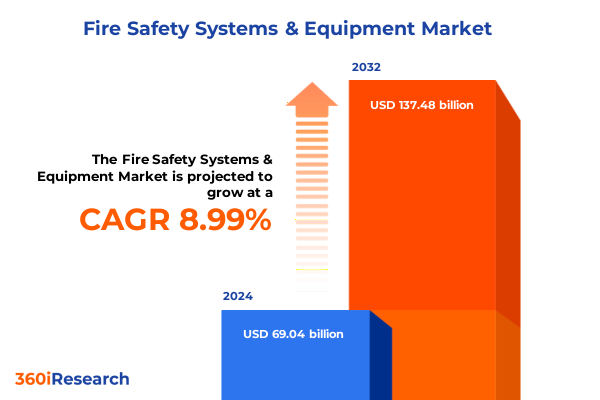

The Fire Safety Systems & Equipment Market size was estimated at USD 74.78 billion in 2025 and expected to reach USD 80.99 billion in 2026, at a CAGR of 9.08% to reach USD 137.48 billion by 2032.

Navigating the Evolving Fire Safety Systems Landscape Amid Increasing Complexity Regulatory Imperatives and Technological Innovation

The contemporary fire safety systems sector is undergoing an unprecedented confluence of pressures that demand both agility and vision from industry stakeholders. Rising demands for robust life-safety measures are colliding with accelerating technological innovation, creating a dynamic environment in which traditional protocols are being reimagined. Moreover, the increasing prevalence of complex infrastructure-from high-rise mixed-use developments to sprawling industrial facilities-has elevated expectations for system interoperability, reliability, and rapid responsiveness. As a result, organizations are compelled to reassess legacy approaches to equipment specification, installation, and maintenance in favor of integrated solutions that can adapt to multifaceted risk profiles.

Furthermore, a heightened regulatory focus-driven by evolving international standards and more stringent national codes-has intensified the need for precise compliance and transparent reporting. End users are looking beyond mere code conformity toward comprehensive risk management frameworks that leverage real-time monitoring and analytics. In parallel, emerging considerations such as climate resilience and sustainability are reshaping procurement criteria, prompting manufacturers and integrators to innovate around low-power wireless technologies, modular designs, and environmentally friendly materials. Ultimately, this introduction establishes the baseline complexity that defines today’s fire safety landscape and sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, and strategic imperatives.

Embracing Disruptive Transformations in Fire Safety Through Advanced IoT Connectivity AI-Driven Analytics and Sustainable Innovations

In recent years, the fire safety domain has witnessed a series of transformative shifts that are redefining system architectures and service models across the value chain. Leading this shift is the integration of Internet of Things (IoT) connectivity, which is enabling addressable detection networks to deliver granular, device-level diagnostics and predictive maintenance alerts. By linking sensors, control panels, and cloud-based dashboards, stakeholders can now preempt equipment failures and optimize inspection workflows, thereby reducing downtime and minimizing risk exposure.

At the same time, artificial intelligence (AI) and advanced analytics are ushering in a new era of proactive risk management. Machine learning algorithms can analyze historical incident data and environmental variables to forecast potential hazard zones, alerting facilities teams to elevated threat levels in advance. Complementing these digital innovations, market participants are increasingly prioritizing sustainable practices-such as energy-harvesting wireless detectors and recyclable componentry-to meet carbon reduction goals and comply with green building certifications. Together, these disruptive advancements are not only elevating safety standards but also unlocking new service-based revenue streams, illustrating how the industry’s architecture is evolving from product-centric to solution-centric paradigms.

Assessing the Ramifications of 2025 US Tariffs on Fire Safety Equipment Supply Chains Production Costs and Competitive Dynamics

The imposition of new United States tariffs on key imports in 2025 has created significant headwinds for fire safety equipment manufacturers and distributors. Increased duties on electronic detection modules, control panel components, and specialized cabling have driven up production costs, compelling many vendors to revisit supplier agreements and reassess global sourcing strategies. In response, some enterprises have accelerated plans to onshore critical manufacturing processes or qualify secondary suppliers in tariff-exempt jurisdictions, seeking to mitigate margin erosion and safeguard lead times for New Installation and Retrofit projects.

These tariff pressures have also manifested in altered pricing dynamics throughout the Distribution Channel spectrum. Direct Sales teams have encountered pushback as end users question elevated list prices, while Distributors, OEMs, and System Integrators are navigating inventory realignment challenges to avoid overstocking high-duty-bearing items. Concurrently, a shift toward Online Sales platforms has emerged as companies explore digital procurement to streamline cost comparisons and secure more favorable freight terms. Moreover, the tariff environment has fostered greater collaboration with domestic component suppliers, which, although typically higher priced, offer supply chain resilience and reduced exposure to future trade disputes. This evolving tariff landscape underscores the necessity of agile commercial strategies and localized sourcing initiatives to maintain competitive positioning.

Uncovering Strategic Market Segmentation Insights Across Technology Installation Channels and End User Verticals Driving Targeted Solutions

Market segmentation offers critical insights into how fire safety solutions must be tailored across distinct technological, installation, distribution, and end-user dimensions. From a Technology perspective, stakeholders must navigate the balance between Addressable and Wireless detection networks, as well as between Wired and Wireless systems more broadly. Addressable networks provide granular device-level control and faster fault identification, while wireless systems facilitate rapid deployment, particularly in retrofit scenarios. Regarding Installation, the market diverges between New Installation projects-where architects and specifiers can embed state-of-the-art systems from the outset-and Retrofit initiatives, which demand flexible, non-invasive solutions that integrate seamlessly with existing infrastructure.

Distribution Channels further diversify market dynamics, encompassing Direct Sales engagements that foster deep client relationships, traditional and specialized Distributors and Dealers, OEM partnerships that bundle safety with broader building automation, system Integrators offering end-to-end deployment, and an emergent Online Sales ecosystem that caters to cost-conscious buyers. Finally, End User verticals reveal a layered landscape: Commercial environments such as Hospitality, Office Buildings, and Retail require solutions that blend aesthetic considerations with high-throughput performance; Industrial sectors including Manufacturing, Oil & Gas, and Power Generation prioritize explosion-proof and extreme-environment configurations; Public Sector domains encompassing Education, Government Facilities, and Healthcare call for standardized, mission-critical reliability; and Residential markets increasingly demand user-friendly systems that integrate with smart home platforms. By understanding these segmentation intersections, industry players can craft targeted value propositions and deployment models that resonate with each unique application scenario.

This comprehensive research report categorizes the Fire Safety Systems & Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Installation

- Distribution Channel

- Technology

- Distribution Channel

- End User

Deciphering Regional Divergences in Fire Safety Demand and Innovation Across Americas EMEA and Asia-Pacific Markets

Regional dynamics exert a profound influence on fire safety system development, adoption, and regulation. In the Americas, robust investment in commercial real-estate redevelopment and stringent life-safety mandates have catalyzed the adoption of integrated network solutions, while incentives for sustainable building practices continue to drive demand for energy-efficient and eco-friendly system components. North American markets also exhibit a growing preference for wireless expansion modules, particularly in retrofit applications, where minimizing operational disruption remains paramount.

Europe, Middle East and Africa (EMEA) present a heterogeneous but regulation-intensive panorama. Western European nations are at the forefront of code innovation, incorporating performance-based design criteria and incentivizing cross-industry interoperability. Meanwhile, emerging EMEA markets are prioritizing cost-effective wired systems and investing in local manufacturing to reduce reliance on imports. In parallel, Middle Eastern infrastructure booms-particularly in hospitality and public sector projects-are integrating wireless and addressable technologies to meet both aesthetic and functional demands.

In Asia-Pacific, rapid urbanization and industrialization are creating significant growth corridors. Regulatory frameworks in established markets like Japan and Australia are steadily aligning with international NFPA and ISO standards, fostering demand for advanced detection and suppression solutions. Conversely, emerging economies are balancing affordability with performance, often favoring hybrid wired-wireless architectures that can be deployed incrementally. Across all regions, the interplay between regulatory rigor, economic priorities, and technological readiness shapes a diverse and evolving global fire safety ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Fire Safety Systems & Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Fire Safety Equipment Providers’ Strategic Positioning Innovations Partnerships and Competitive Advantages Shaping the Market

Leading companies are differentiating themselves through a combination of product innovation, strategic partnerships, and integrated service offerings. Global conglomerates such as Honeywell and Siemens have expanded their portfolios to include AI-enabled analytics platforms and modular suppression systems, leveraging their scale to bundle cross-disciplinary solutions. Similarly, Johnson Controls and Tyco continue to invest in wireless detection technologies coupled with cloud-native management software to meet the growing demand for remote monitoring and predictive maintenance.

At the same time, specialized players such as Bosch Security and UTC Fire & Security are forging partnerships with systems integrators and IoT platform providers to accelerate go-to-market timelines and enhance interoperability. These collaborations often result in turnkey solutions that simplify procurement and compliance, particularly for verticals with stringent certification requirements like healthcare and oil & gas. Moreover, several companies have initiated maker lab-style innovation centers to pilot next-generation sensors and conduct real-world validation, underscoring a broader industry trend toward co-creation and customer-centric product development. Collectively, these strategic moves highlight how competitive advantages are increasingly defined by digital expertise, ecosystem partnerships, and the ability to deliver seamless, end-to-end fire protection services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Safety Systems & Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- ADT Inc.

- Carrier Global Corporation

- Eaton Corporation plc

- Gentex Corporation

- Google LLC by Alphabet Inc.

- Halma plc

- Hochiki Corporation

- Honeywell International Inc.

- Hyfire Wireless Fire Solutions Ltd by Orama group

- Johnson Controls International plc

- Legrand SA

- Panasonic Corporation

- Resideo Technologies, Inc.

- Ring LLC by Amazon.com, Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- WALTER KIDDE PORTABLE EQUIPMENT, INC.

- X-Sense Innovations Co., Ltd

Implementing Actionable Strategies for Industry Leaders to Enhance Fire Safety System Performance Compliance and Market Penetration in a Dynamic Environment

Industry leaders must adopt a multifaceted strategy to thrive amid intensifying technological disruption and regulatory complexity. First, organizations should prioritize investment in IoT-enabled solutions and AI-driven analytics to deliver predictive maintenance capabilities and optimize asset uptime. Simultaneously, diversifying the supply chain through dual sourcing strategies and nearshoring initiatives will mitigate the impact of future tariff fluctuations and geopolitical tensions. Furthermore, cultivating partnerships with systems integrators, software vendors, and component specialists can accelerate deployment cycles and enhance solution interoperability.

On the operational front, companies should develop robust end-user training programs to ensure seamless adoption, complemented by digital platforms that facilitate remote diagnostics and real-time performance monitoring. Emphasizing retrofit-focused offerings will enable stakeholders to capitalize on the retrofit segment’s growth, particularly in legacy portfolios requiring minimal downtime. Additionally, a targeted vertical approach-tailoring solutions to the unique requirements of hospitality, manufacturing, healthcare, and residential end users-can unlock higher value propositions and reinforce customer loyalty. Ultimately, embracing these actionable recommendations will position industry leaders to not only respond to immediate market pressures but also to shape the future of fire safety through sustainable, data-driven innovation.

Detailing Rigorous Research Methodology Combining Qualitative Interviews Quantitative Analysis and Primary Secondary Data Validation Techniques

To ensure the highest level of rigor and relevance, our research methodology combined both qualitative and quantitative approaches. The study commenced with in-depth interviews conducted with senior executives from equipment manufacturers, system integrators, and end-user organizations across multiple verticals. These conversations provided firsthand perspectives on emerging pain points, technology adoption barriers, and strategic priorities. Concurrently, structured surveys were distributed to facility managers and risk management professionals to capture quantitative data on deployment preferences, retrofit planning horizons, and digital transformation budgets.

Complementing primary data collection, extensive secondary research was performed, drawing on publicly available financial disclosures, technical white papers, regulatory databases, and industry association reports. This multilayered approach enabled the cross-validation of insights through data triangulation, ensuring accuracy and completeness. Furthermore, an expert advisory panel comprising fire safety engineers, code consultants, and cybersecurity specialists reviewed interim findings to refine assumptions and stress-test emerging hypotheses. By integrating diverse data sources and stakeholder viewpoints, this methodology delivers a holistic and actionable view of the fire safety systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Safety Systems & Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Safety Systems & Equipment Market, by Technology

- Fire Safety Systems & Equipment Market, by Installation

- Fire Safety Systems & Equipment Market, by Distribution Channel

- Fire Safety Systems & Equipment Market, by Technology

- Fire Safety Systems & Equipment Market, by Distribution Channel

- Fire Safety Systems & Equipment Market, by End User

- Fire Safety Systems & Equipment Market, by Region

- Fire Safety Systems & Equipment Market, by Group

- Fire Safety Systems & Equipment Market, by Country

- United States Fire Safety Systems & Equipment Market

- China Fire Safety Systems & Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights to Illustrate the Future Trajectory of Fire Safety Systems Integration Resilience and Regulatory Alignment

This executive summary has illuminated the key forces reshaping the fire safety systems sector, from disruptive IoT and AI advancements to the strategic implications of recent tariff policy shifts. We have examined how nuanced market segmentation demands differentiated offerings across technology types, installation scopes, distribution pathways, and end-user verticals. Regional insights have underscored the heterogeneity of adoption cycles, regulatory frameworks, and commercial drivers stretching from the Americas to EMEA and Asia-Pacific.

Moreover, leading companies are harnessing digital innovation, strategic alliances, and customer-centric development models to establish competitive moats. Industry leaders must now translate these insights into coherent action plans-optimizing supply chains, fostering ecosystem partnerships, and targeting high-value retrofit opportunities-to maintain resilience and seize emerging growth corridors. By synthesizing these critical findings, this summary provides a strategic blueprint for navigating the complex interplay of technological, regulatory, and market dynamics, while positioning stakeholders to capitalize on the transformative potential that lies ahead in fire safety.

Engage with Ketan Rohom to Unlock Comprehensive Fire Safety Market Intelligence and Propel Strategic Decisions with Our In-Depth Research Report

To seize a competitive edge and obtain the granular insights necessary for navigating the complexity of the fire safety systems market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with his expertise will enable your organization to leverage in-depth analysis of emerging technologies, tariff impacts, segmentation nuances, regional dynamics, and company strategies. Connect directly to explore tailored licensing options, enterprise data packages, or customized advisory engagements that align precisely with your strategic objectives. Embark on a partnership designed to translate rigorous research into actionable intelligence, empowering you to optimize investment decisions, refine go-to-market approaches, and stay ahead of evolving regulatory and technological shifts in fire protection.

- How big is the Fire Safety Systems & Equipment Market?

- What is the Fire Safety Systems & Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?