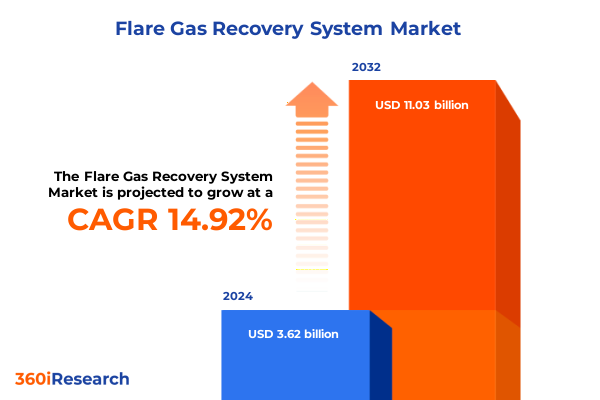

The Flare Gas Recovery System Market size was estimated at USD 4.10 billion in 2025 and expected to reach USD 4.66 billion in 2026, at a CAGR of 15.15% to reach USD 11.03 billion by 2032.

Harnessing Flare Gas Recovery to Drive Tremendous Emission Reductions and Unlock Untapped Energy Potential in a Rapidly Evolving Energy Landscape

Global gas flaring remains one of the most wasteful and environmentally detrimental practices in oil and gas production, releasing an estimated 389 million tonnes of CO₂ equivalent in 2024 alone, including potent methane emissions that significantly exacerbate climate change risks. Despite commitments such as the Zero Routine Flaring by 2030 initiative, flaring volumes reached 151 billion cubic meters in 2024-the highest in nearly two decades-undermining both energy security and decarbonization efforts. As practitioners and regulators intensify pressure to treat flare gas as a valuable resource rather than waste, deploying advanced recovery solutions has become critical for compliance, sustainability, and resource optimization.

Recent assessments by the International Energy Agency underscore that more than 260 billion cubic meters of natural gas are wasted through flaring and leaks each year, with potential to redirect 200 billion cubic meters to markets if targeted mitigation measures are implemented. This volume corresponds to more natural gas than the European Union imported from Russia prior to 2022, highlighting the opportunity cost of inaction. Against this backdrop, flare gas recovery systems have emerged as cornerstone technologies for companies aiming to reduce greenhouse gas footprints, capture additional revenue streams, and align with evolving environmental mandates.

How Technological Innovation and Regulatory Pressures Are Reshaping Flare Gas Recovery Systems and Industry Practices Worldwide

The flare gas recovery landscape has shifted dramatically in recent years, propelled by converging technological breakthroughs and more stringent regulatory frameworks. Digital innovations-such as AI-driven predictive maintenance and cloud-based monitoring platforms-have reduced downtime by up to 25%, ensuring recovery units maintain optimal combustion efficiency and operational availability. Modular skid-mounted systems now enable rapid deployment in remote locations and offshore settings, with portable designs requiring minimal footprint and facilitating plug-and-play installation. This modularity is particularly transformative for operators seeking to scale recovery capabilities without the delays or capital intensity of bespoke engineering projects.

Simultaneously, the pursuit of green and blue hydrogen production from flare streams has matured from concept to pilot-scale reality. In the Middle East, next-generation membrane-cryogenic configurations are being tested to extract hydrogen and liquefied petroleum gases from mixed flare streams, demonstrating recovery efficiencies in excess of 90% under field conditions. Additionally, projects like Oman’s Zulaiyah station illustrate how flare gas can power containerized data centers, turning a liability into a digital asset while avoiding thousands of tons of CO₂ emissions annually. These convergent trends underscore a transformative period in which flare gas recovery is both an environmental imperative and a platform for innovation-led value creation.

Assessing the Cumulative Impact of 2025 United States Tariffs on Flare Gas Recovery Equipment Supply Chains and Operational Costs Nationwide

In 2025, the United States introduced sweeping reciprocal tariffs-imposing a 10% ad valorem duty on all imports effective April 5 and escalating duties on specific trading partners days later-to bolster trade reciprocity but inadvertently increasing costs for energy-related equipment. These measures elevated import expenses for critical components used in flare gas recovery systems, including compressors, membranes, and heat exchangers sourced from Canada, China, and Mexico. Concurrently, March 4 saw tariff hikes of 20% on Chinese goods and 25% on imports from Canada and Mexico, creating a complex duty landscape for procurement teams navigating multiple duty rates and compliance timelines.

The cumulative effect of higher steel and aluminum tariffs-doubled to 50% on primary metal imports-has further exacerbated cost pressures for recovery system manufacturers, with OCTG tubulars and pressure vessels experiencing price uplifts estimated at 15%. Small and medium service providers, which import a significant share of their equipment, are particularly exposed to these duty increases, prompting reevaluation of supply chains, nearshoring strategies, and in some instances, delaying expansions pending tariff relief or reclassification appeals. For larger operators, the duty-induced cost inflation underscores the importance of early procurement planning and collaborative engagement with customs advisors.

Unveiling Critical Segmentation Insights Across Technologies, End Users, Components, Flow Rates, and Operating Pressures to Optimize Strategic Positioning and Product Innovation in Flare Gas Recovery

A nuanced understanding of market segmentation is vital for positioning recovery technologies against varied operational requirements. Technology segmentation spans four core platforms: Absorption systems, which leverage chemical or physical solvents to capture hydrocarbons; Adsorption units, differentiated by pressure swing or temperature swing modalities; Cryogenic processes, deployed in single- or multi-stage configurations for low-temperature gas separation; and advanced polymeric or ceramic Membrane solutions, offering compact, energy-efficient separation under varying feed conditions. Each technological branch presents distinct trade-offs in energy intensity, footprint, and product purity, shaping solution selection for diverse sites.

End-user segmentation delineates key industrial applications across Oil & Gas, Petrochemical, Power Generation, and Refining sectors. Within Oil & Gas, upstream, midstream, and downstream operations each encounter unique gas quality and volume profiles that direct recovery design criteria. Power Generation users deploy recovery units within combined cycle, gas turbine, or steam turbine facilities to reclaim fuel and mitigate flare-stack venting. Component analysis further segments the market into Compressors-ranging from reciprocating to centrifugal and screw designs-Control Systems, be they automatic or manual, Dehydrators employing glycol or solid desiccants, and Heat Exchangers in air-cooled or shell-and-tube formats that govern thermal integration. Flow rate tiers below 1000, between 1000 and 5000, and above 5000 standard cubic feet per day address scale requirements, while operating pressure bands of under 10 bar, 10–50 bar, and above 50 bar ensure compatibility with site hydraulics. This layered segmentation framework empowers stakeholders to align technical capabilities with operational constraints and strategic objectives.

This comprehensive research report categorizes the Flare Gas Recovery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Flow Rate Range

- Operating Pressure

- End User

Key Regional Dynamics Driving Adoption and Innovation in Flare Gas Recovery Across the Americas Europe Middle East Africa and AsiaPacific Markets

Regional dynamics continue to drive differentiated adoption pathways and innovation priorities. In the Americas, the Permian Basin’s methane intensity has declined by over 50% between 2022 and 2024 thanks to advanced monitoring and recovery deployments, even as global flaring volumes set new records. Canada’s flare gas capture is spurred by cross-border energy trade agreements and provincial methane regulations, while Latin American refiners are integrating compact skid-mounted systems to monetize otherwise stranded gas streams.

Europe, the Middle East, and Africa have seen parallel campaigns anchored by the EU’s Methane Strategy and the World Bank’s Global Flaring and Methane Reduction partnership, which have catalyzed zero-routine-flaring commitments in several Gulf Cooperation Council states. Sub-Saharan African nations leverage catalytic grants to pilot low-capex recovery units, targeting both emissions goals and energy access improvements. In the Asia-Pacific, state-led environmental mandates in China and India are accelerating recovery technology roll-out within large refining and petrochemical clusters, complemented by significant investments in digital emissions tracking under national ESG frameworks. Emerging economies across Southeast Asia are poised to mainstream hybrid membrane-cryogenic and AI-integrated systems as part of broader decarbonization roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Flare Gas Recovery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players and Their Strategic Initiatives Shaping the Future of Flare Gas Recovery System Solutions

The competitive arena features a blend of global energy technology leaders and specialized solution providers. Baker Hughes holds prominence through high-impact projects such as its integrated gas recovery and hydrogen sulfide removal system at SOCAR’s Heydar Aliyev Refinery, demonstrating up to 7 million Nm³ of methane recovery per year alongside substantial CO₂ reductions. Siemens Energy and Honeywell UOP have advanced next-generation compressors with dry-seal technology, delivering mean time between failures improvements exceeding 20% and boosting recovery unit availability to above 95% in recent field installations.

Meanwhile, Zeeco’s skid-mounted AI-enabled flare capture modules and John Zink Hamworthy’s blockchain-enabled emissions tracking platforms underscore the push toward smarter, decentralized recovery architectures. Aerzen and Gardner Denver continue to optimize vacuum and compression performance for low-pressure flare streams, whereas EPC collaborators like Technip Energies are integrating modular flare-to-power packages tailored for offshore applications. Through targeted R&D investments and strategic alliances, these companies are reinforcing product portfolios and scaling execution capabilities to meet complex, multi-dimensional customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flare Gas Recovery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aereon, Inc.

- Aerzener Maschinenfabrik GmbH

- Baker Hughes Company

- Cimarron Energy, Inc.

- Eisenmann Environmental GmbH

- Envent Corporation

- Exterran Corporation

- Flowserve Corporation

- Gardner Denver Holdings, Inc.

- Honeywell International Inc.

- John Zink Hamworthy Combustion LLC

- K. LUND Offshore

- Koch Industries, Inc.

- KPS Holdings

- MAN Energy Solutions SE

- MPR Industries plc

- Ramesa Sistemas

- Schlumberger Limited

- SoEnergy International, Inc.

- Sundyne LLC

- Sunpower Technology (Jiangsu) Co., Ltd.

- TechnipFMC plc

- Transvac Systems Ltd

- Wärtsilä Oyj Abp

- Zeeco, Inc.

Actionable Strategic Recommendations to Empower Industry Leaders to Capitalize on Flare Gas Recovery Opportunities and Drive Sustainable Growth

Industry leaders should prioritize modular, digital-first solutions that align with both evolving environmental mandates and the need for flexible deployment. Early engagement with regulators and participation in methane reporting schemes can secure preferential project approvals and unlock carbon credit opportunities. Firms are advised to integrate AI-driven analytics from project inception, enabling real-time performance insights and predictive maintenance that safeguard uptime and optimize recovery yields.

Moreover, supply chain resilience is critical amid tariff-induced cost volatility; organizations should evaluate near-sourcing options in North America and develop strategic component inventories to buffer duty impacts. Joint ventures with local EPC firms and targeted equity partnerships can accelerate market entry, especially within regions offering financing incentives for flaring reduction. Finally, establishing cross-sector collaborations-linking flare recovery units to hydrogen production, cogeneration, or data-center power use cases-can enhance project economics and fortify sustainability credentials, positioning companies to capture new revenue streams.

Transparent and Rigorous Research Methodology Underpinning the Comprehensive Analysis of the Flare Gas Recovery System Market Landscape

This analysis is grounded in a rigorous mixed-methodology approach, blending comprehensive secondary research with primary interviews of technology experts, EPC contractors, and end-users. Public and proprietary databases, government regulations, and technical standards guided the development of the segmentation framework, while global press releases and regulatory filings provided insight into recent technology deployments and policy shifts.

Primary inputs were validated via structured consultations with operational managers and project engineers across key regions, ensuring that real-world performance metrics and deployment challenges informed our evaluation. A triangulation process reconciled quantitative data points against qualitative insights, yielding a robust perspective on technology efficacy, adoption barriers, and regional variances. Throughout, strict quality checks and peer reviews maintained the integrity and neutrality of findings, supporting authoritative decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flare Gas Recovery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flare Gas Recovery System Market, by Technology

- Flare Gas Recovery System Market, by Component

- Flare Gas Recovery System Market, by Flow Rate Range

- Flare Gas Recovery System Market, by Operating Pressure

- Flare Gas Recovery System Market, by End User

- Flare Gas Recovery System Market, by Region

- Flare Gas Recovery System Market, by Group

- Flare Gas Recovery System Market, by Country

- United States Flare Gas Recovery System Market

- China Flare Gas Recovery System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Insights Emphasizing the Critical Role of Flare Gas Recovery Systems in Sustainable Energy Transition and Operational Excellence

Flare gas recovery has evolved from a niche emissions-abatement tactic to a central pillar of sustainable energy strategy, underscored by record global flaring volumes and escalating climate imperatives. Technological innovations-spanning advanced compression, hybrid separation, and AI-driven control systems-now enable operators to transform waste streams into usable fuel and feedstock while satisfying stringent environmental standards and stakeholder expectations.

As tariff landscapes and regional policies continue to shift, the ability to adapt through modular supply chains, digital integration, and strategic collaborations will distinguish market leaders. Ultimately, embracing flare gas recovery not only mitigates environmental impacts but also unlocks new value streams, strengthens operational resilience, and advances the broader energy transition imperative. The confluence of regulatory momentum, technological capability, and commercial viability signals a pivotal moment for industry participants ready to drive measurable progress.

Empower Your Strategic Decisions Today by Connecting with Ketan Rohom to Secure the Authoritative Flare Gas Recovery System Market Research Report

To access the full insights, detailed data, and in-depth analysis on the flare gas recovery system market-including proprietary segmentation, regional performance, and strategic company profiles-reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive report. Engage with Ketan to explore tailored licensing options, request a customized briefing, or arrange an executive summary walk-through that aligns with your organization’s objectives. Don’t miss the opportunity to harness these critical market insights and position your business at the forefront of the global transition toward efficient and sustainable flare gas management.

- How big is the Flare Gas Recovery System Market?

- What is the Flare Gas Recovery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?