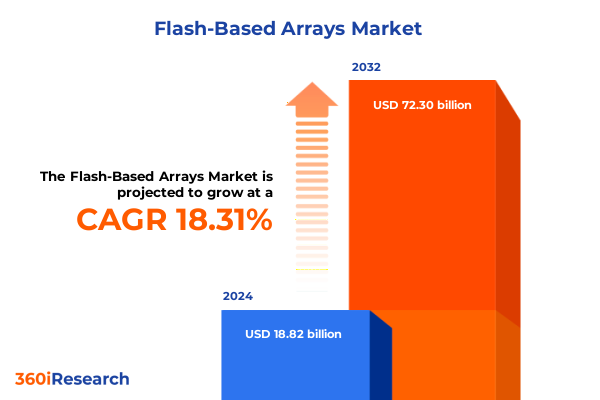

The Flash-Based Arrays Market size was estimated at USD 21.97 billion in 2025 and expected to reach USD 25.66 billion in 2026, at a CAGR of 18.54% to reach USD 72.30 billion by 2032.

Unveiling How Flash-Based Array Technologies Are Redefining Data Infrastructure Performance Security and Scalability Across Enterprise and Cloud Environments

Enterprises today generate and process data at an unprecedented scale, driven by digital transformation initiatives, artificial intelligence and machine learning workloads, and real-time analytics. Traditional spinning-disk storage solutions can no longer accommodate the performance and latency demands of modern applications, leading to bottlenecks in transaction processing, data analytics, and virtualization. Flash-based arrays have emerged at the forefront of storage innovation, offering orders-of-magnitude improvements in input/output operations per second (IOPS), sub-millisecond latency, and energy efficiency, all while reducing physical footprint in data centers and edge environments.

This executive summary provides a panoramic view of the flash-based array market, outlining the technological breakthroughs, evolving deployment models, and key drivers reshaping the storage landscape. It consolidates insights into market segmentation across array types, deployment architectures, industry verticals, application use cases, and interface standards. In addition, it examines how recent policy developments-particularly the United States’ tariff adjustments effective in 2025-are influencing procurement strategies and pricing dynamics. By synthesizing competitive vendor activities and regional growth trajectories, this summary equips decision-makers with a clear framework for evaluating solution portfolios and aligning flash-based array investments with strategic business objectives.

Highlighting the Transformative Technological Shifts Driving Flash-Based Array Adoption Including AI Acceleration Cloud Migration and Evolving Data Workloads

The flash-based array market is being propelled by transformative shifts in application requirements and infrastructure paradigms. As organizations strive for real-time insights, the prevalence of AI and ML workflows has driven demand for high-bandwidth memory integration and NVMe over Fabrics, enabling parallel data access paths that maximize throughput. Combined with advanced controllers and onboard processing, modern flash arrays deliver end-to-end encryption, inline data reduction, and quality-of-service features that streamline performance tuning and lifecycle management.

Concurrently, hybrid cloud adoption is accelerating, with enterprises seeking fluid data mobility between on-premises arrays and public cloud services. Containerization and Kubernetes orchestration are increasingly integrated with storage APIs to support ephemeral workloads and microservices architectures, further blurring the lines between traditional and cloud-native storage. Edge computing deployments introduce additional complexity, as branch offices, manufacturing sites, and retail locations demand compact, resilient flash solutions capable of autonomous operation during connectivity interruptions. These trends underscore a shift from monolithic standalone arrays toward scale-out and distributed storage fabric models, facilitating linear performance growth and easy capacity expansion as workload demands evolve.

Assessing the Cumulative Impact of United States Tariff Policies in 2025 on Flash Array Supply Chains Pricing and Strategic Procurement Decisions

Recent policy shifts in the United States have significantly altered the economic landscape for flash-based storage vendors and end users. Under Section 301 of the Tariff Act, the U.S. Trade Representative imposed a 25% tariff on certain China-origin electronic components beginning in 2018. Effective January 1, 2025, this tariff was raised to 50% for semiconductors classified under HTS headings 8541 and 8542, intensifying cost pressures throughout the supply chain. Storage system manufacturers have responded by re-evaluating supplier agreements, negotiating early delivery windows, and in some cases restructuring product roadmaps to source tariff-exempt alternatives.

In April 2025, reciprocal tariffs introduced a 90-day grace period that triggered a significant uptick in inventory accumulation by buyers and distributors of DRAM and NAND flash components. TrendForce research indicates that this proactive stockpiling led to elevated contract price projections for both conventional DRAM and blended NAND flash in the second quarter of 2025, reflecting a defensive stance against future duty increases and supply volatility. While frontloaded procurement temporarily stabilized component availability, it also disrupted traditional seasonal demand patterns and injected pronounced pricing variability into the market.

Macro-level analyses highlight that the ramifications of sustained semiconductor tariffs extend beyond short-term procurement tactics. An Information Technology and Innovation Foundation study projects that a continuous 25% import duty on semiconductors could suppress U.S. GDP growth by 0.76% over a decade, resulting in a cumulative economic loss of approximately $1.4 trillion and inflicting an average cost burden exceeding $4,000 per American household by the tenth year of implementation. These findings underscore the imperative for industry stakeholders to develop balanced strategies that address immediate cost containment while preserving long-term supply chain resilience and innovation capacity.

Deriving Comprehensive Market Segmentation Insights to Illuminate Flash Array Demand Patterns by Type Deployment Application Industry and Interface

A granular segmentation framework provides critical insights into demand drivers and buyer preferences across multiple dimensions of the flash-based array market. In the type-based segmentation, all-flash arrays are dissected into standalone architectures, favored for targeted performance acceleration, and scale-out configurations that deliver modular scalability for hyperscale environments. Hybrid flash arrays offer automated or manual tiering, enabling cost-effective data placement by intelligently balancing flash and disk resources based on workload characteristics.

Deployment-centric segmentation differentiates solutions across cloud and on-premises environments. Within cloud landscapes, hybrid, private, and public models each present unique operational considerations. Hybrid deployments integrate on-premises infrastructure with multiple cloud providers, private clouds leverage virtualization platforms such as OpenStack and VMware for controlled environments, and public clouds from AWS, Google Cloud, and Microsoft Azure offer elastic consumption models. On-premises installations span traditional data centers and edge computing sites, the latter encompassing branch offices, manufacturing facilities, remote data centers, and retail outlets, all of which demand resilient flash solutions optimized for localized processing and intermittent connectivity.

End-user segmentation highlights vertical priorities in banking, financial services, and insurance; government; healthcare; and information and telecommunications sectors, each with stringent requirements for performance, security, and compliance. Application segmentation addresses AI and ML workloads-including deep learning and machine learning-big data analytics in batch and real-time modes, online transaction processing, virtual desktop infrastructure covering non-persistent and persistent desktops, and virtualization technologies spanning desktop and server environments. Finally, interface segmentation across NVMe, SAS, and SATA standards reflects the market’s progression toward higher bandwidth, lower latency interconnects, enabling storage arrays to match the most demanding enterprise workloads.

This comprehensive research report categorizes the Flash-Based Arrays market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Interface

- Deployment

- End User Industry

- Application

Unpacking Key Regional Dynamics Shaping Flash Array Growth Trajectories Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on flash-based array adoption, driven by distinct infrastructure investments, regulatory frameworks, and technological priorities. In the Americas, the expansion of hyperscale data centers and the rise of AI-driven big data initiatives have catalyzed demand for NVMe-enabled flash arrays that support petabyte-scale deployments. Financial services and healthcare organizations in North America are prioritizing low-latency architectures to satisfy rigorous compliance standards and deliver secure, high-throughput processing for critical applications.

In Europe, Middle East and Africa, evolving data protection regulations such as GDPR and increasing emphasis on data localization are shaping storage strategies. Enterprises are balancing public cloud consumption with on-premises deployments to address sovereignty concerns, while government modernization projects and smart infrastructure programs are integrating flash-based arrays into distributed networks. The combination of regulatory rigor and regional cloud expansions is fostering a hybrid consumption model that leverages both in-region public cloud services and localized flash storage platforms.

The Asia-Pacific region is characterized by aggressive digital transformation roadmaps in key economies. Cloud service providers are scaling flash array offerings to meet surging AI, e-commerce, and streaming media demands, while manufacturing and telecommunications sectors deploy edge flash solutions to support latency-sensitive IoT and industrial automation initiatives. With governments in China, Japan, and India investing heavily in AI research and 5G infrastructure, regional vendors and global suppliers alike are tailoring array capabilities to address performance, security, and resilience requirements in one of the fastest-growing technology markets.

This comprehensive research report examines key regions that drive the evolution of the Flash-Based Arrays market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Innovations by Leading Flash Array Vendors Fueling Competitive Differentiation in the Enterprise Storage Market

The competitive landscape of the flash-based array market is defined by the strategic maneuvers of both incumbent technology giants and agile pure-play innovators. Pure Storage continues to champion its Evergreen Storage model, offering subscription-based capacity scaling and non-disruptive hardware refreshes that appeal to organizations seeking predictable cost structures and future-proof performance. Dell EMC targets enterprise customers with its PowerMax and Unity XT product lines, integrating NVMe and end-to-end data protection features to meet stringent security and high-availability requirements.

NetApp’s All-Flash FAS and AFF series emphasize deep integration with cloud ecosystems, enabling seamless tiering across on-premises arrays and public cloud repositories. Hewlett Packard Enterprise’s Primera and Alletra portfolios combine persistent memory and AI-driven analytics for proactive system maintenance and rapid fault resolution. IBM’s FlashSystem family, supported by Spectrum Virtualize software, delivers sophisticated data reduction and replication capabilities that drive efficiency in mission-critical environments. Emerging challengers, such as VAST Data with its universal storage architecture and Kaminario’s high-density K2 arrays, are pushing boundaries in scale-out performance and architectural simplicity. These vendor strategies underscore a market in which innovation, flexibility, and service-based consumption models are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flash-Based Arrays market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Dell Technologies Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Hitachi Vantara Corporation

- Huawei Investment & Holding Co., Ltd.

- Infinidat Ltd.

- International Business Machines Corporation

- Kaminario, Inc.

- NEC Corporation

- NetApp, Inc.

- Pure Storage, Inc.

- Samsung Electronics Co., Ltd.

- Seagate Technology LLC

- Super Micro Computer, Inc.

- Tintri by DDN, INC.

- VIOLIN Systems LLC

- ZADARA, INC.

Formulating Actionable Strategies for Industry Leaders to Optimize Flash Array Implementations Maximize Performance and Manage Regulatory Risks

Organizations seeking to maximize the strategic value of flash-based arrays should focus on adopting technologies that align with both present demands and future performance trajectories. Prioritizing platforms that support NVMe over Fabrics and persistent memory integration can ensure readiness for AI-driven analytics and real-time processing requirements. Embracing software-defined storage frameworks with policy-based data placement, automated tiering, and intelligent data reduction can optimize resource utilization and reduce operational overhead across heterogeneous deployments.

To mitigate exposure to shifting trade policies and tariff escalations, procurement teams should cultivate diversified supplier ecosystems and negotiate flexible contract terms that include early shipment options and tariff pass-through clauses. Integrating inventory management and demand forecasting tools can provide early visibility into component lead times and help align procurement cycles with policy milestones. Additionally, aligning flash array investments with broader digital transformation initiatives-such as cybersecurity frameworks, regulatory compliance mandates, and edge computing strategies-will drive cohesive infrastructure roadmaps. By implementing a holistic storage strategy that balances cutting-edge technology adoption, supply chain resilience, and governance disciplines, industry leaders can secure performance advantages and sustain a competitive edge in a rapidly evolving market.

Detailing Rigorous Research Methodology Underpinning the Flash Array Market Analysis Including Data Collection Validation and Analytical Frameworks

This report is grounded in a robust research methodology that combines primary and secondary data collection to deliver a comprehensive view of the flash-based array market. Primary research involved structured interviews with storage architects, IT decision-makers, and industry executives across leading enterprises and service providers, providing firsthand insights into technology adoption drivers, performance criteria, and purchasing behavior. Quantitative surveys were conducted to validate trends, capture workload profiles, and assess future investment plans across diverse vertical sectors.

Secondary research encompassed the review of vendor financial statements, product literature, technical white papers, regulatory filings, and reputable industry analyses. Publicly available data sources and proprietary databases were leveraged to ensure a holistic representation of market dynamics. The research process employed data triangulation to cross-verify information from multiple channels, enhancing accuracy and minimizing bias. Analytical frameworks, including SWOT analysis and Porter’s Five Forces, were applied to evaluate competitive pressures and strategic differentiation. Segmentation models were developed in alignment with standardized classification schemes, ensuring consistency in data aggregation across type, deployment, end-user industry, application, and interface categories. Rigorous internal peer reviews and validation workshops were conducted throughout the research lifecycle to refine assumptions and ensure methodological integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flash-Based Arrays market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flash-Based Arrays Market, by Type

- Flash-Based Arrays Market, by Interface

- Flash-Based Arrays Market, by Deployment

- Flash-Based Arrays Market, by End User Industry

- Flash-Based Arrays Market, by Application

- Flash-Based Arrays Market, by Region

- Flash-Based Arrays Market, by Group

- Flash-Based Arrays Market, by Country

- United States Flash-Based Arrays Market

- China Flash-Based Arrays Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude the Executive Summary of Flash Array Market Developments and Opportunities

The flash-based array market is poised for sustained growth as enterprises accelerate their shift away from legacy storage architectures toward high-performance, low-latency solutions that support emerging workloads. Innovations in NVMe, persistent memory, and software-defined storage are driving new use cases in AI, real-time analytics, and edge computing, while evolving tariff and regulatory landscapes require agile procurement and supply chain strategies. The convergence of performance demands, cloud-native application architectures, and data sovereignty considerations underscores the importance of a nuanced approach to array selection and deployment.

Key segmentation insights reveal that organizations are tailoring infrastructure to specific workload profiles, balancing all-flash and hybrid configurations based on cost-performance targets. Regional analysis highlights differentiated adoption patterns across the Americas, EMEA, and APAC, with variances in regulatory influence, cloud maturity, and digital transformation priorities. Vendor strategies centered on subscription-based consumption models, integrated data management, and modular scalability are reshaping competitive dynamics and offering end users flexible pathways to modernize their storage environments.

By synthesizing technological trends, segmentation drivers, regional patterns, and vendor innovations, this executive summary provides a strategic compass for organizations aiming to align flash array investments with their broader digital initiatives. The ability to leverage flash-based storage as a catalyst for operational efficiency, enhanced security, and future-proof performance will determine market leaders in a data-driven economy.

Take the Next Step Toward Gaining Comprehensive Insights and Driving Competitive Advantage with Our Flash Array Market Research Report Today

To gain in-depth, actionable insights into the flash-based array market and stay ahead of competitive and regulatory challenges, reach out to Ketan Rohom, Associate Director of Sales and Marketing, to acquire the comprehensive market research report. Engage with him to explore tailored recommendations that address your organization’s performance, scalability, and total cost of ownership objectives. By leveraging this report’s granular analysis of technological innovation, segmentation dynamics, regional variations, and vendor strategies, you can refine your storage deployment roadmap, optimize procurement timelines, and capitalize on emerging opportunities within the flash storage landscape. Connect with Ketan Rohom to secure the strategic intelligence needed to drive data infrastructure initiatives forward and maintain competitive advantage in the rapidly evolving digital economy.

- How big is the Flash-Based Arrays Market?

- What is the Flash-Based Arrays Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?