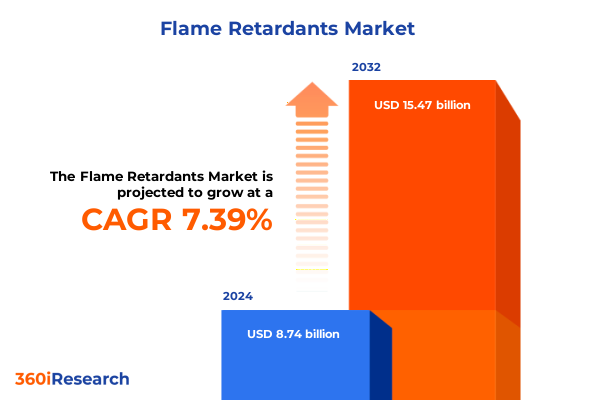

The Flame Retardants Market size was estimated at USD 9.38 billion in 2025 and expected to reach USD 9.99 billion in 2026, at a CAGR of 7.39% to reach USD 15.47 billion by 2032.

Setting the Stage for Flame Retardant Innovation: Understanding Market Drivers, Regulatory Pressures, and Emerging Sustainability Demands

The flame retardants landscape is in a state of dynamic evolution driven by mounting regulatory demands, heightened safety concerns, and an accelerating quest for sustainability. Stakeholders across chemical manufacturing, end-use industries, and governmental bodies are converging on the critical need for materials that not only meet stringent fire safety standards but also align with environmental stewardship. Amid this interplay of forces, the industry is witnessing a redefinition of performance criteria, compelling manufacturers to innovate beyond conventional chemistries.

At the same time, technological breakthroughs in additive and reactive flame retardant systems are creating fresh avenues for differentiation. Whether through the refinement of halogenated compounds or the development of bio-based alternatives, product developers are challenged to optimize efficacy, reduce toxicological footprints, and address end-of-life concerns. This strategic imperative is further underscored by consumers’ growing appetite for eco-conscious products in sectors ranging from construction to electronics.

Consequently, understanding the interplay of market drivers, regulatory catalysts, and innovation trajectories is paramount for decision-makers seeking to maintain competitive advantage. By situating flame retardants within the broader context of shifting environmental policies, supply chain disruptions, and end-use performance benchmarks, this introduction sets the stage for deeper analysis of emerging trends and strategic inflection points.

Identifying the Transformative Shifts Reshaping Flame Retardant Development Including Sustainability, Technology Adoption and Regulatory Evolution

As the world pivots towards a low-carbon, resource-efficient future, the flame retardants sector is experiencing transformative shifts that are reshaping both product development and supply chain strategies. One of the most conspicuous changes is the intensification of sustainability mandates, which has accelerated the transition from legacy halogenated systems toward phosphorus-based and mineral-derived solutions. Industry participants are now investing in advanced chemistries to enhance fire resistance while simultaneously minimizing environmental and health impacts.

Moreover, digitalization and process automation are streamlining quality control and reducing production variability. Data-driven analytics and real-time monitoring platforms are empowering manufacturers to fine-tune reaction parameters, optimize energy consumption, and ensure consistent product performance. These technological advancements, combined with modular production approaches, are not only fostering operational agility but also enabling scalable commercialization of novel retardant formulations.

In parallel, collaborative innovation between chemical suppliers and end-use OEMs is evolving through open innovation networks and consortia. This convergence of expertise is yielding multidisciplinary solutions that integrate flame retardancy with multifunctional properties such as mechanical reinforcement, thermal insulation, and electrical conductivity. As a result, flame retardants are transcending their traditional role and emerging as enablers of next-generation materials in sectors like aerospace, automotive, and consumer electronics.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Cost Structures, and Competitive Dynamics in Flame Retardants

The imposition of new United States tariffs on select chemical imports in early 2025 has introduced a complex web of cost and supply considerations across the flame retardants value chain. Suppliers affected by these levies have encountered elevated input costs, prompting them to reassess vendor relationships and explore nearshoring strategies. In turn, original equipment manufacturers are scrutinizing total cost of ownership to mitigate margin compression, leading to renegotiation of long-term contracts and strategic inventory stockpiling.

Foreign producers of brominated and chlorinated retardants have been particularly impacted, catalyzing a shift toward domestic or regionally sourced phosphorus and nitrogen-based alternatives. This reorientation is altering procurement paradigms and accelerating qualification processes for new chemistries. Simultaneously, transportation and logistics networks have been strained by cross-border duties, which has heightened interest in integrated supply chain platforms capable of optimizing routing and customs compliance.

Despite these headwinds, the tariff environment has also incentivized investment in local manufacturing capacity. Several market leaders are deploying capital to expand domestic reactor facilities and downstream compounding units for reactive flame retardants. By enhancing vertical integration, these companies aim to secure reliable supply, maintain competitive pricing, and uphold rigorous quality standards in a dynamically priced market.

Uncovering Key Insights from Form, Type, End Use Industry, and Application Segmentation Patterns to Guide Strategic Positioning

In scrutinizing the flame retardants market through multiple segmentation lenses, distinct pathways for growth and differentiation emerge. When examining product architecture by form, additive systems-spanning brominated compounds such as hexabromocyclododecane, pentabromodiphenyl ether, and tetrabromobisphenol A, alongside chlorinated and mineral- or nitrogen-based variants-continue to dominate high-performance applications due to ease of incorporation and proven efficacy. Conversely, reactive flame retardants, particularly nitrogen and phosphorus derivatives, are gaining traction as manufacturers pursue covalently bonded systems to reduce leachability and enhance durability in polymer matrices.

Separating the market by chemical type reinforces this duality between halogenated and non-halogenated solutions. Brominated and chlorinated retardants excel in established electronic and industrial sectors, whereas mineral, nitrogen, and phosphorus-based alternatives are capturing share in eco-sensitive segments where regulatory scrutiny is most acute. This bifurcation is prompting technology providers to balance the reliability of legacy formulations with the innovation imperative of halogen-free platforms.

End-use industry segmentation further underscores application-specific drivers. Construction stakeholders demand flame resistant materials for flooring, wall coverings, insulation, and wiring, whereas electronics and electrical benchmarks hinge on connector, socket, enclosure, and printed circuit board performance under high-heat conditions. Packaging applications, including electronics, food, and protective packaging, seek flame retardant integration without compromising safety or recyclability. Textile and transportation verticals-from upholstery and industrial fabrics to aerospace, automotive, and rail-add layers of complexity, requiring tailored solutions that harmonize fire safety with mechanical resilience.

Finally, mapping by application reveals nuanced preferences: fire resistant and intumescent coatings for structural elements; electronic component integration for reliability in harsh environments; flexible and rigid foams for insulation and cushioning; polyolefin, polyurethane, and PVC polymers for molded parts; and specialized flame retardant treatments for clothing, upholstery, and industrial textiles. Together, these segmentation insights enable stakeholders to pinpoint high-potential niches and align R&D investments accordingly.

This comprehensive research report categorizes the Flame Retardants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- End Use Industry

- Application

Analyzing Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Growth Opportunities and Challenges

Across the Americas, flame retardants manufacturers leverage abundant feedstock sources and established regulatory frameworks to innovate in markets ranging from aerospace composites to building materials. The North American push toward circular economy principles is encouraging the integration of recycled polymers with phosphorus-based retardants, while Latin American economies exhibit growing demand for cost-effective additives in the construction sector. Trade policies and energy costs remain focal points for investment decisions, influencing the balance between import reliance and localized production.

In the Europe, Middle East & Africa region, stringent fire safety standards and environmental regulations are accelerating the phase-out of legacy halogenated chemicals. European directives on persistent organic pollutants are particularly influential, driving manufacturers to adopt non-toxic, bio-derived retardants. Meanwhile, Middle Eastern infrastructure expansion and African urbanization are amplifying demand for flame resistant insulation and wiring systems. The intersection of regulatory stringency and infrastructure growth has fostered a diverse competitive landscape that spans established global players and agile regional specialists.

Asia-Pacific continues to represent a dominant growth engine, propelled by rapid industrialization and escalating safety standards in end-use industries such as electronics, automotive, and construction. China’s emphasis on self-reliance has spawned significant investments in local phosphorus and mineral-based retardant production, while Southeast Asian markets are embracing sustainable alternatives to meet international export requirements. This regional mosaic of regulatory intensity, capacity expansion, and end-market demand underscores the Asia-Pacific region’s critical role in shaping future trajectories of flame retardant innovation.

This comprehensive research report examines key regions that drive the evolution of the Flame Retardants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Flame Retardant Producers and Innovators Driving Technological Advancements and Operational Excellence in the Global Market

Leading chemical corporations are consolidating their positions through targeted acquisitions, collaborative R&D ventures, and capacity expansions. Key players with deep expertise in brominated and chlorinated additives continue to refine their offerings, investing in next-generation reactor technologies and advanced compounding processes that deliver enhanced flame retardancy and lower environmental impact. Simultaneously, innovators specializing in phosphorus and nitrogen chemistries are forming strategic partnerships with polymer producers to co-develop integrated solutions that address emerging regulatory thresholds.

Several frontrunners have also embraced digital twins and predictive simulation to accelerate formulation optimization, reduce batch variability, and shorten time-to-market for new retardant products. This commitment to digital transformation is complemented by investments in pilot-scale validation facilities, enabling rapid scalability of promising bio-based and mineral-based compounds.

In parallel, regional champions in Asia-Pacific and the Middle East are capitalizing on domestic feedstock advantages and government incentives to scale local production. These companies are differentiating through agile logistics networks and responsive customer service models that cater to fast-growing end-use segments. Across the board, the competitive landscape is defined by a blend of global tier-one firms and specialized niche players, each leveraging distinct technological competencies to capture premium segments within the broader market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flame Retardants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- Albemarle Corporation

- BASF SE

- BASF SE

- Clariant AG

- Covestro AG

- DIC Corporation

- Dow Inc.

- DuPont de Nemours, Inc.

- Eti Maden İşletmeleri Genel Müdürlüğü

- ICL Group Ltd.

- Italmatch Chemicals S.p.A.

- J.M. Huber Corporation

- LANXESS AG

- LG Chem Ltd.

- Nabaltec AG

- RTP Company

- Teijin Limited

- Thor Group Ltd.

- Tosoh Corporation

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends, Optimize Pricing Strategies, and Strengthen Supply Chains

Industry leaders should prioritize a dual-pronged innovation strategy that balances the optimization of legacy halogenated formulations with accelerated development of halogen-free alternatives. By allocating R&D resources to enhance the performance-to-environmental footprint ratio, manufacturers can preemptively address evolving regulatory mandates while preserving efficacy in critical applications. In parallel, forging collaborative alliances across the value chain-from raw material suppliers to OEM integrators-will expedite co-innovation pipelines and facilitate faster adoption of novel retardant technologies.

To counteract supply chain volatility and tariff-induced cost pressures, executives are advised to diversify sourcing strategies by establishing regional production hubs and nearshore partnerships. This approach not only mitigates geopolitical risks but also enhances responsiveness to localized demand shifts. Additionally, implementing advanced analytics and end-to-end visibility platforms will enable granular tracking of raw material flows, identify bottlenecks, and optimize inventory levels without compromising service quality.

Finally, embedding circular economy principles into product design and manufacturing processes will yield long-term competitive advantages. Leaders can explore chemical recycling initiatives for used polymers, incorporate renewable feedstocks for reactive retardants, and develop take-back programs to reclaim material value. By weaving sustainability into commercial and operational strategies, companies can strengthen brand equity, satisfy stakeholder expectations, and future-proof their market positions.

Explaining the Rigorous Research Methodology Employed to Ensure Data Integrity, Market Validation, and Comprehensive Competitive Benchmarking

This research combines qualitative and quantitative research methodologies to ensure a comprehensive understanding of the flame retardants market. Secondary data was collected from regulatory publications, patent filings, scientific journals, and industry whitepapers to map historical trends, legislative developments, and technological breakthroughs. These insights were triangulated with primary interviews conducted with key stakeholders, including chemical engineers, procurement managers, and compliance officers across major end-use verticals.

Furthermore, the competitive landscape analysis was underpinned by a benchmarking framework that evaluated companies based on innovation intensity, capacity expansion, geographic footprint, and sustainability initiatives. Custom-built data models facilitated scenario analysis of tariff impacts, supply chain disruptions, and raw material price fluctuations. All findings were subjected to a rigorous validation process that involved cross-referencing with publicly disclosed financial reports, press releases, and expert panel reviews.

By integrating these research techniques, the study delivers a robust, multi-dimensional perspective on product performance, market dynamics, and strategic trajectories. This methodology ensures that recommendations are grounded in the latest industry realities while providing stakeholders with actionable intelligence to navigate future uncertainties.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flame Retardants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flame Retardants Market, by Form

- Flame Retardants Market, by Type

- Flame Retardants Market, by End Use Industry

- Flame Retardants Market, by Application

- Flame Retardants Market, by Region

- Flame Retardants Market, by Group

- Flame Retardants Market, by Country

- United States Flame Retardants Market

- China Flame Retardants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Concluding Strategic Imperatives for Stakeholders to Navigate Risks, Leverage Innovation, and Achieve Sustainable Growth in the Flame Retardants Sector

In conclusion, the flame retardants market stands at the nexus of regulatory transformation, technological innovation, and sustainability imperatives. Stakeholders must navigate a landscape shaped by new tariff regimes, evolving fire safety standards, and growing environmental scrutiny. Success will hinge on the ability to seamlessly integrate advanced chemistries with digital manufacturing practices while maintaining agility in supply chain operations.

The segmentation analysis underscores the importance of tailoring solutions to specific form, type, and end-use requirements, whether in construction, electronics, packaging, textiles, or transportation. Regional insights further highlight differentiated strategies for the Americas, EMEA, and Asia-Pacific markets, each with distinct regulatory pressures and growth catalysts. Equally critical is the recognition of competitive dynamics, which demand continuous innovation and strategic partnerships to maintain market leadership.

By synthesizing these insights, stakeholders can chart a clear path forward: invest in next-generation, environmentally benign retardant systems, diversify sourcing strategies, and leverage data-driven decision making. In doing so, they will be well-positioned to meet both the technical demands of fire safety and the broader expectations of sustainability-conscious consumers and regulators alike.

Engaging Consultation Invitation with Ketan Rohom to Access In-Depth Flame Retardants Market Insights and Propel Business Decisions Forward

To explore how evolving regulatory frameworks, shifting industry dynamics, and emerging sustainability criteria converge within the flame retardants arena, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s deep understanding of segment-specific performance metrics and competitive landscapes positions him to guide your acquisition of the full Market Research Report on Flame Retardants. Engage in a personalized consultation to uncover granular insights on form, type, end use verticals, and regional trajectories. By leveraging this engagement, you will gain immediate clarity on supplier assessments, technology roadmaps, and tariff implications shaping cost structures today. Initiate a dialogue to secure a comprehensive analysis that empowers data-driven decisions, optimizes product portfolios, and aligns investment strategies with projected regulatory requirements. Your strategic advantage in the flame retardants market begins with this call to action – ensure your access to the most authoritative, up-to-date intelligence by scheduling a session with Ketan Rohom without delay

- How big is the Flame Retardants Market?

- What is the Flame Retardants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?