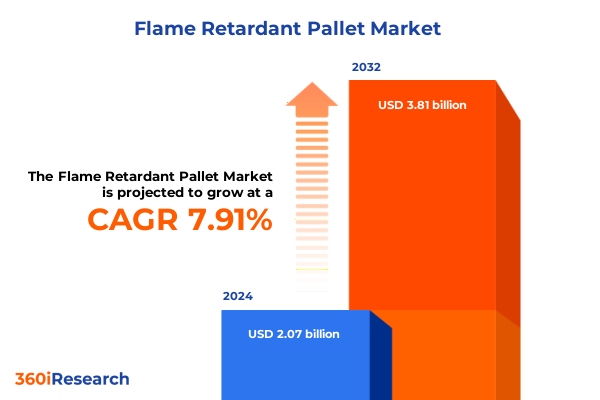

The Flame Retardant Pallet Market size was estimated at USD 2.23 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 7.96% to reach USD 3.81 billion by 2032.

Recognizing the Critical Role of Flame Retardant Pallets in Enhancing Safety Protocols, Regulatory Compliance, and Operational Efficiency in Supply Chains

Flame retardant pallets have emerged as essential components within modern logistics and material handling environments, where safety, regulatory adherence, and operational efficiency converge. The introduction of specialized flame retardant materials addresses critical fire prevention requirements, reducing the risk of cargo-initiated ignition events that can lead to extensive property and product damage. This emphasis on fire safety extends beyond traditional warehousing to encompass manufacturing floors, distribution centers, and transportation corridors, underscoring both the functional and protective roles that flame retardant pallets perform.

Regulatory frameworks continue to evolve, mandating stringent fire performance criteria for palletized loads. Standards outlined by entities such as the National Fire Protection Association (NFPA) in the United States and corresponding international bodies demand that pallet materials comply with specified ignition resistance and flame propagation limits. Compliance with these regulations not only safeguards workers and assets but also mitigates liability exposure for organizations handling high-risk or combustible goods.

As supply chain complexities deepen and sustainability considerations gain prominence, manufacturers and end users are reevaluating their approach to pallet selection. Fire-resistant solutions must now align with broader corporate responsibility objectives, encompassing material recyclability, low-emission additive technologies, and lifecycle management. This comprehensive executive summary navigates the current landscape of flame retardant pallets, spotlighting pivotal trends, regulatory impacts, segmentation nuances, and regional dynamics that shape strategic decision-making.

Uncovering the Transformative Shifts Fueling Innovation, Sustainability, and Regulatory Dynamics in the Evolving Flame Retardant Pallet Landscape

The flame retardant pallet market is undergoing transformative shifts fueled by innovation imperatives and evolving sustainability benchmarks. Recent material science breakthroughs have enabled the integration of advanced polymer composites with inherent flame resistance, reducing dependence on traditional halogenated additives. These novel compounds not only achieve superior fire performance but also meet corporate sustainability targets by lowering toxic emissions and facilitating end-of-life recycling processes.

In parallel, digital technologies are redefining how pallet performance and compliance are monitored. The adoption of embedded sensors and Internet of Things connectivity allows real-time tracking of temperature, humidity, and stress loads, ensuring that fire safety parameters remain within prescribed limits throughout transportation and warehousing. Such digital oversight enhances risk management, providing stakeholders with actionable data to preempt potential incidents.

Regulatory attention has also intensified, with jurisdictions refining classification criteria and flammability test methods. The European Union’s updated fire retardancy directives and similar measures from Asia-Pacific regulatory agencies necessitate continuous adaptation from manufacturers. Consequently, companies are investing in research partnerships and pilot programs to validate new formulations against stringent test protocols, signaling a decisive move toward product robustness and compliance assurance.

Evaluating the Cumulative Effects of Recent United States Tariff Adjustments on Flame Retardant Pallet Import Flows and Cost Structures

In early 2025, the United States Trade Representative announced cumulative tariff adjustments targeting imported flame retardant pallet assemblies originating from key manufacturing hubs. These revised duties, applied across designated Harmonized Tariff Schedule codes, have elevated landed costs for international suppliers, compelling end users to reevaluate sourcing strategies. The aggregated tariff burden, which incorporates base duties alongside antidumping and countervailing measures, has significantly altered the cost calculus for organizations reliant on offshore production.

Consequently, supply chain operators are pursuing nearshoring initiatives and bolstering domestic manufacturing capacities to mitigate the financial impact of heightened import barriers. This shift entails strategic investments in local extrusion and molding facilities, as well as partnerships with regional resin producers. By internalizing production, companies can achieve greater supply chain visibility, reduce lead times, and enhance responsiveness to regulatory changes, thereby preserving competitive margins in a tariff-constrained environment.

Moreover, the tariff-driven landscape has prompted warehousing and distribution networks to optimize inventory deployment. Firms are leveraging decentralized storage and cross-docking strategies to minimize duty exposure while sustaining service levels. This recalibration underscores the importance of agility and cost discipline in maintaining operational continuity amidst fluctuating trade policies.

Revealing Critical Insights from Material Composition, Design Variations, Application Domains, and End Use Industries Driving Market Demand

Material composition remains a defining factor in the flame retardant pallet sector, where distinctions between metal and plastic substrates inform fire performance and operational suitability. Metal pallets, often fabricated from steel or aluminum alloys, deliver inherent non-combustibility but may pose challenges in weight-sensitive applications. In contrast, plastic pallets-specifically those produced from polyethylene and polypropylene-combine lightweight maneuverability with tailored flame retardant additive packages, achieving a balance between ease of handling and compliance with flammability standards.

Pallet design further diversifies market offerings, as nestable, rackable, and stackable configurations cater to specific logistical requirements. Nestable designs optimize storage density for empty pallet returns, whereas rackable variants provide reinforced load-bearing capacity within racking systems, ensuring consistent fire performance under static and dynamic loads. Stackable pallets afford straightforward vertical storage, delivering cost-effective utility in environments where cross-tier fire safety measures are in place.

Applications for flame retardant pallets span the breadth of supply chain functions, encompassing logistics, storage, and transportation phases. During inbound and outbound logistics, pallets must resist ignition sources such as forklift sparks or pallet wrap friction. In long-term storage, fire-retardant properties protect inventory within facilities subject to spontaneous combustion risks, particularly in high-temperature zones. Meanwhile, transportation applications demand resistance to heat generation from engine compartments and high-speed airflow across palletized cargo.

End use industries further shape the demand profile, with automotive manufacturers prioritizing pallets that withstand welding slag and heat exposure on assembly lines, and chemical producers requiring resistance to flammable vapors in storage yards. Electronics firms focus on low-smoke, low-toxicity formulations to safeguard sensitive components during transit. Food & beverage operations emphasize compliance with sanitary and fire codes, while pharmaceutical enterprises demand traceable, fire-resistant solutions that align with stringent safety and validation protocols.

This comprehensive research report categorizes the Flame Retardant Pallet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Composition

- Pallet Design

- Application

- End Use Industry

Analyzing Regional Dynamics and Strategic Growth Opportunities Across the Americas, Europe Middle East & Africa, and Asia Pacific Territories

The Americas region exhibits robust adoption of flame retardant pallets, driven by comprehensive fire safety regulations and a concentrated manufacturing base. In the United States and Canada, stringent NFPA codes and OSHA standards mandate the use of fire-resistant handling equipment within warehouses and cold storage facilities. Meanwhile, Mexico is emerging as a nearshoring destination, with expanding polymer fabrication capacity that caters to North American supply chains seeking tariff mitigation and reduced lead times.

Europe, the Middle East, and Africa present a diverse regulatory tapestry where European Union fire retardancy directives set high compliance bars, influencing markets across the region. Germany and France lead in integrating eco-friendly flame retardant technologies, with manufacturers investing in halogen-free additive systems. The Middle East is witnessing infrastructure growth in logistics hubs, prioritizing fire-safe materials under international building codes. In Africa, nascent adoption trends are emerging as multinationals establish distribution centers that comply with global fire safety norms.

Asia-Pacific markets remain central to the global supply of flame retardant pallets, with China sustaining large-scale production of polymer and metal variants. Japan’s focus on industrial automation drives demand for pallets with integrated sensor networks that monitor fire safety metrics. India, bolstered by government initiatives to expand logistics corridors, is advancing its thermal processing capabilities for polymer pallets, emphasizing flame retardancy in warehousing and transport.

Cross-regional trade agreements and strategic partnerships are redefining the distribution of flame retardant pallets. Free trade zones and customs unions facilitate the movement of compliant units, while collaborative R&D initiatives bridge regulatory and technological gaps between continents. These dynamics underscore the necessity for supply chain planners to maintain a global perspective when selecting flame retardant pallet solutions.

This comprehensive research report examines key regions that drive the evolution of the Flame Retardant Pallet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants and Their Strategic Initiatives Advancing Innovation, Capacity Expansion, and Partnership Networks

Leading industry participants have prioritized product innovation and strategic expansion to capitalize on the growing demand for flame retardant pallets. Established manufacturers are channeling R&D budgets into developing non-halogenated additive systems that deliver high-performance flame resistance while addressing environmental concerns. Concurrently, global pallet pooling providers are upgrading rental fleets with fire-retardant polymer models, reinforcing service commitments to multinational clients.

Capacity expansion projects are underway across several key facilities, enabling producers to increase output of both metal and plastic flame retardant pallets. Strategic partnerships with specialty chemical suppliers are enhancing material performance, as additive developers collaborate to refine formulations that pass rigorous ignition and smoke density tests. These alliances not only accelerate time to market but also spread development risks through co-investment.

Furthermore, manufacturers are forging joint ventures and logistics partnerships to streamline distribution and aftermarket services. By integrating digital traceability systems with inventory management platforms, companies ensure that each pallet’s fire certification and maintenance history are accessible to end users. This convergence of manufacturing excellence and supply chain visibility is reinforcing market leadership and enabling differentiated value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flame Retardant Pallet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.G. Founders & Engineers

- Albemarle Corporation

- Arkema S.A.

- BASF SE

- Brambles Limited

- Cabot Corporation

- CHEP International Ltd.

- Clariant International Ltd.

- DENHAM Plastics LLC

- Kaihua

- Millwood Inc.

- OCS Products

- One Way Solutions

- ORBIS Corporation

- Polymer Solutions International, Inc.

- Premier Handling Solutions

- Qingdao Huading Industry. Co.,Ltd.

- Qingdao Sanhedacheng International Trade Co., Ltd.

- Rehrig Pacific Company

- Ricron Panels Pvt. Ltd.

- RoboK

- ShoreFit

- Snyder Industries, Inc.

- The Nelson Company

Delivering Actionable Strategic Recommendations to Strengthen Competitive Positioning and Drive Sustainable Growth in the Flame Retardant Pallet Market

Industry leaders should prioritize investment in next-generation flame retardant materials that deliver enhanced fire performance with reduced environmental footprint. By collaborating with specialty additive suppliers and university research centers, companies can develop proprietary formulations that achieve low-smoke, low-toxicity characteristics while maintaining cost competitiveness. This focus will position organizations at the forefront of both regulatory compliance and sustainability goals.

In response to evolving trade policies, it is advisable to diversify manufacturing footprints by establishing regional extrusion and molding capabilities. Nearshoring production close to key markets will mitigate tariff exposure, shorten lead times, and bolster resilience against international supply disruptions. Engaging local contract manufacturers with expertise in polymer processing can accelerate capacity deployment while controlling capital expenditures.

Digital transformation remains a critical pathway to strengthen competitive positioning. Implementing RFID tags and blockchain-enabled ledgers will enhance traceability of fire certification data, enabling real-time verification for auditors and regulators. This level of transparency fosters trust among end users and supports premium pricing strategies for certified flame retardant pallets.

Finally, developing circular economy initiatives-such as take-back and recycling programs-will address end-of-life management and align with corporate environmental commitments. By creating closed-loop streams for both polymer and metal pallets, companies can reduce raw material costs, lower carbon footprints, and provide clients with demonstrable sustainability metrics.

Outlining a Comprehensive Research Methodology Incorporating Primary Interviews, Secondary Data Validation, and Rigorous Qualitative and Quantitative Analyses

The research methodology underpinning this analysis is founded on a rigorous, multi-source approach that blends primary and secondary data. Primary interviews were conducted with procurement executives, fire safety engineers, and operations managers to capture firsthand perspectives on material preferences, compliance challenges, and operational constraints. These stakeholder engagements provided qualitative depth and real-world context to the study.

Secondary research complemented primary insights by drawing on industry white papers, regulatory filings, and patent databases. Key performance standards from the National Fire Protection Association and corresponding international bodies were reviewed to validate the technical attributes of flame retardant materials. Additionally, scholarly articles and trade publications offered a broader understanding of technological developments and market drivers.

Qualitative analysis involved thematic coding of interview transcripts and workshop outputs, enabling the identification of common pain points and innovation opportunities. These qualitative findings were supplemented by quantitative techniques, including data triangulation of customs import records, raw material cost indices, and corporate financial disclosures to ensure reliability and accuracy.

Throughout the study, rigorous cross-validation protocols were applied to all data sources. Discrepancies were resolved through additional expert consultations and sensitivity checks, ensuring that conclusions are robust and actionable. This structured research framework guarantees that the insights presented are both credible and directly applicable to strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flame Retardant Pallet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flame Retardant Pallet Market, by Material Composition

- Flame Retardant Pallet Market, by Pallet Design

- Flame Retardant Pallet Market, by Application

- Flame Retardant Pallet Market, by End Use Industry

- Flame Retardant Pallet Market, by Region

- Flame Retardant Pallet Market, by Group

- Flame Retardant Pallet Market, by Country

- United States Flame Retardant Pallet Market

- China Flame Retardant Pallet Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Key Findings and Emphasizing the Strategic Imperative of Flame Retardant Pallets in Modern Safety Management and Supply Chain Resilience

This executive summary has highlighted the evolving landscape of flame retardant pallets, underscoring how material innovations, digital integration, and tightening regulatory requirements are reshaping market dynamics. We have examined the implications of new tariff measures on import costs and the resulting strategic pivot toward domestic and nearshore manufacturing. Furthermore, our segmentation analysis revealed distinct trends across material composition, design configurations, application areas, and end use industries, each influencing product adoption in nuanced ways.

Regional insights demonstrated that the Americas maintain robust demand driven by comprehensive fire safety mandates, while Europe, the Middle East, and Africa navigate diverse regulatory frameworks that encourage eco-friendly additive technologies. Asia-Pacific remains a global manufacturing hub, simultaneously advancing material science and digital traceability to meet strict safety standards. Together, these findings illustrate a market at the intersection of safety, sustainability, and supply chain efficiency.

In conclusion, flame retardant pallets are more than a compliance requirement; they represent a strategic asset that enhances operational resilience, risk mitigation, and environmental performance. Organizations that proactively integrate these solutions, guided by a deep understanding of segmentation, regional dynamics, and competitive landscapes, will be well positioned to drive growth and maintain a leadership edge.

Engaging with Ketan Rohom for Personalized Consultations and Exclusive Access to the Comprehensive Flame Retardant Pallet Market Research Report Today

I appreciate your dedication to securing unparalleled insights into the flame retardant pallet market. To explore how this comprehensive research can inform your strategic decisions, I invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. By reaching out, you will gain personalized consultations tailored to your specific operational and logistical challenges, ensuring that you extract maximum value from the report’s findings.

Your engagement will grant you exclusive access to in-depth analyses, proprietary data visualizations, and interactive discussions that align with your organization’s goals. Whether you require detailed clarification on tariff implications, segmentation deep dives, or regional dynamics, Ketan will facilitate bespoke briefings and provide you with sample extracts to confirm the report’s relevance. This approach will empower your team to make informed investments in material innovation, supply chain resilience, and regulatory compliance strategies.

Don’t miss the opportunity to partner with an expert who can translate complex market insights into actionable roadmaps. Connect with Ketan Rohom today to arrange a personalized demonstration of the flame retardant pallet market research report and embark on a pathway to greater operational safety, cost efficiency, and sustainable growth.

- How big is the Flame Retardant Pallet Market?

- What is the Flame Retardant Pallet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?