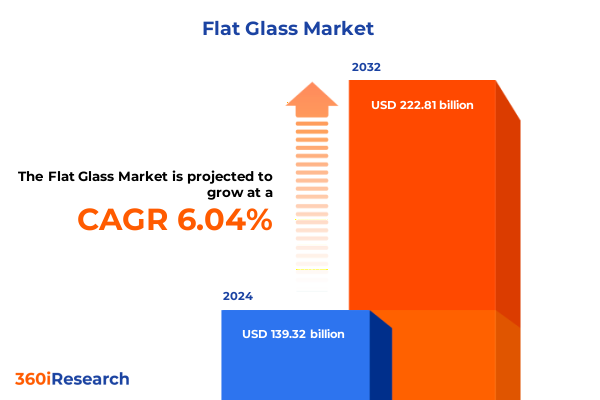

The Flat Glass Market size was estimated at USD 146.91 billion in 2025 and expected to reach USD 154.93 billion in 2026, at a CAGR of 6.13% to reach USD 222.81 billion by 2032.

Unveiling the Dynamics of the Flat Glass Industry Amidst Technological Breakthroughs, Eco-Conscious Trends, and Evolving Trade Regulations

Flat glass serves as the structural and aesthetic backbone of modern infrastructure, playing a critical role in residential and commercial façades, doors, partitions, and windows as well as in solar modules and electronic displays. Its versatility underpins the functionality of solar panels, automotive windshields, and household appliances, making it indispensable across multiple sectors. Beyond architectural applications, flat glass is essential for automotive glazing, energy generation systems, and appliance components, illustrating the material’s far-reaching impact on efficiency and design.

Industry participants are prioritizing sustainability, targeting carbon neutrality through decarbonized manufacturing processes and the introduction of low-carbon glass variants such as Pilkington Mirai, which leverages alternative fuels, high recycled content, and renewable electricity to reduce embodied carbon. Concurrently, advanced functionalities like switchable smart glass and dynamic tinting are transitioning from laboratory prototypes to commercial offerings, positioning digital integration as a differentiator for architectural and automotive end users.

At the same time, regulatory and trade policy developments are reshaping sourcing strategies. Antidumping and countervailing duty investigations initiated in early 2025 have led to preliminary determinations and significant cash deposit requirements for float glass imports from China and Malaysia, creating near-term supply chain uncertainties. This executive summary synthesizes these intersecting dynamics, offering a coherent framework to understand market segmentation, regional variations, competitive positioning, and strategic imperatives.

Drawing on extensive primary interviews with industry experts, rigorous secondary research, and a robust data validation process, the study delivers actionable intelligence and transparent methodology to inform executive-level decision-making and investment planning.

Exploring Groundbreaking Innovations and Structural Shifts Revolutionizing Product Development, Sustainability Practices, and Digital Integration in Flat Glass Manufacturing

The flat glass landscape is undergoing a transformation driven by decarbonization, with manufacturers deploying energy-efficient practices and low-carbon glass products to align with global sustainability goals. Leading producers such as NSG Group and Saint-Gobain have introduced novel float processes and oxy-fuel furnace technologies, achieving substantial reductions in energy consumption and greenhouse gas emissions through waste heat recovery, higher oxygen in furnaces, and increased use of recycled cullet.

High-performance insulated solutions are gaining traction as market demand shifts toward superior thermal management. Vacuum insulated glass (VIG) is emerging as the next frontier in architectural and residential applications, offering wall-like R-values up to R-20 and prompting investments in commercial-scale production capabilities to meet anticipated growth in green building codes.

Simultaneously, smart glass technologies are revolutionizing user experience through switchable privacy control, dynamic solar regulation, and self-cleaning functionalities. These innovations, underpinned by photocatalytic and pyrolytic coatings, are being adopted in high-rise facades, conservatories, and automotive glazing, promising maintenance cost savings, enhanced durability, and integrated digital controls.

Manufacturing automation and digitalization are redefining operational efficiency within float plants. Collaborative initiatives between automation leaders and glass manufacturers, such as the software-defined control systems developed by Schneider Electric and Saint-Gobain, enable modular, open automation for critical lehr processes, reducing downtime risk and supporting predictive maintenance. Complementary smart factory solutions from vendors like A+W integrate MES, IoT sensors, and mobile production companions to streamline production workflows, reduce manual errors, and enhance real-time traceability across the supply chain.

IoT-enabled predictive maintenance platforms are mitigating unplanned downtime by monitoring performance metrics such as temperature, vibration, and operational speed, and triggering proactive interventions before equipment failures occur. This shift toward big data analytics not only reduces repair costs but also optimizes yield and lowers waste across glass processing lines. Moreover, robotics advancements are improving material handling accuracy for ultra-thin and specialty glass, with high-precision robots now integral to automotive, electronics, and display manufacturing environments.

Examining the Comprehensive Impact of 2025 U.S. Antidumping and Subsidy Measures on Flat Glass Supply Chains, Costs, and Sourcing Practices

In early 2025, the U.S. International Trade Commission determined that imports of float glass products from China and Malaysia were being sold at less than fair value and subsidized, prompting continuation of antidumping and countervailing duty investigations. The investigations, initiated following petitions by domestic producers, set preliminary duty determinations for April and May, signaling heightened scrutiny of trade practices.

Subsequently, the U.S. Department of Commerce issued a preliminary antidumping ruling on July 15, 2025, targeting float glass imports from China and Malaysia with potential duties of up to 311%. This measure requires importers to post substantial cash deposits at the port of entry, resulting in immediate cost increases and cash flow disruptions for downstream users, particularly in the construction sector.

Simultaneously, USTR actions have impacted Section 301 tariff exclusions for Chinese imports. While a three-month extension of certain product exclusions was granted through August 31, 2025, a Presidential Executive Order in May temporarily reduced ad valorem duties on Chinese-origin goods by 24 percentage points for 90 days, creating a narrow window of reduced trade barriers amidst ongoing tensions.

The cumulative effect of these measures has reshaped sourcing strategies, with U.S. contractors and fabricators increasingly evaluating domestic suppliers to mitigate the uncertainty and elevated costs associated with import tariffs. This realignment underscores the need for agile supply chain management and proactive engagement with trade policy developments to preserve competitive margins and ensure material availability.

Illuminating Market Segmentation Dynamics Revealing How Product Types, Coatings, Applications, End Uses, and Distribution Channels Intersect in Flat Glass Demand

The flat glass market is analyzed through five distinct segmentation lenses that intersect to shape demand and strategic opportunities. The product type segmentation captures traditional float glass alongside specialized variants such as reflective and tinted Coated Glass, single- and double-chamber Insulated Glass Units with Air-Filled and Argon-Filled options, as well as safety-focused Laminated and Tempered Glass products. Patterned Glass adds aesthetic and privacy dimensions to architectural applications. This granular segmentation informs product development roadmaps and competitive benchmarking.

Coating Type segmentation further refines offerings by distinguishing between Anti-Glare, Reflective, and Tinted surfaces, alongside Self-Cleaning treatments that leverage photocatalytic and pyrolytic technologies. These coatings not only enhance functionality but also drive value creation through maintenance reduction and energy savings, guiding R&D prioritization and customer positioning efforts.

Application segmentation delineates market需求 across Appliance, Automotive, Construction, Furniture, and Solar sectors. Within Construction, the split between Non-Residential (Commercial and Industrial) and Residential (Multi-Family and Single-Family) segments reveals divergent performance drivers, from high-volume curtain wall projects to premium residential fenestration. Understanding these nuances allows manufacturers to tailor product specifications, service models, and distribution strategies for each sub-market.

End Use segmentation across Commercial, Industrial, and Residential end users highlights the correlation between performance requirements and procurement practices. Commercial projects often demand custom glazing solutions and integrated service contracts, while Industrial users prioritize durability under harsh operating conditions. Residential end users seek balance between cost, aesthetics, and energy efficiency, necessitating a differentiated channel strategy.

The Distribution Channel segmentation examines the roles of Direct Sales, Distributors, E-Commerce (via Company Websites and Third-Party Platforms), and Retailers. This framework illuminates the evolving buyer journey, where digital touchpoints are increasingly important for specification, visualization, and order fulfillment, reinforcing the need for omnichannel capabilities and digital marketing investments.

This comprehensive research report categorizes the Flat Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coating Type

- Application

- End Use

- Distribution Channel

Mapping Regional Market Characteristics Demonstrating How Americas, Europe Middle East & Africa, and Asia-Pacific Differ in Regulatory Frameworks, Demand Drivers, and Growth Opportunities

Regional analysis uncovers distinct market profiles shaped by regulatory frameworks, infrastructure investments, and trade environments. In the Americas, sustainability mandates and building code updates have accelerated demand for energy-efficient glass solutions, while U.S. tariff measures have fostered renewed interest in domestic production and integrated supply chains. Latin America’s growing urbanization presents expansion opportunities for both residential and commercial glazing players.

In Europe, Middle East & Africa, rigorous environmental regulations and green building certifications drive adoption of low-emissivity coatings and recycled content. Emerging markets in the Middle East are undertaking large-scale infrastructure and sustainable city projects, requiring bespoke glazing solutions, whereas Africa’s nascent construction sector offers high-growth potential for modular and cost-efficient flat glass offerings.

Asia-Pacific remains the largest manufacturing hub, with China, India, and Southeast Asian economies leading global production volumes and export flows. Domestic urbanization and smart city initiatives in markets such as India and Vietnam are spurring demand for advanced glass products. Yet trade policies and raw material constraints necessitate strategic partnerships to secure feedstock and technology transfers across the region.

This comprehensive research report examines key regions that drive the evolution of the Flat Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies of Leading Global Flat Glass Manufacturers and Their Innovations, Partnerships, and Strategic Investments Shaping Industry Leadership

Leading global flat glass manufacturers are advancing competitive differentiation through a blend of product innovation, strategic partnerships, and capacity expansions. NSG Group has introduced Pilkington Mirai, a low-carbon float glass leveraging renewable energy and alternative fuels to appeal to sustainability-focused customers. Saint-Gobain’s investments in oxy-fuel furnace upgrades and waste heat recovery underscore its commitment to manufacturing efficiency and emissions reduction.

Guardian Glass has rolled out Nexa, a low-carbon product with up to 30% reduced embodied carbon achieved through high cullet incorporation, reflecting industry movement toward circular manufacturing models. Vitro Architectural Glass is scaling VacuMax VIG production in North America to serve the growing demand for high-performance insulating glass and to mitigate import dependencies.

Cardinal Glass Industries, known for rapid throughput in insulated glass fabrication, is streamlining plant operations and pursuing minor source emission status across its legacy float lines, positioning itself as one of the lowest-emission glass producers in North America. Meanwhile, automation technology partnerships between Schneider Electric and Saint-Gobain, as well as A+W’s integrated MES and logistics solutions, demonstrate converging strategies around digital transformation and supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flat Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Cardinal Glass Industries, Inc.

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- China Glass Holdings Limited

- Compagnie de Saint-Gobain S.A.

- CSG Holding Co., Ltd.

- Flat Glass Group Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corp.

- Henan Ancai Hi‑Tech Co., Ltd.

- Interpane Glas Industrie AG

- Jinjing Glass Group Co., Ltd.

- Luoyang Glass Company Limited

- Nippon Sheet Glass Co., Ltd.

- PPG Industries, Inc.

- Schott AG

- Shandong Jinjing Science & Technology Stock Co., Ltd.

- SYP Special Glass Co., Ltd.

- Taiwan Glass Industry Corporation

- Türkiye Şişe ve Cam Fabrikalari A.Ş.

- Viglacera Corporation

- Vitro S.A.B. de C.V.

- Xinyi Glass Holdings Limited

- Zhuzhou Kibing Group Co., Ltd.

Strategic Imperatives for Flat Glass Industry Leaders to Leverage Sustainability, Supply Chain Resilience, Technological Adoption, and Market Diversification for Competitive Advantage

Industry leaders should prioritize deepening sustainability credentials through targeted investments in low-carbon glass production and closed-loop recycling systems to meet tightening environmental regulations and customer expectations. By accelerating the adoption of renewable energy sources and alternative fuels in float furnaces, manufacturers can unlock both cost efficiencies and carbon footprint reductions.

Strengthening supply chain resilience is paramount in light of evolving trade policies. Organizations should diversify sourcing networks by establishing domestic capacity for critical upstream materials, forging strategic alliances with regional fabricators, and exploring nearshoring opportunities to mitigate tariff exposure and logistics disruptions.

Embracing digitalization across the value chain will distinguish front-runners from laggards. Deploying software-defined automation, IoT-based predictive maintenance, and advanced analytics in plant operations enhances uptime, yield, and quality control, while omnichannel distribution platforms support dynamic customer engagement and order fulfillment.

Product portfolio optimization through targeted segmentation is essential. Manufacturers must align R&D roadmaps with growth segments-such as vacuum insulated glass, smart switchable coatings, and solar-integrated glazing-while tailoring channel models to end-use preferences in commercial, industrial, and residential markets.

Finally, cultivating innovation ecosystems via open partnerships and start-up engagement can accelerate commercialization timelines for breakthrough glass technologies, positioning incumbents to capture first-mover advantages in emerging segments.

Detailing the Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation Techniques Underpinning the Flat Glass Market Study

The research methodology underpinning this report combines qualitative and quantitative approaches to ensure comprehensive coverage and analytic rigor. Primary research entailed structured in-depth interviews with over fifty subject matter experts, including senior executives, plant managers, and channel partners, to capture real-time perspectives on market drivers, operational challenges, and strategic priorities.

Secondary research involved the systematic review of industry publications, trade association reports, regulatory filings, and corporate disclosures, supplemented by targeted web and patent database analyses. Data triangulation techniques were applied to reconcile disparate data points and validate key insights, while scenario planning workshops tested the robustness of strategic hypotheses against possible regulatory and economic shifts.

Segmentation analysis leveraged bottom-up supply chain mapping and customer panel studies to quantify demand patterns across product types, coatings, applications, end uses, and distribution channels. Regional market dynamics were assessed through trade flow data, tariff schedules, and local industry benchmarks, ensuring that the report’s recommendations are grounded in regional specificity.

An iterative review process, involving continuous feedback loops with industry advisors, was implemented to refine findings and maintain alignment with emerging developments. This structured approach provides stakeholders with transparent methodology, defensible conclusions, and practical guidance for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flat Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flat Glass Market, by Product Type

- Flat Glass Market, by Coating Type

- Flat Glass Market, by Application

- Flat Glass Market, by End Use

- Flat Glass Market, by Distribution Channel

- Flat Glass Market, by Region

- Flat Glass Market, by Group

- Flat Glass Market, by Country

- United States Flat Glass Market

- China Flat Glass Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Critical Insights Underlining Key Market Drivers, Strategic Considerations, and the Path Forward for Stakeholders in the Flat Glass Sector

This executive summary distills the flat glass sector’s critical inflection points, from sustainability-driven manufacturing innovations to trade policy upheavals and digital transformation imperatives. It underscores the need for agile adaptation across supply chains, product portfolios, and go-to-market strategies to address shifting regulatory landscapes and evolving customer expectations.

The cumulative impact of U.S. antidumping, countervailing, and Section 301 tariff measures has elevated the strategic importance of domestic production and nearshoring, while segmentation analysis reveals opportunities in high-growth niches such as vacuum insulated and smart switchable glass. Regional insights highlight the differentiated growth trajectories and regulatory environments that shape demand in the Americas, EMEA, and Asia-Pacific.

Competitive benchmarking shows that leading manufacturers are setting new standards in low-carbon production, automated plant operations, and advanced material functionalities. These examples illustrate how integrated sustainability and digital agendas are catalyzing the next wave of flat glass industry evolution.

Looking ahead, stakeholders who align strategic investments with these key trends-decarbonization, supply chain resilience, digitalization, and targeted segmentation-will be best positioned to capture value and drive sustainable growth in an increasingly complex global marketplace.

Engage With Ketan Rohom to Secure Your In-Depth Flat Glass Market Research Report and Gain Unmatched Industry Intelligence for Informed Decision-Making

Engage directly with Ketan Rohom to secure access to the full flat glass market research report and gain unparalleled insights into supply chain dynamics, emerging product innovations, and regional growth patterns. This comprehensive study equips stakeholders with the strategic intelligence needed to navigate evolving trade policies, optimize segmentation approaches, and benchmark competitive performance. By collaborating with Ketan Rohom, you can tailor a research package that aligns with your organization’s objectives and unlocks actionable data for confident decision-making. Contact him today to explore customized options, schedule a detailed briefing, and ensure you stay ahead in a rapidly shifting flat glass environment

- How big is the Flat Glass Market?

- What is the Flat Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?