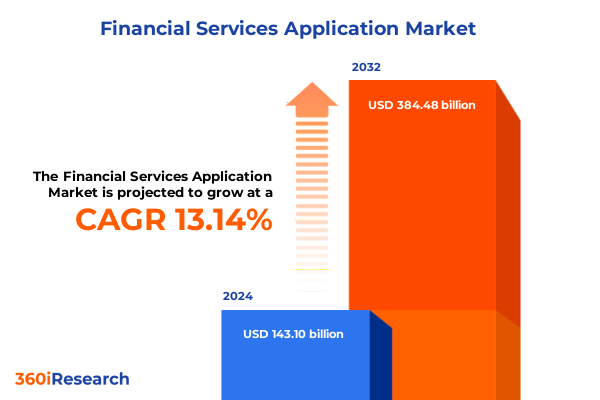

The Financial Services Application Market size was estimated at USD 161.04 billion in 2025 and expected to reach USD 181.50 billion in 2026, at a CAGR of 13.23% to reach USD 384.48 billion by 2032.

Setting the Stage for Digital Transformation: Understanding the Current Financial Services Application Ecosystem and Its Strategic Imperatives

Financial services application leaders are confronting a pivotal moment marked by renewed investment and accelerated innovation. After the slowdown in technology projects during 2023, major global banks have reignited their spending on digital initiatives, particularly in areas such as generative artificial intelligence and cybersecurity to enhance resilience and customer experience. Firms like Tata Consultancy Services, Infosys, and Wipro report an uptick in project starts, driven by client demand for advanced analytics, real-time processing, and secure digital channels.

At the same time, C-Suite executives are placing digital transformation and AI at the top of their strategic agendas. According to a recent Thomson Reuters Institute survey, 85% of senior leaders believe AI will have a transformational or high impact on their businesses over the next five years, while 82% rate digital transformation as a critical priority. These shifts underscore the imperative to modernize legacy infrastructure and accelerate cloud-native deployments to remain competitive.

In parallel, the confluence of blockchain adoption-now embraced by over three-quarters of institutions for use cases ranging from smart contracts to secure ledger services-and the rapid expansion of open banking ecosystems is redefining how applications integrate within broader financial networks. Industry benchmarks indicate that roughly 78% of organizations have initiated blockchain pilots and 92% have integrated AI for fraud detection, personalization, and operational efficiency.

Consequently, financial institutions and software providers are forging strategic partnerships to deliver next-generation capabilities. For example, payment giant Mastercard has integrated Fiserv’s stablecoin platform, enabling merchants to settle transactions in FIUSD as regulatory clarity emerges under the GENIUS Act. This collaboration exemplifies the interplay between traditional networks and digital asset innovation, setting the tone for a wave of platform-based financial applications.

Unveiling Groundbreaking Catalysts Reshaping Financial Services Applications Amid Rapid Technological and Regulatory Evolution

Embedded finance and open banking architectures are swiftly becoming foundational elements in financial services applications. By standardizing APIs and collaborating with fintech partners, leading institutions are embedding payment, lending, and insurance capabilities directly into third-party platforms. This shift fosters seamless customer journeys and expands market reach beyond traditional banking channels. As these ecosystems mature, incumbents must balance platform openness with data security and regulatory compliance.

Equally transformative is the rise of AI-powered personalization at scale. Organizations leveraging real-time behavioral data can deliver hyper-personalized product recommendations, pricing, and support, driving engagement and loyalty. Recent data shows that institutions implementing AI-driven personalization can achieve up to an eightfold return on marketing investments and a double-digit increase in sales effectiveness. Given the intense competitive pressures, leveraging machine learning models to tailor customer experiences has become a decisive differentiator.

Cloud migration and core system modernization continue to accelerate as firms seek agility and cost efficiency. A growing number of banks are decommissioning mainframes in favor of cloud-native, microservices-based architectures, reducing time-to-market for new services while strengthening regulatory reporting and disaster recovery capabilities. Reports indicate that early adopters of cloud core banking platforms have accelerated product launches by as much as 60% and improved operational uptime significantly.

Meanwhile, blockchain technology is moving beyond proof-of-concepts into production environments, facilitating transparent, tamper-resistant transaction records and enhancing security in trade finance, payments, and identity management. Institutional adoption of distributed ledger technology has reached 78%, with significant pilots in cross-border transfers and digital asset custody. These deployments underscore the potential for blockchain to streamline processes and reduce friction across multi-party workflows.

Assessing the Compound Effects of U.S. Tariff Actions in 2025 Creating New Dynamics for Financial Services Application Providers

The United States’ ongoing tariff policy adjustments are exerting notable pressure on the supply chains underpinning financial services application hardware and infrastructure. Following the USTR’s four-year review, semiconductor import tariffs are slated to rise from 25% to 50% by 2025, a move intended to bolster domestic chip manufacturing but one that will increase costs for processors, servers, and specialized networking equipment essential to fintech platforms.

Concurrently, exclusions from certain Section 301 tariffs on Chinese imports-originally scheduled to expire May 31, 2025-have been extended through August 31, 2025, for critical manufacturing equipment and components. While this extension offers short-term relief for firms diversifying supply, the impending reinstatement of duties on over 100 product categories will necessitate strategic sourcing and inventory planning to mitigate cost escalations and procurement delays.

Furthermore, earlier rounds of tariff increases encompassed clean energy and advanced manufacturing inputs, including electric vehicles, lithium-ion batteries, and solar cells, with some levies elevated to 100% in 2024 and 2025. These measures, while targeted at industrial policy objectives, indirectly affect data center electrification projects and hardware upgrades that financial institutions depend upon to support scaling digital applications and sustainability goals.

In aggregate, these tariff dynamics are reshaping cost structures and supply-chain resilience strategies. Firms are responding by diversifying manufacturing partners, investing in localized assembly capabilities, and building strategic inventories of semiconductors and electronic components. As geopolitical tensions persist, proactive supply-chain mapping and agile procurement processes will be essential to maintaining uninterrupted digital service delivery.

Deep Dive into Technology, Applications, Functionality, Enterprise Size, and End-User Segments Driving Market Differentiation

The financial services application arena is undergoing nuanced differentiation driven by the convergence of multiple segmentation lenses. Across technology platforms, providers are calibrating their roadmaps to support AI and machine-learning powered applications that automate decisioning, embedding big data and analytics to derive actionable insights, exploring blockchain and distributed ledger technology for transaction integrity, and integrating IoT-enabled financial apps to deliver real-time contextual services.

From an application-type perspective, end users are selecting solutions that align with core banking requirements, financial planning and budgeting tools that optimize capital allocation, insurance management systems split between life and non-life product lines, investment and wealth management suites for portfolio orchestration, lending and credit origination and servicing engines, payment processing frameworks encompassing digital wallets, mobile and point-of-sale channels, and risk and compliance management modules addressing AML/KYC, fraud prevention, and regulatory adherence.

Functionally, organizations are leveraging specialized platforms for customer relationship management to drive acquisition and retention, data analytics and business intelligence for strategic insights, enterprise financial management for accurate reporting and treasury operations, human capital management to streamline workforce processes, and IT and infrastructure management for resilient, secure environments. Additional focus areas include marketing and sales applications for engagement, operations management for process optimization, and risk and compliance tools to navigate evolving regulatory landscapes.

Moreover, segmentation by enterprise size reveals divergent priorities, with large organizations pursuing end-to-end integrated suites for global consistency, while small and medium enterprises emphasize modular, cost-effective solutions that can be deployed rapidly. Finally, end-user perspectives-from financial institutions seeking robust back-office engines, to government and regulatory bodies requiring transparency and auditability, to retail consumers demanding intuitive experiences-underscore the imperative for adaptable, user-centric application designs.

This comprehensive research report categorizes the Financial Services Application market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Application Type

- Function

- Enterprise Size

- End-User

Evaluating Regional Market Variations Across Americas, EMEA, and Asia-Pacific to Inform Strategic Growth Priorities

Regional dynamics are shaping the adoption and customization of financial services applications across three primary markets. In the Americas, the United States and Canada are leading investments in cloud-native core banking, digital wallets, and regulatory technology, driven by mature fintech ecosystems and stringent compliance regimes. Latin American markets are following suit, leveraging partnerships with global vendors to accelerate financial inclusion and mobile banking innovation.

Across Europe, Middle East, and Africa, regulatory frameworks such as PSD2 in Europe and sandbox initiatives in the Gulf Cooperation Council are catalyzing open banking and embedded finance models. The diversity of regulatory environments-from the European Union’s rigorous data privacy standards to emerging markets’ focus on digital identity-creates opportunities for solution providers to tailor compliance and integration capabilities accordingly.

In the Asia-Pacific region, rapid smartphone penetration and government-led digital economy programs are fueling demand for mobile payments, super-apps, and AI-driven credit scoring. Markets such as India, China, and Australia are advancing distinct pathways: India’s Unified Payments Interface is enabling real-time retail payments at scale, while China’s digital yuan pilot is integrating CBDC use cases; Australia’s open banking reforms are unlocking data-driven services.

These regional trends highlight the need for flexible application architectures that can adapt to localized regulatory, technological, and consumer-behavior requirements. By understanding these geographical nuances, providers can prioritize go-to-market strategies and partner ecosystems to capture growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Financial Services Application market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Industry Players’ Strategic Moves and Partnerships Defining Competitive Leadership in the Financial Services Application Sector

Major players in the financial services application sector are making strategic moves to reinforce their market positions through acquisitions and divestitures. For instance, FIS announced the acquisition of Global Payments’ Issuer Solutions business for an enterprise value of $13.5 billion, augmenting its credit processing and loyalty capabilities while divesting its Worldpay stake to monetize non-core assets. This transaction is expected to generate significant revenue and EBITDA synergies, underlining FIS’s pursuit of end-to-end issuer processing leadership.

Concurrently, Global Payments committed to purchase Worldpay in a $24.2 billion cash-and-stock deal, consolidating its merchant acquiring franchise and gaining scale in e-commerce payments. By aligning Worldpay’s global footprint with its existing platforms, Global Payments aims to deepen customer relationships, although analysts caution about integration complexity and competitive pressure from niche fintech entrants.

On the technology partnership front, Fiserv is strengthening its product suite by collaborating with Mastercard to integrate its FIUSD stablecoin into the Mastercard network, enabling merchants to settle in digital currency as regulatory clarity emerges under the new stablecoin framework. Additionally, Fiserv’s cloud-native banking platform, Finxact, was selected by FirstRand Group in Africa to modernize core banking operations, demonstrating Fiserv’s expanding footprint in next-generation cloud deployments.

In Europe, Fiserv has also partnered with Vanquis to deploy its Vision Next™ processing platform, while in North America it joined forces with Paysafe to enhance digital wallet solutions and with StoneX to broaden cross-border payment capabilities. These collaborations reflect Fiserv’s strategy to provide modular, scalable ecosystems that address both regional requirements and global ambitions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Financial Services Application market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- ACI Worldwide, Inc.

- Backbase B.V.

- Bloomberg L.P.

- Broadcom Inc.

- Broadridge Financial Solutions, Inc.

- Calypso by Consilium Technologies (PTY) Ltd.

- Cisco Systems, Inc.

- Diebold Nixdorf, Incorporated

- Envestnet, Inc.

- Fidelity National Information Services, Inc.

- Finastra Group Holdings Limited

- Fiserv, Inc.

- Infosys Limited

- International Business Machines Corporation

- Intuit Inc.

- Jack Henry & Associates, Inc.

- Mambu B.V.

- Microsoft Corporation

- NCR Corporation

- NEC Corporation

- Nucleus Software Exports Limited

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- SimCorp A/S

- SoluLab

- SS&C Technologies Holdings Inc.

- Tata Consultancy Services Limited

- Temenos Headquarters SA

Executive Recommendations for Industry Leaders Focused on Innovation, Operational Resilience, and Customer-Centric Digital Strategies

Industry leaders must prioritize an integrated approach to technology adoption, weaving together AI-driven analytics, blockchain-enabled security, and cloud-native architectures to deliver seamless, personalized experiences. By embedding machine learning models into core processes-such as credit underwriting, fraud detection, and customer engagement-organizations can differentiate through speed and relevance.

Simultaneously, it is essential to fortify supply-chain resilience in light of evolving tariff regimes and geopolitical uncertainties. Establishing dual-source agreements, investing in regional hardware assembly partnerships, and leveraging strategic inventory buffers will mitigate the impact of import duties and ensure uninterrupted service provisioning.

From an organizational standpoint, fostering an innovation culture through cross-functional agile teams and external fintech collaborations will accelerate time-to-market for new offerings. Engaging in joint innovation labs and API marketplaces can unlock new revenue streams and elevate the customer value proposition.

Lastly, compliance and risk functions must be embedded within development lifecycles to ensure regulatory adherence without sacrificing agility. Implementing continuous compliance frameworks and leveraging RegTech solutions for real-time monitoring will help navigate the complex landscape of data privacy, anti-money laundering, and open banking regulations.

Robust Research Methodology Combining Primary Insights, Secondary Sources, and Rigorous Analysis to Ensure Reliable Market Intelligence

This analysis draws upon a multi-tiered research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with 30 senior stakeholders across banking, payments, and regulatory bodies, providing firsthand insights into strategic priorities, technology roadmaps, and procurement decision criteria.

Secondary research comprised a comprehensive review of public filings, government trade notices, and industry press releases to capture recent tariff developments, partnership announcements, and technology adoption metrics. Authoritative sources included the U.S. Trade Representative’s four-year tariff review publications and reputable news outlets reporting on strategic transactions and policy changes.

Quantitative data points-such as adoption rates, projected spending trends, and technology utilization benchmarks-were validated through cross-referencing multiple sources to ensure consistency and reliability. Qualitative insights were synthesized into thematic pillars to identify core transformation drivers, segmentation dynamics, and regional nuances.

To maintain analytical rigor, all findings were subjected to peer review by financial services domain experts, ensuring that recommendations and conclusions are grounded in factual accuracy and industry best practices. This robust methodology underpins the credibility of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Financial Services Application market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Financial Services Application Market, by Technology

- Financial Services Application Market, by Application Type

- Financial Services Application Market, by Function

- Financial Services Application Market, by Enterprise Size

- Financial Services Application Market, by End-User

- Financial Services Application Market, by Region

- Financial Services Application Market, by Group

- Financial Services Application Market, by Country

- United States Financial Services Application Market

- China Financial Services Application Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights on Pivotal Trends, Emerging Opportunities, and Strategic Imperatives Shaping the Financial Services Application Landscape

In closing, the financial services application market is at an inflection point defined by rapid technological evolution, shifting regulatory landscapes, and strategic industry realignments. Organizations that can harness AI for hyper-personalization, adopt cloud-native architectures for agility, and integrate secure distributed ledger solutions will capture the competitive edge in delivering innovative customer experiences.

Moreover, as tariff policies impact hardware procurement and supply chains, proactive resilience measures and diversified sourcing strategies will be crucial to minimizing disruption. The interplay between global partnerships and regional market requirements further underscores the need for adaptable, modular application platforms.

Ultimately, success will hinge upon an ecosystem mindset-where collaboration with fintech innovators, alignment with regulatory guidelines, and relentless focus on user-centric design coalesce to drive sustainable growth. By acting decisively on the insights and recommendations outlined in this summary, industry participants can position themselves to lead in the next wave of digital transformation.

Engage Directly with Ketan Rohom to Access the Full Market Research Report and Unlock Strategic Competitive Intelligence

If you’re ready to deepen your understanding of the financial services application market and leverage actionable intelligence for strategic decision-making, Ketan Rohom, Associate Director, Sales & Marketing, is available to guide you. Engage directly with Ketan to explore how this comprehensive report can support your growth objectives, mitigate risks, and position your organization at the forefront of innovation. Secure your competitive advantage today by reaching out and accessing the full suite of insights tailored to your needs.

- How big is the Financial Services Application Market?

- What is the Financial Services Application Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?