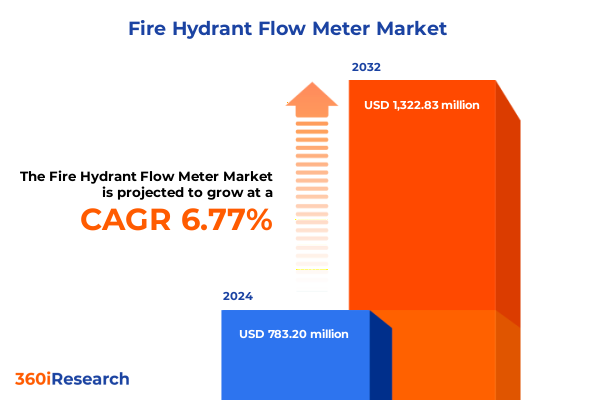

The Fire Hydrant Flow Meter Market size was estimated at USD 831.28 million in 2025 and expected to reach USD 890.12 million in 2026, at a CAGR of 6.86% to reach USD 1,322.83 million by 2032.

Discover How Advancements in Fire Hydrant Flow Meter Technologies Are Transforming Fire Safety Protocols and Water Resource Management Across the Globe

Fire hydrant flow meters serve as the cornerstone for validating the performance and reliability of fire suppression systems, underpinning public safety and infrastructure resilience. By measuring discharge rates and pressure, these devices ensure compliance with NFPA 291 standards for annual flow testing, reducing liability and supporting municipal liability frameworks that demand precise documentation of hydrant performance. Enhanced calibration capabilities further fortify the integrity of fire protection audits, giving stakeholders confidence in emergency preparedness and regulatory conformity.

Over the last decade, the advent of IoT-enabled flow meters has redefined conventional testing protocols by embedding sensors that stream real-time data to centralized platforms. This connectivity facilitates predictive maintenance, enabling fire departments to identify early signs of leaks, blockages, or wear before critical failures occur. Smart hydrants now integrate seamlessly with asset management systems, shortening response times and elevating the accuracy of maintenance schedules.

Beyond safety imperatives, growing pressure to conserve water and reduce operational costs has intensified demand for high-precision flow measurement. Municipal utilities leverage these meters to pinpoint excess consumption, while insurers extend premium incentives to facilities equipped with certified calibration records. A Midwest consortium, for example, reported multimillion-dollar annual savings through insurer-approved flow meter deployments that optimized both fire readiness and resource management.

Uncover the Pivotal Technological and Regulatory Shifts Reshaping Fire Hydrant Flow Meter Adoption and Operational Efficiency Today

In recent years, breakthroughs in IoT, cloud computing, and edge analytics have collectively redefined the fire hydrant flow meter landscape. Modern devices now capture granular pressure and velocity data at sub-second intervals, transmitting it via secure cellular or LPWAN networks to cloud-based dashboards. This real-time visibility empowers decision-makers to generate predictive insights, prioritize maintenance interventions, and preempt network vulnerabilities before they escalate into full-scale failures. As a result, the barriers between traditional fire safety equipment and smart city infrastructures continue to erode.

Simultaneously, material science innovations have yielded corrosion-resistant alloys and advanced composites that extend meter lifecycles in challenging environments. Freeze-resistant housings and ceramic-coated internals are becoming standard specifications, particularly in regions that demand seismic or temperature-resilient designs. Urban centers experiencing extreme weather variability now mandate meters that endure thermal cycling without calibration drift, setting new benchmarks for long-term accuracy and durability.

Regulatory frameworks have also evolved to reinforce accountability and data transparency. Updated provisions under California’s Title 24 require digital logging of flow tests, while Germany’s DIN 1988-500 standard compels bidirectional measurement for leak detection. These mandates have sparked procurement shifts, phasing out purely mechanical meters and elevating multifunctional devices that integrate seamlessly with analytics platforms. Consequently, vendors that align product roadmaps with emerging codes and interoperability standards are securing competitive advantages.

Examine the Far-Reaching Consequences of Cumulative US Tariff Policies on Fire Hydrant Flow Meter Supply Chains and Cost Structures

The introduction of new US tariffs on critical electronic components, including ultrasonic transducers and communication modules, has exerted upward pressure on manufacturing costs for smart water management devices. Producers of flow meters that rely on imported sensors now contend with elevated raw material prices, compelling many to recalibrate pricing strategies or absorb narrower margins to preserve market positioning. Short-term impacts include extended lead times and project delays as supply chains reroute to alternative suppliers.

Tariffs targeting industrial sensor parts such as pressure and turbine meter internals have compounded cost escalations, particularly for vendors dependent on Chinese or Southeast Asian manufacturing hubs. Industry estimates suggest cost hikes in the range of 3% to 6% for core sensor components, disrupting just-in-time inventory models and prompting firms to reevaluate sourcing footprints and inventory buffers.

In response, leading meter manufacturers are diversifying their supplier networks by forging partnerships with component fabricators in Vietnam, India, and Mexico. This strategic realignment aims to mitigate tariff exposure and streamline logistics, while longer-term measures include advancing domestic assembly capabilities and designing modular architectures that simplify integration of locally sourced sensor modules.

Discover Critical Segmentation Insights That Illuminate End User Verticals Technology Types Application Scenarios Material Choices and Accuracy Tiers

The fire hydrant flow meter market encompasses a spectrum of end-user segments that hinge on distinct operational requirements. Commercial establishments such as hospitals and shopping malls prioritize accuracy and reliability for annual compliance tests, whereas fire departments differentiate between professional brigades requiring robust fixed meters and volunteer units preferring portable, quick-deploy trailers. Industrial operators in chemical plants and oil & gas facilities demand corrosion-resistant variants to withstand harsh process environments, while municipalities deploy a mix of government agency and water utility solutions calibrated for network-wide monitoring.

Classification by type reveals a dynamic interplay between flanged inline meters installed as permanent fixtures in high-throughput zones and handheld instruments or trailer-mounted arrays ideal for ad-hoc flow assessments. These choices often align with lifecycle cost considerations and maintenance workflows, driving technology adoption curves. In turn, meter technology spans electromagnetic clamp-on and inline designs, mechanical orifice plates and turbine wheels, ultrasonic Doppler and transit-time sensors, as well as vortex meters engineered for large-bore and small-bore pipelines.

Applications range from direct firefighting operations-where live flow data underpins pump calibration and training exercises-to pipeline integrity tasks such as leak detection and pressure testing. Water distribution management leverages these meters for network monitoring and non-revenue water reduction initiatives. Material selections span brass with lead-free options, carbon fiber or fiberglass composites, CPVC and PVC plastics, and stainless steel in 304 and 316 grades. Accuracy tiers of ±1%, ±2%, and ±5% are available in both analog and digital formats, enabling stakeholders to match performance criteria with budgetary and regulatory thresholds.

This comprehensive research report categorizes the Fire Hydrant Flow Meter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Material

- Application

- End-User

Unlock Strategic Regional Insights Highlighting Distinct Trends Challenges and Growth Drivers Across Americas EMEA and Asia Pacific

North America leads the global adoption of fire hydrant flow meters, driven by stringent NFPA requirements and widespread infrastructure modernization initiatives. Over 78% of US municipalities with populations above 50,000 have formal hydrant testing programs, supported by insurance premium discounts for certified flow monitoring. Canada’s fire code similarly enforces performance verification in high-risk wildfire zones, prompting utilities to embrace digital flow logging to inform response strategies.

In the Europe, Middle East & Africa region, regulatory harmonization and heritage preservation mandates are accelerating uptake. Germany’s industrial clusters adhere to DIN standards that demand precision bidirectional measurement, while the UK integrates real-time flow data into historic city water networks to safeguard legacy structures. Middle Eastern petrochemical hubs deploy explosion-proof meters to meet Aramco specifications, and UAE civil defense protocols tie flow data integration to building information modeling for major developments, reinforcing cross-sector interoperability.

The Asia-Pacific market exhibits the fastest growth trajectory, underpinned by stringent codes in China and Japan. Shanghai and Tokyo require periodic flow verification in high-rise and seismic areas, fueling demand for robust, vibration-resistant meters. Singapore’s Smart Water Grid program targets IoT connectivity for 80% of public hydrants by 2025, while Australia’s bushfire mitigation efforts have installed thousands of meters to feed predictive fire models. These regional dynamics underscore the critical interplay between regulatory drivers and technological readiness.

This comprehensive research report examines key regions that drive the evolution of the Fire Hydrant Flow Meter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Reveal the Competitive Landscape by Profiling Leading Providers Pioneering Next Generation Fire Hydrant Flow Meter Innovations

The competitive landscape for fire hydrant flow meters is characterized by a mix of legacy infrastructure providers and emerging IoT specialists. Hawle and Mueller Systems command leading positions, leveraging strong distribution networks and brand recognition to capture over 40% of the installed base in smart monitoring applications. These incumbents continue to invest in R&D to advance sensor accuracy, materials resilience, and cloud integration layers that streamline compliance and reporting workflows.

Simultaneously, technology-driven players such as Siemens and Honeywell are carving out niches with software-centric platforms. Siemens’s MindSphere analytics ecosystem aggregates flow data to predict hydrant network degradation, while Honeywell’s iterative use of carbon-reinforced PEEK housings and ceramic-coated impellers bolsters performance in corrosive coastal environments. These innovations facilitate longer service intervals and lower total cost of ownership, appealing to municipalities and industrial end users alike.

Further diversification emerges from specialized OEMs offering trailer-mounted ultrasonic meters and subscription-based analytics, enabling rapid deployment for emergency drills and remote site assessments. As the market evolves, alliances between hardware manufacturers and software integrators will likely define the next frontier of customer value, combining advanced flow metrology with enterprise asset management capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Hydrant Flow Meter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akron Brass

- American AVK Company

- Ames Fire & Waterworks

- Badger Meter

- CY Plastics

- Fluid Components International (FCI)

- Fluid Metering, Inc.

- FMC Technologies

- J & S Valve

- Kam Controls

- Krohne

- Kupferle Foundry Company

- M.E. Simpson Company

- McCrometer

- Mueller Water Products

- Neptune Technology Group

- Pollardwater

- Roper Pump Company

- Running Industry Co., Ltd

- Sigelock Systems

- Watts Water Technologies

- Zenner USA

Actionable Strategies for Industry Leaders to Drive Growth Optimize Operations and Strengthen Fire Hydrant Flow Meter Value Propositions

To capitalize on evolving market dynamics, industry leaders should accelerate investment in IoT and cloud analytics, ensuring interoperability with municipal asset management systems. Embedding cellular and LPWAN connectivity into new meter designs will unlock continuous monitoring capabilities, while application programming interfaces (APIs) should facilitate integration with existing SCADA and smart city platforms. These measures will enhance predictive maintenance, reduce unplanned outages, and strengthen vendor-customer partnerships.

Leaders must also proactively address tariff-driven cost pressures by diversifying supply chains and qualifying secondary suppliers in low-cost regions. Nearshoring manufacturing operations and modularizing sensor architectures can mitigate exposure to fluctuating duties while shortening lead times. Meanwhile, total cost of ownership models that incorporate calibration schedules and lifecycle services will resonate with end users focused on long-term budget predictability, especially in markets with biannual certification mandates.

Finally, executives should leverage segmentation insights to tailor product portfolios to distinct end-user needs-from heavy-duty fixed inline meters for industrial sites to lightweight handheld units for volunteer fire departments. By aligning material choices and accuracy grades with application scenarios, firms can offer differentiated value propositions that meet both functional and regulatory requirements, driving adoption and fostering long-term loyalty.

Understand the Rigorous Research Approach Methodologies and Data Triangulation Techniques Underpinning This Fire Hydrant Flow Meter Market Analysis

This analysis is grounded in a rigorous methodology that combines primary interviews with fire department chiefs, municipal water authority managers, OEM executives, and calibration service providers. Supplemented by secondary research across industry publications, regulatory documents, and technology white papers, the study triangulates quantitative and qualitative insights to ensure robustness and perspective.

Data collection encompassed structured surveys to capture real-world deployment patterns and preferences, alongside in-depth case studies from municipal and industrial end users. Technical performance benchmarks were evaluated through lab testing protocols aligned with NFPA 291 and ISO 7243-2021 standards, verifying sensor accuracy and durability under simulated field conditions.

To validate findings, the research team employed cross-vendor comparisons, scenario modeling, and expert panel reviews. This multi-layered approach ensures that conclusions reflect the latest regulatory developments, materials innovations, and market responses to tariff adjustments, providing a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Hydrant Flow Meter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Hydrant Flow Meter Market, by Type

- Fire Hydrant Flow Meter Market, by Technology

- Fire Hydrant Flow Meter Market, by Material

- Fire Hydrant Flow Meter Market, by Application

- Fire Hydrant Flow Meter Market, by End-User

- Fire Hydrant Flow Meter Market, by Region

- Fire Hydrant Flow Meter Market, by Group

- Fire Hydrant Flow Meter Market, by Country

- United States Fire Hydrant Flow Meter Market

- China Fire Hydrant Flow Meter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesize Key Findings and Industry Takeaways to Solidify Your Understanding of Fire Hydrant Flow Meter Market Dynamics and Opportunities

In synthesizing the key insights, it becomes clear that the fire hydrant flow meter market is at an inflection point driven by digital transformation, regulatory enhancements, and cost pressures from tariff policies. Municipalities and industrial operators are converging on IoT-enabled, high-accuracy meters to meet compliance mandates and optimize water usage while reducing operational risks.

The interplay between segmentation factors-from end-user profiles to material specifications and accuracy tiers-offers a blueprint for product differentiation. Regional nuances underscore the importance of localized strategies that account for specific standards, environmental conditions, and infrastructure maturity. Meanwhile, competitive dynamics are favoring agile providers capable of integrating software analytics with robust hardware built to withstand demanding field environments.

Ultimately, stakeholders that embrace technological convergence, supply chain diversification, and customer-centric segmentation will be best positioned to capture emerging opportunities and sustain growth in the evolving landscape of fire hydrant flow metering.

Connect With Ketan Rohom to Secure Your Fire Hydrant Flow Meter Market Research Report and Accelerate Informed Strategic Decisions Today

For personalized guidance on leveraging our in-depth insights to drive strategic growth and operational excellence in the fire hydrant flow meter space, reach out to Ketan Rohom, our Associate Director of Sales & Marketing. Ketan can provide tailored consultation on how this comprehensive market research report addresses your priorities, whether you seek to optimize product portfolios, mitigate tariff impacts, or accelerate adoption of IoT-enabled solutions. Engage with Ketan today to secure your copy of the full report and gain the intelligence needed to outpace competitors and capitalize on emerging opportunities in the fire hydrant flow meter market.

- How big is the Fire Hydrant Flow Meter Market?

- What is the Fire Hydrant Flow Meter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?