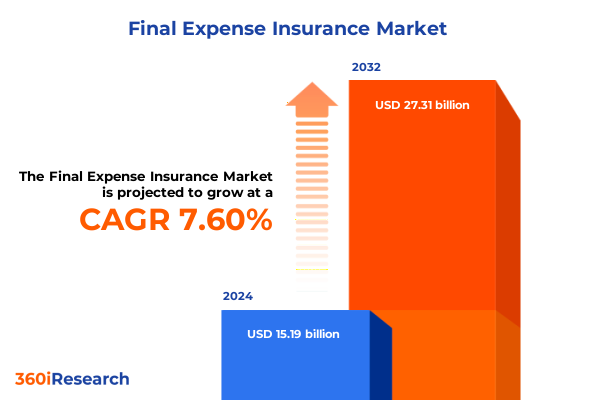

The Final Expense Insurance Market size was estimated at USD 16.27 billion in 2025 and expected to reach USD 17.46 billion in 2026, at a CAGR of 7.67% to reach USD 27.31 billion by 2032.

Understanding the Rising Significance of Final Expense Insurance in Addressing Aging Populations and Financial Security Concerns

Final expense insurance has emerged as a critical financial planning tool for individuals seeking to alleviate the burden of end-of-life costs on their loved ones. As the population in the United States continues to age, more families face rising funeral and administrative expenses that can quickly exhaust personal savings or strain family budgets. In response, insurers have developed tailored solutions that offer predictable premiums and guaranteed benefits, ensuring that policyholders can leave a dignified legacy without leaving behind debt.

In addition to demographic pressures, changing consumer expectations are reshaping how final expense insurance is designed and delivered. Policyholders now demand greater transparency around coverage terms, streamlined underwriting processes, and digital engagement channels that align with broader trends in financial services. Consequently, carriers are investing heavily in technology platforms and data-driven underwriting models to expedite policy issuance and enhance the overall customer experience.

This executive summary provides an overview of the evolving landscape, highlighting the factors driving demand, the challenges that insurers must navigate, and the strategic implications for stakeholders. By synthesizing the most pertinent insights, decision-makers can develop a clear line of sight into emerging opportunities and risks, enabling them to fine-tune product portfolios and distribution strategies accordingly.

Navigating the Transformative Shifts Reshaping Final Expense Insurance Through Digital Innovation and Changing Consumer Preferences

The final expense insurance sector is undergoing profound transformation, propelled by technological innovation, evolving consumer behaviors, and regulatory adjustments. Traditional underwriting models that relied on lengthy medical questionnaires are giving way to accelerated and simplified approaches, reducing approval times from weeks to just days or even hours. This shift not only enhances customer satisfaction but also opens the door to previously underserved segments whose health profiles might have disqualified them under older protocols.

Meanwhile, digital distribution channels are gaining traction as insurers seek to meet customers where they are most comfortable. From direct-to-consumer online platforms to mobile applications that allow for real-time quotes and policy management, carriers are building omnichannel ecosystems that integrate with existing customer journeys. At the same time, affinity partnerships remain a key growth driver, as professional associations and senior communities offer trusted gateways into niche demographics.

On the regulatory front, recent guidance aimed at greater product transparency is prompting carriers to simplify benefit illustrations and clarify premium schedules. This has the dual effect of improving policyholder confidence while reducing compliance risks. Ultimately, these transformative shifts are converging to create an environment in which agility and customer centricity define competitive advantage, setting the stage for the next wave of innovation in the final expense space.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Final Expense Insurance Ecosystems and Ancillary Service Costs

In 2025, the United States implemented a series of tariffs targeting imported funeral goods, including caskets, memorial headstones, and certain funeral home equipment. As a result, the underlying costs that funeral providers incur have risen significantly, exerting upward pressure on the total expenses policyholders can expect at the time of claim. Insurers offering final expense coverage have consequently faced a dilemma: whether to absorb these incremental costs within existing benefit structures or to adjust premium arrangements and policy riders to maintain financial sustainability.

Many carriers have chosen a hybrid approach. While some have integrated modest premium adjustments to offset part of the tariff impact, others have negotiated long-term partnerships with domestic manufacturers to secure preferential pricing on essential funeral goods. These strategic alliances not only mitigate cost volatility but also support local suppliers, strengthening community ties and enhancing brand reputation. In parallel, certain insurers have introduced optional riders specifically designed to cover tariff-related surcharges, giving policyholders the flexibility to tailor their protection without increasing base premiums across the board.

Looking ahead, the cumulative impact of these tariffs underscores the importance of supply chain resilience and proactive cost management for insurers in this segment. By monitoring legislative developments and fostering agile procurement strategies, carriers can protect policyholder value while safeguarding their own profitability in an era of shifting trade dynamics.

Uncovering Critical Segmentation Insights to Tailor Final Expense Insurance Offerings Across Demographics and Distribution Channels

Final expense insurance offerings must reflect the distinct requirements of different product types, each with its own underwriting criteria and benefit structures. Guaranteed issue policies deliver coverage without medical exams or health questions, serving those with significant health concerns. Simplified issue plans strike a balance between accessibility and risk assessment through limited health screenings. Term life variants provide temporary protection with lower initial premiums, appealing to younger buyers seeking short-term coverage. Whole life solutions, on the other hand, guarantee lifelong protection and level premiums, making them a compelling choice for individuals who prioritize certainty over cost variability.

Age group segmentation plays an equally critical role in designing effective plans. Adults under 50 often seek flexible premium arrangements that can adjust as life circumstances evolve. As policyholders transition into the 50 to 59 and 60 to 69 cohorts, demand typically shifts toward streamlined issuance processes and broader coverage amounts that account for the rising cost of final expenses. Meanwhile, those aged 70 and above frequently prioritize guaranteed acceptance products, as they provide immediate coverage without the risk of medical disqualification, even though premiums reflect the higher risk profile.

Gender dynamics also influence coverage preferences and risk assessments, with female buyers tending to prioritize predictable long-term cost structures and male buyers often more open to flexible premium options tied to changing income levels. In parallel, premium type customization-whether through flexible premiums that adjust over time, lump sum payments simplifying policy administration, or traditional monthly premiums-enables carriers to cater to individual budgetary constraints and payment preferences.

Coverage amounts further differentiate customer segments, as policies below $10,000 address minimal funeral costs, mid-tier plans in the $10,000 to $20,000 range reconcile cost efficiency with comprehensive coverage, and offerings above $20,000 provide a premium level of protection. Distribution channels intersect with these factors, from affinity partnerships with professional associations and senior clubs to bank-sponsored products, broker networks, and direct-to-consumer digital platforms. Finally, understanding whether target customers are businesses procuring employee plans-spanning government employees, private enterprises, and unionized workforces-or individuals with pre-existing conditions or limited income ensures that product design and marketing strategies are precisely aligned with end-user needs.

This comprehensive research report categorizes the Final Expense Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Gender

- Premium Type

- Coverage Amount

- Distribution Channel

- Target Customers

Analyzing Key Regional Dynamics Influencing Final Expense Insurance Trends Across the Americas, EMEA, and Asia-Pacific Markets

Geographic regions exhibit distinct patterns in final expense insurance adoption, shaped by regulatory environments, cultural norms, and distribution infrastructures. In the Americas, the United States leads in advanced digital capabilities and affinity-based sales channels, while Canada places greater emphasis on simplified underwriting and integration with broader life insurance portfolios. Latin American markets are characterized by growing consumer awareness and emerging direct-to-consumer platforms, though distribution remains heavily reliant on broker networks and community ties.

In the Europe, Middle East & Africa region, regulatory oversight around policy transparency and consumer protection is more prescriptive, prompting carriers to invest in clear benefit disclosures and robust compliance frameworks. Western European markets exhibit high penetration of whole life offerings with guaranteed acceptance, whereas emerging Middle Eastern economies are witnessing the introduction of simplified issue plans to address nascent demand among aging populations. In African markets, microinsurance initiatives and partnerships with community organizations drive accessibility among underserved segments.

Asia-Pacific presents a diverse landscape, with Japan and Australia leading in product innovation and digital distribution. In contrast, Southeast Asian nations often leverage affinity partnerships with labor unions and senior associations to build trust and scalability. Regulatory modernization across the region is unlocking new accelerated underwriting pathways, but carriers must navigate varying licensing requirements and product approvals on a country-by-country basis.

These regional dynamics underscore the necessity for insurers to adopt localized strategies, leveraging global best practices while respecting the unique regulatory, cultural, and distribution nuances of each geography.

This comprehensive research report examines key regions that drive the evolution of the Final Expense Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies’ Strategic Initiatives and Competitive Tactics Driving Innovation in Final Expense Insurance

Leading insurers in the final expense segment are deploying a combination of organic innovation and strategic alliances to maintain competitive advantage. Legacy carriers are modernizing their back-end platforms, enabling seamless integration of third-party data sources for accelerated underwriting and more accurate risk assessments. Meanwhile, nimble InsurTech entrants focus on user experience, offering mobile-first applications that guide prospective buyers through quote comparisons and policy customization in real time.

Several top-tier companies have pursued joint ventures with funeral service providers and domestic manufacturers to stabilize supply chain costs in response to tariff pressures. By coordinating procurement and leveraging group purchasing power, these alliances create a win-win scenario for insurers and service vendors. In parallel, some carriers are piloting usage-based policies that adjust coverage parameters based on lifestyle data, blurring the line between traditional life insurance and final expense solutions.

In addition, key players are exploring embedded insurance models, integrating final expense coverage into retirement planning tools and personal financial management platforms. This approach enhances customer stickiness and opens new distribution gateways beyond conventional agents and brokers. Mergers and acquisitions among smaller carriers and regional specialists continue to reshape the competitive landscape, as scale becomes increasingly important for negotiating favorable rates and expanding digital capabilities.

Together, these initiatives illustrate how major companies are redefining the boundaries of final expense insurance, creating more personalized, cost-effective, and technologically advanced offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Final Expense Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAA Life Insurance Company

- Aflac Incorporated

- Allianz SE

- Anthem Insurance Group, Inc.

- Assurity Benefits Group

- Bajaj Finserv Limited

- Corebridge Financial, Inc.

- CVS Final Expense by Accendo Insurance Company

- Fidelity Life Association

- First Generation Life

- Gerber Life Insurance Company

- Globe Life Inc.

- Londen Insurance Group, Inc.

- Manulife Financial Corporation

- MetLife Services and Solutions, LLC

- Mutual of Omaha Insurance Company

- New York Life Insurance Company

- Royal Neighbors of America

- State Farm Mutual Automobile Insurance Company

- Symmetry Financial Group by Quility Insurance Holdings

- The Baltimore Life Insurance Company

- The Savings Bank Mutual Life Insurance Company

- Transamerica Corporation

- TruStage Financial Group, Inc.

- United Home Life Insurance Company

Actionable Strategies for Industry Leaders to Enhance Market Positioning and Drive Growth in Final Expense Insurance Segment

Industry leaders seeking to strengthen their positions in the final expense segment should prioritize investments in digital underwriting and customer engagement platforms. By leveraging predictive analytics and alternative data such as tissue-based health indicators, carriers can streamline approval processes and reduce operational overhead, translating into a more compelling value proposition for policyholders.

Furthermore, forging deeper partnerships with affinity groups, professional associations, and senior communities will unlock targeted distribution channels with built-in trust and loyalty. Customized co-branded products that address the unique needs of these communities can drive accelerated growth while reinforcing brand affinity. In parallel, negotiating strategic supply agreements with funeral goods manufacturers can shield carriers from cost volatility induced by tariff fluctuations, ensuring that benefit promises remain viable.

Product innovation should also extend to policy riders and modular coverage enhancements, enabling policyholders to select protection levels aligned with their financial circumstances and risk profiles. By offering flexible premiums and lump sum payment options alongside traditional monthly structures, insurers can accommodate a broader spectrum of customer preferences.

Finally, embracing an embedded insurance strategy-integrating final expense coverage into retirement advisory platforms, mortgage origination processes, and employer-sponsored benefit portals-will diversify distribution and create more touchpoints for policy acquisition. This holistic approach positions carriers to capture incremental share while delivering a seamless customer experience.

Detailing the Comprehensive Research Methodology Combining Primary Interviews and Secondary Data Analysis for Robust Insights

This research draws upon a rigorous methodology designed to deliver reliable, actionable insights into the final expense insurance landscape. Primary data collection included in-depth interviews with senior executives at leading insurance carriers, underwriting specialists, distribution partners, funeral service providers, and regulatory advisors. These conversations provided qualitative perspectives on emerging trends, competitive dynamics, and the practical challenges of tariff mitigation.

Secondary research involved a comprehensive review of publicly available filings, regulatory publications, white papers, and industry association reports. In addition, the analysis leveraged proprietary data sets on underwriting performance benchmarks, policy lapse rates, and distribution channel efficiency metrics. Advanced statistical techniques were applied to validate correlations between demographic variables and product uptake, ensuring that segmentation insights are grounded in robust evidence.

Data triangulation was employed to cross-verify findings from multiple sources, reducing the risk of bias and enhancing the credibility of the conclusions. Each insight was subjected to peer review by actuaries and market analysts to confirm its relevance and accuracy. The combination of qualitative and quantitative approaches ensures a holistic view of the final expense segment, enabling stakeholders to make informed decisions based on a balanced assessment of market realities.

Through this blended methodology, the research delivers a nuanced understanding of the forces shaping final expense insurance today and the strategic pathways available to industry participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Final Expense Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Final Expense Insurance Market, by Product Type

- Final Expense Insurance Market, by Age Group

- Final Expense Insurance Market, by Gender

- Final Expense Insurance Market, by Premium Type

- Final Expense Insurance Market, by Coverage Amount

- Final Expense Insurance Market, by Distribution Channel

- Final Expense Insurance Market, by Target Customers

- Final Expense Insurance Market, by Region

- Final Expense Insurance Market, by Group

- Final Expense Insurance Market, by Country

- United States Final Expense Insurance Market

- China Final Expense Insurance Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Implications to Inform Future Directions in Final Expense Insurance Landscape

The landscape of final expense insurance is characterized by dynamic shifts in consumer demographics, regulatory requirements, and distribution modalities. As carriers adapt to the realities of an aging population and rising funeral costs, they must balance the twin imperatives of product accessibility and financial sustainability. The rise of digital underwriting, simplified issue products, and strategic partnerships has created fertile ground for growth, yet it also demands vigilance against cost pressures and compliance challenges.

By examining the cumulative impact of 2025 tariffs, we have highlighted how supply chain resilience and vendor collaboration can safeguard benefit promises. Our segmentation analysis underscores the importance of tailoring offerings across product types, age cohorts, gender preferences, premium structures, coverage levels, distribution channels, and target customer profiles. Regionally, the divergence between mature markets and emerging economies reveals opportunities for differentiated strategies that respect local nuances.

Leading companies are deploying innovative tactics-from embedded insurance models to co-branded affinity products-to maintain competitive edge, while a robust methodology has validated these insights with both quantitative rigor and qualitative depth. The actionable recommendations presented here offer a clear roadmap for insurers to refine their strategies, harness emerging technologies, and deepen customer relationships.

Together, these findings chart a course for sustained success in the final expense insurance segment, emphasizing agility, customer centricity, and strategic partnership as the pillars of future value creation.

Engage with Ketan Rohom to Secure In-Depth Final Expense Insurance Insights and Accelerate Your Strategic Decision Making

If you are ready to elevate your understanding of final expense insurance and harness these insights to shape winning strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a deep knowledge of industry dynamics and can guide you through the comprehensive research report, highlighting the opportunities and challenges most relevant to your organization. His expertise will help you interpret nuanced findings, align them to your strategic priorities, and unlock the competitive advantages that a data-driven approach can deliver.

Engaging with Ketan ensures you receive personalized support, whether through a tailored briefing, in-depth discussions on segmentation nuances, or a deep dive into regional and tariff impacts. He will facilitate access to the executive summary, full report, and any ancillary materials, ensuring that your team can act swiftly on the evidence-based recommendations.

Don’t miss the chance to leverage this authoritative resource to inform product development, channel strategies, and partnership opportunities. Contact Ketan today to discuss how this research can inform your next move in the final expense insurance market and drive sustainable growth for your organization.

- How big is the Final Expense Insurance Market?

- What is the Final Expense Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?