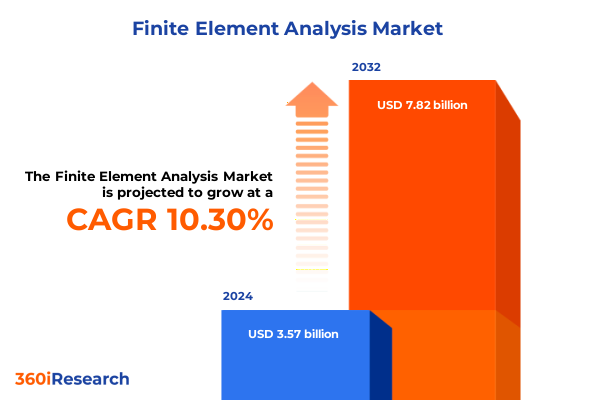

The Finite Element Analysis Market size was estimated at USD 3.92 billion in 2025 and expected to reach USD 4.31 billion in 2026, at a CAGR of 10.37% to reach USD 7.82 billion by 2032.

Revealing the Pivotal Role of Finite Element Analysis in Driving Engineering Advancements and Shaping Strategic R&D Priorities Across Industries

Finite Element Analysis (FEA) has emerged as a transformative pillar in modern engineering, enabling virtual prototyping and high-fidelity simulation across diverse sectors. By discretizing complex geometries into finite elements and applying numerical methods to solve governing equations, FEA offers unprecedented insight into structural integrity, thermal performance, and fluid interactions before physical production. This proactive approach alleviates the risk of costly design flaws, accelerates time to market, and facilitates innovation in advanced materials and system architectures.

As computational resources have proliferated and algorithms have become more efficient, the scope of FEA has expanded far beyond traditional industries. What once required high-performance workstations now scales seamlessly across cloud infrastructures, allowing research teams, design bureaus, and product manufacturers to harness on-demand simulation power without substantial capital expenditure. Moreover, the integration of machine learning tools alongside FEA has begun to unlock predictive capabilities, enabling intelligent design exploration and automated optimization that significantly improve engineering productivity and effectiveness.

Transitioning from manual calculations to fully digital testbeds, organizations leverage FEA to underpin digital twin strategies, driving continuous performance monitoring and adaptive control in real time. In doing so, they gain a competitive edge by iterating designs more rapidly, ensuring compliance with emerging regulations, and embedding simulation knowledge into product lifecycles. This introduction sets the stage for an in-depth exploration of the seismic shifts, regulatory headwinds, segmentation nuances, and regional as well as corporate strategies shaping the current Finite Element Analysis landscape.

Illuminating Emerging Disruptive Paradigms Reshaping the Finite Element Analysis Landscape Through Technological Innovation and Evolving User Expectations

The Finite Element Analysis ecosystem is undergoing a rapid metamorphosis driven by technological breakthroughs and evolving user demands. Cloud-native simulation platforms have become mainstream, enabling geographically dispersed teams to collaborate on complex models through secure, scalable infrastructures. Hybrid cloud deployments bridge the gap between on-premises data control and public cloud elasticity, catering to organizations seeking both compliance and cost-efficiency in their simulation workflows.

In parallel, advances in nonlinear analysis now empower engineers to capture realistic material behaviors, including plastic deformation and crack propagation, which were once prohibitively complex to simulate. This pivot toward higher-fidelity modeling is complemented by modal and harmonic analysis enhancements, allowing for deeper insights into vibration characteristics critical for aerospace, automotive, and energy applications. As a result, dynamic analysis modules that handle transient and random vibration scenarios are increasingly embedded into engineering toolchains, fostering innovation in noise, vibration, and harshness optimization.

Moreover, the convergence of artificial intelligence with FEA tools has given rise to rapid design exploration and generative simulation capabilities. Engineers can now leverage surrogate models trained on high-resolution FEA data to screen thousands of design variants in a fraction of the time, pinpointing optimal configurations with minimal manual intervention. This democratization of simulation through intuitive user interfaces and low-code platforms is broadening FEA adoption across small and medium enterprises that previously lacked the specialized expertise for complex analyses.

Collectively, these transformative shifts are redefining the competitive landscape, as providers race to integrate advanced solver technologies, intuitive workflows, and collaborative ecosystems that anticipate and adapt to the evolving requirements of modern engineering.

Unpacking the Far-Reaching Effects of 2025 United States Tariff Measures on Finite Element Analysis Procurement Costs and Supply Chain Dynamics

In 2025, the United States extended and recalibrated tariffs on key industrial inputs, notably steel, aluminum, and semiconductor components, under Section 232 and related trade measures. These adjustments have reverberated through the supply chains of Finite Element Analysis providers, driving up hardware procurement costs for data center operators, as well as elevating the price of specialized simulation materials used in validation testing. Consequently, many simulation vendors have reevaluated their pricing models to account for the increased cost basis associated with high-performance computing infrastructure.

As procurement teams confront these headwinds, organizations have responded by shifting workloads to cloud platforms that bundle simulation software licensing with compute resources. By transforming capital expenditures into operating expenses, engineering groups mitigate upfront tariff exposures and gain access to the latest solver capabilities without the burden of localized hardware acquisition. This dynamic has accelerated the adoption of subscription licensing and pay-as-you-go consumption plans, enabling teams to align costs with project timelines and workload peaks rather than absorbing fixed rates on depreciating assets.

Simultaneously, a trend toward regionalized data center deployments has emerged, as vendors strive to localize compute capacity closer to end users in tariff-sensitive markets. This strategy not only reduces import duties on physical servers but also enhances data sovereignty and performance for latency-critical simulation tasks. From a strategic standpoint, companies are forging partnerships with local resellers and service providers to navigate tariff complexities and ensure uninterrupted access to mission-critical FEA tools, underscoring the importance of supply chain resilience in the face of trade policy volatility.

Unveiling Critical Segmentation Perspectives to Illuminate Finite Element Analysis Adoption Patterns Across Deployment Models, Components, and Industry Verticals

A nuanced understanding of Finite Element Analysis adoption requires examining deployment modalities, component preferences, organizational scale, licensing structures, analytical technologies, application domains, and vertical markets in concert. Organizations prioritizing data control continue to invest in on-premises solutions, while cloud-centric engineering teams leverage hybrid architectures that blend private and public cloud instances to optimize cost, security, and performance. This coexistence has led to differentiated demand for software platforms that can seamlessly migrate models between secure vaults and cloud clusters in real time.

From a component perspective, the synergy between software and services is vital to successful FEA implementation. Core solver platforms form the backbone of the simulation environment, whereas consulting services guide model setup and best practices, maintenance agreements ensure timely updates, and tailored training programs bridge the skills gap. This service-software continuum empowers large enterprises to scale global simulation standards while enabling smaller firms to access on-demand expertise as they navigate complex engineering challenges.

Enterprise size further delineates adoption patterns. Large corporations with dedicated research and development budgets deploy advanced nonlinear, dynamic, and multiphysics capabilities across global engineering hubs. In contrast, small and medium enterprises gravitate toward streamlined solver packages, focusing on linear and modal analysis to validate foundational designs before outsourcing specialized simulations. The proliferation of annual and monthly subscription licences has lowered barriers to entry, while perpetual node-locked and floating licences remain attractive for organizations seeking predictable long-term investment in core simulation platforms.

Technology segmentation reveals distinct use cases: harmonic and transient dynamic methods deliver critical frequency response and random vibration insights for aerospace and automotive components, while geometric and material nonlinearity solvers address complex structural deformation and failure analysis. Linear routines underpin preliminary design iterations, and thermal modules handle heat transfer challenges in energy systems and electronic cooling. Multiphysics integration, particularly fluid‐structure interaction and thermal‐electrical coupling, elevates simulation fidelity across fluid, structural, and thermal applications, enabling engineers to capture interdependent phenomena and accelerate innovation.

Vertical segmentation underscores how industry nuances shape FEA requirements. Aerospace and automotive firms demand rigorous certification workflows with high‐accuracy modal and fatigue analyses. Energy operators focus on fluid simulation for turbulence modeling and multiphysics for safety systems. Healthcare device manufacturers rely on structural and thermal investigations to validate implantable components under physiological conditions. Manufacturing sectors leverage a broad mix of dynamic, linear, and nonlinear workflows to optimize tooling and process equipment. Understanding this layered segmentation landscape illuminates the diverse strategies by which organizations adopt and scale Finite Element Analysis capabilities.

This comprehensive research report categorizes the Finite Element Analysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment

- Enterprise Size

- Industry

Mapping Divergent Regional Trends Driving Differential Finite Element Analysis Utilization From the Americas to EMEA and Asia-Pacific Powerhouses

Regional dynamics exert a powerful influence on Finite Element Analysis utilization, with the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific each displaying divergent priorities and maturity curves. In the Americas, North American aerospace and automotive leaders spearhead the integration of cloud-based simulation into digital engineering programs. This region’s emphasis on agility and early adoption of subscription licensing has fueled rapid uptake of advanced solver modules, particularly those addressing dynamic and nonlinear challenges in next-generation vehicle platforms.

Across EMEA, stringent regulatory frameworks and sustainability mandates drive demand for accurate thermal and structural analysis in energy and manufacturing sectors. European engineering firms have long leveraged public and hybrid clouds to collaborate across research institutions and centralized regulatory bodies, while Middle Eastern oil and gas operators prioritize multiphysics solvers to optimize safety systems. African markets are increasingly exploring FEA services through localized partnerships, aligning with infrastructure development initiatives and academic collaborations to build in-region simulation proficiency.

In Asia-Pacific, the convergence of robust manufacturing ecosystems and governmental investments in smart infrastructure programs has propelled FEA into mainstream usage. Automotive OEMs in Japan and South Korea integrate harmonic and frequency response analyses into electric vehicle design, whereas China’s semiconductor industry harnesses thermal and electromagnetic coupling in microchip packaging validation. Emerging markets in Southeast Asia and India are also expanding their simulation footprints, supported by the availability of monthly subscription models and cloud-hosted solver packages that lower the barrier for accelerating product innovation.

This comprehensive research report examines key regions that drive the evolution of the Finite Element Analysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovative Offerings From Leading Finite Element Analysis Vendors Shaping Competitive Dynamics and Market Evolution

A handful of leading vendors shape the strategic contours of the Finite Element Analysis market through continuous innovation, ecosystem partnerships, and global service networks. ANSYS has fortified its solver portfolio with enhanced multiphysics integration and AI-driven optimization tools, positioning itself as a one-stop solution for high-fidelity simulation across structural, thermal, and fluid domains. Its channel partner expansions in emerging economies have broadened access to localized training and support, reinforcing its competitive edge.

Dassault Systèmes stands out with its immersive 3D experience platform, integrating FEA capabilities directly into collaborative product development workflows. By embedding simulation in the virtual design environment, the company fosters tighter coordination between design, engineering, and manufacturing teams, accelerating iteration cycles and reducing validation delays. Siemens’ Simcenter suite continues to evolve with robust hardware-in-the-loop and real-time testing features, addressing the demands of electrification and autonomous vehicle systems.

Altair’s open licensing approach and scalable cloud implementations have resonated with organizations seeking flexibility in solver deployment. Its emphasis on rapid procurement, combined with a growing network of consulting partners, has boosted adoption among small and medium enterprises. MSC Software, now part of Hexagon, leverages digital twin frameworks to deliver end-to-end simulation insights, integrating high-performance computing with advanced visualization for complex structural and dynamic analyses.

Collectively, these companies drive competitive intensity by investing in solver accuracy, computational efficiency, and user experience enhancements. Strategic acquisitions and collaborative alliances with cloud providers and system integrators underscore the imperative to deliver holistic simulation ecosystems that meet the nuanced requirements of contemporary engineering challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Finite Element Analysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansys, Inc. by Synopsys, Inc.

- Aspen Technology, Inc.

- Autodesk, Inc.

- Bentley Systems, Incorporated

- COMSOL, Inc.

- Dassault Systèmes SE

- ESI Group

- Hexagon AB

- MathWorks, Inc.

- PTC Inc.

- Siemens AG

- SimScale GmbH

- Tech Soft 3D, Inc.

- Tecplot, Inc.

Delivering Targeted Action Plans to Empower Industry Stakeholders With Tactical Strategies for Maximizing Finite Element Analysis Capabilities

To strengthen their Finite Element Analysis capabilities, industry leaders should prioritize cloud-native platform adoption, ensuring that simulation workloads can elastically scale to meet peak demand without incurring prohibitive capital expenses. Embracing subscription and metered-use licensing models permits precise cost alignment with project cycles, reducing financial risk and accelerating access to solver innovations. In tandem, developing robust service frameworks-encompassing consulting, maintenance, and targeted training-will help organizations cultivate internal expertise, minimize time-to-value, and foster long-term simulation proficiency.

Furthermore, engineering organizations are advised to invest in advanced nonlinear and multiphysics solvers as a strategic differentiator, particularly in sectors where material complexity and coupled phenomena define product performance. Leveraging generative design and AI-augmented workflows will unlock new paradigms of optimized geometry and resource efficiency. To mitigate supply chain volatility and tariff exposures, firms should consider diversifying data center footprints across regions and forging partnerships with local service providers, ensuring continuity in hardware maintenance and software support.

Collaboration with academic institutions and cross-industry alliances can also cultivate innovation by exposing technical teams to emerging FEA methodologies and fostering talent pipelines. Establishing standardized modeling libraries and best-practice guidelines will streamline simulation workflows, enhance reliability, and reduce the learning curve for new engineers. By proactively integrating these recommendations, industry stakeholders can solidify their competitive positioning, drive sustainable innovation, and unlock the full strategic potential of Finite Element Analysis.

Outlining Rigorous Research Foundations Leveraging Primary Interviews, Secondary Sources, and Robust Data Triangulation to Ensure Thoroughness and Credibility

The research underpinning this analysis combines extensive primary and secondary methodologies to ensure comprehensive coverage and rigorous validation. Primary insights were gathered through structured interviews with senior engineering leaders, simulation architects, and procurement specialists across diverse industry verticals, providing firsthand perspectives on emerging trends, technology adoption barriers, and strategic priorities. These conversations enabled the identification of critical success factors and use-case requirements directly from practitioners driving Finite Element Analysis initiatives.

Secondary research leveraged a broad spectrum of publicly available data sources, including peer-reviewed journals, technical white papers, and industry consortium reports. Historical analysis of trade policies, academic collaborations, and software release notes was conducted to contextualize the cumulative impact of recent tariff measures and technology shifts. Through systematic data triangulation, quantitative findings from survey responses were cross-referenced against qualitative insights from expert interviews to validate overarching themes and uncover nuanced drivers of simulation uptake.

In addition, the methodological framework incorporated SWOT and PESTLE analyses to evaluate internal capabilities and external market forces, ensuring that actionable recommendations are grounded in a holistic understanding of strategic imperatives. This multi-layered research design underscores the credibility and relevance of the insights presented, equipping decision-makers with the evidence-based intelligence required for informed strategy formulation and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Finite Element Analysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Finite Element Analysis Market, by Component

- Finite Element Analysis Market, by Technology

- Finite Element Analysis Market, by Deployment

- Finite Element Analysis Market, by Enterprise Size

- Finite Element Analysis Market, by Industry

- Finite Element Analysis Market, by Region

- Finite Element Analysis Market, by Group

- Finite Element Analysis Market, by Country

- United States Finite Element Analysis Market

- China Finite Element Analysis Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Reflections on Finite Element Analysis Trajectories Emphasizing Its Critical Role in Future Product Development and Industry Expansion

Finite Element Analysis continues to cement its status as a cornerstone of digital engineering, driving transformative innovation across product development lifecycles. As organizations grapple with increasingly complex design challenges, the ability to simulate structural, thermal, and fluid phenomena with precision offers a vital competitive differentiator. Looking ahead, the confluence of AI-driven solvers, cloud-native architectures, and democratized user interfaces will further accelerate the adoption of FEA, enabling teams of all sizes to harness its analytical prowess.

Concluding reflections underscore the importance of strategic alignment between technology investments and organizational objectives. By integrating advanced modeling capabilities within broader digital twin ecosystems, engineering leaders can achieve real-time performance monitoring, predictive maintenance, and closed-loop feedback that elevate product reliability and efficiency. Moreover, proactive tariff management, service ecosystem development, and talent cultivation will define which enterprises excel in an environment marked by rapid innovation and shifting trade dynamics.

Ultimately, the trajectory of Finite Element Analysis is intertwined with the broader evolution of digital engineering. Stakeholders who embrace holistic simulation strategies-encompassing deployment flexibility, robust service support, and continuous learning-will be best positioned to translate analytical insights into market-leading products and sustainable growth.

Engage With Ketan Rohom to Unlock Customized Finite Element Analysis Insights Tailored to Your Strategic Objectives and Secure Immediate Access to the Full Report

To explore this comprehensive analysis and secure direct support in interpreting the findings for your organization’s unique objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through personalized advisory, ensuring you capitalize on the intelligence within this Finite Element Analysis study. Engage today to arrange a tailored briefing and obtain immediate access to the full report.

- How big is the Finite Element Analysis Market?

- What is the Finite Element Analysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?