filters Market, by Application

- Filters Market, by Sales Channel

- Filters Market, by Region

- Filters Market, by Group

- Filters Market, by Country

- United States Filters Market

- China Filters Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Consolidating Insights for Strategic Advantage: Executive Reflections on the Filtration Industry’s Future Trajectory Amid Technological, Regulatory, and Market Pressures

As the filtration industry navigates the crosscurrents of protectionist trade policies and accelerated digital transformation, companies that embrace agility, innovation, and sustainability will emerge as critical enablers of environmental and operational resilience. The interplay of AI‐driven intelligence, advanced material systems, and strategic supply chain realignment is reshaping traditional cost models and opening avenues for differentiated service offerings.

Regulatory complexity and tariff volatility, while challenging, also catalyze domestic capacity investments and material innovations that can reinforce competitive moats and foster long‐term growth. Regional demand disparities underscore the need for tailored approaches-leveraging local partnerships, compliance expertise, and targeted product mixes.

By aligning strategic decisions with the evolving segmentation, regional, and company‐specific insights detailed herein, stakeholders can position themselves to not only withstand immediate headwinds but also capitalize on the transformative shifts redefining the global filtration ecosystem.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Unlock Premium Insights and Propel Your Filtration Market Strategies with Our Comprehensive Report

Ready to harness the actionable insights and strategic imperatives detailed in this executive summary? To explore how these in-depth analyses can elevate your market positioning and drive sustainable growth, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage with an expert who understands your industry challenges and can guide you to the tailored market intelligence necessary for confident decision-making and competitive advantage. Let’s connect and ensure your organization is equipped with the premium filtration market research that informs every strategic move and unlocks new growth horizons.

- How big is the Filters Market?

- What is the Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?