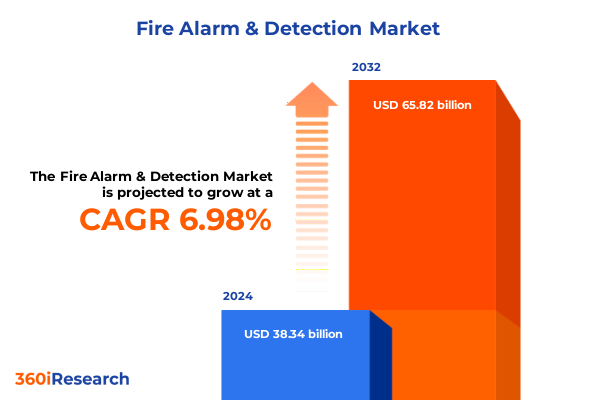

The Fire Alarm & Detection Market size was estimated at USD 40.87 billion in 2025 and expected to reach USD 43.61 billion in 2026, at a CAGR of 7.04% to reach USD 65.82 billion by 2032.

Exploring the Critical Role and Emerging Dynamics Shaping the Fire Alarm and Detection Industry Landscape for Informed Decision-Making

The fire alarm and detection sector stands at a pivotal moment, driven by technological breakthroughs and evolving safety standards that collectively redefine risk management across buildings of all scales. As urban environments grow denser and regulatory frameworks intensify, stakeholders are demanding solutions that transcend basic warning functions to deliver integrated, intelligent monitoring and rapid response capabilities. With emerging sensor technologies and enhanced connectivity models, the industry is transitioning from standalone devices to holistic safety platforms, enabling real‐time data exchange and actionable analytics that inform asset protection strategies and occupant well-being.

Against this backdrop, the introduction serves as a compass, orienting readers to the fundamental dynamics shaping today’s market. By examining the convergence of advanced detection mechanisms, regulatory imperatives, and interoperability requirements, this section lays the groundwork for understanding how modern fire alarm systems evolve beyond threshold alarms into predictive instruments that anticipate and mitigate hazards. The narrative emphasizes the importance of adaptability, underscoring the need for solutions capable of integrating with building automation systems, emergency response protocols, and broader facility management ecosystems.

Transitioning from traditional fire safety paradigms toward interconnected, intelligent networks requires a clear appreciation of both historical milestones and future trajectories. This introduction thus frames subsequent analysis by highlighting core drivers, including performance optimization, compliance enforcement, and the growing imperative to align safety technology with operational resilience goals.

Unveiling the Transformative Shifts Driving Technological Innovation and Regulatory Evolution in Fire Detection and Alarm Solutions

Over the past decade, the fire alarm and detection field has witnessed transformative shifts driven by rapid innovation and regulatory evolution. Today’s sensor suites harness infrared and ultraviolet spectrums to identify flame signatures, while advances in photoelectric and ionization technologies refine smoke detection accuracy, significantly reducing false alarms. Concurrently, thermovelocimetric and thermal detectors leverage precise temperature measurements to deliver early warnings where conventional devices might lag, enabling proactive risk mitigation before threats escalate.

In parallel, connectivity paradigms have experienced a profound overhaul: wired architectures now coexist with robust wireless frameworks employing Bluetooth, Wi-Fi, and Zigbee protocols. This hybridization of networks facilitates seamless integration with building management systems and Internet of Things platforms, empowering remote diagnostics, firmware updates, and performance analytics. Such interoperability not only streamlines maintenance workflows but also supports the deployment of distributed safety meshes in challenging retrofit scenarios.

Regulatory landscapes have mirrored these technological strides. Stricter building codes now mandate addressable fire alarm configurations in critical infrastructures such as hospitals and data centers, fostering demand for scalable solutions that deliver granular zone identification. Meanwhile, international harmonization efforts are aligning standards across markets, spurring manufacturers to adopt modular, upgrade-friendly designs that satisfy both regional mandates and global certification requirements. Collectively, these shifts have recalibrated competitive dynamics, favoring agile providers that blend advanced engineering with compliance acuity.

Assessing the Cumulative Impact of 2025 United States Tariffs on Supply Chains Component Costs and Competitive Positioning in the Market

The United States tariff adjustments enacted in early 2025 have introduced new complexities into the fire alarm and detection supply chain, affecting component sourcing, equipment pricing, and global competitive positioning. Increases in import duties on semiconductor sensors and electronic modules have compelled manufacturers to reassess supplier relationships, balancing cost pressures against the imperative to maintain product performance and reliability. As a result, some players have initiated near-shoring strategies or strengthened domestic partnerships to mitigate exposure to fluctuating duties and transpacific logistics uncertainties.

These tariffs have also influenced material selection and design methodologies. Engineering teams are exploring alternative sensor materials with equivalent sensitivity thresholds yet lower applied tariffs, while sourcing electronic housings from regional fabricators to optimize duty classifications. This re-engineering approach has introduced additional development cycles and validation steps, prompting firms to invest in rapid prototyping and testing infrastructures that accelerate time-to-market despite the new trade barriers.

On a broader scale, the cumulative impact extends to after-sales support and service networks. Elevated equipment costs have led end users to seek extended warranties and performance guarantees, shifting the value proposition toward full-life-cycle maintenance agreements. Service providers are adapting by bundling advanced diagnostics and predictive maintenance analytics into subscription models, ensuring cost transparency and consistent safety outcomes. Ultimately, these trade policy changes underscore the necessity of agile sourcing frameworks, robust supplier diversification, and innovation-driven cost management.

Illuminating Key Segmentation Insights Revealing Diverse Product Types Connectivity Technologies Power Sources and Application Niches

A nuanced examination of market sectors reveals that product type segmentation is reshaping solution portfolios and go-to-market strategies. Detection systems encompass flame detectors, smoke detectors, and temperature detectors, each underpinned by sub-categories such as combined infrared and ultraviolet detectors or photoelectric detectors that cater to specific risk scenarios. Conventional fire alarms coexist alongside addressable fire alarms, offering tiered installation complexity and scalability. Meanwhile, connectivity segmentation distinguishes wired systems from wireless systems, with wireless variants leveraging Bluetooth, Wi-Fi, or Zigbee technologies to support seamless device interlinking and remote monitoring.

Further stratification emerges through technology segmentation, which categorizes offerings into analog and digital systems. Analog platforms remain prevalent in legacy environments due to simplicity and cost considerations, yet digital systems are gaining traction for their enhanced diagnostic capabilities and networked functionality. Power source segmentation highlights battery-powered devices, hybrid systems, and mains-powered configurations, reflecting diverse deployment requirements-from standalone battery-backed units in residential settings to fully mains-driven installations with auxiliary power in commercial and industrial complexes.

Application segmentation delivers critical context by aligning product choices with environment-specific demands. Commercial applications such as healthcare facilities, offices, and shopping complexes prioritize addressable solutions with robust integration into facility management networks. Industrial settings, including data centers, manufacturing facilities, and warehouses, favor high-sensitivity detectors and redundant communication paths to ensure uninterrupted operations. Residential environments, conversely, emphasize ease of installation and user-friendly interfaces, driving demand for wireless, battery-backed smoke and heat detection solutions.

This comprehensive research report categorizes the Fire Alarm & Detection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Technology

- Power Source

- Application

Decoding Key Regional Insights Highlighting Growth Drivers Opportunities and Market Nuances across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics significantly influence how fire alarm and detection systems are designed and adopted. In the Americas, demand for smart building integrations and retrofit-ready wireless devices is surging, driven by renovation projects in mature urban markets as well as new builds seeking LEED certification and IoT convergence. This region’s regulatory frameworks emphasize performance certification and interoperability, encouraging system providers to prioritize compliance testing and cross-platform compatibility.

Across Europe, the Middle East, and Africa, regulatory diversity presents both challenges and opportunities. European union directives standardize core safety requirements, prompting manufacturers to develop modular hardware architectures that adapt to localized code variations. In the Middle East and Africa, rapid infrastructure investment in commercial and industrial projects fuels desire for turnkey fire safety packages, often bundled with installation and maintenance services to address skills shortages and logistical constraints.

In Asia-Pacific, rapid urbanization and robust construction pipelines have created fertile ground for large-scale deployments. Governments are increasingly mandating smart city initiatives, positioning fire detection tools as integral elements within broader urban resilience frameworks. This has encouraged partnerships with local integrators and technology firms to embed advanced analytics and cloud connectivity, enhancing both real-time monitoring and post-incident forensic capabilities.

This comprehensive research report examines key regions that drive the evolution of the Fire Alarm & Detection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Insights into Strategic Initiatives Partnerships and Innovations Shaping the Fire Alarm and Detection Competitive Landscape

Leading enterprises are driving the fire alarm and detection market through strategic investments in research and development, partnerships, and digital transformation initiatives. Many prominent manufacturers have established innovation hubs focused on sensor fusion, algorithmic fire pattern recognition, and cloud-based analytics, enabling systems to differentiate between benign and hazardous events with unprecedented accuracy. Collaboration with building management system providers has become a cornerstone of product roadmaps, as these alliances facilitate seamless integration into broader operational platforms.

Mergers and acquisitions have reshaped the competitive landscape, allowing smaller specialized sensor firms to align with global solution providers, thereby enhancing portfolio breadth and technical capabilities. Strategic alliances with regional distributors and technology integrators enable companies to extend market reach and deliver localized support, which is increasingly important for complex deployments. Concurrently, some organizations are forming research consortia with academic institutions to pilot emerging technologies such as nanoparticle smoke detection and AI-driven predictive analytics, ensuring early mover advantages in next-generation safety systems.

Corporate differentiation also hinges on comprehensive service models. Industry leaders are augmenting product sales with subscription-based maintenance, firmware-upgrade programs, and 24/7 remote monitoring services. Such offerings not only generate recurring revenue streams but also deepen customer engagement, fostering long-term partnerships grounded in performance assurance and continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Alarm & Detection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Analog Devices, Inc.

- Carrier Global Corporation

- Eaton Corporation

- Emerson Electric Co.

- General Electric Company

- Halma PLC

- Honeywell International, Inc.

- Johnson Controls International PLC

- Robert Bosch GmbH

- Schneider Electric SE

Strategic and Actionable Recommendations Equipping Industry Leaders with Practical Steps to Drive Resilience Growth and Innovation in Safety Systems

To thrive in an environment marked by rapid technological change and shifting regulatory imperatives, industry leaders should pursue a multipronged approach. First, leveraging modular hardware architectures will facilitate swift adaptation to evolving standards and regional code variations, while reducing redesign costs. Second, integrating advanced analytics and machine learning capabilities can elevate detection accuracy and minimize false alarms, ultimately enhancing end-user trust and satisfaction.

Additionally, diversifying supply chains by cultivating relationships with both domestic and international component manufacturers can mitigate tariff risks and improve resilience against geo-political disruptions. Embracing service-oriented business models, such as subscription-based maintenance and remote diagnostics, will not only create recurring revenue but also strengthen customer retention through ongoing performance assurances. Investing in workforce training programs and partnering with independent integrators can further enhance installation quality and after-sales support, ensuring that sophisticated systems deliver promised reliability.

Finally, fostering cross-industry collaborations-particularly with IoT platform providers, cybersecurity specialists, and building automation vendors-can drive the development of holistic safety ecosystems. By positioning fire detection solutions as integral components of smart building and smart city initiatives, manufacturers and system integrators can unlock new value propositions and capture emerging market opportunities.

Transparent and Rigorous Research Methodology Underpinning the Comprehensive Analysis of Fire Alarm and Detection Market with Data Sources and Validation Processes

This comprehensive analysis combines qualitative and quantitative data obtained through a triangulated research framework. Primary research was conducted via in-depth interviews with key stakeholders, including system integrators, end users, regulatory authorities, and technology providers. These discussions furnished first-hand perspectives on emerging pain points, adoption drivers, and integration challenges across diverse applications and regions.

Secondary research involved a meticulous review of technical standards, policy publications, industry journals, and patent filings to ensure alignment with the latest regulatory developments and technological breakthroughs. Case studies and white papers were analyzed to validate best practices in sensor deployment, network architecture, and service-based models. Additionally, competitor intelligence was gathered to map strategic positioning, product portfolios, and partnership ecosystems.

Data synthesis and analysis employed cross-validation techniques to reconcile insights from multiple sources, while thematic coding enabled the identification of macro-level trends and localized nuances. Risk factors such as supply chain disruptions, tariff fluctuations, and evolving codes were systematically evaluated to inform scenario planning. The result is a robust framework that underpins actionable recommendations, ensuring stakeholders can navigate complexity with confidence and clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Alarm & Detection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Alarm & Detection Market, by Product Type

- Fire Alarm & Detection Market, by Connectivity

- Fire Alarm & Detection Market, by Technology

- Fire Alarm & Detection Market, by Power Source

- Fire Alarm & Detection Market, by Application

- Fire Alarm & Detection Market, by Region

- Fire Alarm & Detection Market, by Group

- Fire Alarm & Detection Market, by Country

- United States Fire Alarm & Detection Market

- China Fire Alarm & Detection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives Synthesizing Key Findings and Outlining the Strategic Imperatives for Stakeholders in the Fire Alarm and Detection Arena

The fire alarm and detection industry is poised at the intersection of innovation, regulation, and strategic adaptation. Technological advancements in sensor technologies and connectivity are redefining capabilities, while evolving safety standards are driving demand for more sophisticated, interoperable solutions. Trade policy shifts underscore the significance of agile supply chains and cost-management methodologies, and segmentation analyses illuminate the critical importance of tailoring offerings across product types, connectivity options, power sources, and application environments.

Regional disparities highlight the need for flexible strategies that accommodate local codes and infrastructure maturity levels, whereas competitive dynamics stress the value of partnerships, service models, and continuous R&D investments. By synthesizing these dimensions, stakeholders can prioritize investments in sensor fusion, digital platforms, and modular architectures, ensuring resilience in the face of disruption and alignment with long-term operational objectives.

Ultimately, the integration of intelligent analytics, robust network design, and proactive maintenance frameworks will determine leadership in the next generation of fire detection and alarm solutions. As organizations navigate this complex landscape, the strategic imperatives surfaced in this report provide a roadmap to mitigate risks, capitalize on emerging trends, and drive sustainable growth through enhanced safety performance.

Empowering Your Next Steps Unlock Exclusive Access to Critical Fire Detection Insights by Connecting with Ketan Rohom Today

To unlock the full potential of your organization’s safety strategy and secure comprehensive insights into the fire alarm and detection ecosystem, reach out now to Ketan Rohom, Associate Director, Sales & Marketing. A brief consultation can clarify how this detailed analysis aligns with your priorities, ensuring that your investment delivers actionable intelligence, cutting-edge trend analysis, and tailored recommendations that empower decision-makers. Secure your copy today to transform data into decisive, growth-oriented initiatives.

- How big is the Fire Alarm & Detection Market?

- What is the Fire Alarm & Detection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?