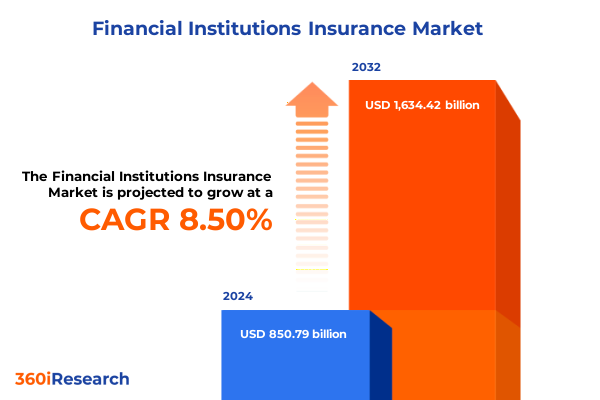

The Financial Institutions Insurance Market size was estimated at USD 14.56 billion in 2025 and expected to reach USD 15.14 billion in 2026, at a CAGR of 5.34% to reach USD 20.98 billion by 2032.

Setting the Stage for Financial Institutions Insurance by Embracing Complexity and Seizing Strategic Opportunities in a Rapidly Evolving Global Risk Environment

The dynamic landscape of financial institutions insurance demands a comprehensive understanding of evolving risks and tailored strategies. In an era marked by intensified regulatory requirements, technological innovation, and emerging threats, organizations must navigate a complex web of exposures to safeguard assets and reputation. This executive summary provides a concise but thorough overview of pivotal trends shaping the sector, offering decision-makers a clear path to strategic alignment and risk mitigation.

Against the backdrop of global economic shifts and heightened scrutiny from regulators, insurers and insured parties alike are compelled to reassess traditional approaches. Today’s environment requires a blend of forward-looking risk modeling, agile policy design, and integrated loss-prevention services. By examining transformative shifts, regulatory impacts such as 2025 US tariffs, segmentation insights, and regional dynamics, this summary lays the groundwork for informed action. The subsequent sections delve into critical aspects of the market, from granular segmentation analysis to high-level strategic recommendations, setting the stage for a deeper dialogue on resilience and growth.

Understanding the Transformative Forces Redefining Financial Institutions Insurance Through Digital Innovation, Regulation, and Ecosystem Collaboration

Financial institutions insurance is being reshaped by rapid technological progress, a redefined regulatory terrain, and rising stakeholder expectations. Insurers are integrating advanced analytics and artificial intelligence into underwriting and claims management to sharpen risk assessment and accelerate decision-making. Meanwhile, digital transformation initiatives across banks and asset managers are generating new data streams, fostering collaboration between insurers and technology providers to co-develop bespoke solutions that address the unique needs of fintech platforms and legacy institutions alike.

Simultaneously, regulatory bodies are harmonizing standards to strengthen consumer protection and enhance systemic stability. These shifts are compelling insurers to invest in compliance infrastructure and cultivate expertise in specialized lines such as cyber liability and pension trustee liability. Adding to the complexity, climate-linked risks and geopolitical uncertainties are driving demand for crime and fraud insurance products with embedded risk-control services. As these trends converge, the market is evolving toward an ecosystem-based model, where partnerships, data sharing, and modular policy components become essential for maintaining competitive advantage.

Evaluating the Cumulative Impact of United States 2025 Tariffs on Technology Costs, Policy Design, and Supply Chain Risk Management in Financial Insurance

The introduction of significant United States tariffs in early 2025 has reverberated through financial institutions insurance, elevating costs and reshaping risk profiles. Tariffs imposed on critical technology imports-ranging from specialized cybersecurity hardware to data center components-have increased replacement values and hampered rapid recovery after system failures. As a result, insurers have responded by revising coverage terms, introducing higher deductibles, and incorporating stricter loss-prevention requirements focused on supply chain resilience.

Furthermore, the elevated cost base has led to closer scrutiny of asset schedules and property valuations within financial institutions’ books. Insurers and risk managers are collaborating to conduct more frequent audits and stress-tests on infrastructure critical to transaction processing and client data security. In parallel, heightened geopolitical tensions underpin a surge in demand for political risk riders and contingent business interruption coverage. Taken together, the cumulative impact of 2025 tariffs is driving a fundamental reassessment of underwriting practices, emphasizing dynamic policy structures that can adapt to shifting cost and supply chain pressures.

Gaining Strategic Insights from Multidimensional Segmentation Highlighting Type, Duration, Channel, and End-User Dynamics in Financial Institutions Insurance

A nuanced segmentation analysis reveals distinct patterns in policy selection and distribution dynamics. By insurance type, organizations prioritize cyber insurance where digitization accelerates vulnerability exposure, while crime and fraud insurance garners increased attention in markets exhibiting high transaction volumes. Employment practice liability steadily gains ground among institutions with expansive workforces, and professional indemnity solutions are customized for asset managers seeking specialized coverage. Each line prompts unique service expectations, driving insurers to assemble modular offerings.

Segmenting by policy duration highlights a clear bifurcation: long-term policies, often spanning multiple years, are favored by institutions seeking budget stability, whereas short-term policies appeal to agile fintech and digital banks experimenting with novel business models. Distribution channels also shape buying behavior: bancassurance leverages established banking relationships to embed coverage at origination, while insurance brokers drive competitive tenders and advisory-led transactions. Finally, end-user segmentation underscores the importance of tailoring propositions; asset and wealth management firms look for bespoke governance safeguards, banks prioritize deposit and transactional security, fintechs emphasize rapid policy issuance, and insurance carriers focus on reinsurance structures and capital efficiency.

This comprehensive research report categorizes the Financial Institutions Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insurance Type

- Policy Duration

- Distribution Channel

- End-User

Uncovering Regional Dynamics Shaping Financial Institutions Insurance Demand and Innovation Across Americas, EMEA, and Asia-Pacific Markets

Regionally, the Americas continue to demonstrate robust appetite for comprehensive cyber and operational risk solutions, underpinned by mature regulatory frameworks and high digital adoption rates. Insurers in this region are pioneering parametric coverages and real-time risk monitoring, enabling clients to mitigate exposures proactively. In contrast, Europe, the Middle East, and Africa present a complex mosaic of market maturity levels. While Western Europe emphasizes harmonization under evolving financial directives, Middle Eastern markets focus on Sharia-compliant structures, and African jurisdictions seek capacity-building partnerships to manage emerging fraud and financial crime risks.

Asia-Pacific stands out for its rapid fintech proliferation and government-led initiatives to bolster digital banking. This environment fuels demand for scalable insurance solutions that blend global best practices with localized underwriting standards. Carriers are forging joint ventures with regional technology providers to tailor products for diverse regulatory landscapes, from stringent data sovereignty rules to evolving customer protection laws. Collectively, these regional distinctions inform insurers’ geographic priorities and investment strategies, underscoring the importance of local expertise and collaborative distribution models.

This comprehensive research report examines key regions that drive the evolution of the Financial Institutions Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Insurance Firms Driving Innovation Through Digital Platforms, Advisory Ecosystems, and Strategic Alliances in Financial Institutions Coverage

Leading insurers in this sector are distinguished by their agility in product innovation, depth of risk advisory capabilities, and strength of distribution networks. Organizations that have invested in digital platforms for policy management, claims automation, and real-time risk analytics consistently set the benchmark for customer experience. Meanwhile, collaborations between global carriers and niche regional underwriters enable a synthesis of capital strength with localized knowledge, driving superior underwriting precision.

Moreover, firms integrating professional services-such as cybersecurity audits, regulatory compliance advisory, and business continuity planning-are capturing growing wallet share by offering end-to-end risk management ecosystems. Strategic alliances with technology vendors, consulting firms, and data providers further enhance proposition depth, allowing insurers to deliver predictive insights and tailored risk-control frameworks. As capital markets increasingly reward insurers demonstrating robust balance sheet management and differentiated service models, these companies are well-positioned to capitalize on rising demand for specialized financial institutions insurance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Financial Institutions Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- American International Group, Inc.

- Arch Capital Group Ltd.

- Aspen Insurance Holdings Limited

- AXA XL

- AXIS Capital Group

- Beazley Plc

- Berkshire Hathaway European Insurance DAC

- Chubb Group of Insurance Companies

- CNA Financial Corporation

- HCC Insurance Holdings, Inc.

- Hiscox Ltd

- Liberty Mutual Insurance Company

- Markel Group Inc.

- Old Republic Professional Liability, Inc.

- QBE Holdings, Inc.

- RLI Corp.

- Sompo International Holdings Ltd.

- The Hartford Insurance Group, Inc.

- The Travelers Companies, Inc.

- W.R. Berkley Corporation.

- Zurich Insurance Company Ltd

Driving Growth with Data-Driven Underwriting, Ecosystem Partnerships, and Continuous Expertise Development in Financial Institutions Insurance

Industry leaders should prioritize the integration of advanced analytics and machine learning into both underwriting and claims operations to refine risk selection and accelerate service delivery. By building modular policy architectures, insurers can swiftly adjust coverage layers in response to geopolitical shifts and regulatory updates. Additionally, forging cross-sector partnerships will be critical: engaging with cybersecurity firms, supply chain specialists, and legal experts ensures that product enhancements align with evolving client needs.

Simultaneously, carriers should invest in continuous learning programs to deepen internal expertise on emerging threats, from quantum computing vulnerabilities to climate-linked financial risks. Expanding ecosystem collaborations with fintechs and incumbents will unlock co-creation opportunities for data-driven solutions, thereby enhancing client stickiness. Finally, embedding sustainability and governance considerations within policy frameworks not only mitigates potential exposures but also strengthens relationships with stakeholders who demand transparency and accountability.

Ensuring Robust Insights Through a Structured Research Methodology Blending Executive Interviews, Scenario Analysis, and Comprehensive Secondary Research

This analysis is grounded in a rigorous research methodology combining primary and secondary sources. Primary research involved in-depth interviews with C-level executives at banks, asset managers, and insurers, along with consultations with regulatory specialists and risk management professionals. These qualitative insights were supplemented by scenario workshops to validate assumptions on tariff impacts and emerging risk vectors.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, and thought leadership reports. Data triangulation methods ensured the reliability of qualitative findings, while thematic analysis facilitated the synthesis of interview transcripts into actionable insights. This structured approach enables a holistic understanding of market drivers, competitive dynamics, and strategic imperatives shaping financial institutions insurance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Financial Institutions Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Financial Institutions Insurance Market, by Insurance Type

- Financial Institutions Insurance Market, by Policy Duration

- Financial Institutions Insurance Market, by Distribution Channel

- Financial Institutions Insurance Market, by End-User

- Financial Institutions Insurance Market, by Region

- Financial Institutions Insurance Market, by Group

- Financial Institutions Insurance Market, by Country

- United States Financial Institutions Insurance Market

- China Financial Institutions Insurance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Key Findings and Strategic Imperatives for Building Resilience and Capturing Opportunity in Financial Institutions Insurance

In conclusion, the financial institutions insurance landscape is at a pivotal inflection point. Technological advancements, evolving regulations, and geopolitical shifts are collectively redefining risk exposures and coverage requirements. Insurers that respond with agile product design, data-driven risk assessment, and integrated advisory services will build resilient portfolios and capture emerging opportunities.

By synthesizing transformative trends, tariff impacts, segmentation dynamics, and regional nuances, organizations can chart a strategic path toward sustained growth. The recommendations outlined herein offer a blueprint for insurers and risk managers to innovate with confidence, strengthen partnerships, and enhance operational agility. As the market continues to evolve, ongoing collaboration and informed decision-making will be paramount to securing long-term success in the financial institutions insurance sector.

Unlock Competitive Advantage by Connecting with Ketan Rohom for Exclusive Access to the Comprehensive Financial Institutions Insurance Market Research Report

To explore the untapped potential of financial institutions insurance and gain a nuanced understanding of emerging risks and opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Partnering with an experienced specialist will enable you to secure industry-leading insights, customized analysis, and actionable strategies to support your organization’s growth ambitions. Don’t miss the chance to transform your risk management framework and stay ahead of the competition-connect with Ketan today to purchase the comprehensive market research report that will drive informed decision-making and strategic success.

- How big is the Financial Institutions Insurance Market?

- What is the Financial Institutions Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?