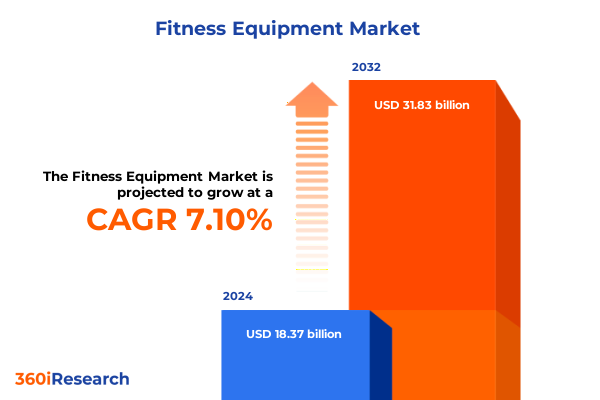

The Fitness Equipment Market size was estimated at USD 17.27 billion in 2025 and expected to reach USD 18.46 billion in 2026, at a CAGR of 6.98% to reach USD 27.70 billion by 2032.

Transformative Dynamics Shaping the Future of Fitness Equipment Market and Strategic Imperatives for Stakeholder Success

Fitness equipment is experiencing a profound evolution driven by changing consumer expectations, technological breakthroughs, and renewed focus on health and wellness across demographic groups. The surge in home-based fitness solutions, combined with the resilience of commercial facilities, has created a dynamic environment that demands strategic agility from manufacturers, distributors, and end users alike. In response, this executive summary synthesizes critical trends shaping the market, offers segmentation insights, assesses the impact of recent trade measures, and presents actionable recommendations to capitalize on future growth avenues.

By examining the interplay between product innovation, technology integration, distribution channels, and end-user preferences, this analysis provides a holistic view of the complex forces at work. From cardiovascular equipment featuring immersive interactive displays to strength training systems enhanced by AI-powered training guidance, the industry is at the crossroads of digital transformation and experiential fitness. Strategic decision makers will find value in understanding how tariff policies have recalibrated supply chains, how regional market dynamics influence adoption rates, and how leading companies are differentiating through partnerships and operational excellence.

The goal of this executive summary is to equip stakeholders with the clarity needed to navigate uncertainty, prioritize investment in high-impact areas, and anticipate shifts in consumer behavior. Through rigorous research methodology and comprehensive qualitative and quantitative insights, this document serves as a roadmap for informed decision making and sustainable value creation in the evolving fitness equipment landscape.

Unprecedented Convergence of Digital Innovation Consumer Behavior and Business Models Redefining the Competitive Landscape of Fitness Equipment Industry

The fitness equipment landscape has undergone transformative shifts that extend well beyond traditional product upgrades. Digital innovation has converged with consumer expectations for on-demand convenience, resulting in hybrid models that seamlessly blend at-home and commercial experiences. Interactive display technologies now offer real-time performance metrics, immersive virtual classes, and gamified challenges, fostering deeper engagement and long-term adherence.

Simultaneously, AI-powered training is redefining personalization, enabling equipment to adjust resistance, pace, and workout intensity based on individual biometric feedback. Wearable compatibility ensures that users can track progress holistically, integrating heart rate, calorie burn, and recovery metrics into a cohesive digital ecosystem. This convergence of hardware and software has elevated fitness equipment into scalable platforms for subscription-based services, content delivery, and community building.

Consumer behavior is also shifting toward holistic wellness, with demand rising for versatile accessories and compact strength training systems that fit apartment living. Commercial operators are responding by upgrading facilities with connected machinery that delivers data-driven insights to corporate wellness programs, health clubs, and medical centers. As a result, manufacturers are investing in modular designs, software updates, and service models that create recurring revenue streams and foster brand loyalty. These transformative shifts chart a course for competitive differentiation and sustainable growth.

Escalating Trade Measures and Their Far Reaching Consequences on Cost Structures Supply Chains and Profitability in the United States Fitness Equipment Sector

Since 2018, the United States has implemented Section 301 tariffs on a broad range of imports from key manufacturing hubs, notably affecting fitness equipment components and finished goods. Over the years, incremental increases and additional duties imposed in 2025 have led to elevated costs for manufacturers reliant on overseas supply chains. This has intensified pressure on profit margins, prompting a strategic reevaluation of sourcing models, pricing strategies, and domestic production incentives.

The cumulative impact of these tariffs has been most pronounced in categories with high material and labor inputs. Steel and aluminum surcharges have driven up the base cost of weight machines, dumbbells, and metal-framed cardio equipment, while rising freight rates have compounded challenges for companies sourcing from Asia-Pacific. As a result, some producers have shifted assembly operations to Mexico and Central America, seeking tariff relief under USMCA provisions and reducing lead times for North American distribution.

In response, major players have negotiated supply contracts that lock in component prices, invested in near-shoring initiatives, and explored alternative materials to mitigate cost inflation. On the demand side, price increases have been partially absorbed by premium segments, where consumers demonstrate greater willingness to pay for advanced features and seamless digital integration. Nonetheless, smaller independent brands and price-sensitive channels continue to face significant headwinds, underscoring the strategic imperative to optimize supply chains and pursue operational efficiencies.

Comprehensive Examination of Product Technology Distribution and End User Segmentation Highlighting Diverse Preferences and Growth Opportunities in the Market

A detailed examination of market segmentation reveals significant variation in growth drivers and consumer priorities across product categories, technology adoption, distribution channels, and end-user groups. Based on product, the market is studied across Accessories, Cardiovascular Training Equipment, and Strength Training Equipment. The Cardiovascular Training Equipment segment is further studied across Elliptical, Rowing Machines, Stationary Cycles, and Treadmills, while Strength Training Equipment is analyzed through Dumbbells, Kettlebells, Resistance Bands, and Weight Machines. Insights indicate that cardiovascular equipment featuring interactive display and app-based connectivity commands premium positioning, whereas compact strength accessories are gaining traction among urban consumers.

Based on technology integration, market is studied across AI-Powered Training, App-Based Connectivity, Interactive Display, and Wearable Compatibility. AI-driven coaching is emerging as a key differentiator, enabling adaptive workouts that respond to user performance. App-based ecosystems further amplify user engagement by offering personalized content, community challenges, and integrated health tracking.

Based on distribution, market is studied across Offline Retail Store and Online Retail Store. E-commerce platforms continue to capture share through flash sales, virtual showrooms, and white-glove delivery services, while brick-and-mortar outlets emphasize experiential demonstrations and in-store financing options to drive upsell opportunities.

Based on end-user, market is studied across Commercial Users and Personal/Home Users. The Commercial Users group is further studied across Fitness Centers & Gyms, Health Clubs, Hospitals & Medical Centers, and Hotels, demonstrating varied equipment preferences and service requirements. Commercial buyers prioritize durability and multiuser software dashboards, whereas personal users increasingly seek space-efficient designs and subscription-based content packages. These segmentation insights illuminate distinct pathways for targeting, product development, and tailored service offerings.

This comprehensive research report categorizes the Fitness Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Tier

- Technology

- Usage Type

- Distribution Channel

Insightful Comparative Analysis of Regional Dynamics Driving Market Trends and Adoption Rates Across Americas Europe Middle East Africa and Asia Pacific

Regional performance in the fitness equipment market is shaped by a confluence of economic, demographic, and regulatory factors that diverge significantly across the globe. In the Americas, robust consumer spending and strong corporate wellness initiatives are driving demand for connected cardio machines and high-end strength systems. The expansion of boutique studios and premium home gyms in the United States underscores a continued appetite for immersive technology and personalized digital experiences.

In Europe, Middle East & Africa, regulatory emphasis on health outcomes and workplace wellness is fueling B2B sales to health clubs, corporate fitness centers, and hospitality venues. European markets demonstrate an accelerated shift toward sustainable materials and energy-efficient designs, supported by government incentives that reward eco-friendly product certifications.

Asia-Pacific has emerged as a high-growth region, propelled by rising disposable income, increasing health awareness, and rapid urbanization. China and India represent the largest single-country markets, where hybrid gym models and online-offline integration are gaining momentum. Local manufacturers in the region are scaling up production capabilities, investing in smart manufacturing, and forging partnerships with global fitness technology providers to meet local consumer expectations.

This comparative analysis of regional dynamics highlights unique market drivers, competitive landscapes, and regulatory frameworks that inform strategic prioritization. By aligning product portfolios, go-to-market strategies, and innovation roadmaps with regional nuances, stakeholders can unlock untapped potential and mitigate localization risks.

This comprehensive research report examines key regions that drive the evolution of the Fitness Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Innovative Strategic Movements Partnerships and Competitive Differentiation Shaping Leading Players Influence and Positioning in Global Fitness Equipment Market

Leading players in the fitness equipment industry are executing differentiated strategies to capture market share and foster sustainable growth. Peloton has continued to expand its content library, integrating AI-enhanced coaching and live interactive classes, while forging partnerships with boutique studios to diversify subscription offerings. Technogym stands out for its sleek industrial design and energy-harvesting solutions that convert workout energy into electricity for facility use.

Life Fitness has deepened its presence in corporate wellness by deploying comprehensive software platforms that aggregate performance data and facilitate remote program management. Johnson Health Tech has pursued M&A opportunities, acquiring regional brands to strengthen its distribution network in Asia-Pacific and Europe. At the same time, emerging startups are innovating around modular home-gym pods, compact multifunctional equipment, and advanced biomechanical sensors that deliver real-time corrective feedback.

Across the competitive landscape, strategic partnerships are playing a pivotal role in capability building and market access. Collaboration between hardware manufacturers and fitness content providers has grown increasingly prevalent, enabling seamless integration of connected platforms. In addition, investments in sustainability initiatives-from recyclable materials to carbon-neutral production facilities-are becoming table stakes, driving brand differentiation and compliance with evolving environmental standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fitness Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Johnson Health Tech Co., Ltd.

- Technogym S.p.A.

- Decathlon S.A.

- Peloton Interactive, Inc.

- Life Fitness, LLC

- iFIT Inc.

- Rogue Fitness, LLC

- Dyaco International Inc.

- Tonal Systems, Inc.

- Keep Inc.

- Core Health & Fitness, LLC

- Hydrow, Inc.

- Body-Solid, Inc.

- HAMMER SPORT AG

- Hoist Fitness Systems, Inc.

- Eleiko Group AB

- gym80 International GmbH

- Exercycle, S.L.

- Ab Hur Oy

- Atlantis Inc.

- Concept2, Inc.

- Echelon Fitness Multimedia, LLC

- Impulse (QingDao) Health Tech Co., Ltd.

- Jerai Fitness Pvt. Ltd.

- Keiser Corporation

- Landice Inc.

- LES MILLS INTERNATIONAL LTD

- Nortus Fitness

- Panatta Srl

- Performance Health Systems LLC

- Rexon Industrial Corp.,Ltd

- Shandong EM Health Industry Group Co., Ltd.

- Shuhua Sports Co., Ltd.

- Sorinex Exercise Equipment Inc.

- Titan Manufacturing and Distributing, Inc.

- Torque Fitness

- True Fitness Technology, Inc.

- Tuff Tread

- WaterRower Inc.

- WOODWAY GmbH

- Yanre Fitness

Practical Strategic Guidance Emphasizing Innovation Collaboration and Operational Excellence to Empower Industry Leaders in Evolving Fitness Equipment Markets

Industry leaders must embrace a multidimensional strategy that balances innovation with operational efficiency to thrive in the evolving fitness equipment market. First, deepening investments in AI-powered training and immersive interactive displays will enable product differentiation and drive subscription-based revenue models. By prioritizing modular designs and software update capabilities, manufacturers can foster long-term customer engagement and recurring service income.

Second, optimizing distribution through an omnichannel approach is essential. Strengthening e-commerce platforms with virtual reality showrooms and digital consultations can broaden market reach, while strategic partnerships with specialty retailers and commercial integrators will enhance physical touchpoints and after-sales support.

Third, near-shoring initiatives and strategic sourcing agreements will help mitigate the impact of tariffs and reduce lead times. Collaborating with logistics partners to establish regional fulfillment centers can further improve supply chain resilience and cost predictability.

Fourth, companies should develop tailored offerings for distinct end-user segments, including premium cardiovascular machines for health clubs, space-efficient strength solutions for home users, and customizable equipment packages for hospitals and hotels. Finally, integrating sustainability across the value chain-from eco-friendly materials to energy-efficient manufacturing processes-will resonate with increasingly conscious consumers and satisfy regulatory requirements.

Robust Multi Layered Analytical Framework Incorporating Qualitative Interviews Quantitative Surveys and Secondary Triangulation to Derive Deep Market Insights

This research relies on a robust, multi-layered analytical framework designed to ensure comprehensiveness and accuracy. The methodology combines qualitative interviews with senior executives at leading manufacturers, distributors, and commercial end users, providing firsthand perspectives on market drivers, challenges, and strategic priorities. Quantitative surveys conducted with a diverse respondent pool spanning personal users and commercial operators validate demand preferences, willingness to pay, and adoption barriers.

Secondary triangulation techniques are employed to corroborate primary findings, drawing on industry white papers, regulatory filings, import-export databases, and financial reports. This cross-verification process enhances confidence in the insights, reducing potential bias and aligning disparate data sources. Product segmentation, technology integration, distribution channels, and end-user segments are defined based on contractual agreements with industry stakeholders, ensuring clarity and consistency.

Regional analyses leverage economic indicators, demographic data, and policy developments to contextualize market performance across the Americas, Europe Middle East & Africa, and Asia-Pacific. Peer review and internal validation exercises further strengthen the robustness of conclusions, enabling strategic decision makers to rely on the findings with high certainty.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fitness Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fitness Equipment Market, by Product Type

- Fitness Equipment Market, by Price Tier

- Fitness Equipment Market, by Technology

- Fitness Equipment Market, by Usage Type

- Fitness Equipment Market, by Distribution Channel

- Fitness Equipment Market, by Region

- Fitness Equipment Market, by Group

- Fitness Equipment Market, by Country

- United States Fitness Equipment Market

- China Fitness Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Holistic Perspective Highlighting Key Insights Strategic Imperatives and Future Directions to Inform Decision Making in the Evolving Fitness Equipment Landscape

The fitness equipment market stands at a pivotal juncture, characterized by rapid digitalization, evolving consumer behaviors, and complex macroeconomic forces. Key insights underscore the rising importance of technology integration-from AI-powered coaching to wearable compatibility-as a driver of differentiation and value creation. Trade measures have reshaped cost structures and supply chain strategies, while segmentation analysis reveals targeted opportunities within cardiovascular, strength training, and accessory categories.

Regionally, growth trajectories diverge based on regulatory landscapes, consumer purchasing power, and infrastructure maturity, necessitating tailored go-to-market strategies. Leading companies distinguish themselves through partnerships, M&A activity, and sustainability commitments that align with emerging regulatory requirements and consumer expectations. Actionable recommendations for industry leaders highlight the need to balance innovation investments with operational resilience, leveraging omnichannel distribution and near-shoring to mitigate external risks.

Looking ahead, market stakeholders must harness the research insights to anticipate future directions, adapt product portfolios, and refine strategic priorities. By embracing digital transformation, optimizing supply chains, and delivering personalized user experiences, companies can secure sustainable growth and reinforce competitive positioning in an increasingly dynamic global landscape.

Engaging Call To Action Encouraging Collaboration With the Associate Director to Secure Comprehensive Fitness Equipment Market Research for Strategic Advantage

If you are ready to harness the strategic insights and in-depth analysis contained within this executive summary and the full market research report, reach out directly to Associate Director, Sales & Marketing Ketan Rohom. He will guide you through the comprehensive scope of the market study, outline the tailored benefits for your organization, and facilitate immediate access to proprietary data and expert forecasts. Engaging with Ketan Rohom ensures you gain a competitive edge, leveraging the findings on product innovation, tariff implications, regional dynamics, and technology integration to inform critical decisions and drive growth. Secure your copy today and position your company to navigate evolving industry landscapes with clarity, confidence, and a forward-looking strategy that capitalizes on emerging opportunities.

- How big is the Fitness Equipment Market?

- What is the Fitness Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?