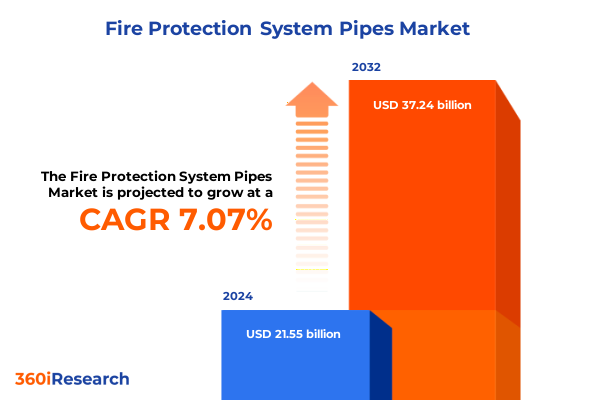

The Fire Protection System Pipes Market size was estimated at USD 23.00 billion in 2025 and expected to reach USD 24.57 billion in 2026, at a CAGR of 7.12% to reach USD 37.24 billion by 2032.

Exploring the Critical Landscape of Fire Protection System Pipes Through Market Drivers, Regulations, Technological Advances, and Strategic Imperatives for Safety

In today’s complex risk landscape, fire protection system pipes represent a foundational element of building safety and operational resilience. These integral conduits channel critical media-whether water, foam, or suppression agents-to control or extinguish fires swiftly. As regulatory bodies intensify safety mandates and organizations seek to safeguard assets and lives, the performance and reliability of pipe infrastructure have emerged as top priorities. Concurrently, evolving environmental standards and sustainability goals drive innovation in materials and coatings, challenging traditional paradigms and inspiring novel solutions.

Within this dynamic environment, industry participants must navigate a multifaceted matrix of technical specifications, regional codes, and economic pressures. The convergence of digital technologies, such as sensor integration and data analytics, further transforms the design and maintenance of pipe networks. As decision-makers weigh upgrade investments against lifecycle costs, a holistic understanding of market drivers and barriers becomes indispensable. This introduction sets the stage for an in-depth exploration of the forces reshaping the fire protection pipes landscape, offering a strategic vantage point to interpret current trends and anticipate future developments.

Assessing Emerging Technological Shifts and Industry Disruptions Redefining Fire Protection System Pipes with Digital Integration, Sustainability, and Prefabrication Trends

The fire protection system pipes sector is undergoing a paradigm shift as digital transformation converges with evolving safety priorities. Real-time monitoring and predictive maintenance applications, powered by Internet of Things connectivity and advanced analytics, are fundamentally altering how operators oversee pipe integrity and system readiness. This digital overlay not only enhances response capabilities but also extends asset life by enabling condition-based servicing, reducing unplanned downtime, and lowering maintenance expenditures.

Simultaneously, sustainable design principles are driving material innovation. Composite blends infused with corrosion-inhibiting agents and lightweight polymers are gaining traction alongside traditional copper and steel offerings. These advanced materials marry strength with environmental stewardship, addressing growing demands for reduced carbon footprints and extended service intervals. Additionally, industry leaders are embracing prefabricated piping assemblies to accelerate on-site installation, streamline labor requirements, and minimize project timelines.

As these transformative shifts intersect, stakeholders must reassess supply chain models, invest in strategic partnerships, and cultivate specialized technical expertise. By aligning organizational priorities with the latest advancements, manufacturers, distributors, and end users can unlock new value propositions, elevate safety standards, and maintain agility in an increasingly competitive landscape.

Analyzing the Strategic Consequences of United States Tariffs on Fire Protection System Pipes in 2025 Including Supply Chain Realignment and Cost Management Pressures

The imposition of tariffs on imported materials in 2025 has introduced a fresh layer of complexity for fire protection pipe stakeholders. With steel levies and duties impacting baseline costs, organizations are compelled to reevaluate sourcing strategies and supplier partnerships. These measures, intended to bolster domestic manufacturing, have inadvertently prompted a scramble for alternative material options and flexible procurement models.

In response, many manufacturers have accelerated efforts to qualify domestic composite materials and enhanced plastics, seeking to offset higher expenses associated with traditional metal piping. This shift has encouraged R&D collaborations aimed at optimizing performance characteristics, including durability under hydrostatic stress and fire exposure. Concurrently, distributors and contractors are negotiating long-term agreements to secure stable pricing and guarantee material availability, thus mitigating supply chain volatility.

Despite initial cost pressures, the tariff environment has stimulated localized production ecosystems, fostering job creation and capacity expansion in key regions. However, end users must remain vigilant of potential quality disparities and ensure compliance with stringent fire safety standards. Ultimately, navigating the tariffs’ ripple effects demands strategic agility, informed risk assessment, and proactive engagement with material science advancements.

Unveiling Key Segmentation Insights That Illuminate How Product Types, Materials, Connection Styles, Applications, and End-Use Sectors Shape Market Dynamics

A nuanced exploration of market segments reveals a landscape defined by diverse product formats, material compositions, connection methods, application environments, and end-user requirements. Fire suppression network designs span deluge configurations optimized for rapid water discharge, dry pipe assemblies suited to colder climates, foam distribution systems for hydrocarbon risks, pre-action solutions offering dual-trigger safeguards, and traditional wet pipe networks renowned for reliability. Within each design category, performance parameters such as activation time, corrosion resistance, and maintenance intervals drive product differentiation and customer preference.

Equally pivotal are material selections, where composite blends, copper conduits, plastic piping, and steel frameworks each deliver distinct cost structures, mechanical properties, and environmental footprints. Connection typologies further segment the market, with flanged joints offering robust sealing, grooved couplings enabling swift assembly, and threaded fittings appealing to retrofit scenarios. Across application domains, fire sprinkler layouts represent the majority of installations, while specialized suppression architectures address high-risk industrial settings.

Moreover, the consumption profile diverges among commercial facilities seeking aesthetic integration, industrial plants prioritizing heavy-duty resilience, and residential projects emphasizing safety and ease of maintenance. These segmentation lenses collectively shape the competitive landscape, informing product development roadmaps, marketing strategies, and distribution networks tailored to evolving end-user expectations.

This comprehensive research report categorizes the Fire Protection System Pipes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Connection Type

- Application

- End-Use

Examining Regional Growth Patterns and Regulatory Environments Across the Americas, Europe Middle East & Africa, and Asia-Pacific Influencing Fire Protection System Pipes

Geographic diversity underpins the fire protection pipes market, with distinct drivers emerging across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, rigorous regulatory frameworks and extensive infrastructure modernization programs propel demand for advanced piping solutions. High-profile renovation initiatives in commercial and residential sectors further stimulate retrofit opportunities, while collaborative ventures between private firms and government agencies support capacity expansion.

Across Europe, Middle East & Africa, stringent building codes and sustainability objectives emphasize corrosion-resistant materials and environmentally friendly manufacturing processes. Regional standardization efforts, particularly in European Union member states, facilitate cross-border trade and harmonize technical specifications. Conversely, in rapidly urbanizing Middle Eastern economies, monumental construction projects necessitate large-scale pipe deployments, often under harsh environmental conditions.

In the Asia-Pacific region, accelerating urban development, expanding manufacturing hubs, and growing energy infrastructure projects converge to drive robust market growth. Local manufacturers are scaling production to meet escalating demand, while international suppliers forge alliances to strengthen distribution channels. This vibrant ecosystem fosters continuous innovation, as stakeholders strive to address challenging climatic factors and evolving safety requirements.

This comprehensive research report examines key regions that drive the evolution of the Fire Protection System Pipes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Movements in Innovation, Partnerships, and Market Positioning to Understand Competitive Dynamics in Pipe Solutions

The competitive arena is shaped by both established conglomerates and specialized innovators, each pursuing distinct strategic pathways. Leading entities consistently invest in material science research to introduce proprietary coatings and composite formulations that enhance durability and corrosion resistance. Parallel to these efforts, several firms have adopted an acquisition-driven model, integrating niche technology providers to broaden their portfolios and reinforce market presence.

Partnership ecosystems have also emerged as a critical mechanism for advancing digital capabilities. By collaborating with sensor manufacturers and software developers, pipe system producers offer value-added services such as real-time diagnostics and automated maintenance alerts. These collaborative ventures not only elevate product differentiation but also cultivate recurring revenue through subscription-based monitoring services.

Furthermore, geographic expansion strategies are central to maintaining competitive momentum. Top-tier companies establish regional manufacturing facilities and distribution hubs to reduce lead times and comply with local content regulations. Simultaneously, targeted marketing campaigns underscore brand reliability and post-installation support, positioning these companies as trusted long-term partners in safety infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Protection System Pipes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aquatherm GmbH

- Ashirvad by Aliaxis Group SA

- ASTRAL LIMITED

- Bull Moose Tube Company by Caparo Group Limited

- China Lesso Group Holdings Limited

- Düker GmbH

- Encore Fire Protection

- Engineered Fire Piping

- Engineered Fire Piping, SL

- Fire suppression Limited

- Georg Fischer Rohrleitungssysteme AG

- Jindal Industries Pvt. Ltd.

- Johnson Controls International plc

- Minimax GmbH

- NewAge Fire Fighting Co. Ltd.

- Octal Steel

- Perma-Pipe International Holdings Inc.

- Prince Pipes And Fittings Ltd.

- Simona AG

- Tata Steel Limited

- The Supreme Industries Ltd.

- Victaulic Company

- Wheatland Tube by Zekelman Industries

- Youngstown Tube

- Zekelman Industries

Articulating Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience, Accelerate Innovation, and Optimize Supply Chains in Fire Safety Infrastructure

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders must adopt a multi-pronged strategic approach. Prioritizing supply chain diversification can reduce dependency on a single material stream and cushion the impact of tariff fluctuations. Engaging in joint ventures with alternative material suppliers and exploring localized manufacturing partnerships further strengthens resilience against global trade uncertainties.

In parallel, accelerating investment in digital tools-ranging from asset tracking systems to predictive analytics platforms-will improve operational visibility and support data-driven decision-making. Embracing modular designs and prefabrication practices can expedite project delivery timelines, optimize labor costs, and minimize on-site disruptions. This approach fosters agile responses to shifting customer needs and regulatory updates.

Moreover, embedding sustainability at the core of product development and manufacturing processes enhances brand equity and aligns with increasingly stringent environmental mandates. By integrating lifecycle assessments and eco-friendly material sourcing policies, organizations demonstrate a commitment to responsible growth. Lastly, cultivating talent through specialized training programs ensures that technical expertise keeps pace with advancing technologies and installation best practices.

Detailing a Robust Research Methodology Emphasizing Data Triangulation, Primary Interviews, and Comprehensive Analysis for Rigorous Insights into Pipe Market Dynamics

This research employs a rigorous methodology designed to ensure robust, reliable insights. The analysis commenced with an extensive secondary research phase, encompassing technical standards, regulatory documentation, and industry white papers. This groundwork established a foundational understanding of market drivers, material properties, and emerging trends. Building upon this, the primary research component involved structured interviews with subject matter experts, including engineers, safety consultants, and procurement specialists, to validate qualitative findings and capture nuanced operational perspectives.

Data triangulation techniques were applied to reconcile discrepancies between secondary sources and primary feedback, ensuring consistency and credibility. The segmentation framework was then synthesized around five critical dimensions, each reflecting a unique lens through which market dynamics can be interpreted. Regional analyses incorporated macroeconomic indicators, infrastructure investment patterns, and local regulatory landscapes to contextualize growth trajectories. Throughout the process, the research adhered to strict quality control measures, including peer review of key assumptions and validation of technical specifications with certified professionals.

This multi-layered approach guarantees that the conclusions drawn and recommendations offered are grounded in verified evidence, offering decision-makers a solid basis for strategic planning and operational execution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Protection System Pipes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Protection System Pipes Market, by Product Type

- Fire Protection System Pipes Market, by Material Type

- Fire Protection System Pipes Market, by Connection Type

- Fire Protection System Pipes Market, by Application

- Fire Protection System Pipes Market, by End-Use

- Fire Protection System Pipes Market, by Region

- Fire Protection System Pipes Market, by Group

- Fire Protection System Pipes Market, by Country

- United States Fire Protection System Pipes Market

- China Fire Protection System Pipes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude on the Evolving Role of Fire Protection System Pipes in Modern Safety Architectures and Industry Outlook

The collective insights underscore a market at the crossroads of innovation and regulatory evolution. Advancements in digital monitoring and predictive maintenance are redefining lifecycle management, while material science breakthroughs present alternatives to conventional metal piping. Tariff-induced realignments have expedited the adoption of composite and plastic conduits, promoting localized production models and collaborative R&D efforts.

Segmentation analysis highlights the interplay between product configurations, material choices, connection technologies, applications, and end-use sectors, each shaping competitive positioning and value propositions. Geographic distinctions reveal tailored opportunities, with infrastructure upgrades dominating the Americas, regulatory harmonization steering growth in Europe Middle East & Africa, and rapid urbanization fueling demand across Asia-Pacific.

As leading companies refine their strategic focus through partnerships, acquisitions, and digital ecosystems, the path forward demands resilience, agility, and a commitment to sustainability. Organizations that integrate these imperatives into their operational blueprints will be best equipped to navigate uncertainties and capture value in a market defined by complexity and rapid transformation.

Inviting Decision-Makers to Engage with Associate Director Ketan Rohom for Exclusive Access to Comprehensive Fire Protection System Pipes Market Intelligence and Reports

To unlock the full potential of fire protection system pipes and secure a competitive advantage, decision-makers are encouraged to reach out for tailored insights. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to provide personalized guidance on leveraging comprehensive market intelligence to drive strategic initiatives. By establishing a direct dialogue, industry leaders can explore bespoke solutions that align with organizational goals, navigate regulatory complexities, and capitalize on emerging opportunities.

Engaging with Ketan ensures access to a detailed market research report that synthesizes the latest trends, segmentation analysis, regional dynamics, and competitive intelligence. This report serves as an indispensable resource for organizations committed to strengthening their fire safety infrastructure, optimizing supply chains, and pioneering advanced solutions in fire protection. Prospective clients will benefit from expert consultation, clarifying any specific requirements and unlocking deeper understanding of evolving market drivers.

Take the next step toward informed decision-making by connecting with Ketan Rohom. Empower your organization with strategic insights that foster resilience, innovation, and sustainable growth in the fire protection system pipes sector. Reach out today to begin a collaborative partnership designed to elevate your market positioning and accelerate long-term success.

- How big is the Fire Protection System Pipes Market?

- What is the Fire Protection System Pipes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?