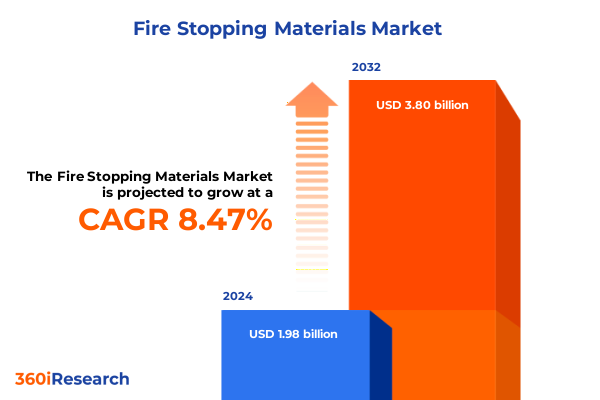

The Fire Stopping Materials Market size was estimated at USD 1.66 billion in 2025 and expected to reach USD 1.78 billion in 2026, at a CAGR of 8.45% to reach USD 2.93 billion by 2032.

Understanding the Critical Role of Fire Stopping Materials in Ensuring Safety, Resilience, and Compliance Across Global Built Environments

Fire stopping materials play a fundamental role in safeguarding structures, occupants, and critical assets from the devastating effects of fire. In today’s construction and maintenance landscape, the selection and application of high-performance materials can mean the difference between containment and catastrophe. As building codes advance and safety standards evolve, stakeholders across design, specification, and procurement functions are placing ever-greater emphasis on proven fire resistance, regulatory compliance, and long-term performance. This growing emphasis is driving a dynamic market where innovation is rewarded and legacy solutions are being re-evaluated.

In parallel, rising demand for sustainable and eco-conscious products has introduced new criteria for material evaluation, prompting manufacturers to explore low-VOC formulations and renewable components. At the same time, increasing digitalization in building design and monitoring is influencing how fire stopping solutions are integrated into complex systems. Consequently, manufacturers, distributors, and end users alike must navigate a rapidly shifting terrain that blends technological breakthroughs with stringent regulatory frameworks. This introduction sets the stage for a comprehensive examination of the transformative shifts, policy impacts, segmentation dynamics, regional drivers, competitive landscape, and strategic recommendations that together define the current and future state of the fire stopping materials market.

Emerging Technologies and Regulatory Developments Shaping the Evolution of Fire Stopping Materials in Modern Construction Environments

The fire stopping materials landscape is undergoing a fundamental transformation driven by breakthroughs in material science, regulatory updates, and evolving construction practices. Innovative formulations such as intumescent sealants with enhanced expansion properties, next-generation silicone compounds designed for extreme temperature resistance, and bio-based mortars are redefining the performance benchmarks for fire containment. Concurrently, additive manufacturing and 3D printing are beginning to influence how complex fire barriers are fabricated and customized, offering unprecedented design flexibility for intricate penetrations and joint conditions.

Regulatory momentum is equally impactful, with authorities in major markets revising fire safety codes to incorporate new testing standards and performance classifications. As a result, supply chain priorities are shifting toward validated suppliers and accredited testing partners, while project managers are integrating fire stopping specifications earlier in the design phase to streamline compliance. Moreover, the growing intersection of smart building technologies and fire safety systems is fostering integrated solutions that combine monitoring sensors with active containment materials. Together, these technological advances and regulatory drivers are ushering in a new era of performance-focused, data-driven, and sustainability-aligned fire stopping solutions.

Assessing the Cumulative Effects of 2025 United States Tariffs on Supply Chains and Cost Structures in the Fire Stopping Materials Market

In 2025, the United States implemented a series of tariff adjustments affecting key inputs used in fire stopping materials, including specialty chemicals and metal substrates. These duties have incrementally increased import costs and compelled manufacturers to reassess global sourcing strategies. As tariffs on acrylic resin imports rose, producers of acrylic sealants encountered pressure on margins, leading some to pass additional costs to distribution channels or absorb them through operational efficiencies. Likewise, tariffs on steel and aluminum components used in board products and certain fire-rated assemblies have prompted a gradual shift toward regional supply partnerships.

The cumulative impact of these measures has manifested in extended lead times, fluctuating raw material inventories, and more pronounced cost volatility. Some manufacturers have responded by intensifying collaboration with domestic chemical producers to diversify feedstock sources, while others have accelerated investments in recycled or alternative raw materials to mitigate exposure. Furthermore, the tariff-driven emphasis on domestic production has catalyzed capacity expansions in strategic geographic hubs, reshaping traditional import-export flows. Collectively, these factors underscore the profound influence of trade policy on both supply chain resilience and competitive dynamics within the fire stopping materials sector.

Deep Exploration of Product Type and Application-Based Segmentation Revealing Key Drivers and Opportunities in Fire Stopping Materials

A nuanced examination of market segmentation reveals distinct performance drivers and opportunity spaces tied to both product categories and end-use pathways. From the standpoint of product type, acrylic sealants are gaining traction due to their rapid curing profiles and ease of application in retrofit settings, while board products are favored in large-scale infrastructure projects for their dimensional stability and standardized testing credentials. Intumescent sealants continue to lead in applications demanding high expansion ratios and penetration sealing, whereas mortars and cements are chosen for bespoke installations requiring heavy-duty fire resistance. Silicone sealants, with their resilience under extreme environmental conditions, are becoming indispensable in civil infrastructure and transportation sectors.

Equally significant is how the market landscape is delineated by application and end use. Ductwork fire stopping solutions have seen accelerated uptake owing to stringent HVAC compartmentalization requirements in commercial high-rises, while fire doors demand specialized gasketing and edge sealants to meet multi-hour rating thresholds. Wall penetrations remain a critical focus area, bridging the intersection of mechanical, electrical, and plumbing systems with passive barrier integrity. In terms of end-use segmentation, new construction projects emphasize integrated fire stopping systems specified during the design phase, whereas retrofit contracts prioritize modular, rapid-install products that minimize operational disruption. This dual-layer segmentation underscores the need for tailored strategies and specialized product development to capture emerging niches.

This comprehensive research report categorizes the Fire Stopping Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Composition

- Penetration Type

- Construction Phase

- Form Factor

- Application Area

- End Use Industry

Comparative Analysis of Regional Dynamics Driving Differentiated Growth Trends across the Americas, EMEA, and Asia-Pacific Fire Stopping Markets

Regional dynamics play a pivotal role in shaping demand patterns, competitive intensity, and regulatory priorities. In the Americas, heightened focus on green building certifications and seismic resilience is elevating demand for fire stopping solutions that align with multi-hazard design philosophies. Meanwhile, infrastructure renewal initiatives and public safety mandates are driving investments in both retrofit and new construction sectors, with manufacturers expanding service footprints to meet regional specification requirements. Transitioning across the Atlantic, Europe, Middle East & Africa are witnessing harmonized fire safety regulations under pan-European directives, while Middle Eastern markets with rapid urbanization are adopting advanced fire containment solutions to support landmark projects. In Africa, capacity building and code enforcement are nascent yet growing drivers of market formalization.

Across Asia-Pacific, the interplay of megacity expansions, industrial modernization, and evolving building codes is fueling sustained demand for fire stopping products. China’s stringent fire safety overhaul in manufacturing zones and India’s infrastructure push are accelerating project pipelines. Simultaneously, Southeast Asian nations are balancing cost-sensitive applications with rising quality expectations, creating fertile ground for versatile sealants and board solutions. These regional trends highlight the necessity for manufacturers to calibrate product portfolios, compliance strategies, and market entry approaches according to localized regulatory frameworks and infrastructure priorities.

This comprehensive research report examines key regions that drive the evolution of the Fire Stopping Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Positioning and Innovation Strategies Employed by Prominent Manufacturers Shaping Fire Stopping Materials Competitiveness

The competitive landscape is characterized by a blend of global corporations and specialized regional players, each leveraging unique strengths to maintain or expand their market foothold. Prominent manufacturers are investing heavily in research and development to introduce next-generation formulations that meet evolving regulatory thresholds and sustainability criteria. Collaborative partnerships between chemical suppliers and application specialists are yielding hybrid products that offer combined benefits, such as rapid cure times paired with environmentally friendly profiles. Additionally, mergers and acquisitions continue to reshape the competitive hierarchy, as enterprises seek to broaden geographical reach and complement product portfolios through strategic consolidation.

Several market leaders have differentiated themselves through vertical integration, aligning raw material procurement with in-house manufacturing to ensure consistent quality and supply stability. Others are focusing on digital tools, offering online specification libraries, installation training modules, and augmented reality support to streamline adoption among architects, engineers, and contractors. At the same time, smaller innovators are capitalizing on niche segments such as marine-grade intumescent coatings or low-temperature mortars, establishing specialized credentials that command premium positioning. Altogether, these varied competitive strategies underscore a market in flux, where agility, technological prowess, and deep industry relationships form the cornerstones of sustained leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Stopping Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ARCAT, Inc.

- Fosroc International Limited

- Hilti AG

- J.M, HUBER CORPORATION

- PPG Industries, Inc

- Promat

- Promat International NV

- ROCKWOOL International A/S

- Sika AG

- Tremco CPG Inc.

- Vijay Systems Engineers Pvt Ltd.

Strategic Recommendations to Enhance Supply Chain Resilience, Foster Innovation, and Strengthen Market Position for Fire Stopping Material Leaders

To thrive in an increasingly complex environment, industry stakeholders must pursue multifaceted strategic initiatives. First, optimizing supply chain resilience through diversified procurement and localized inventory hubs can mitigate the impact of trade policy fluctuations and logistical disruptions. This approach should be complemented by proactive engagement with raw material partners to explore alternative chemistries and recycled feedstocks, aligning cost structures with sustainability goals. Second, prioritizing product differentiation via performance-driven innovation-such as rapid-curing sealants, multi-hazard board assemblies, and eco-friendly mortars-will address the dual demands of regulatory compliance and customer preference.

Furthermore, integrating digital capabilities across specification, training, and quality assurance workflows can elevate value propositions and foster stickiness among key accounts. Manufacturers should harness data analytics to refine product development cycles and anticipate emerging trends, while sharpening their focus on high-growth segments identified through robust segmentation analysis. Lastly, cultivating strategic alliances-whether through joint ventures, co-development agreements, or targeted acquisitions-will enable rapid market entry into underserved regions and bolster competitive moats. Collectively, these actionable recommendations provide a roadmap for leaders aiming to enhance operational agility, strengthen market presence, and drive sustainable growth.

Robust Research Methodology Illustrating Multi-Source Data Collection, Expert Engagement, and Analytical Techniques Underpinning Market Insights

The foundation of this analysis rests on a rigorous, multi-tiered research methodology designed to ensure both depth and reliability of insights. Secondary data sources were exhaustively reviewed, encompassing regulatory publications, industry white papers, technical standards, and peer-reviewed literature. This desktop research established the contextual framework for market dynamics, compliance requirements, and technological developments. Complementing this effort, primary research was conducted through structured interviews with fire safety engineers, specification consultants, procurement managers, and senior executives at leading manufacturing firms.

Quantitative data collection included detailed surveys capturing application-specific usage, procurement cycles, and material performance priorities across diverse geographies. Qualitative validation was achieved through expert panels and focus groups, which provided nuanced perspectives on emerging trends and strategic imperatives. All data points underwent triangulation against multiple sources to mitigate biases and enhance the robustness of conclusions. Finally, the research process adhered to strict quality controls, including data integrity checks, thematic coding protocols for qualitative inputs, and iterative feedback loops with domain specialists to refine findings and ensure accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Stopping Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Stopping Materials Market, by Product Type

- Fire Stopping Materials Market, by Material Composition

- Fire Stopping Materials Market, by Penetration Type

- Fire Stopping Materials Market, by Construction Phase

- Fire Stopping Materials Market, by Form Factor

- Fire Stopping Materials Market, by Application Area

- Fire Stopping Materials Market, by End Use Industry

- Fire Stopping Materials Market, by Region

- Fire Stopping Materials Market, by Group

- Fire Stopping Materials Market, by Country

- United States Fire Stopping Materials Market

- China Fire Stopping Materials Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesis of Key Findings Emphasizing Strategic Imperatives and Future Directions in the Fire Stopping Materials Industry Landscape

Pulling together the strands of regulatory shifts, technological innovation, trade policy impacts, and competitive dynamics reveals an industry at a pivotal juncture. Sustainable material formulations and enhanced performance requirements are collectively raising the bar for product development, while digital integration in building management systems is reshaping how fire stopping solutions are specified and monitored. At the same time, tariff-driven supply chain adaptations and regional infrastructure investment patterns are recalibrating market priorities across major geographies.

Looking ahead, manufacturers and stakeholders will need to balance agility with strategic foresight, embedding resilience in procurement and logistics while pursuing targeted innovation that speaks to green building mandates and multi-hazard design protocols. By aligning segmentation strategies with regional nuances and forging collaborative alliances, industry participants can position themselves to capture emerging opportunities. Ultimately, the confluence of these factors underscores a trajectory of sustained evolution, where informed decision-making and proactive adaptation will determine market leadership in the fire stopping materials sector.

Engage Our Associate Director to Access Comprehensive Market Research and Unlock Exclusive Fire Stopping Materials Intelligence for Strategic Growth

Leverage the opportunity to engage directly with Ketan Rohom, the Associate Director of Sales & Marketing, to tailor the report’s insights to your specific strategic objectives and secure proprietary findings that can inform critical decisions. By connecting with Ketan Rohom, you will gain immediate access to comprehensive market data, exclusive trend analyses, and expert perspectives that are not available through any other channel. This personalized consultation ensures that you receive the precise information most relevant to your business context, whether you are exploring new product innovations, evaluating regional expansion, or seeking to strengthen supply chain resilience. With an emphasis on delivering high-impact, actionable intelligence, this direct engagement provides a seamless path from discovery to implementation. Reach out now to initiate a conversation about acquiring the complete fire stopping materials market research report and unlock the strategic insights you need to drive growth, mitigate risk, and capitalize on emerging opportunities in this dynamic sector.

- How big is the Fire Stopping Materials Market?

- What is the Fire Stopping Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?