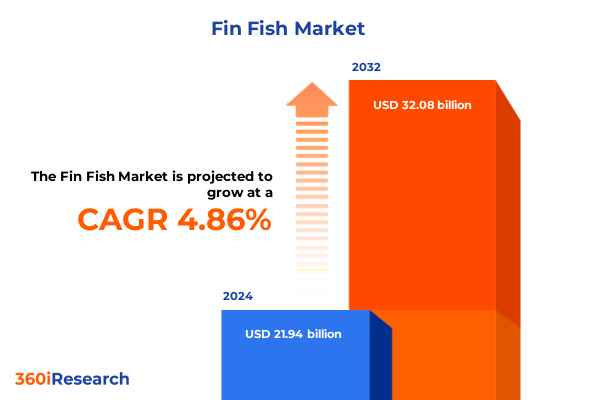

The Fin Fish Market size was estimated at USD 184.68 billion in 2025 and expected to reach USD 195.08 billion in 2026, at a CAGR of 5.95% to reach USD 276.84 billion by 2032.

Unveiling the Core Dynamics and Strategic Imperatives Shaping the Fin Fish Market Amid Evolving Consumer Preferences and Supply Chain Realities

The fin fish sector stands at a pivotal juncture where shifting consumer demands, evolving supply chain architectures, and emerging sustainability priorities converge to redefine traditional paradigms. This market, deeply influenced by nutritional trends and environmental stewardship, has witnessed a pronounced tilt toward higher standards of product integrity, reflecting a broader public appetite for traceability and ethical sourcing. In parallel, the industry’s maturation has catalyzed a wave of innovation across harvesting techniques, processing technologies, and distribution models, revealing novel pathways to serve both established and emerging market segments.

Amid these dynamics, health-conscious shoppers increasingly prioritize omega-rich proteins and transparent origin stories, compelling producers and retailers to recalibrate product portfolios. Meanwhile, operational pressures arising from regulatory compliance, complex logistics, and fluctuating raw material availability are urging organizations to pursue integrated digital solutions. Consequently, the convergence of these demand- and supply-side forces underscores a transformative era characterized by agility and data-driven decision making.

Against this backdrop, this executive summary distills critical insights into the forces sculpting the modern fin fish landscape, offering a coherent narrative that bridges macroeconomic influences with granular market behaviors. Through an interdisciplinary lens, the analysis traverses policy impacts, segmentation nuances, regional variations, competitive dynamics, and strategic recommendations. Moreover, the research methodology underpinning this work emphasizes rigorous data validation and stakeholder engagement, ensuring that the findings resonate with both industry veterans and strategic investors.

In light of intensifying global competition, heightened consumer scrutiny, and the imperative for sustainable growth, this introduction sets the stage for a deeper exploration of the transformative shifts and actionable strategies that define the trajectory of the fin fish market today.

Identifying Pivotal Shifts Redefining the Fin Fish Ecosystem Through Technological Innovation, Sustainability Practices, and Regulatory Overhauls

Over the past several years, the fin fish industry has undergone a series of radical transformations driven by technological breakthroughs, regulatory realignments, and evolving sustainability imperatives. The adoption of precision aquaculture techniques, including real-time water quality monitoring and automated feeding systems, has markedly improved yield consistency and reduced environmental externalities. Simultaneously, blockchain-enabled traceability frameworks have emerged, offering end-to-end visibility from harvest to plate and thereby reinforcing consumer trust in product provenance.

Regulatory landscapes have also been reshaped to address mounting concerns around illegal, unregulated, and unreported fishing. Enhanced certification schemes and stricter import standards have raised entry barriers, prompting businesses to adopt robust compliance protocols. In turn, this has stimulated investment in onshore processing capacity and value-added production streams designed to meet stringent food safety benchmarks, while also buttressing domestic job creation and economic resilience.

Parallel to these developments, the acceleration of e-commerce and direct-to-consumer fulfillment has opened new revenue channels, allowing smaller operators to reach niche audiences without the necessity of traditional wholesale partnerships. This digital pivot has been further propelled by sophisticated cold chain logistics, which enable temperature-controlled shipping across extended geographies, thereby unlocking markets that were once inaccessible due to perishability constraints.

Taken together, these shifts delineate an industry in the midst of reorientation, where digital enablers, sustainability mandates, and regulatory modernization coalesce to forge a more transparent, efficient, and resilient ecosystem. The following sections will unpack the implications of these transformational dynamics and identify strategic pathways to thrive in this evolving milieu.

Assessing the Multifaceted Consequences of the 2025 United States Tariff Policies on Fin Fish Supply Chains and Market Accessibility

In 2025, a comprehensive revision of United States tariff schedules introduced new duties across a broad spectrum of fin fish imports, affecting both fresh and processed forms. The imposition of these tariffs has exerted upward pressure on landed costs for importers, who have been compelled to reevaluate sourcing strategies and renegotiate supplier contracts. As a result, domestic producers have found themselves better positioned to capitalize on internal demand, while import-dependent businesses have faced margin compression.

At the same time, the tariff adjustments have triggered shifts in trade flows, with several exporters redirecting shipments toward markets in Asia-Pacific and Europe, where duty burdens remain comparatively lower. This reallocation has induced supply shortfalls in certain product categories within the United States, particularly for filleted forms of salmon and yellowfin tuna, which historically rely on high-volume imports. To mitigate these gaps, wholesalers and distributors have initiated longer-term agreements with domestic aquaculture ventures and regional fishing cooperatives, seeking to establish secured supply chains insulated from tariff volatility.

Moreover, the evolving tariff environment has accelerated conversations around nearshoring and vertical integration. Fish processing facilities have been exploring partnerships with coastal fishing enterprises to co-locate value-added operations, thereby curtailing cross-border duties and enhancing operational control. In this context, the interplay between trade policy and supply chain architecture underscores the need for adaptive sourcing frameworks that can both absorb regulatory disruptions and sustain competitive pricing.

Deciphering Critical Segmentation Patterns to Illuminate End Use, Product Forms, Distribution Channels, and Species Preferences

A nuanced understanding of market segmentation illuminates the diverse pathways through which fin fish products traverse from sea to table. In the realm of end use, meal ingredients and ready-to-eat offerings within the food processing industry coexist alongside the full-service catering, hotel, and restaurant segments of the broader hospitality channel, as well as direct purchasing for household consumption. These distinct consumption occasions each impose unique quality, packaging, and value propositions, mandating tailored approaches to product formulation, portioning, and distribution.

Likewise, variations in product form-from filleted or whole presentations in fresh offerings to block or individually quick-frozen options in frozen formats-reflect the operational requirements of different market players. Further processing yields canned or smoked variants that cater to extended shelf life needs, while value-added fillets and steaks satisfy premium segment demand with convenience and elevated culinary experiences. Each form factor interacts with supply mechanics, storage infrastructure, and consumer acceptance in idiosyncratic ways, shaping profitability and logistical complexity.

Distribution channels add another layer of differentiation. Traditional brick-and-mortar outlets such as convenience stores and dedicated fish markets coexist with specialized seafood retailers and large-format chain supermarkets alongside hypermarkets. In parallel, the rise of online platforms, whether through direct-to-consumer portals or national e-commerce ecosystems, has redefined last-mile distribution, enabling perishable products to reach rural and urban consumers alike under tightly controlled temperature regimes.

Finally, species selection drives product positioning across Atlantic and Pacific varieties of cod and salmon, as well as the differential characteristics of skipjack versus yellowfin tuna. Each species exhibits unique flavor profiles, nutritional attributes, and harvest constraints, demanding species-specific marketing narratives and supply planning. Taken together, these segmentation insights offer a comprehensive lens through which stakeholders can align portfolio strategies with consumer preferences and operational capabilities.

This comprehensive research report categorizes the Fin Fish market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Species

- End Use

- Distribution Channel

Comparative Examination of Regional Consumption Trends and Industry Drivers Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics shape the competitive landscape in profound ways, as each geography brings distinct consumption behaviors, regulatory frameworks, and supply chain architectures to bear. In the Americas, a strong tradition of filleted and frozen presentations caters to diverse urban and suburban retailers, anchored by robust cold storage networks and a preference for protein variety among health-conscious consumers. Conversely, local aquaculture expansion initiatives have begun to challenge long-standing import dependencies, particularly in coastal communities where onshore farming yields steady year-round production.

Across Europe, the Middle East, and Africa, the regulatory mosaic varies widely, with some nations embracing stringent sustainability certifications and eco-labeling, while others maintain less formal oversight. Consumers in Western Europe increasingly favor traceable wild-capture cod and salmon, often sourced under Marine Stewardship Council or equivalent endorsements. Meanwhile, burgeoning middle-class populations in parts of Africa and the Gulf region are driving interest in both Canned and value-added offerings, blending convenience with aspirational culinary experiences.

In the Asia-Pacific sphere, a blend of powerhouse producers and voracious consumer markets fosters intense competition. Japan and South Korea continue to command respect for traditional fresh and sashimi-grade presentations, whereas Southeast Asian nations demonstrate rising demand for frozen block and individually quick-frozen formats that support extended supply lines. Australia and New Zealand have leveraged their regulatory alignment with sustainability best practices to export premium salmon and tuna products, capitalizing on brand equity in premium retail segments.

By comparing these regional appetites and operational contexts, industry players can pinpoint both latent market opportunities and potential pitfalls, ensuring that product development, distribution strategies, and regulatory engagement are attuned to the unique characteristics of each territory.

This comprehensive research report examines key regions that drive the evolution of the Fin Fish market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Positioning of Leading Corporations Shaping the Future of the Fin Fish Industry Landscape

Leading corporations within the fin fish sector have pursued a variety of strategic initiatives to reinforce their market positions and capture emerging opportunities. Several heritage aquaculture firms have invested substantially in off-shore farming technologies, seeking to expand production capacities of Atlantic salmon while mitigating environmental impact through closed-containment systems. In contrast, established canning enterprises have diversified their portfolios by acquiring specialized smokehouse operations, elevating product quality and broadening their appeal in gourmet segments.

In parallel, vertically integrated operators have consolidated harvesting, processing, and distribution under unified structures, enabling end-to-end traceability and cost efficiencies. This approach has been particularly advantageous in the context of evolving tariff regimes, as it facilitates tariff mitigation through domestic value addition. Simultaneously, mid-tier seafood specialists have forged exclusive partnerships with coastal cooperatives to secure direct access to artisanal species, catering to niche retailers and high-end hospitality clients.

On the innovation front, a cohort of technology-centric firms has introduced advanced data analytics platforms designed to optimize fleet routing, harvest timing, and cold chain temperature management. These digital enablers are rapidly gaining traction, as they unlock predictive insights that reduce spoilage and align supply volumes with real-time demand signals. Additionally, sustainability-focused players have partnered with certification bodies to strengthen eco-labeling credentials, thereby appealing to the growing cohort of environmentally conscious consumers.

Collectively, the strategic maneuvers of these key companies illustrate a balanced interplay between scale-driven efficiency, product differentiation, and digital transformation. Their experiences provide valuable case studies for industry participants aiming to navigate complexity, enhance resilience, and foster long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fin Fish market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AquaChile

- Australis Seafoods S.A.

- Bakkafrost P/F

- Camanchaca S.A.

- Cermaq Group AS

- Cooke Aquaculture Inc.

- Grieg Seafood ASA

- Huon Aquaculture Group Pty Ltd

- Jifmar Group

- Lerøy Seafood Group ASA

- Marine Harvest Canada

- Mowi ASA

- New Zealand King Salmon Co. Ltd.

- Nireus S.A.

- Nordic Aquafarms AS

- Pesquera Los Fiordos Ltda.

- SalMar ASA

- Sanford Limited

- Scottish Sea Farms Ltd.

- Selonda Aquaculture S.A.

- Stolt Sea Farm

- Tassal Group Limited

Actionable Strategies to Enhance Resilience, Drive Innovation, and Secure Competitive Advantage for Industry Leaders in the Fin Fish Sector

To thrive amid ongoing volatility and intensifying competition, industry leaders should prioritize the integration of digital monitoring tools across harvesting and processing operations. Real-time analytics can significantly improve yield predictability and quality control, while simultaneously enabling more responsive adjustments to logistic disruptions. By institutionalizing data-driven decision making, organizations can reduce operational waste and calibrate supply volumes to evolving consumer patterns.

Equally important is the expansion of value-added offerings that cater to convenience-driven segments. By developing ready-to-cook fillets with pre-seasoned marinades or pre-sliced steaks packaged in eco-friendly formats, companies can capture premium margins and reinforce brand loyalty. This strategy also mitigates tariff exposure when processing steps are performed domestically, thereby bolstering margin integrity under shifting trade policies.

Strategic alignment with sustainability certifications and collaborative stewardship programs will further strengthen market credibility. Engaging proactively with accreditation bodies and local fishing communities fosters a narrative of environmental responsibility that resonates with end users. Simultaneously, exploring partnerships for carbon-neutral transportation solutions can reduce the sector’s ecological footprint and preempt regulatory risks related to greenhouse gas emissions.

Finally, cultivating agile sourcing networks that blend domestic aquaculture partnerships and targeted imports will insulate businesses from geopolitical or policy-driven supply shocks. By establishing multi-tiered supplier alliances and transparent contract mechanisms, organizations can preserve continuity of supply, maintain cost stability, and position themselves to capitalize on emerging demand across diverse consumer segments.

Detailing the Rigorous Research Methodology and Analytical Framework Ensuring Comprehensive Insights and Data Integrity Throughout the Study

The research underpinning this executive summary is grounded in a multi-stage methodology designed to ensure both breadth and depth of insight. Initially, secondary sources such as peer-reviewed journals, government trade datasets, and industry association publications were analyzed to construct an overarching market framework and identify prevailing trends. This foundational desk research provided context around regulatory developments, historical trade flows, and species-specific consumption patterns.

Following the secondary analysis, a series of structured interviews were conducted with key stakeholders across the value chain, including aquaculture operators, large-scale processors, distributors, and retail buyers. These qualitative conversations yielded nuanced perspectives on operational challenges, evolving end-consumer tastes, and emerging technological investments. Interview participants were selected based on their strategic roles and geographic representation, ensuring that insights reflect both global and localized viewpoints.

To validate and quantify qualitative findings, the study incorporated quantitative data gathering through proprietary surveys distributed to a cross-section of buyers and suppliers. Responses were anonymized and aggregated to detect patterns in sourcing preferences, certification priorities, and channel mix strategies. All data underwent rigorous triangulation, comparing primary findings against publicly available financial reports, import-export logs, and third-party audit certifications to confirm accuracy and minimize bias.

Throughout the process, a peer-review mechanism engaged independent experts in fishery science, supply chain resilience, and trade policy to critique assumptions and refine analytical models. This iterative validation approach bolstered the reliability of conclusions and ensured that strategic recommendations are both evidence-based and practically actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fin Fish market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fin Fish Market, by Product Form

- Fin Fish Market, by Species

- Fin Fish Market, by End Use

- Fin Fish Market, by Distribution Channel

- Fin Fish Market, by Region

- Fin Fish Market, by Group

- Fin Fish Market, by Country

- United States Fin Fish Market

- China Fin Fish Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Their Implications to Guide Stakeholders Toward Informed Decisions in the Fin Fish Industry

In synthesizing the key takeaways from this analysis, several thematic imperatives emerge. First, the industry’s trajectory is increasingly defined by the interplay between consumer-driven sustainability demands and the digitization of supply chains, compelling organizations to adopt integrated solutions that enhance transparency and mitigate ecological impact. Second, the recalibration of tariff structures underscores the importance of flexible sourcing strategies and domestic value addition as levers for cost management and supply security.

Furthermore, segmentation insights reveal that end-use diversification, form factor innovation, and species differentiation each present distinct avenues for margin enhancement and customer loyalty. Regional nuances-from the regulatory rigor of Western Europe to the dynamic import-export interplay in the Americas and Asia-Pacific-necessitate tailored approaches that align product offerings with local preferences and logistical realities.

Collectively, the strategic actions of leading companies illustrate a playbook centered on vertical integration, technology adoption, and sustainability certification, offering valuable lessons for market entrants and incumbents alike. By embracing these paradigms, stakeholders can navigate complexity, capitalize on shifting consumer appetites, and forge resilient growth pathways.

Engage Directly with Ketan Rohom to Unlock Tailored Market Intelligence and Drive Strategic Growth in Your Fin Fish Business with Expert Insights

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to uncover how this comprehensive fin fish market research report can inform your strategic planning and drive growth outcomes by delivering tailored intelligence and actionable recommendations that align with your business objectives

- How big is the Fin Fish Market?

- What is the Fin Fish Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?