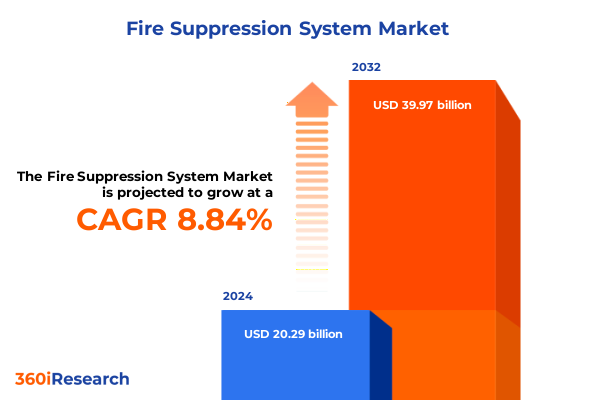

The Fire Suppression System Market size was estimated at USD 21.98 billion in 2025 and expected to reach USD 23.80 billion in 2026, at a CAGR of 8.92% to reach USD 39.97 billion by 2032.

Setting the Stage for the Global Future of Fire Suppression Systems Amid Rising Complexity and Heightened Safety Expectations

The modern fire suppression landscape is at a critical juncture, shaped by evolving safety standards, technological breakthroughs, and shifting risk environments. As urban density increases and industrial operations expand, stakeholders across sectors are demanding more effective, reliable, and environmentally responsible fire protection solutions. Innovations in detection technologies, advanced extinguishing agents, and integrated monitoring platforms are redefining baseline expectations, creating a fertile ground for new entrants and legacy suppliers alike to differentiate through performance and compliance.

Looking ahead, convergence of digital connectivity and regulatory rigor will amplify these market drivers. Increasingly stringent fire codes, coupled with insurers’ emphasis on risk mitigation, are mandating real-time performance validation and predictive maintenance frameworks. At the same time, concerns around environmental impact and resource efficiency are accelerating adoption of clean agents and low-water systems, underscoring the imperative for research, development, and strategic partnerships. In this dynamic setting, organizations that can anticipate regulatory shifts and harness technology to deliver scalable, data-driven solutions will unlock significant competitive advantage.

Navigating Para-Digital Transformation in Fire Suppression Through Advanced Materials Connectivity and Data-Driven Risk Mitigation Frameworks

The fire suppression market is undergoing transformative shifts driven by convergence of digitalization, advanced materials, and real-time analytics. Connected sensors and IoT-enabled platforms now feed continuous performance data into centralized monitoring systems, enabling predictive maintenance and automated emergency response coordination. This shift from reactive to proactive fire risk management is elevating system reliability while reducing false activations and service intervention costs. Regulatory bodies are beginning to codify these digital frameworks, reflecting an industry-wide pivot toward evidence-based safety protocols.

Parallel to digital integration, sustainability considerations are reshaping agent chemistry and system design. Clean agents are displacing traditional halogenated compounds in sensitive environments, while water mist technologies are gaining traction for high-value assets where water damage must be minimized. Material science advances have produced lighter, corrosion-resistant piping and nozzles that extend service life and simplify installation. Together, these developments indicate a market moving toward holistic solutions that balance environmental stewardship with stringent performance requirements.

Assessing the Far-Reaching Effects of United States 2025 Tariff Adjustments on Fire Suppression Supply Chains and Industry Dynamics

In 2025, the United States implemented targeted tariffs on key fire suppression components, including steel piping, control panels, and certain electronic assemblies, in an effort to bolster domestic manufacturing. These measures have disrupted long-standing global supply chains, elevating input costs and prompting system integrators to re-evaluate sourcing strategies. While domestic producers have capitalized on sheltered demand, import-dependent manufacturers have absorbed higher duties or passed incremental costs onto end users, testing budgetary allocations for safety investments.

Despite near-term headwinds, these tariff adjustments have catalyzed strategic realignment. Several stakeholders are establishing joint ventures with regional suppliers to mitigate duty exposure and secure component availability. Others are investing in automation and vertical integration to offset margin pressures through productivity gains. In parallel, government incentives aimed at modernizing critical infrastructure have begun to offset some of the increased procurement costs, fostering an environment in which resiliency and supply chain diversification are becoming integral to long-term competitiveness.

Unlocking Deep Market Intelligence Through System Type End User Component Distribution Channel and Installation Perspectives in Fire Suppression

Deep insight into the market emerges through a multifaceted view of system types, each with specialized subsegments tailored to unique operational needs. Foam-based solutions accommodate both alcohol-resistant formulations and aqueous film forming foams, delivering superior performance in flammable liquid scenarios. Gas-based installations range from clean agents and CO₂ systems to inert gas blends, each optimized for environments where surface damage or electrical hazard must be minimized. Powder-based offerings leverage ABC and BC powders for rapid knockdown in open or confined spaces, while water-based architectures include deluge, pre-action, and sprinkler configurations suited to diverse hazard profiles.

End-user segmentation underscores the heterogeneous demand drivers across commercial, industrial, and residential channels. Office campuses, retail outlets, and hospitality venues prioritize seamless integration with architectural aesthetics and minimal operational disruption. Meanwhile, manufacturing, oil and gas infrastructure, and power generation facilities require heavy-duty systems calibrated for high-risk scenarios and extended operational cycles. Residential applications demand plug-and-play simplicity and occupant-friendly profiles.

Component-level analysis highlights agents, control panels, detectors, nozzles, and piping as the foundational elements that define system performance. Intelligent control units enable nuanced activation logic and networked alerts, while advanced detectors differentiate between false alarms and genuine threats. Meanwhile, nozzles engineered for precise droplet size or spray pattern augment suppression efficacy, and corrosion-resistant piping materials extend asset lifecycles.

Channel dynamics illustrate the strategic roles played by direct sales, OEM and wholesale distributors, and e-commerce platforms. Direct engagements foster bespoke engineering and dedicated after-sales support, whereas distributors leverage deep inventory networks to accelerate delivery timelines. Online channels, split between manufacturer-owned storefronts and third-party marketplaces, are expanding reach to end users seeking rapid procurement of off-the-shelf safety assets. Finally, installation considerations span brownfield retrofits and greenfield new builds, each presenting distinct logistical, regulatory, and engineering challenges.

This comprehensive research report categorizes the Fire Suppression System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Installation

- End User

- Distribution Channel

Elucidating Regional Market Nuances Across the Americas Europe Middle East Africa and Asia-Pacific Fire Suppression Ecosystems

Regional dynamics reveal distinct trajectories across the Americas, where North American demand is buoyed by infrastructure modernization initiatives and robust commercial construction. Latin American markets are gradually embracing enhanced building codes, driving upticks in retrofit projects and heightening focus on compliance.

In Europe, Middle East and Africa, regulatory harmonization under EU directives and GCC civil defense protocols is promoting uptake of advanced clean agents and networked monitoring schemes. European manufacturers are at the forefront of low-global-warming-potential agent development, while Gulf markets represent high-growth zones for large-scale oil and gas applications. Africa’s nascent regulatory frameworks are spurring pilot projects, often supported by international development funds.

Across Asia-Pacific, urbanization and industrial expansion in China, India, and Southeast Asia underpin demand for both greenfield installations and retrofit upgrades. Japan’s mature market drives premium system adoption, including laser-based detection and hybrid suppression technologies, whereas emerging economies are balancing cost-containment with shifting regulatory mandates. Australia and New Zealand emphasize wildfire mitigation and deploy combined water-mist and foam strategies tailored to bushfire-prone zones.

This comprehensive research report examines key regions that drive the evolution of the Fire Suppression System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators Driving Technological Excellence and Strategic Collaborations in the Fire Suppression Equipment Marketplace

Leading system manufacturers are charting differentiated pathways through technology investment and strategic alliances. Multinational conglomerates have broadened their portfolios by integrating building management systems with fire detection and suppression controls, enabling end-to-end risk management platforms. Specialized firms are carving niches in clean agent development, securing intellectual property through patents on new chemistries that meet both performance and sustainability benchmarks.

Collaboration patterns include joint ventures between sensor innovators and established safety equipment suppliers to co-develop next-generation detection modules capable of multi-gas identification and cloud-based analytics. Several companies are forging partnerships with cybersecurity vendors to harden networked fire suppression controls against malicious interference. Additionally, aftermarket service providers are offering predictive maintenance plans that leverage machine learning to forecast component wear, minimizing downtime and ensuring code compliance throughout the system lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fire Suppression System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amerex Corporation

- Carrier Global Corporation

- Fike Corporation

- Firetrace International Limited

- Halma plc

- Hochiki Corporation

- Honeywell International Inc.

- Johnson Controls International plc

- Marioff Corporation Oy

- Minimax Viking Group GmbH

- Robert Bosch GmbH

- Siemens Aktiengesellschaft

Crafting Actionable Roadmaps for Industry Leaders to Enhance Operational Resilience and Capitalize on Emerging Fire Suppression Trends

To navigate emerging market complexities, industry leaders should adopt a dual approach: invest in digital integration while diversifying supply chain footprints. By deploying IoT-enabled devices and cloud-based analytics, organizations can transition from periodic inspections to real-time health monitoring, unlocking predictive maintenance and reducing the likelihood of catastrophic system failures. Concurrently, forging partnerships with regional component manufacturers and qualifying multiple suppliers can mitigate tariff-induced cost pressures and safeguard against geopolitical disruptions.

Furthermore, executives must prioritize research into next-gen suppression agents that align with evolving environmental regulations. Establishing collaborative R&D consortia with academic institutions and regulatory bodies can accelerate development timelines and streamline approval processes. On the commercial front, tailoring offerings to specific end-user segments-ranging from hospitality complexes requiring aesthetic integration to industrial facilities demanding high-capacity delivery-will differentiate value propositions. Lastly, embedding flexible financing and service contracts will foster long-term customer relationships and stabilize revenue streams amidst cyclical capital expenditure patterns.

Articulating Rigorous Mixed Methodology Approaches Integrating Primary Insights Secondary Data and Advanced Analytical Rigor

Our research methodology integrates a robust blend of primary qualitative engagements and secondary data synthesis to ensure comprehensive market coverage. Senior-level interviews with system manufacturers, distributors, and facility managers provided firsthand insights into adoption drivers, regulatory challenges, and technology roadmaps. These discussions were complemented by structured surveys targeting end users across key verticals, capturing nuanced requirements around performance thresholds and total cost of ownership considerations.

Secondary research encompassed rigorous analysis of industry standards publications, technical white papers, patent databases, and corporate filings. We mapped regulatory frameworks across major jurisdictions to assess compliance implications and reviewed trade policies to quantify supply chain vulnerabilities. Advanced analytical techniques, including regression modeling and scenario analysis, were employed to evaluate tariff impacts and to model evolving demand patterns. Data validation protocols, such as cross-referencing multiple sources and vetting outliers through expert panel reviews, reinforced the credibility and actionability of our findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fire Suppression System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fire Suppression System Market, by System Type

- Fire Suppression System Market, by Component

- Fire Suppression System Market, by Installation

- Fire Suppression System Market, by End User

- Fire Suppression System Market, by Distribution Channel

- Fire Suppression System Market, by Region

- Fire Suppression System Market, by Group

- Fire Suppression System Market, by Country

- United States Fire Suppression System Market

- China Fire Suppression System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives on Market Evolution Investment Priorities and Strategic Imperatives for Next-Generation Fire Suppression Systems

The fire suppression market stands at the intersection of technological innovation, regulatory evolution, and shifting risk landscapes. Investment priorities are transitioning toward integrated platforms that marry detection, analytics, and automated response, underpinned by sustainable agent chemistries and modular system designs. Stakeholders who align capital allocation with digital transformation initiatives and environmental imperatives will be best positioned to capture value in the next wave of market expansion.

Strategic imperatives include deepening collaborative networks across the value chain-from material suppliers and component manufacturers to system integrators and end-user organizations. Companies must remain agile, continuously scanning for regulatory changes, tariff fluctuations, and competitive disruptions, and adapt through rapid prototyping and iterative pilot deployments. Ultimately, the confluence of safety demands and performance expectations will drive the industry toward solutions that are smarter, greener, and more resilient.

Empowering Decision Makers to Unlock Comprehensive Fire Suppression Intelligence Through Strategic Engagement with Ketan Rohom

For personalized guidance on unlocking the full potential of this market research, reach out to Associate Director of Sales & Marketing, Ketan Rohom. Engage directly to explore tailored insights, receive a bespoke briefing, or secure your copy of the comprehensive report. Through a brief consultation, you can align the analysis with your specific organizational objectives, clarify any outstanding questions, and obtain exclusive perspectives on emerging opportunities. Act now to position your enterprise at the forefront of fire suppression innovation and to ensure your strategic decisions are grounded in robust, data-driven intelligence.

- How big is the Fire Suppression System Market?

- What is the Fire Suppression System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?