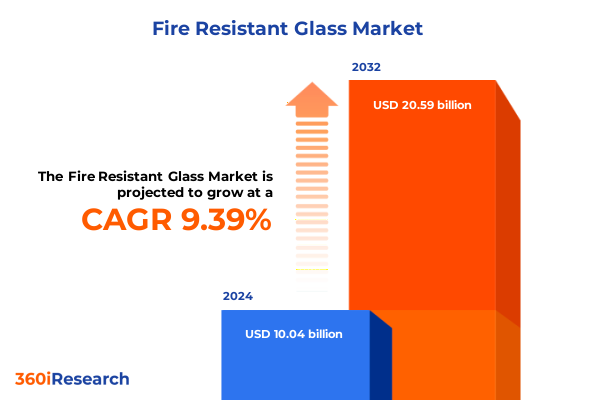

The Fire Resistant Glass Market size was estimated at USD 10.98 billion in 2025 and expected to reach USD 12.01 billion in 2026, at a CAGR of 9.40% to reach USD 20.59 billion by 2032.

Unveiling the Evolving Fire Resistant Glass Market and Its Critical Contribution to Next-Generation Building Safety and Infrastructure Resilience

The science and technology underpinning fire resistant glass have evolved into a cornerstone of modern fire safety and architectural design. As urban environments become denser and building codes grow more stringent, fire resistant glass has transitioned from a niche safety product to a fundamental component of resilient infrastructure. This material not only preserves structural integrity under extreme temperatures but also maintains visibility and daylighting, thereby supporting both safety and occupant wellbeing.

In the current landscape, stakeholders across construction, automotive, and industrial sectors increasingly recognize the critical role that high-performance glass plays in life safety protocols. Regulations such as the International Building Code and various national fire safety standards have raised the bar for fire resistance requirements, prompting developers, architects, and facility managers to integrate advanced glazing solutions early in project planning. This shift underscores the necessity of understanding material properties, certification processes, and the broader implications for design flexibility.

Moreover, surging demand for smart buildings and sustainable development has placed fire resistant glass at the intersection of safety and environmental performance. Innovations in interlayer chemistry and manufacturing techniques now allow glazing to achieve rigorous fire ratings while enhancing thermal insulation and acoustic damping. These dual-function capabilities position fire resistant glass as an invaluable asset in optimizing energy efficiency without compromising life safety. Consequently, the market’s trajectory is shaped by the interplay between regulatory imperatives and the pursuit of integrated building solutions.

Recognizing the Transformative Forces Redefining Fire Resistant Glass Adoption Amid Technological Advancements and Regulatory Overhauls

Technological breakthroughs have dramatically altered the competitive landscape for fire resistant glass. Novel ceramic formulations now deliver exceptional performance at higher temperature thresholds, while laminated assemblies incorporating intumescent interlayers expand the range of fire ratings without sacrificing optical clarity. Simultaneously, digital manufacturing techniques-such as laser cutting and robotic tempering-are enhancing production precision, reducing lead times, and enabling bespoke glazing configurations for complex facades and curved architectural elements.

Regulatory developments are reinforcing these advances by mandating ever-stricter fire resistance levels in public and private constructions alike. Amendments to key standards have introduced more rigorous test protocols and broadened the scope of building types requiring comprehensive glazing solutions. This has stimulated demand for advanced certification programs and third-party validation, elevating quality assurance as a pivotal differentiator among suppliers.

At the same time, end-use applications are diversifying as stakeholders seek integrated safety systems that blend structural glazing with fire-detection technologies. Automotive designers, for example, are integrating fire rated windshields into electric vehicle architectures, while industrial operators are adopting fire resistant partitions for critical containment areas. This expansion beyond conventional building envelopes is redefining market boundaries and laying the foundation for cross-sector collaboration.

Examining the Cumulative Effects of 2025 United States Tariffs on Supply Chains, Pricing Structures, and Competitive Dynamics in Fire Resistant Glass

In 2025, sweeping tariff measures introduced by the United States government reshaped global trade flows for fire resistant glass. Imported ceramic and laminated glass products faced newly imposed duties aimed at protecting domestic manufacturers and addressing trade imbalances. These levies directly impacted landed costs for companies reliant on established supply routes from Asia and Europe, compelling many to reassess procurement strategies and nearshore critical operations.

As import costs climbed, buyers began shifting orders to North American fabricators, prompting capacity expansions among local producers. At the same time, new partnerships emerged between domestic processors and raw-glass importers to secure preferential rates and streamline cross-border logistics. In parallel, the tariff environment accelerated the development of alternative supply chains, with glass component sourcing diversifying into low-duty jurisdictions.

These dynamics also influenced pricing strategies and competitive positioning. Domestic suppliers leveraged tariff-driven cost advantages to negotiate long-term contracts, while international players explored hybrid models that combined regional warehousing with on-site fabrication. Amid these adjustments, stakeholders prioritized supply-chain resilience and transparency, adopting real-time tracking and vendor scorecards to mitigate tariff volatility and ensure product continuity in critical projects.

Unlocking Deep Segmentation Insights by Product Type, Application, Fire Rating, Thickness, and Distribution Channels to Identify Growth Opportunities

Analysis by product type illustrates that ceramic glass has become a preferred solution for applications requiring high-temperature endurance, whereas laminated variants are favored in projects prioritizing combined fire resistance and security. Tempered glass maintains a key role in lower fire-rating scenarios where mechanical strength and breakage safety are paramount, while wired glass continues to secure niche industrial installations that benefit from embedded reinforcement.

Turning to application segments, automotive deployment has gained momentum as electric vehicle battery compartments integrate fire resistant glazing, and commercial real estate has elevated its specification of fire rated curtain walls and internal partitions to meet enhanced safety codes. Industrial environments rely on specialized glazing for containment rooms, while residential construction adopts fire rated doors and windows to comply with evolving homeowner association standards.

Exploring fire rating gradations, products certified for 30-minute protection address localized containment needs, whereas 60- and 90-minute ratings support more critical applications such as stairwell glazing and exit corridors. The 120-minute category, albeit less common, caters to high-occupancy venues and specialized installations requiring maximum performance.

When thickness is evaluated, 3 mm to 5 mm sheets are established in standard partitions, 6 mm to 8 mm assemblies serve dual fire and security requirements, and thicker configurations above 8 mm deliver exceptional containment for specialized façades. Distribution channels similarly differentiate value propositions: direct sales empower large institutional buyers to negotiate bespoke contracts; distributor networks offer broad geographic coverage and inventory reach; and online sales platforms facilitate rapid procurement for smaller projects or replacement orders.

This comprehensive research report categorizes the Fire Resistant Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fire Rating

- Thickness

- Application

- Distribution Channel

Analyzing Pivotal Regional Market Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Navigate Emerging Opportunities

In the Americas, demand is driven by stringent North American fire safety codes and substantial retrofit budgets in urban centers. Regional manufacturers benefit from tariff–induced supply shifts and government incentives for resilient infrastructure, supporting investments in expanded capacity and advanced automation.

Europe, the Middle East & Africa present a mosaic of regulatory environments where the European Union’s harmonized standards coexist with national requirements in the Middle East and Africa. Projects in high-growth Gulf States and restoration work in historical European districts have fueled demand for custom fire resistant glazing solutions that marry performance with aesthetic considerations.

In Asia-Pacific, rapid urbanization in markets such as China, India, and Southeast Asia underpins a significant share of new construction activity. Regulatory modernization across major economies has elevated fire safety priorities, while regional fabricators are investing in advanced coating and interlayer technologies to capture export opportunities and meet the exacting specifications of multinational developers.

This comprehensive research report examines key regions that drive the evolution of the Fire Resistant Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profile of Leading Fire Resistant Glass Manufacturers Showcasing Strategic Partnerships, Innovative Developments, and Competitive Positioning

Leading manufacturers are distinguished by their integrated value chains, from raw-material sourcing through precision fabrication and certification. Global glass conglomerates have forged strategic alliances with specialized interlayer producers to secure proprietary technologies and accelerate new product introductions. Others have invested heavily in digital formlines and automated tempering ovens to enhance throughput and reduce lead times.

Joint ventures between interior fit-out specialists and fire glass fabricators have created end-to-end solutions, bundling certified glazing with design and installation services. This trend reflects a broader industry shift toward turnkey offerings, where manufacturers differentiate themselves by managing project complexities, warranties, and compliance across multiple jurisdictions.

Meanwhile, mid-tier players focus on niche innovation, developing intumescent coatings that improve visibility under fire stress and collaborating with research institutes to achieve advanced thermal insulation ratings. These firms leverage agility and specialized expertise to compete effectively against larger entities, targeting market segments that demand rapid prototyping and customized performance parameters.

Collectively, the competitive landscape is shaped by dynamic partnerships, strategic acquisitions, and continuous investment in process optimization. Companies that balance scale with innovation remain best positioned to capture emerging opportunities and navigate evolving regulatory frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Resistant Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Anemostat Door Products

- Asahi India Glass Ltd.

- Central Glass Co., Ltd.

- Fuso Glass India Pvt. Ltd.

- Glas Trösch Holding AG

- Nippon Sheet Glass Co., Ltd.

- POLFLAM sp. z o.o.

- Promat International NV

- Pyroguard Ltd.

- Ravensby Glass Co. Ltd.

- SAFTI FIRST

- Saint-Gobain

- Schott AG

- Technical Glass Products

Actionable Strategies for Industry Leaders to Capitalize on Market Shifts, Strengthen Supply Chains, and Drive Sustainable Growth Trajectories

Industry leaders should prioritize supply-chain diversification by establishing parallel sourcing agreements with both domestic processors and low-duty international partners to mitigate the impact of tariff fluctuations. Concurrently, investing in advanced manufacturing capabilities-such as automated assembly lines and real-time quality monitoring-can drive efficiency improvements and shorten delivery cycles.

Collaborative innovation programs with research universities and material science institutes will accelerate next-generation interlayer development and thermal performance enhancements. Leadership teams ought to engage early with regulatory bodies to influence emerging fire safety standards and ensure proactive compliance. By participating in standards committees, companies can shape testing protocols and differentiate products through early certification milestones.

Marketing and sales organizations must refine value propositions by packaging fire resistant glass offerings with digital tools, such as augmented-reality visualization and performance simulators, to illustrate benefits in real-world scenarios. Establishing regional centers of excellence and certified installation networks will further strengthen customer confidence and support premium pricing.

Finally, widening service portfolios to include post-installation maintenance, performance audits, and training programs will foster long-term customer relationships and unlock recurring revenue streams. A holistic approach that integrates product innovation, regulatory engagement, and value-added services will define the next wave of competitive winners.

Transparent Research Methodology Outline Incorporating Multi-Source Data Collection, Rigorous Validation, and Expert Interviews

The research methodology underpinning this analysis integrates both primary and secondary data sources to ensure robustness and credibility. Primary research comprised in-depth interviews with C-level executives, product engineers, and purchasing managers across key regions to capture nuanced perspectives on technology trends, procurement challenges, and strategic priorities.

Secondary data collection involved a comprehensive review of industry associations’ publications, fire safety standards documentation, patent filings, and financial disclosures of leading glass manufacturers. Trade journals and regulatory bulletins were systematically analyzed to track policy changes and certification updates globally.

Quantitative insights were validated through triangulation, comparing company shipment data, customs statistics, and market intelligence databases to corroborate volume trends and supply-chain shifts. Qualitative inputs were cross-checked by consulting fire testing laboratories and certifying agencies to confirm performance parameters and regulatory compliance.

A peer-review process engaged external subject-matter experts in fire safety engineering and architectural glazing to vet key findings. This rigorous, multi-step approach ensures that the conclusions and recommendations presented are both actionable and grounded in the most recent industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Resistant Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Resistant Glass Market, by Product Type

- Fire Resistant Glass Market, by Fire Rating

- Fire Resistant Glass Market, by Thickness

- Fire Resistant Glass Market, by Application

- Fire Resistant Glass Market, by Distribution Channel

- Fire Resistant Glass Market, by Region

- Fire Resistant Glass Market, by Group

- Fire Resistant Glass Market, by Country

- United States Fire Resistant Glass Market

- China Fire Resistant Glass Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Drawing Conclusive Insights That Highlight Market Trends, Stakeholder Implications, and Future Pathways for Fire Resistant Glass

This executive summary distills the pivotal forces shaping the fire resistant glass market and delivers actionable insights for stakeholders across the value chain. Technological innovation, regulatory evolution, and tariff dynamics collectively dictate competitiveness, underlining the importance of agility and strategic foresight.

Segmentation analysis reveals distinct pathways for product differentiation, from high-temperature ceramic solutions to laminated assemblies with enhanced functionality. Regional breakdowns illustrate how divergent regulatory frameworks and construction trends influence demand patterns and investment flows.

Leading manufacturers are consolidating their positions through partnerships, capacity expansions, and digital transformations, while nimble challengers drive niche innovation. Industry leaders must blend operational excellence with proactive regulatory engagement and customer-centric service offerings.

Ultimately, success in this market hinges on the ability to anticipate regulatory shifts, optimize supply chains, and deliver integrated solutions that resonate with safety-conscious end users. The insights within this report equip decision-makers with the strategic clarity required to navigate a rapidly evolving environment and to capitalize on emerging growth opportunities.

Connect with Ketan Rohom for Expert Guidance and to Secure Your Comprehensive Fire Resistant Glass Market Research Report Today

For personalized insights, tailored strategies, and to secure the detailed market research report on fire resistant glass, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan possesses a deep understanding of the fire resistant glass landscape and can guide you through the comprehensive findings, interactive data dashboards, and exclusive executive insights contained within the report. Engage now to discuss how the research aligns with your organization’s objectives, explore customized data packages, and ensure your stakeholders have the intelligence needed to make informed, strategic decisions. Don’t miss the opportunity to leverage this authoritative resource and stay ahead in a rapidly evolving market-connect with Ketan today to take the next step toward unlocking your competitive edge.

- How big is the Fire Resistant Glass Market?

- What is the Fire Resistant Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?