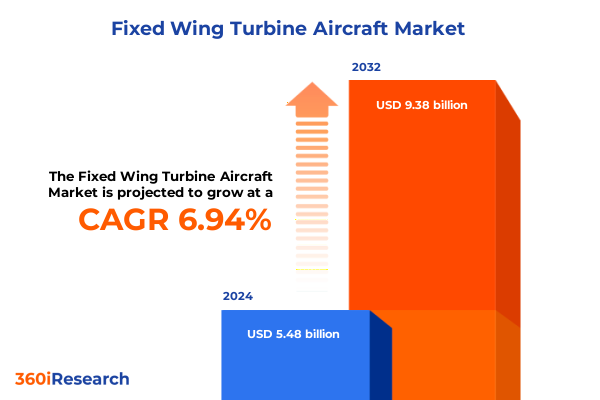

The Fixed Wing Turbine Aircraft Market size was estimated at USD 5.86 billion in 2025 and expected to reach USD 6.22 billion in 2026, at a CAGR of 6.95% to reach USD 9.38 billion by 2032.

Pioneering the Future of Fixed Wing Turbine Aircraft Through Unprecedented Innovation, Efficiency, and Strategic Market Positioning

In a rapidly evolving aviation environment, fixed wing turbine aircraft have become indispensable assets connecting global markets, enabling efficient cargo movement, and empowering high-value corporate travel. Advances in turbine propulsion and aerodynamic design have not only elevated performance metrics but also transformed operational economics. The continuous pursuit of improved fuel efficiency, reduced emissions, and enhanced safety has driven complex supply chain orchestration, forcing industry stakeholders to adapt their sourcing, manufacturing, and maintenance strategies. Consequently, understanding the interplay of technological innovation, regulatory shifts, and shifting end-user preferences is crucial for any organization seeking to thrive in this sector.

Moreover, as airlines and private operators seek to optimize fleet utility and flexibility, the demand for versatile models spanning regional aircraft to ultra-long-range business jets has intensified. Concurrently, geopolitical dynamics and evolving environmental mandates are reshaping investment priorities. In response, manufacturers and service providers are coalescing around digitalization strategies, collaborative partnerships, and next-generation propulsion research. These developments underscore the need for a holistic perspective that integrates market fundamentals with forward-looking scenario planning. With this foundational view, decision-makers can navigate uncertainties, anticipate emerging risks, and capitalize on opportunities driven by technology and policy convergence.

Navigating the Transformative Waves Reshaping the Fixed Wing Turbine Aircraft Sector from Technological Breakthroughs to Evolving Commercial Dynamics

Transformative technology advances are redefining every aspect of fixed wing turbine aviation. Digital twins and predictive maintenance platforms are revolutionizing how operators monitor engine health and optimize maintenance schedules, leading to unprecedented reliability. Simultaneously, lightweight composite materials and additive manufacturing techniques are unlocking new design possibilities that improve fuel economy and reduce life-cycle costs. Beyond hardware, blockchain-enabled supply chains are enhancing traceability of critical components, ensuring higher quality and compliance with stringent safety standards.

In parallel, the quest for sustainability has accelerated investments in alternative fuels and hybrid-electric propulsion concepts. These initiatives are reshaping R&D agendas and prompting strategic alliances between traditional aerospace giants, emerging technology firms, and research institutions. Furthermore, the integration of advanced avionics and connectivity solutions is enhancing mission versatility, from real-time weather updates to next-generation cockpit automation. Regulatory bodies are also stepping in, with new noise and emissions guidelines that demand greater operational efficiency, setting the stage for a competitive landscape where innovation pace and regulatory agility determine market leadership. Against this backdrop, stakeholders must harness digital capabilities, material advancements, and collaborative ecosystems to remain at the forefront of industry transformation.

Unpacking the Layered Consequences of United States Tariff Measures on Fixed Wing Turbine Aircraft Supply Chains and Competitive Equations in 2025

The implementation of United States tariff measures in 2025 has cast a significant shadow over global fixed wing turbine aircraft value chains. While aimed at safeguarding domestic industries, these levies have introduced new cost pressures across the supply spectrum-from raw material sourcing to finished aircraft deliveries. As a result, original equipment manufacturers (OEMs) and maintenance providers face escalating expenses for imported components, compelling them to re-evaluate supplier relationships and manufacturing footprints. In response, some leading engine and airframe builders have accelerated nearshoring initiatives to mitigate tariff impacts and secure tariff-free trade corridors.

Furthermore, the cumulative effect of these duties has rippled through aftermarket service agreements, increasing the total cost of ownership for operators. Lease financing structures are being recalibrated to account for potential customs duties, and procurement strategies now emphasize dual-sourcing to ensure continuity. However, these adjustments carry their own trade-offs, including potential quality variability and longer lead times. Against this backdrop, agility has become a strategic imperative. Companies that proactively engage with policymakers, invest in tariff classification expertise, and pursue localized production stand to cushion the financial impact while maintaining competitive positioning in a market increasingly defined by trade policy volatility.

Illuminating Critical Perspectives on Aircraft Type, Engine Configurations, Application Scope, Operational Range, Seating Capacities, and End User Dynamics

Critical segmentation insights reveal how diverse aircraft types capture distinct value pools. High-end business jets, from heavy to ultra-long-range categories, cater to the most demanding corporate and VIP travel needs, while light and midsize jets excel in regional connectivity and cost-efficient operations. Converted freighters and purpose-built cargo platforms speak to the logistics sector’s appetite for rapid goods movement, whereas narrow body variants, whether as passenger carriers or dedicated freighters, form the backbone of short-haul air travel. Regional jets with up to seventy seats or up to a hundred seats address niche point-to-point routes, and wide body models configured for either freighter or passenger use enable intercontinental journeys and large-scale cargo transport.

Engine type segmentation further clarifies market dynamics. High bypass ratio turbofan engines, prized for superior fuel burn and lower noise, dominate commercial fleets, while low bypass configurations maintain relevance in performance-critical missions. Turbojets serve legacy platforms, and turboprops, categorized by shaft horsepower thresholds, excel on shorter routes and austere airfields. In application terms, the business segment spans corporate charters to fractional ownership arrangements, the commercial sphere encompasses low cost, major carrier, and regional airline operations, and the military domain includes fighter, surveillance, tanker, trainer, and transport roles. Moreover, range classifications from short to ultra-long-range inform mission planning and fleet deployment, just as seating capacity tiers-from up to nineteen seats to above two hundred-shape cabin design and customer experience.

End user differentiation underscores how airlines, civil and defense government customers, and private operators navigate operational trade-offs. Airlines remain volume-driven operators with standardized fleets, governments balance infrastructure imperatives with national security, and private operators leverage charter and corporate ownership models for flexibility. By synthesizing these dimensions, market strategists can pinpoint segments with the highest potential return on investment and tailor offerings that align precisely with evolving customer demands.

This comprehensive research report categorizes the Fixed Wing Turbine Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Range

- Operation Type

- Application

- End User

Deciphering Regional Market Nuances across the Americas, Europe Middle East and Africa, and Asia Pacific to Uncover Strategic Growth Histories

Regional market nuances shape the trajectory of fixed wing turbine aircraft adoption and highlight where tailored strategies are most vital. In the Americas, robust corporate travel and an established MRO infrastructure underscore high demand for business jets and narrow body fleets, while North American freight operators leverage converted freighters to support e-commerce growth. Latin American carriers, by contrast, focus on regional connectivity through turboprop and small regional jet investments, bolstered by government initiatives to expand domestic routes.

Europe, the Middle East, and Africa present a mosaic of opportunities. European operators emphasize sustainability upgrades for aging regional and narrow body platforms, and leading aerospace suppliers maintain R&D hubs across the region. Middle Eastern carriers continue to invest in long-range wide body aircraft to connect emerging markets, supported by state-backed purchase agreements. In Africa, air travel growth remains uneven, yet significant infrastructure projects are laying the groundwork for increased turboprop and regional jet deployment.

Asia Pacific stands out for its rapid expansion in both business and commercial segments. Demand for light and midsize business jets is soaring among high-net-worth individuals, while domestic carriers in China and India are scaling narrow body and regional jet fleets to serve underserved secondary cities. Government modernization programs further stimulate orders for military transports and trainer aircraft. Across all regions, local regulatory requirements and fuel pricing dynamics influence fleet composition and aftermarket service strategies, emphasizing the need for nuanced, region-specific planning.

This comprehensive research report examines key regions that drive the evolution of the Fixed Wing Turbine Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Elevating the Competitive Landscape through a Close Examination of Leading Fixed Wing Turbine Aircraft Manufacturers and Their Strategic Footprints

Leading industry participants demonstrate how technological leadership, strategic partnerships, and service excellence coalesce to drive competitive advantage. Engine specialists such as GE Aviation define benchmarks in high bypass turbofan performance, while Pratt & Whitney’s geared turbine designs continue to set new standards for fuel burn efficiency. Rolls-Royce and Safran intensify collaboration on ultra-efficient propulsion systems, jointly exploring next-generation architectures that align with stricter emissions mandates.

On the airframe side, legacy OEMs and emergent players alike are forging alliances to accelerate time to market. Boeing and Airbus maintain their duopoly through integrated MRO networks and customer financing schemes, whereas Bombardier’s repositioning around its Global series and Embraer’s expansion into hybrid-electric regional platforms illustrate the power of strategic refocusing. Similarly, Honeywell and Collins Aerospace reinforce the avionics and systems integration landscape with comprehensive flight deck and connectivity solutions.

Maintenance and aftermarket specialists like Lufthansa Technik and FL Technics deepen their digital service portfolios to support predictive analytics and remote diagnostics. Cross-sector collaborations between aerospace giants and technology startups generate co-innovation hubs, underscoring a transition toward open, platform-based ecosystems. As competitive dynamics intensify, the ability to orchestrate end-to-end value chains, from R&D investment to post-delivery support, will determine which companies retain market leadership in fixed wing turbine aviation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fixed Wing Turbine Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SAS

- Avions de Transport Régional GIE

- Bombarider Inc.

- Cirrus Aircraft

- Dassault Aviation SA

- Delta Air Lines, Inc.

- Diamond Aircraft Industries

- Embraer S.A.

- Flight Design general aviation GmbH

- Grob Aircraft SE

- Gulfstream Aerospace Corporation

- Honda Aircraft Company, LLC

- Lockheed Martin Corporation

- Northrop Grumman

- Pilatus Aircraft Ltd

- Piper Aircraft, Inc.

- Textron Aviation Inc.

- The Boeing Company

- Zenith Aviation Limited

Driving Executive Action through Focused Recommendations for Navigating Market Complexities and Capturing Value in Fixed Wing Turbine Aviation

Industry leaders must take decisive steps to remain resilient amid shifting trade policies, evolving customer demands, and accelerating technological disruption. Companies should begin by broadening their supplier networks to include low-risk geographies and local content sources, thereby reducing exposure to sudden tariff escalations. In addition, piloting digital twin initiatives and scalable analytics platforms can unlock new predictive maintenance capabilities, helping to drive down unscheduled downtime and spare parts inventories.

Furthermore, collaborating with academic institutions and industry consortia on sustainable aviation fuel trials and hybrid propulsion experiments will yield both operational insights and brand differentiation. Engaging proactively with regulators to shape fair tariff classifications and streamline certification processes forms another critical pillar of strategic risk management. Partnerships focusing on aftermarket services should prioritize blockchain-enabled traceability, so operators gain full lifecycle visibility and traceable provenance for high-value components.

Finally, aligning product roadmaps with emerging customer segments-such as aircraft for niche medical evacuation missions or urban air mobility feeder services-will unlock incremental revenue streams. Investing in workforce upskilling and cross-functional training ensures that organizations possess the adaptive talent needed to integrate new technologies and navigate complex global regulations. By executing these recommendations in an integrated manner, decision-makers can transform external challenges into avenues for sustainable competitive growth.

Methodical Approaches to Data Collection, Analysis Frameworks, and Quality Assurance Protocols Underpinning Fixed Wing Turbine Aircraft Research

This study employed a rigorous, multi-tiered methodology to ensure the highest standards of data integrity and analytical rigor. Primary research formed the foundation, incorporating in-depth interviews with executives at leading OEMs, engine manufacturers, airlines, maintenance providers, private operators, and regulatory officials. These conversations were complemented by structured surveys of fleet managers and C-suite decision-makers to capture emerging trends, technology adoption rates, and purchase intent frameworks.

Secondary research involved the systematic review of publicly available regulatory filings, patent databases, technical journals, trade association publications, and financial statements to contextualize market movements and innovation pathways. A proprietary data-triangulation approach then cross-validated these findings, merging qualitative insights with quantitative metrics. Segmentation frameworks were carefully developed to reflect real-world categorizations by aircraft type, engine configuration, application, range, seating capacity, and end-user group.

Rigorous quality assurance protocols were applied throughout, including peer reviews by aviation specialists and statistical validation checks. A dedicated advisory panel of industry veterans provided ongoing feedback to refine assumptions and challenge prevailing hypotheses. Confidentiality agreements secured the participation of sensitive stakeholders, while adherence to ethical research standards maintained data transparency and reliability. This robust methodology ensures that the insights presented are both comprehensive and actionable for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fixed Wing Turbine Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fixed Wing Turbine Aircraft Market, by Engine Type

- Fixed Wing Turbine Aircraft Market, by Range

- Fixed Wing Turbine Aircraft Market, by Operation Type

- Fixed Wing Turbine Aircraft Market, by Application

- Fixed Wing Turbine Aircraft Market, by End User

- Fixed Wing Turbine Aircraft Market, by Region

- Fixed Wing Turbine Aircraft Market, by Group

- Fixed Wing Turbine Aircraft Market, by Country

- United States Fixed Wing Turbine Aircraft Market

- China Fixed Wing Turbine Aircraft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Crafting a Strategic Synthesis That Emphasizes Key Takeaways and Forward Looking Perspectives on Fixed Wing Turbine Aviation Driving Sustained Advancement

The strategic synthesis underscores that the fixed wing turbine aircraft market is defined by converging forces: technological innovation, policy-driven trade dynamics, and nuanced market segmentation. Key takeaways reveal that engine efficiency gains and digital maintenance platforms are no longer optional but vital for sustaining operational performance. Tariff impositions have heightened the imperative for agile supply chain strategies and nearshoring investments, even as end-users demand greater flexibility across business, commercial, and military applications.

Moreover, segmentation analysis highlights the importance of aligning product development with distinct customer requirements-from the ultra-long-range business jet traveler to regional turboprop commuter services. Regional insights emphasize that local regulatory frameworks, infrastructure maturity, and economic growth trajectories will continue to drive fleet decisions across the Americas, EMEA, and Asia Pacific. Competitive intelligence reveals that market leaders are leveraging collaborative R&D, digital ecosystems, and aftermarket service innovations to defend and expand their market positions.

Looking ahead, organizations that integrate these multidimensional insights into coherent strategic roadmaps will be best positioned to lead. Adaptability to evolving regulations, investment in sustainable technologies, and targeted customer engagement emerge as the cornerstones of future success. This synthesis provides a clear vantage point from which stakeholders can navigate uncertainties and chart a path to enduring industry leadership.

Seize Opportunities Today by Engaging with Our Expert Analyst to Secure Comprehensive Fixed Wing Turbine Aircraft Market Intelligence and Strategic Guidance

To explore the full depth of fixed wing turbine aircraft insights and secure a competitive edge, reach out to Ketan Rohom, the Associate Director for Sales & Marketing. His expertise in aviation research will guide you to the right package tailored to your strategic needs and growth objectives. By engaging directly with Ketan, you can gain customized data, bespoke market analyses, and priority access to upcoming industry briefings. Contacting him ensures that your organization receives actionable intelligence promptly and benefits from dedicated support throughout the purchasing process. Take the first step toward informed decision-making by connecting with Ketan today to acquire the comprehensive market research report and elevate your strategic planning in the dynamic world of fixed wing turbine aviation

- How big is the Fixed Wing Turbine Aircraft Market?

- What is the Fixed Wing Turbine Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?