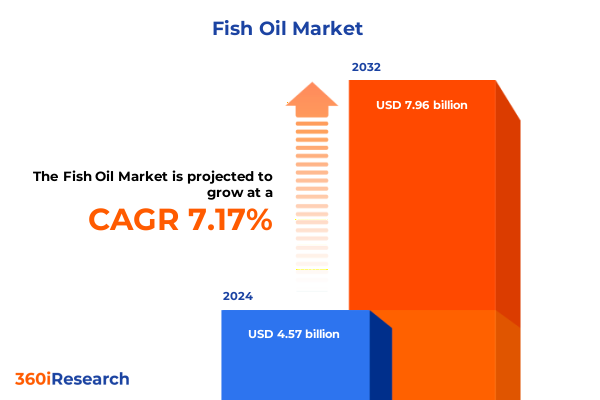

The Fish Oil Market size was estimated at USD 4.88 billion in 2025 and expected to reach USD 5.21 billion in 2026, at a CAGR of 7.24% to reach USD 7.96 billion by 2032.

Exploring the Rising Significance of Fish Oil in Contemporary Health Regimens and Market Dynamics Shaping Industry Trajectory

Fish oil has emerged as a cornerstone of modern nutritional strategies, prized for its rich omega-3 fatty acids that support cardiovascular health, cognitive function, and inflammatory regulation. Over recent years, the confluence of rising chronic disease prevalence and growing consumer emphasis on wellness has propelled fish oil from a niche supplement to a mainstream health essential. As individuals increasingly seek evidence-based interventions for preventive care, fish oil’s clinical validation and versatility across diverse applications have reinforced its status as a go-to ingredient for both health professionals and end-users.

Beyond its direct health benefits, fish oil’s market trajectory has been shaped by evolving supply chain complexities and shifting consumer attitudes. Sustainability concerns and regulatory scrutiny now play pivotal roles in how raw materials are sourced, processed, and distributed. Concurrently, innovations in formulation-from flavored liquids to advanced encapsulation techniques-have broadened appeal and accessibility. With these multidimensional factors in play, stakeholders must grasp the intricate interplay of nutritional science, consumer behavior, and operational logistics that define the current fish oil landscape.

Identifying Pivotal Transformative Shifts in Fish Oil Production Distribution Regulation and Consumer Preferences Redefining the Marketplace

In recent years, the fish oil industry has undergone transformative shifts driven by sustainability imperatives, technological breakthroughs, and heightened consumer expectations. Harvesting practices have moved toward certified responsible wild-capture and aquaculture systems that emphasize traceability and ecosystem stewardship. Simultaneously, extraction methods have evolved from traditional solvent-based processes to supercritical CO₂ and enzymatic techniques, yielding purer concentrates with reduced environmental impact. This pivot toward greener technologies underscores a broader market trend in which ecological accountability has become as critical as product efficacy.

Moreover, regulatory frameworks worldwide have tightened quality and labeling standards, compelling manufacturers to adopt rigorous batch testing and transparent sourcing disclosures. Consumer preferences have also pivoted toward clean-label formulations, driving demand for products free from artificial flavors and additives. Digital channels have further reshaped marketing and distribution, with personalized e-commerce platforms enabling brands to engage directly with health-conscious audiences. Collectively, these transformative shifts are redefining how companies operate and innovate, marking a new era in which agility and sustainability are paramount.

Assessing the Cumulative Impact of Newly Implemented United States Tariffs on Fish Oil Imports Supply Chain Costs and Market Viability in 2025

The introduction of new United States tariffs on imported fish oil in early 2025 has created cascading effects across the entire supply chain. Importers have faced increased landed costs, prompting a reevaluation of supplier networks and contractual terms. For some manufacturers, higher input prices have squeezed margins, leading to selective price adjustments that have, in turn, influenced retail pricing strategies for end-consumers and professional buyers alike.

In response, several industry players have accelerated domestic processing initiatives and invested in North American raw material sources to mitigate tariff exposure. This strategic shift has strengthened regional value chains, fostering closer collaboration between fishery operators and processing facilities. However, the reconfiguration of logistics has introduced new complexities in inventory management and transport scheduling. Companies that proactively diversified their sourcing mix and engaged in hedging agreements have been better positioned to maintain stable supply and navigate short-term cost volatility. As the market continues to adapt, these tariff-induced adjustments underscore the importance of agile procurement strategies and robust risk mitigation frameworks.

Unlocking Key Segmentation Insights Across Application Source Form Formulation Omega-3 Type Distribution Channel and End-User Perspectives

The fish oil market exhibits nuanced differentiation across multiple dimensions that cater to varied industry requirements and consumer segments. Based on application, the industry spans dietary supplements designed for direct consumption by adults, functional foods and beverages that integrate omega-3 enrichment, animal feed formulations that support livestock health, and pharmaceutical preparations that target specific clinical outcomes. When viewed through the lens of source materials, the market differentiates anchovy-derived concentrates prized for sustainability certifications, mackerel and salmon oils valued for their fatty acid profiles, and sardine extracts noted for purity and low environmental footprint.

Formulation formats further diversify the landscape. Liquid presentations, whether flavored to enhance palatability or unflavored for formulation flexibility, address preferences for direct-use supplements, while powdered variants-micronized or non-micronized-enable seamless incorporation into fortified foods and nutraceutical blends. Softgel capsules, available in bovine, marine, or vegetarian gelatin options, offer convenient dosing flexibility, and tablets-coated or uncoated-serve mass-market retail channels with established manufacturing processes. Insights into omega-3 type segmentation reveal a balance between combination products, DHA-focused formulations aimed at cognitive and prenatal support, and EPA-centric offerings designed for cardiovascular benefits. Distribution channels range from rapidly expanding online retail and specialized pharmacy networks to traditional specialty stores, supermarkets, and hypermarkets, each presenting unique consumer touchpoints. End-user demographics encompass adults seeking preventive wellness solutions, elderly populations prioritizing joint and heart health, and infants benefiting from targeted developmental supplementation. Together, these segmentation insights illuminate the multifaceted demand drivers shaping strategy and innovation trajectories.

This comprehensive research report categorizes the Fish Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Omega-3 Type

- Application

- Distribution Channel

- End-User

Diving into Key Regional Insights Highlighting Growth Drivers Challenges and Strategic Opportunities in the Americas EMEA and Asia-Pacific Markets

Regional dynamics in the fish oil market reveal distinct growth catalysts and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, strong consumer awareness of cardiovascular health and well-established retail infrastructure underpin steady demand for high-purity concentrates and value-added formulations. Regulatory clarity and support for domestic processing have bolstered local production initiatives, yet supply chain disruptions and feedstock scarcity remain areas of strategic focus.

Across Europe Middle East & Africa, sustainability credentials drive purchasing decisions, with consumers and institutional buyers favoring certified fish oil sources that align with environmental stewardship frameworks. Evolving regulatory regimes and reimbursement policies for nutraceutical products introduce both opportunities and compliance hurdles for new entrants. Meanwhile, in Asia-Pacific, rapid growth is fueled by expanding middle-class populations, increasing disposable incomes, and rising adoption of preventive health approaches. Local aquaculture capacities and government incentives for nutritional fortification programs further stimulate market expansion, although logistical complexities and varying import regulations present ongoing considerations for global suppliers.

This comprehensive research report examines key regions that drive the evolution of the Fish Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Companies Shaping the Fish Oil Market Through Innovation Sustainability and Strategic Partnerships to Gain Competitive Advantage

The competitive landscape is led by companies that combine large-scale manufacturing capabilities with innovation in sustainability and formulation technologies. Established players leverage integrated supply chains, from fisheries to extraction facilities, to ensure consistent quality and traceability. These organizations invest heavily in research partnerships and pilot programs that explore next-generation encapsulation and targeted delivery mechanisms, setting new performance benchmarks.

Meanwhile, mid-tier and niche firms distinguish themselves through specialized product portfolios that address emerging consumer trends such as plant-based alternatives to marine gelatin, clean-label positioning, and personalized nutrition platforms. Strategic alliances and joint ventures are increasingly common, enabling companies to bridge geographic gaps and share technical expertise. As digital commerce platforms gain prominence, industry leaders are also forging partnerships with e-tailers and health tech providers to leverage data-driven insights and enhance consumer engagement. The cumulative effect of these competitive strategies underscores a market in which agility, sustainability commitments, and continuous innovation define long-term leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fish Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Austevoll Seafood ASA

- Cargill, Incorporated

- Copeinca ASA

- Croda International Plc

- DSM Nutritional Products AG

- EPAX AS

- FF Skagen A/S

- GC Rieber Oils AS

- Golden Omega S.A

- KD Pharma GmbH

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha, Ltd.

- Nippon Suisan Kaisha, Ltd.

- Ocean Nutrition Canada, Inc.

- Omega Protein Corporation

- Pesquera Diamante S.A.

- Peter Pan Seafoods, LLC

- Polaris ASA

- Seven Seas Ltd

- Tecnológica de Alimentos S.A.

- TripleNine Thyborøn A/S

Delivering Actionable Recommendations for Industry Leaders to Navigate Supply Chain Volatility Regulatory Shifts and Evolving Consumer Expectations Effectively

Industry leaders can capitalize on prevailing market dynamics by adopting a multifaceted strategy that emphasizes supply chain resilience, regulatory alignment, and customer-centric innovation. Prioritizing supplier diversification-including both wild-capture and aquaculture sources-can buffer against geopolitical risks and tariff fluctuations. Concurrently, investing in green extraction technologies and obtaining recognized sustainability certifications will reinforce brand credibility and satisfy increasingly discerning end-users.

On the regulatory front, proactive engagement with standards bodies and industry associations can facilitate early awareness of policy changes and create avenues for advocacy. Companies should also leverage advanced analytics to refine product portfolios according to consumer insights, focusing on high-growth segments such as pediatric formulations and specialty delivery systems. Finally, enhancing digital commerce capabilities-from direct-to-consumer platforms to partnerships with telehealth providers-will enable personalized marketing, bolster customer loyalty, and drive incremental revenue streams. Through these targeted actions, industry participants can strengthen market positioning and navigate uncertainty with confidence.

Elucidating the Rigorous Research Methodology Employed in Data Collection Analysis and Validation to Ensure Unparalleled Accuracy and Reliability

This analysis is grounded in a rigorous mixed-methodology approach combining extensive secondary research with targeted primary interviews. Secondary sources included peer-reviewed journals, governmental publications, and industry white papers to establish foundational insights into nutritional science, regulatory frameworks, and extraction technologies. Primary research involved in-depth interviews with a cross-section of stakeholders, including fishery operators, processing facility managers, regulatory experts, and leading nutritionists, to capture on-the-ground perspectives and validate emerging trends.

Data triangulation techniques were applied to reconcile quantitative supply chain metrics with qualitative stakeholder feedback, ensuring robust findings. Segment-level insights were generated using a bottom-up analytical framework, analyzing individual application, source, formulation, omega-3 type, distribution channel, and end-user segments to uncover nuanced demand drivers. Geographic assessments leveraged regional trade data and import-export statistics. Throughout the research process, a dedicated review committee conducted iterative quality checks and scenario analyses, upholding the highest standards of accuracy and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fish Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fish Oil Market, by Source

- Fish Oil Market, by Form

- Fish Oil Market, by Omega-3 Type

- Fish Oil Market, by Application

- Fish Oil Market, by Distribution Channel

- Fish Oil Market, by End-User

- Fish Oil Market, by Region

- Fish Oil Market, by Group

- Fish Oil Market, by Country

- United States Fish Oil Market

- China Fish Oil Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Drawing Comprehensive Conclusions on Fish Oil Market Trajectories Industry Resilience and the Imperative Strategies for Sustained Growth and Value Creation

The fish oil market stands at a pivotal juncture, characterized by evolving consumer expectations, stringent regulatory oversight, and dynamic supply chain realignments. While recent tariff adjustments have introduced near-term cost pressures, they have also spurred strategic realignments toward domestic sourcing and process innovation. Sustainability and green technology adoption remain essential for differentiating offerings and meeting regulatory thresholds, while digital engagement will determine success in direct-to-consumer channels.

Looking ahead, the industry’s resilience will hinge on its ability to blend agility with long-term strategic investments in advanced extraction methods, sustainable certification frameworks, and data-driven product development. Organizations that embrace collaborative partnerships and leverage cross-segment insights will be well-positioned to capture growth across health individuals, animal nutrition, functional foods, and pharmaceutical applications. Ultimately, the convergence of scientific rigor, market responsiveness, and sustainability stewardship will define the next era of value creation in the fish oil sector.

Seize Exclusive Market Intelligence on Fish Oil Dynamics by Engaging with Ketan Rohom to Propel Strategic Decisions and Acquire the Definitive Research Report

To explore the full depth of fish oil market dynamics, secure the definitive research report tailored to your strategic needs. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to obtain exclusive insights that will empower your organization to stay ahead of industry shifts. Engage now to transform your approach, optimize decision-making, and capitalize on emerging opportunities with unparalleled confidence.

- How big is the Fish Oil Market?

- What is the Fish Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?