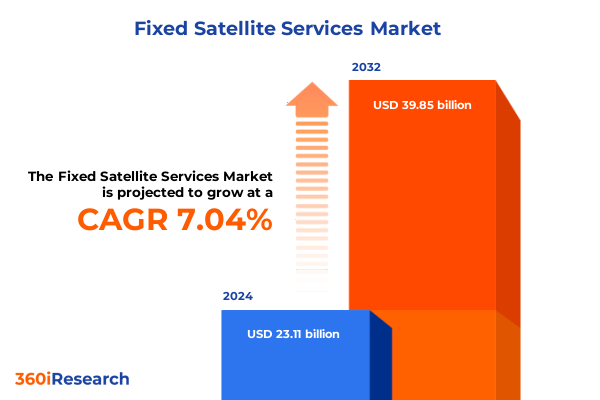

The Fixed Satellite Services Market size was estimated at USD 24.78 billion in 2025 and expected to reach USD 26.36 billion in 2026, at a CAGR of 7.02% to reach USD 39.85 billion by 2032.

Unveiling the Evolving Dynamics of Global Fixed Satellite Connectivity Emphasizing Resilience and Scalability

The global landscape of fixed satellite services is undergoing a profound transformation driven by the insatiable demand for seamless connectivity. Rapid urbanization, the proliferation of high-bandwidth applications, and the urgency to bridge the digital divide have converged to elevate the strategic importance of fixed satellite networks. As organizations and governments seek resilient communication infrastructures, the satellite segment has emerged as a cornerstone for delivering broadband, data, telephony, and video services to the most remote and underserved regions.

Building on decades of technological evolution, the current era is defined by enhanced payload capacities, sophisticated beamforming techniques, and the integration of cloud-centric orchestration platforms. These advancements not only bolster data throughput but also facilitate scalable, on-demand service models that align with the agile requirements of modern enterprises. Moreover, the convergence of terrestrial and non-terrestrial networks is unlocking hybrid architectures that optimize cost, performance, and reliability.

Looking ahead, fixed satellite services are poised to play a pivotal role in supporting emerging use cases such as unmanned aerial systems, Internet of Things (IoT) backhaul, and high-definition content distribution. This report provides an in-depth examination of market catalysts, technological inflections, and regulatory trends shaping the industry’s trajectory, empowering stakeholders to navigate this dynamic environment with clarity and confidence.

Highlighting Technological Breakthroughs and Business Model Innovations Reshaping Satellite Service Delivery

The fixed satellite services domain is witnessing transformative shifts propelled by disruptive innovations and paradigm-altering business models. One of the most significant shifts is the deployment of high-throughput satellites (HTS) that leverage spot-beam technology to achieve gigabit-level capacities. This evolution enhances spectral efficiency and cost per bit, enabling service providers to deliver enterprise-grade connectivity in previously uneconomical markets.

Concurrently, the rise of software-defined satellites is redefining payload flexibility. By decoupling hardware configurations from in-orbit functionality, operators can reassign resources in real time, optimize bandwidth allocation, and adapt coverage footprints to emergent demands. This shift toward on-demand capacity allocation heralds a new era of network elasticity, allowing dynamic scaling in response to traffic patterns, mission-critical events, or disaster recovery scenarios.

Furthermore, the integration of artificial intelligence and machine learning into satellite operations is optimizing spectrum management, predictive maintenance, and link adaptation. These intelligent capabilities reduce operational expenditures, minimize service disruptions, and enhance quality of service. Collectively, these transformative shifts underscore a maturation of fixed satellite services from rigid, long-cycle deployments to agile, software-driven ecosystems that can rapidly respond to evolving market needs.

Examining the Financial Reverberations of Newly Enforced U.S. Tariffs on Satellite Infrastructure Imports

In 2025, the United States implemented revised tariffs on satellite equipment and ground infrastructure components that have reverberated across the fixed satellite services ecosystem. These tariffs, aimed at balancing domestic manufacturing incentives with national security considerations, impose additional duties on imported modules such as high-frequency transponders, parabolic reflectors, and advanced terminal electronics.

The cumulative impact of these levies has manifested in increased capital expenditure requirements for network operators, compelling many to reevaluate supplier portfolios and accelerate localization strategies. Equipment manufacturers have responded by enhancing domestic assembly lines and forging partnerships with U.S.-based foundries, which in turn mitigates tariff exposure but often introduces extended lead times and incremental certification processes.

On the service delivery front, operators have absorbed portions of the cost uptick through revised rate cards, while simultaneously enhancing value propositions by bundling managed network services and proactive maintenance offerings. This dual approach has helped preserve customer loyalty, particularly among enterprise and government clients that prioritize reliability and end-to-end accountability. As the market adapts, the tariff environment underscores the importance of supply chain resilience, diversified procurement, and strategic alliances in maintaining operational continuity and competitive positioning.

Unraveling Multidimensional Segments Defining Service Types Frequency Bands and Applications Across the Spectrum

An intricate tapestry of service types underpins the fixed satellite services market, encompassing broadband, data, telephony, and video. Within the data segment, a further delineation distinguishes between broadband Internet, fixed VSAT, and mobile VSAT, each catering to discrete user requirements ranging from consumer access to mission-critical on-the-move communications. The breadth of service types enables tailored solutions for remote community connectivity, corporate network extensions, offshore platforms, and emergency response scenarios.

Frequency bands serve as another axis of market segmentation, with C Band, Ka Band, Ku Band, and X Band each offering unique propagation characteristics, capacity profiles, and regulatory constraints. C Band remains a stalwart choice for robust broadcast and enterprise connectivity, while Ka Band’s expansive bandwidth facilitates high-throughput backhauling and direct-to-home services. Ku Band continues to strike a balance between capacity and weather resilience, and X Band’s specialized allocations address defense and governmental applications requiring stringent security and reliability.

Application-driven segmentation further illuminates usage dynamics, spanning aviation, broadcast, enterprise, government, maritime, and telecommunication verticals. Aviation leverages VSAT connectivity for in-flight Wi-Fi and operational telemetry, while maritime networks support vessel tracking, crew welfare communications, and cargo data exchange. In broadcasting, satellite distribution undergirds global content delivery, whereas government applications prioritize secure command-and-control links. Together, these segmentation frameworks provide a multifaceted lens for understanding demand profiles, competitive landscapes, and technology adoption patterns.

This comprehensive research report categorizes the Fixed Satellite Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Frequency Band

- Application

Dissecting Regional Growth Drivers and Strategic Partnerships Across Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping fixed satellite services strategies and investment priorities. In the Americas, the proliferation of broadband initiatives across remote regions of North and South America has catalyzed demand for both HTS and traditional FSS architectures. Operators in this region are increasingly partnering with local terrestrial providers to deliver integrated connectivity solutions, fueling growth in rural broadband deployments and enhancing digital inclusivity.

Europe, Middle East & Africa present a heterogeneous landscape characterized by advanced satellite ecosystems in Western Europe, emerging market uptake in Sub-Saharan Africa, and robust government-led programs in the Gulf Cooperation Council states. This region is witnessing significant investments in regulatory harmonization, spectrum licensing reforms, and space-based IoT platforms, which collectively drive competitive differentiation and ecosystem expansion.

Asia-Pacific remains a hotbed of innovation, fueled by large-scale national broadband agendas in countries such as India and China, alongside growing maritime and aviation applications in the region’s vast archipelagos. Satellite operators are forging joint ventures with regional telecom incumbents to co-develop capacity and share infrastructure, while governments are championing public–private partnerships to extend connectivity to underserved islands and rural districts. These regional insights underscore the importance of localized go-to-market approaches and adaptive service portfolios.

This comprehensive research report examines key regions that drive the evolution of the Fixed Satellite Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies of Established Operators and Agile Entrants in the Satellite Connectivity Sector

Leading the fixed satellite services arena, several global players distinguish themselves through strategic fleets, ground infrastructure investments, and service innovation. Viasat has expanded its HTS footprint, focusing on interactive broadband solutions for residential and mobility segments, while Hughes Network Systems continues to dominate enterprise access through a diverse constellation portfolio and cloud-managed gateways.

Intelsat has shifted toward hybrid architectures, integrating terrestrial fiber and edge caching to optimize content delivery networks, whereas SES has doubled down on multi-orbit strategies, incorporating medium Earth orbit (MEO) assets to supplement its geostationary platforms and reduce latency. Telesat is advancing its low Earth orbit (LEO) ambitions with a focus on global enterprise backhaul, and EchoStar explores multi-purpose payloads that blend communications, Earth observation, and data analytics.

Emerging challengers are disrupting incumbent dominance by leveraging nanosatellite clusters and software-defined networks to offer cost-effective, scalable capacity. These agile entrants prioritize modular manufacturing and rapid deployment cycles, compelling traditional operators to accelerate digital transformation initiatives and deepen ecosystem collaborations. Collectively, these company strategies illustrate a competitive landscape marked by both heritage strength and new-age innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fixed Satellite Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- APT Satellite Holdings Limited

- Arabsat

- AT&T Inc.

- BT Group plc

- Embratel

- Eutelsat Communications S.A.

- Hispasat S.A.

- Indosat Ooredoo

- Inmarsat Global Limited

- Intelsat S.A.

- Lumen Technologies

- RSCC

- SES S.A.

- Singtel

- Sky Perfect JSAT Corporation

- Star One

- Telesat Canada

- Thaicom Public Company Limited

- Verizon Communications Inc.

- Viasat, Inc.

Outlining Strategic Imperatives for Enhancing Flexibility Resilience and Collaborative Innovation in SFS

To thrive amid intensifying competition and geopolitical headwinds, industry leaders must adopt a multi-pronged approach. First, prioritizing supply chain diversification by engaging multiple equipment vendors and bolstering domestic production capabilities will mitigate tariff-induced risks and ensure continuity of satellite deployments. Concurrently, operators should invest in software-defined infrastructure that enables dynamic resource allocation and rapid service customization without the need for costly hardware revisions.

Second, forging deep partnerships with cloud service providers and terrestrial network operators will unlock hybrid connectivity models that blend satellite resilience with fiberized performance. These collaborations can yield differentiated managed services, joint marketing programs, and shared innovation roadmaps that accelerate time-to-market and expand addressable opportunities.

Third, stakeholders should embrace advanced analytics and AI-driven network optimization to enhance spectrum utilization, predict maintenance windows, and personalize service-level agreements. This data-centric mindset fosters operational efficiency, reduces downtime, and improves customer satisfaction. Finally, cultivating talent in satellite engineering, regulatory affairs, and cybersecurity will secure the human capital necessary to innovate and navigate complex international frameworks.

Detailing a Comprehensive Hybrid Research Methodology Integrating Primary Interviews Secondary Data and Analytical Triangulation

This analysis draws upon a rigorous methodology that combines primary interviews with senior executives from satellite operators, ground equipment vendors, and end-users across vertical segments. Secondary research encompassed a comprehensive review of industry white papers, regulatory filings, patent databases, and technical journals to map technological trajectories and policy developments.

Quantitative insights were derived from aggregated data on signal throughput, spectrum allocations, and network coverage, enriched by proprietary indices measuring service performance and customer satisfaction. A cross-functional advisory panel validated findings, ensuring that the analytical framework reflects real-world implementation challenges and evolving business models.

Careful triangulation of sources, including financial disclosures, trade event presentations, and technical working group reports, underpinned the report’s accuracy. Continuous stakeholder engagement and iterative review cycles guaranteed that the final analysis aligns with the latest market realities and technological breakthroughs, providing readers with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fixed Satellite Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fixed Satellite Services Market, by Service Type

- Fixed Satellite Services Market, by Frequency Band

- Fixed Satellite Services Market, by Application

- Fixed Satellite Services Market, by Region

- Fixed Satellite Services Market, by Group

- Fixed Satellite Services Market, by Country

- United States Fixed Satellite Services Market

- China Fixed Satellite Services Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesizing Core Insights and Future Directions in Satellite Connectivity to Guide Strategic Market Engagement

In an era where connectivity underpins economic and social advancement, fixed satellite services have emerged as a critical enabler of global digital inclusion and enterprise agility. Technological strides in high-throughput payloads, software-defined networks, and intelligent automation are reshaping the sector, while tariff dynamics and geopolitical considerations underscore the need for resilient supply chains.

Segmentation insights reveal diverse demand drivers across service types, frequency bands, and application verticals, offering a granular view of end-user requirements. Regional analyses emphasize the importance of localized strategies that respond to regulatory frameworks, partnership ecosystems, and infrastructure readiness. Competitive intelligence highlights a balance between legacy operators leveraging scale and agile entrants exploiting nimble architectures.

Moving forward, the convergence of satellite and terrestrial networks, the rise of multi-orbit constellations, and the integration of AI-driven operations will define the next frontier. Stakeholders equipped with this comprehensive understanding can capitalize on emerging growth pockets, safeguard against disruption, and chart a course toward sustainable value creation in the global fixed satellite services landscape.

Initiate a Conversation with Our Associate Director of Sales & Marketing to Unlock Exclusive Fixed Satellite Services Market Intelligence

To secure comprehensive intelligence and gain a competitive edge in the dynamic fixed satellite services arena, connect directly with Associate Director, Sales & Marketing, Ketan Rohom. His expertise and leadership can guide you to the precise insights and customized solutions your organization requires. Engage today with Ketan Rohom to explore tailored report packages, unlock exclusive data sets, and receive a personalized briefing that aligns with your strategic imperatives. The pathway to actionable intelligence and market leadership starts with this direct conversation-reach out to Ketan Rohom now to transform your decision-making processes and maximize your return on insight investments.

- How big is the Fixed Satellite Services Market?

- What is the Fixed Satellite Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?