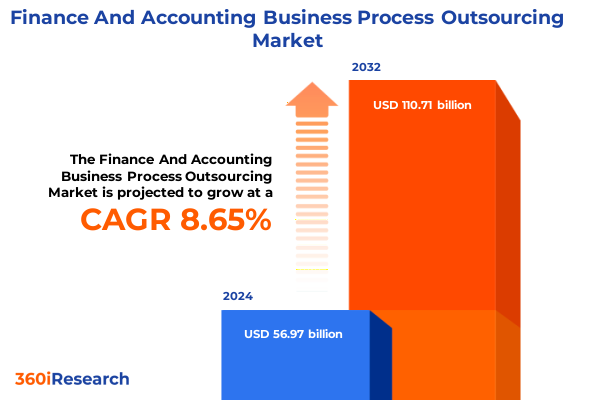

The Finance And Accounting Business Process Outsourcing Market size was estimated at USD 61.69 billion in 2025 and expected to reach USD 66.81 billion in 2026, at a CAGR of 8.71% to reach USD 110.71 billion by 2032.

Deep Dive into Strategic Imperatives and Market Forces Shaping Finance and Accounting Outsourcing Landscape

Industry executives and financial leaders face an accelerating wave of complexity as global markets evolve and regulatory environments shift. In this context, finance and accounting outsourcing emerges not merely as a cost-saving measure but as a strategic lever for growth and agility. This executive summary provides a concise overview of the transformative dynamics at play, the ripple effects of United States tariff policy in 2025, nuanced segmentation insights that reveal targeted opportunities, and a regional breakdown highlighting areas of competitive advantage.

From organizations seeking to streamline transactional processes to enterprises aiming to harness advanced analytics for forecasting, the outsourced finance and accounting value proposition has expanded in both scope and sophistication. By outlining key industry trends, spotlighting major service providers, and offering actionable recommendations, this summary equips decision-makers with the clarity and foresight needed to navigate the shifting landscape. It sets the stage for a deeper exploration of market drivers, segmentation patterns, and strategic imperatives that will define success in the coming years.

How Cloud, Automation, and Advanced Analytics Are Redefining the Role of Outsourced Finance and Accounting Services

The finance and accounting outsourcing sector is undergoing a metamorphosis driven by rapid technological advancements and evolving stakeholder expectations. Automation through robotic process automation (RPA) and intelligent document processing has moved beyond pilot projects to enterprise-wide adoption, enabling organizations to process high volumes of transactions with unprecedented speed and accuracy. At the same time, the deployment of cloud-based platforms has fostered real-time collaboration between service providers and clients, breaking down silos and ensuring that financial data flows seamlessly across organizational boundaries.

Moreover, there is a growing emphasis on data analytics and predictive insights, allowing companies to shift from reactive reporting to proactive advisory services. Service providers are increasingly embedding analytics dashboards and AI-driven forecasting tools into their offerings, empowering clients to make data-driven decisions about cash flow management, cost optimization, and risk mitigation. As regulatory complexity intensifies, especially around tax compliance and financial reporting standards, the ability to integrate compliance checks into core workflows has become a critical differentiator.

These technological and regulatory shifts are redefining the traditional roles of finance and accounting functions, elevating them from back-office operations to strategic partners in organizational performance. Service models are adapting rapidly to these changes, ensuring that providers can deliver end-to-end value-from transactional efficiency to strategic advisory-all within a secure, compliance-driven framework.

Examining the Full Scope of How 2025 U.S. Tariff Policies Have Transformed Cost Structures and Compliance in Outsourced Finance Operations

In 2025, the United States implemented a series of tariffs targeting a broad array of imported goods and intermediate components, with significant knock-on effects for finance and accounting BPO operations. As many service providers rely on cross-border data centers and shared services hubs, increased costs on hardware and software licenses have compelled organizations to reassess their sourcing strategies. This has spurred a dual focus on supply chain resiliency and the localization of key processes to mitigate exposure to tariff fluctuations.

Beyond technology inputs, the tariffs have reverberated through client industries such as manufacturing, retail, and telecom-sectors that are heavy users of transactional accounting services. For instance, increased manufacturing costs have led to tighter margins, elevating the demand for cost-containment strategies within accounts payable and expense management workflows. Service providers have responded by optimizing process standardization and enhancing automation to protect profitability while preserving service levels.

Regulatory compliance services have also been affected. Tariff-induced price volatility has increased the complexity of financial reporting, requiring more frequent revaluations and disclosures. This has driven heightened demand for audit-ready reporting solutions and real-time monitoring of tariff adjustments. In turn, providers are developing adaptive frameworks that can quickly incorporate new tariff schedules into compliance checks, ensuring that clients maintain accuracy and transparency in their financial statements despite ongoing policy evolutions.

Overall, the cumulative impact of the 2025 U.S. tariffs has been to accelerate strategic shifts toward technology-enabled efficiency, risk-centric process design, and nimble compliance models that can withstand the pressures of an uncertain trade environment.

Uncovering Strategic Differentiators by Analyzing Service, Model, Function, Client, Industry, Size, and Deployment Segmentation Dynamics

An in-depth segmentation analysis reveals critical opportunities for tailored service delivery. When slicing the market by service type, auditing services bifurcate into external and internal functions, enabling organizations to engage specialized expertise for compliance reviews while leveraging rigorous internal audits to strengthen governance. Core accounting and financial reporting services ensure that balance sheets and cash flow statements maintain integrity, while regulatory compliance offerings embed evolving statutory requirements directly into workflows. Within transactional accounting, a distinct focus on accounts payable, accounts receivable, and fixed asset management delivers granular process control, and advanced expense management practices, from corporate credit card reconciliations to detailed travel expense audits, offer deeper insights into cost drivers.

Exploring the service model dimension highlights three dominant approaches: FTE-based arrangements, which provide predictable staffing; output-based engagements that align fees with defined deliverables; and transactional pricing models tailored to individual process volumes. Each model appeals to different client priorities, whether stability of resource allocation or variability tied to transaction spikes.

From a business function perspective, outsourced solutions span human resources functions, intricate payroll processing with salary management and time-tracking protocols, and end-to-end procurement services that optimize the sourcing-to-pay cycle. Client type segmentation underscores the divergent needs of private entities-ranging from global corporations with complex intercompany structures to fast-growing SMEs-and public sector organizations, which prioritize transparency, audit readiness, and stringent cost controls.

Industry vertical analysis points to specialized demand in banking, insurance, manufacturing, retail, and telecom, where compliance and transactional volumes drive outsourcing adoption. Organization size further nuances the market, with large enterprises seeking integrated global solutions, mid-market firms balancing cost and capability, and small enterprises, including local businesses and high-growth start-ups, leveraging BPO to access enterprise-grade platforms without heavy upfront investment. Lastly, deployment types bifurcate into cloud-based solutions-spanning hybrid, private, and public cloud architectures-that facilitate scalable, secure access, and on-premise installations favored by clients with stringent data residency requirements.

This comprehensive research report categorizes the Finance And Accounting Business Process Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Service Model

- Business Function

- Client Type

- End User Industry

- Organization Size

- Deployment Type

Highlighting Regional Contrasts and Growth Patterns Shaping Finance and Accounting BPO Adoption Across Key Global Territories

Regional dynamics in finance and accounting outsourcing vary considerably across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, North American clients drive demand for advanced analytics-driven advisory services, while Latin American markets demonstrate strong uptake of transactional accounting solutions as organizations prioritize cost efficiency amidst evolving economic landscapes. The Americas’ mature regulatory frameworks propel growth in external and internal audit services, compelling providers to offer specialized compliance expertise.

Across Europe, the Middle East, and Africa, complexity arises from a mosaic of tax regimes and reporting standards. Western Europe’s convergence on IFRS and heightened digital transformation initiatives favor cloud-based and hybrid deployment models, whereas firms in the Middle East are rapidly embracing finance outsourcing as a means to access global best practices. In Africa, emerging economies select BPO partners to fortify financial controls and support cross-border expansion.

In Asia-Pacific, the landscape is characterized by significant scale and diversity. Large enterprises in developed APAC markets demand full-spectrum finance and accounting outsourcing that integrates automation, predictive forecasting, and real-time reporting. Meanwhile, emerging markets rely heavily on transactional services to standardize processes and improve working capital management. Regional cost arbitrage, coupled with strategic nearshoring in local hubs, continues to make Asia-Pacific a cornerstone for service delivery, especially for global corporations seeking flexible, scalable solutions.

This comprehensive research report examines key regions that drive the evolution of the Finance And Accounting Business Process Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling How Global Leaders and Specialized Firms Are Raising the Bar in Finance and Accounting Outsourcing Innovation and Delivery Excellence

Major service providers are distinguishing themselves through technological investments, global delivery networks, and sector-specific expertise. Leading firms are embedding AI-driven analytics and machine learning capabilities into core accounting platforms, accelerating the reconciliation of high-volume transactions and enabling real-time anomaly detection. Several providers have established specialized vertical practices, deploying dedicated teams with deep industry knowledge in banking, insurance, and manufacturing to address complex compliance demands and process nuances.

Additionally, alliances between BPO leaders and cloud infrastructure giants are creating new hybrid deployment models, offering clients seamless integration between on-premise systems and cloud-native services. Strategic acquisitions have further expanded the scale and scope of end-to-end finance outsourcing portfolios, enabling providers to deliver both breadth of service-from payroll processing and procurement to regulatory compliance-and depth of expertise in high-stakes audit and advisory engagements.

At the same time, mid-tier and niche players are carving out differentiated positions by focusing on specialized workflows such as expense management, intercompany reconciliations, and tax compliance automation. These firms often emphasize consultative service models that blend traditional FTE-based support with outcome-driven pricing, offering clients flexibility to ramp operations up or down in response to market volatility. Through investment in digital platforms and robust process governance frameworks, these providers continue to elevate the bar for quality, security, and customer experience in the finance and accounting BPO space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Finance And Accounting Business Process Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Acelerar Technologies Pvt Ltd

- Automatic Data Processing, Inc.

- Baker Tilly International Ltd.

- Baltic Assist

- Capgemini

- CES Ltd.

- Coastal Cloud

- Cognizant Technology Solutions Corporation

- Concentrix Corporation

- Conduent, Inc.

- Datamatics Global Services Ltd.

- Deloitte Touche Tohmatsu Limited

- Exela Technologies, Inc.

- ExlService Holdings, Inc.

- Genpact

- HCL Technologies Ltd.

- Infosys Limited

- International Business Machines Corporation

- Invensis Technologies Private Limited

- MaxTech Data House Private Limited

- Mesopotamia Trade Ltd.

- Oworkers

- SS&C Technologies Holdings Inc.

- Systemart LLC

- TATA Consultancy Services Limited

- Tech Mahindra Ltd.

- Teleperformance SE

- Wipro Limited

- WNS (Holdings) Ltd.

Strategic Blueprint for Leveraging Automation, Flexible Models, and Geographic Diversification to Reinvent Outsourced Finance Functions

To thrive in this dynamic environment, industry leaders must adopt a forward-looking agenda that balances efficiency with strategic growth. First, investing in intelligent automation and cognitive technologies across core workflows-from accounts systems to audit platforms-will be pivotal for reducing manual tasks and minimizing error rates. Concurrently, organizations should cultivate analytics capabilities that transform raw financial data into actionable business insights, enabling dynamic forecasting and proactive risk management.

Second, embracing flexible operating models-blending FTE, output-based, and transactional pricing frameworks-will allow clients to tailor engagements in line with fluctuating transaction volumes and strategic priorities. Leaders should negotiate service-level agreements that incorporate continuous improvement benchmarks and transparent performance metrics, ensuring that providers remain accountable for innovation and cost optimization.

Third, a regional diversification strategy can help mitigate geopolitical and tariff-related risks. By combining delivery centers across the Americas, EMEA, and Asia-Pacific, organizations can safeguard operations against supply chain disruptions and currency fluctuations. Finally, fostering collaborative partnerships with providers through joint governance structures and co-innovation programs will drive sustained improvements in process efficiency, regulatory compliance, and the integration of emerging technologies.

Ensuring Data Integrity Through Rigorous Primary Interviews, Secondary Research, Expert Review, and Cross-Validation Protocols

The research methodology underpinning this report integrates multiple data sources and analytical frameworks to ensure robust and reliable insights. Primary research was conducted through in-depth interviews with finance executives across client organizations, complemented by discussions with senior leaders at leading service providers. These conversations provided nuanced perspectives on technology adoption, process optimization, and regional delivery strategies.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, and technology vendor white papers to map current trends and emerging best practices. A rigorous triangulation process compared findings across data sets, identifying convergent themes and resolving discrepancies. Quantitative analysis of process volumes, client spending patterns, and delivery center footprints validated qualitative insights and illustrated the relative maturity of service models in different geographies and industries.

To ensure neutrality and accuracy, an expert advisory panel reviewed draft findings, offering feedback on analytical assumptions and the portrayal of regional dynamics. This collaborative approach fostered a balanced interpretation of market forces, technology trajectories, and regulatory pressures, resulting in actionable recommendations that resonate with both service buyers and providers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Finance And Accounting Business Process Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Finance And Accounting Business Process Outsourcing Market, by Service Type

- Finance And Accounting Business Process Outsourcing Market, by Service Model

- Finance And Accounting Business Process Outsourcing Market, by Business Function

- Finance And Accounting Business Process Outsourcing Market, by Client Type

- Finance And Accounting Business Process Outsourcing Market, by End User Industry

- Finance And Accounting Business Process Outsourcing Market, by Organization Size

- Finance And Accounting Business Process Outsourcing Market, by Deployment Type

- Finance And Accounting Business Process Outsourcing Market, by Region

- Finance And Accounting Business Process Outsourcing Market, by Group

- Finance And Accounting Business Process Outsourcing Market, by Country

- United States Finance And Accounting Business Process Outsourcing Market

- China Finance And Accounting Business Process Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesis of Insights on Digital Transformation, Segmentation Strategies, Regional Nuances, and Provider Capabilities Shaping Future BPO Excellence

This executive summary distills the pivotal currents reshaping finance and accounting outsourcing, from accelerating automation and advanced analytics to the strategic responses required in the wake of U.S. tariff policy shifts. Our segmentation analysis highlights the diverse needs of organizations by service type, delivery model, business function, client classification, industry vertical, company size, and deployment preference. Regional insights underscore the unique regulatory and operational landscapes across the Americas, EMEA, and Asia-Pacific.

By examining leading providers’ investments in technology, sector specialization, and delivery networks, we uncover how best-in-class strategies are evolving to meet escalating demands for efficiency, transparency, and resilience. The actionable recommendations presented herein offer a blueprint for industry leaders to harness emerging technologies, adopt flexible engagement models, and optimize geographic delivery to fortify their finance and accounting functions.

Ultimately, this report offers a comprehensive foundation for informed decision-making, equipping executives with the clarity needed to navigate a complex and rapidly evolving environment. Whether embarking on a digital transformation initiative, reevaluating outsourcing partners, or designing governance frameworks, stakeholders will find practical insights and strategic guidance to chart a path toward operational excellence and sustained competitive advantage.

Secure Comprehensive Intelligence on Finance and Accounting Outsourcing Trends by Partnering with Ketan Rohom for the Definitive Industry Report

As competitive pressures intensify and stakeholders demand ever-greater visibility into operational performance, securing comprehensive insights has never been more critical. By engaging our research team, you will gain access to an in-depth analysis of the forces shaping finance and accounting outsourcing, uncover best practices across a full spectrum of services and client types, and obtain a strategic roadmap for maximizing efficiency and resilience. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to elevate your decision-making and align your organization with the latest industry paradigms. Let’s embark on this journey together-connect with us today to acquire the definitive market research report and drive your business forward.

- How big is the Finance And Accounting Business Process Outsourcing Market?

- What is the Finance And Accounting Business Process Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?