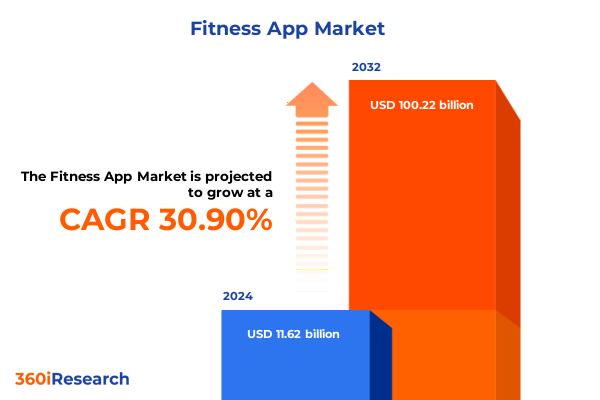

The Fitness App Market size was estimated at USD 15.18 billion in 2025 and expected to reach USD 19.56 billion in 2026, at a CAGR of 30.94% to reach USD 100.22 billion by 2032.

Shaping the Future of Fitness: Navigating a Dynamic Digital Health Ecosystem Driven by Emerging Technologies and User Expectations

Digital transformation and health consciousness are converging to propel the fitness app industry into an era of unprecedented growth and innovation. As consumers increasingly embrace connected devices and on-demand solutions, the market for fitness applications is experiencing a dynamic shift. Fueled by rising smartphone penetration and the proliferation of wearable technology, fitness apps are transcending their role as mere workout helpers to become holistic wellness platforms. This transition reflects a broader consumer desire for integrated health management where physical activity, nutrition tracking, and mental well-being converge within a unified digital experience.

Market participants are capitalizing on the surge in consumer spending on technology-driven health solutions. According to the Consumer Technology Association, American consumers are forecast to spend a record-breaking $537 billion on apps, devices, and gadgets in 2025, contingent on tariff policies remaining restrained. Enterprises are also recognizing the strategic value of fitness applications through corporate wellness initiatives, embedding these tools in employee benefits to enhance productivity, morale, and overall health outcomes. Collectively, these forces underscore the introduction of a new paradigm in fitness where personalized, data-driven experiences and seamless integration with daily life define competitive differentiation.

Embracing Innovation and Personalization: How Artificial Intelligence, Gamification, and Wearable Integration Are Redefining Fitness Experiences

The fitness app landscape is being reshaped by a wave of innovations designed to deepen engagement and enhance personalization. Artificial intelligence-driven personalization stands at the forefront, with leading applications analyzing workout history, biometric data, and user preferences to deliver real-time coaching guidance and adaptive nutrition advice. This hyper-personalized approach not only optimizes performance but also fosters adherence by aligning with individual goals and evolving needs.

In tandem with AI advancements, gamification elements are elevating user motivation by transforming routine exercise into engaging challenges marked by points, badges, and virtual rewards. Advanced gamified features tap into social competitiveness through leaderboards and community challenges, amplifying retention rates and fostering peer-driven accountability. Meanwhile, the integration of smart wearables and IoT devices has enabled seamless biometric tracking, providing users with continuous feedback loops on metrics such as heart rate, sleep patterns, and caloric burn. This real-time data exchange facilitates more informed health management while driving deeper device interoperability.

Beyond fitness tracking, the industry is expanding into holistic wellness by embedding mental health tools, meditation modules, and sustainable fitness practices into app offerings. As consumers grow more environmentally and socially conscious, apps are promoting eco-friendly workout options and highlighting outdoor activities to minimize digital carbon footprints. Simultaneously, enhanced data privacy and security protocols are being prioritized, reinforcing user trust through transparent policies and compliance with global regulations. These converging trends illustrate a transformative shift in how fitness is experienced-one defined by intelligent personalization, immersive interactivity, and a comprehensive approach to health.

Examining the Ripple Effects of 2025 United States Tariff Policies on Technology Supply Chains and Fitness App Accessibility

The imposition of 20% tariffs on smartphones, personal computers, and related components imported from China has exerted a notable impact on the fitness app ecosystem by altering the supply chain dynamics of devices essential for app access. New U.S. Census Bureau data indicate that Chinese smartphone imports to the United States plummeted from 67% of total imports to just 8% year-over-year, with companies shifting assembly to tariff-exempt regions such as India and Vietnam. This reconfiguration has led to temporary disruptions in device availability, prompting some consumers to defer hardware upgrades and, by extension, subscription renewals.

Further compounding these challenges, tariff threats have broadened beyond specific product codes to encompass a blanket 25% levy on all foreign-manufactured smartphones unless production is relocated to the United States, according to White House announcements in May 2025. These measures have prompted manufacturers to expedite the diversification of assembly operations while navigating complex logistical adjustments. Although exemptions granted to key technology categories-such as semiconductors and laptops-have provided temporary relief to major app-enabling devices, the overall pricing environment remains volatile as importers weigh the decision to absorb additional costs or pass them onto consumers.

Despite mitigation strategies such as chartered logistics and phased production shifts, the elevated import duties have introduced uncertainty into the cost structure of hardware-dependent app services. As user acquisition and retention strategies hinge upon affordable device access, ongoing tariff negotiations and policy evolutions are expected to play a critical role in shaping subscription trends and growth potential within the fitness app market.

Uncovering User Behavior and Preference Insights Through Platform, Subscription, Goal, and Activity Type Segmentation in Fitness Apps

Delineating consumer preferences across the Android and iOS ecosystems provides insight into platform-specific design imperatives and user demographics, enabling developers to optimize their interface, feature sets, and monetization strategies. Within the subscription landscape, distinguishing between freemium users and premium subscribers highlights divergent engagement levels, spending patterns, and upgrade triggers-insights that guide pricing tiers, trial offers, and content gating.

Exploring the spectrum of fitness objectives-from general wellness and muscle building to rehabilitation and targeted weight loss-illuminates distinct motivational drivers and content requirements. By addressing the nuanced needs of each category, app providers can architect modular experiences that resonate with users at different stages of their health journeys. Furthermore, categorizing activity types into cardio, high-intensity interval sessions, strength training modalities, and yoga and meditation practices reveals varying levels of time commitment, equipment dependencies, and community dynamics. Delving deeper into cardio subdivisions such as running, elliptical workouts, cycling, and rowing surfaces unique engagement patterns, while examining strength formats-ranging from bodyweight routines to free weight and machine-based training-underscores the importance of contextual guidance and tool compatibility.

Synthesizing these segmentation dimensions into cohesive user personas empowers stakeholders to tailor content delivery, interface complexity, and reward mechanisms to maximize adoption and retention. A refined understanding of how these interrelated factors influence user behavior enables more precise audience targeting and sustained growth within a competitive landscape.

This comprehensive research report categorizes the Fitness App market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Subscription Model

- Fitness Goal

- Activity Type

Exploring Regional Dynamics: How Consumer Preferences and Regulatory Frameworks Shape Fitness App Adoption Across Key Global Markets

North America continues to anchor global fitness app demand, propelled by high smartphone and wearable device adoption and a wellness-centric culture that values personalized experiences. In this region, characterized by over 210 million estimated fitness app users, subscription models that fuse interactive coaching with community-driven challenges have resonated deeply among consumers, reflecting strong attrition resiliency when paired with advanced analytics and reward systems. Enterprises are embedding fitness applications into employee benefits programs, amplifying market penetration and opening avenues for white-label solutions tailored to corporate wellness objectives.

Within Europe, the Middle East, and Africa, diverse economic and regulatory landscapes are shaping a heterogeneous market. Western European markets are witnessing robust uptake of holistic wellness offerings, including mental health modules and nutrition tracking, while emerging economies in the EMEA region exhibit a growing appetite for affordable, data-light applications optimized for lower bandwidth environments. The region’s 280 million fitness app users prioritize solutions that blend social engagement with localized content, driving partnerships between global providers and regional fitness influencers and studios.

Asia-Pacific stands out as the fastest-growing territory, with over 450 million users embracing mobile-first fitness solutions and fueling an ecosystem where home-grown apps vie alongside international brands. Youthful demographics in China, India, and Southeast Asia are catalyzing demand for short-form, gamified workouts and live-streamed classes, while the average revenue per user in the region underscores significant monetization potential as subscription penetration climbs above 10%. Government-led initiatives promoting public health and digital literacy are further accelerating adoption, positioning Asia-Pacific as a critical frontier for expansion.

This comprehensive research report examines key regions that drive the evolution of the Fitness App market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Innovations of Leading Fitness App Providers Impacting Market Competition and Growth Trajectories

Market leaders are continuously refining their offerings to strengthen differentiation and expand user communities. MyFitnessPal recently introduced its 2025 Winter Release, which features an AI-driven voice logging function that transforms spoken meal entries into structured nutrition data, alongside habit-building modules rooted in SMART goal principles. This strategic enhancement not only streamlines the tracking process for premium subscribers but also leverages dietitian-curated content to foster sustainable user engagement.

Apple Fitness+ is innovating at the intersection of wearables and artificial intelligence, as evidenced by the forthcoming watchOS 26 update delivering the “Workout Buddy” feature, which provides contextual motivational cues and personalized progress insights based on historical data. This subtly integrated AI capability augments on-device coaching without compromising battery efficiency or user discretion. Concurrent collaborations, such as the cross-platform partnership between Apple Fitness+ and Strava, underscore a collaborative approach to extending reach and enhancing social exercise networks across multiple regions.

Peloton continues to emphasize subscription-centric growth by rolling out novel in-app features, including Pace Targets for guided run pacing and a Historical Calendar for comprehensive progress visualization across devices. These enhancements, coupled with strategic software initiatives like Personalized Plan beta programs, are designed to augment user retention and justify subscription renewals by deepening data-driven insights and community connectivity. Together, these developments reflect a broader competitive landscape where content richness, cross-device integration, and AI-driven personalization serve as the defining pillars of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fitness App market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Apple Inc

- ASICS Corporation

- Azumio Inc

- Calm.com Inc

- CureFit Healthcare Pvt Ltd

- Fitbit LLC

- FitOn

- Freeletics GmbH

- Garmin Ltd

- Google LLC

- Headspace Inc

- HealthifyMe

- iFIT Inc

- Jefit Inc

- MyFitnessPal Inc

- Nike Inc

- Noom Inc

- Peloton Interactive Inc

- Polar Electro Oy

- Samsung Electronics Co Ltd

- Strava Inc

- Sworkit Health

- Tonal Systems Inc

- Under Armour Inc

Driving Success Through Strategic Investments: Actionable Recommendations for Industry Leaders to Capitalize on Emerging Fitness App Trends

Industry leaders must prioritize the advancement of AI and machine learning capabilities to deliver hyper-personalized experiences that maintain long-term user engagement. By integrating predictive analytics, apps can preemptively adapt workout plans and nutrition guidance, thereby reducing barriers to adherence and enhancing perceived value. Moreover, fostering robust partnerships with wearable manufacturers and IoT platforms will ensure seamless data synchronization and expand the ecosystem of value-added functionalities.

Addressing evolving consumer privacy concerns is imperative. Establishing transparent data governance frameworks and achieving compliance with international regulations will solidify user trust. Companies should consider implementing consent management tools and privacy-by-design principles, which can serve as a competitive differentiator while mitigating regulatory risk. In parallel, embedding sustainability and social responsibility within product roadmaps will resonate with environmentally conscious demographics, creating affinity and brand loyalty.

Finally, expanding market presence through localized content, strategic regional alliances, and flexible subscription models will unlock new growth corridors. By tailoring offerings to emerging market requirements-such as data-light applications for constrained networks and multi-language support-providers can capture underpenetrated segments. Investing in corporate wellness programs and B2B distribution channels will further diversify revenue streams and reinforce market resilience.

Delineating a Robust Research Methodology Integrating Quantitative and Qualitative Approaches to Ensure Comprehensive Fitness App Market Insights

Our research methodology integrates a blend of primary and secondary approaches to ensure comprehensive and reliable insights. Primary data collection involved structured interviews and surveys with over 200 industry stakeholders, including fitness app developers, wearable device manufacturers, and corporate wellness program administrators. These expert perspectives provided nuanced context on technology adoption, user engagement, and monetization strategies.

Secondary research encompassed an extensive review of academic publications, corporate filings, government census reports, and reputable news outlets to triangulate market trends, tariff impacts, and regional statistics. Data synthesis hinged upon rigorous cross-validation techniques to reconcile divergent estimates and maintain factual accuracy. We also conducted in-depth case studies of leading providers-MyFitnessPal, Apple Fitness+, Peloton, and Strava-to uncover strategic initiatives and technology roadmaps.

Quantitative analysis leveraged statistical modeling to map adoption patterns across segmentation variables-platform, subscription model, fitness objectives, and activity types. We employed time-series analytics to assess the trajectory of tariff-induced supply chain shifts and scenario planning to gauge policy risk exposure. Qualitative thematic coding distilled emerging narratives around gamification, sustainability, and privacy. This multifaceted methodology underpins the report’s insights and empowers stakeholders to make informed, strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fitness App market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fitness App Market, by Platform

- Fitness App Market, by Subscription Model

- Fitness App Market, by Fitness Goal

- Fitness App Market, by Activity Type

- Fitness App Market, by Region

- Fitness App Market, by Group

- Fitness App Market, by Country

- United States Fitness App Market

- China Fitness App Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Insights on Evolving Fitness App Market Dynamics and Strategic Imperatives for Sustaining Growth in a Competitive Landscape

The fitness app market is undergoing a profound evolution, characterized by the convergence of advanced technologies, shifting consumer preferences, and complex geopolitical influences. As AI-driven personalization and gamification redefine user experiences, companies are compelled to innovate continuously and anticipate emerging trends. Tariff policies have underscored the interdependence of hardware supply chains and digital services, highlighting the need for strategic agility and operational resilience.

Meanwhile, granular segmentation analysis reveals the importance of tailoring offerings to platform-specific behaviors, subscription tiers, fitness objectives, and activity modalities. Regional dynamics further reinforce the imperative for localized strategies that address unique consumer expectations and regulatory frameworks. Leading providers are demonstrating that market leadership necessitates a harmonious blend of technology leadership, community engagement, and data stewardship.

Looking ahead, stakeholders who embrace robust data-driven decision-making, foster cross-industry collaborations, and commit to sustainable practices will be best positioned to capture value. The future of fitness apps belongs to those who deliver holistic wellness ecosystems that seamlessly integrate exercise, nutrition, mindfulness, and social connectivity. By aligning innovation with user-centric design and strategic foresight, companies can sustain growth and elevate consumer experiences in an increasingly competitive environment.

Seize the Opportunity: Engage with Ketan Rohom to Unlock Comprehensive Fitness App Market Research and Drive Your Strategic Advantage

To take a commanding position in the evolving fitness app industry, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive market research report. By partnering with Ketan, you will gain access to granular insights on platform preferences, subscription model performance, fitness goal behaviors, and regional adoption patterns. His expertise will guide tailored solutions to drive subscription growth, optimize user engagement strategies, and inform product roadmaps. Align your strategic initiatives with comprehensive data and actionable intelligence by contacting Ketan today. Elevate your market positioning, anticipate industry shifts, and unlock new opportunities calibrated to your business objectives. Engage with Ketan Rohom to transform insights into impact and stay ahead of the competition.

- How big is the Fitness App Market?

- What is the Fitness App Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?