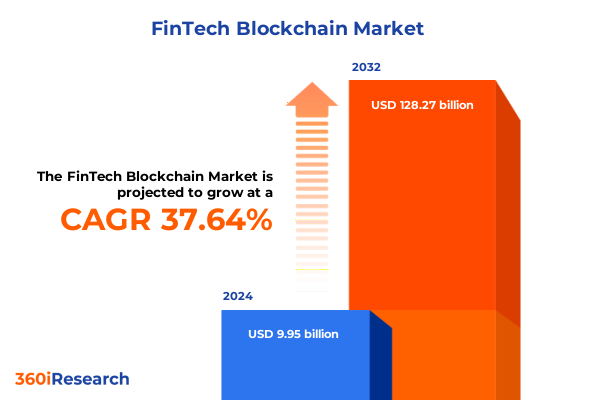

The FinTech Blockchain Market size was estimated at USD 6.20 billion in 2025 and expected to reach USD 8.10 billion in 2026, at a CAGR of 31.44% to reach USD 42.04 billion by 2032.

Exploring How FinTech Blockchain Is Redefining Financial Services with Trust Transparency and Efficiency in a Rapidly Adapting Landscape

Blockchain technology is transforming the financial services industry by introducing unparalleled levels of transparency, efficiency, and trust. As organizations strive to streamline operations and reduce reliance on intermediaries, distributed ledger systems are offering real-time settlement, immutable audit trails, and cost reductions across a variety of use cases. This shift is not merely a technological upgrade but a reimagining of core business processes, where financial institutions, regulators, and technology providers collaborate to create a more resilient and inclusive ecosystem. According to a global survey of executives, 84% are already piloting or deploying blockchain initiatives, reflecting an industry-wide acknowledgment of its transformative potential.

Identifying The Pivotal Shifts Driving Blockchain Adoption and Disrupting Traditional Finance with Innovative Decentralized Financial Solutions

The blockchain FinTech landscape is undergoing profound transformation driven by several concurrent trends. First, tokenization of real-world assets is moving beyond experimental pilots to live use cases-yardsticks of success include the recent tokenized commercial paper issuance by large corporates and institutional adoption of private permissioned networks. Second, decentralized finance protocols are fostering new financial primitives such as automated market making and on-chain lending, breaking down barriers to capital access and reshaping liquidity provision. Third, interoperability solutions are emerging to connect isolated blockchain silos, enabling seamless asset and data transfers between networks and traditional systems. Amid regulatory evolutions and the advent of central bank digital currency experiments, the industry is poised to enter a tipping point by 2025 where blockchain adoption scales across financial markets. Equally significant, hardware supply chains are being realigned as major Chinese mining equipment vendors establish U.S. production facilities to navigate tariff headwinds, marking a new era in crypto-infrastructure geopolitics.

Analyzing The Compound Effects of Recent United States Tariff Policies on the Blockchain Hardware Supply Chain and Mining Economics in 2025

In 2025, U.S. tariff policies targeting blockchain hardware have had a pronounced impact on the economics of Bitcoin mining and related infrastructure. Tariffs ranging from 22% to 36% on imported ASIC machines have increased unit costs by roughly $240 for every $1,000 device, directly squeezing profit margins for both large-scale and smaller mining operators. As hardware accounts for nearly a third of a miner’s expenses, a 25% levy can slash typical profit margins from 37% to 25%, threatening the viability of mid-tier and emerging firms. Beyond cost inflation, higher duties have led to shipping delays and supply shortages, extending equipment lead times by up to six months and putting U.S. hashrate growth at risk of missing global benchmarks.

Uncovering Critical Insights Across Provider Technology Usage Organization Deployment Application and Vertical Segmentation in Blockchain FinTech Markets

A nuanced understanding of blockchain FinTech requires examining multiple segmentation dimensions that collectively define market dynamics. Provider segmentation reveals a landscape where application and solution vendors deliver end-user platforms, infrastructure and protocol providers build the foundational networks, and middleware players offer integration layers to connect disparate systems. Technology type segmentation differentiates private, permissioned environments favored by regulated institutions from public blockchains that underpin open-access, decentralized networks. Usage type segmentation spans business-to-business deployments that optimize corporate workflows, business-to-consumer services that facilitate digital asset exchange and retail investment, and consumer-to-consumer applications that enable peer-driven marketplaces. Organizational segmentation highlights the contrasting priorities of large enterprises seeking enterprise-grade security and compliance versus small and medium enterprises that value agile deployment and cost efficiency. Deployment mode segmentation captures the trade-off between cloud-based solutions that deliver rapid scalability and on-premise installations that offer greater control over data and governance. Application segmentation showcases the varied use cases-ranging from compliance management and know-your-customer protocols to cross-border payment and remittance services, identity management systems, payment, clearing and settlement platforms, and smart contract frameworks-each unlocking unique operational benefits. Vertical segmentation underscores the distinct adoption trajectories in banking, insurance, and non-banking financial services, reflecting sector-specific regulatory, customer, and technology readiness factors.

This comprehensive research report categorizes the FinTech Blockchain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Provider

- Technology Type

- Usage Type

- Organization Size

- Deployment Mode

- Application

- Industry Vertical

Highlighting Distinct Regional Dynamics and Adoption Patterns of Blockchain FinTech Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of blockchain FinTech adoption. In the Americas, the United States leads with the highest concentration of enterprise pilots and production deployments, driven by a supportive regulatory climate for tokenization and digital asset services, complemented by Canada’s progressive regulatory sandbox initiatives. Latin American markets are also embracing blockchain for cross-border remittances, leveraging stablecoins to bypass traditional banking fees and currency volatility. Europe, the Middle East and Africa exhibit a mosaic of approaches: the European Union’s Markets in Crypto-Assets regulation provides a cohesive framework for market participants, while leading financial centers in the Middle East deploy digital currency experiments to diversify economies, and African nations capitalize on blockchain to enhance financial inclusion and streamline government services. Asia-Pacific stands at the forefront of large-scale blockchain investment and policy innovation, with China’s digital yuan pilot programs, India’s regulatory roadmap for crypto assets, and regional hubs such as Singapore and Australia fostering public-private partnerships that drive interoperability and enterprise use cases.

This comprehensive research report examines key regions that drive the evolution of the FinTech Blockchain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Blockchain FinTech Innovators Shaping the Industry Through Technology Partnerships Tokenization and Enterprise-Grade Solutions

The competitive landscape is characterized by collaborations between traditional financial institutions and specialized blockchain technology firms. Major system integrators such as IBM are advancing enterprise solutions through blockchain platforms like Hyperledger Fabric, enabling secure data sharing across financial supply chains. ConsenSys continues to expand the Ethereum ecosystem, powering decentralized applications and developer tools that underpin smart contract innovation. R3’s Corda platform remains a cornerstone for permissioned network deployments in trade finance and syndicated lending. At the same time, leading digital asset infrastructure providers such as Chainalysis are setting standards in compliance and analytics, equipping regulators and institutions with transaction monitoring capabilities that mitigate financial crime risks. On the crypto exchange and custody front, Coinbase’s institutional suite and Binance’s global reach underscore the growing demand for regulated trading venues and digital asset safekeeping services. Meanwhile, established banks are deepening their on-chain capabilities: JPMorgan’s blockchain division, now operating as Kinexys, is exploring loans collateralized by crypto assets and has begun public blockchain settlements for tokenized Treasury instruments. Goldman Sachs and BNY Mellon’s collaboration to tokenize money-market funds exemplifies institutional tokenization at scale, reflecting the alignment between regulatory clarity and market demand. Simultaneously, hardware manufacturers like Bitmain and Canaan are localizing production in the U.S. to circumvent tariffs and ensure supply chain resilience, signaling a strategic pivot in crypto-mining infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the FinTech Blockchain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Binance Holdings Ltd.

- Coinbase Global, Inc.

- Block, Inc.

- Bybit Fintech Limited

- Tata Consultancy Services Limited

- Microsoft Corporation

- Wipro Limited

- Ripple Labs Inc.

- Robinhood Markets, Inc.

- Chainalysis Inc.

- Fireblocks Inc.

- Accenture PLC

- AlphaPoint Corporation

- Amazon Web Services, Inc.

- Anchorage Digital

- Applied Blockchain Ltd.

- Auxesis Group

- Bitfury Group Limited

- BitGo Holdings, Inc.

- BitPay, Inc.

- Blockchain.com, Inc.

- Chain

- Circle Internet Financial, LLC

- Consensys Software Inc.

- Digital Asset Holdings, LLC

- Foris DAX Asia Pte. Ltd.

- Gemini Trust Company, LLC

- GuardTime OÜ

- International Business Machines Corporation

- JPMorgan Chase & Co.

- Kraken by Payward, Inc.

- Morgan Stanley

- OKX INC.

- Oracle Corporation

- R3 HoldCo LLC

Delivering Strategic Recommendations for Industry Leaders to Capitalize on Emerging Blockchain FinTech Trends and Navigate Regulatory and Market Complexities

Industry leaders looking to harness blockchain’s full potential should prioritize a clear alignment between use cases and business objectives, ensuring that every initiative delivers measurable outcomes beyond technological novelty. Building shared ecosystems with cross-industry partners will be essential to establish common standards and governance models, reducing fragmentation and accelerating network effects. Engaging proactively with regulators, including participating in sandbox programs and policy consultations, will not only mitigate compliance risks but also shape favorable frameworks that support scalable adoption. To address interoperability challenges, companies should invest in modular architecture and open protocols, leveraging middleware solutions and interoperability bridges to seamlessly connect legacy systems and emerging ledgers. Strategic investment in talent development and partnerships with security and audit specialists will be crucial to build trust and fortify resilience against cyber threats. Finally, organizations must integrate sustainability considerations into their blockchain strategies, exploring renewable energy sources for mining operations and adopting energy-efficient consensus mechanisms to align with environmental, social and governance (ESG) imperatives.

Detailing the Comprehensive Research Methodology Employed to Synthesize Primary Secondary Data and Expert Insights for Blockchain FinTech Analysis

Our research methodology combined extensive primary and secondary data collection to deliver a robust analysis of the blockchain FinTech landscape. Primary research comprised in-depth interviews with industry executives, technology developers, regulatory officials and subject-matter experts, supplemented by bespoke surveys targeting decision-makers across banking, insurance and non-banking financial services. Secondary research involved a thorough review of academic studies, regulatory publications, corporate filings, technical white papers and reputable market reports. Data triangulation and cross-validation were performed to reconcile insights and identify consistent trends, while qualitative findings from expert dialogues enriched the quantitative evidence. Throughout the process, best-practice standards for reliability and validity were applied, ensuring that our conclusions reflect the most accurate and actionable intelligence available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our FinTech Blockchain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- FinTech Blockchain Market, by Provider

- FinTech Blockchain Market, by Technology Type

- FinTech Blockchain Market, by Usage Type

- FinTech Blockchain Market, by Organization Size

- FinTech Blockchain Market, by Deployment Mode

- FinTech Blockchain Market, by Application

- FinTech Blockchain Market, by Industry Vertical

- FinTech Blockchain Market, by Region

- FinTech Blockchain Market, by Group

- FinTech Blockchain Market, by Country

- United States FinTech Blockchain Market

- China FinTech Blockchain Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Concluding Insights into the Evolution of Blockchain in Financial Services and Its Role in Driving Future Innovation Trust and Operational Efficiency

Blockchain technology’s evolution from experimental proofs of concept to enterprise-grade solutions marks a critical inflection point for financial services. Its capacity to enhance transparency, streamline processes and unlock new digital asset classes underscores a broader shift toward decentralized and collaborative business models. Amid rising geopolitical and regulatory influences, including recent tariff measures that have reshaped supply chains and hardware economics, the industry’s resilience and adaptability have been tested. However, as tokenization, cross-border settlement and interoperable networks gain momentum, the stage is set for more integrated and efficient financial ecosystems. Decision-makers who embrace these insights and engage proactively across stakeholder groups will be best positioned to lead the next wave of innovation and capture the full promise of blockchain.

Engage With Ketan Rohom to Access the Definitive Blockchain FinTech Market Research Report and Empower Your Strategic Decision-Making Today

To gain a competitive edge and make informed strategic decisions in the rapidly evolving blockchain FinTech space, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan is ready to provide you with tailored insights, expert guidance, and a comprehensive market research report designed to address your organization’s unique challenges and opportunities. Whether you’re exploring new technology partnerships, evaluating regulatory environments, or seeking to optimize your blockchain initiatives, Ketan’s expertise will help you navigate the complexity and seize emerging growth avenues. Engage today to unlock the full potential of blockchain for your business and ensure you stay ahead of the curve in this dynamic industry.

- How big is the FinTech Blockchain Market?

- What is the FinTech Blockchain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?