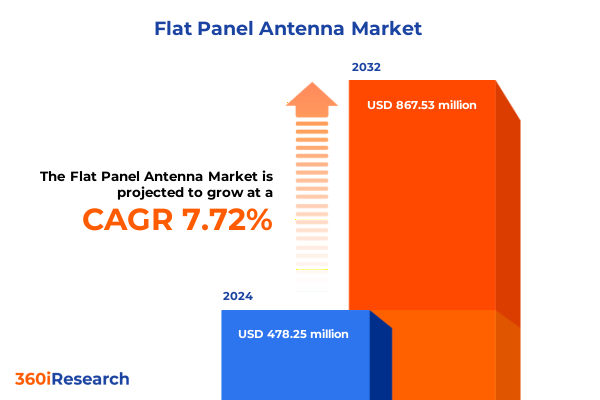

The Flat Panel Antenna Market size was estimated at USD 511.70 million in 2025 and expected to reach USD 554.27 million in 2026, at a CAGR of 7.83% to reach USD 867.52 million by 2032.

Exploring the Technological Evolution and Emerging Potential of Flat Panel Antennas in Addressing Next Generation Connectivity Challenges

Flat panel antennas are reshaping the communications ecosystem by combining compact form factors with high-performance capabilities. As traditional parabolic dishes give way to sleek, electronically steered surfaces, industry stakeholders are witnessing accelerated adoption across a spectrum of use cases. From bolstered connectivity in urban 5G backhaul networks to resilient linkages on maritime vessels and aerospace platforms, the flat panel antenna’s promise of reliability, reduced latency, and simplified alignment illustrates why this technology stands at the forefront of modern communication infrastructure.

Moreover, the gradual convergence of satellite navigation, VSAT solutions, and point-to-point radio frequency links within a unified flat panel architecture underscores the market’s trajectory toward integrated connectivity platforms. As supply chains mature and advanced materials are adopted, manufacturers are introducing lighter, more energy-efficient designs. Consequently, decision-makers are presented with flexible deployment options that meet stringent weight and power requirements for both mobile and fixed-mount applications. This introduction sets the stage for a deeper exploration of the transformative trends propelling the flat panel antenna landscape.

Unveiling the Transformative Shifts Shaping Flat Panel Antenna Adoption Driven by Technological Breakthroughs and Evolving Use Cases

The flat panel antenna landscape is undergoing transformative shifts driven by breakthroughs in materials science, semiconductor integration, and advanced signal processing. Innovations in metamaterials and low-loss substrates have enabled designers to achieve broader bandwidth performance while minimizing insertion loss. Concurrently, the integration of beamforming capabilities directly into application-specific integrated circuits and field-programmable gate arrays has ushered in a new era of digital beamforming, allowing for rapid beam steering without mechanical components. These architectural advances are redefining system reliability and paving the way for scalable mass production.

Furthermore, the rise of electronic scanning techniques, made possible through GaN-based transmit-receive modules and silicon-based alternatives, has accelerated deployment time and reduced maintenance requirements. As regulatory agencies around the world allocate additional spectrum for satellite constellations and 5G mobile networks, flat panel antennas increasingly serve as the interface between earthbound infrastructure and orbital assets. These evolving use cases, coupled with mounting demand for low-profile designs in defense and consumer electronics, underscore the degree to which technological innovation is reshaping adoption patterns and strategic priorities across the communications sector.

Assessing the Cumulative Effects of 2025 United States Tariff Measures on Supply Chains Production and Innovation in Flat Panel Antennas

In 2025, a series of tariff adjustments implemented by the United States government have cumulatively influenced both cost structures and strategic decision-making within the flat panel antenna supply chain. Increased duties on imported components-from specialized substrates to semiconductor modules-have elevated input costs, compelling manufacturers to reassess sourcing strategies and negotiate new supplier relationships. This landscape has, in turn, spurred a renewed emphasis on domestic production capabilities, with a growing number of companies exploring partnerships and joint ventures to mitigate exposure to trade restrictions and logistical bottlenecks.

At the same time, the tariff landscape has heightened the importance of innovation in offsetting cost pressures. Firms are investing in alternative materials and streamlined manufacturing processes to preserve margins, while service providers are adjusting contracts and long-term agreements to reflect the evolving cost basis. Although some market participants have experienced short-term disruptions, the broader effect has been an accelerated drive toward supply chain resilience and technological self-sufficiency. As the market adapts to these tariff measures, organizations that proactively diversify their component portfolios and optimize production workflows will be best positioned to thrive in a more protectionist environment.

Delving into the Comprehensive Segmentation Framework Revealing Diverse Application End User Architecture Frequency and Distribution Insights

A nuanced understanding of the flat panel antenna market emerges through a layered segmentation framework that examines distinct vectors of technology, application, and distribution. When dissecting the market by application, the study examines use cases ranging from 5G backhaul through point-to-point telecom, RFID Wi-Fi integration for industrial tracking solutions, satellite navigation systems for precision positioning, and VSAT deployments that bridge connectivity gaps in remote regions. Transitioning to end-user categories, the analysis covers aerospace original equipment manufacturers known for rigorous performance standards alongside consumer electronics firms seeking compact, low-profile modules. Government and defense agencies drive requirements for resilient, rapid-deployment systems, while maritime OEMs prioritize robust, corrosion-resistant form factors and telecommunication service providers emphasize scalable network integration.

Delving deeper into architectural distinctions, the research evaluates active versus passive flat panel variants in addition to phased array and reflectarray configurations. Within the phased array domain, both digital beamforming and electronic scanning approaches receive close scrutiny; digital beamforming further fragments into beamforming ICs and FPGA-based solutions, whereas electronic scanning explores the merits of GaN-based transmit-receive modules versus silicon-based alternatives. Frequency segmentation spans C, Ka, Ku, L, S, and X bands, reflecting diverse regulatory allocations and performance trade-offs. Finally, considerations of mounting-ranging from fixed installations to mobile platforms and portable units-coupled with distribution insights across aftermarket channels, direct sales, distributor networks, and original equipment manufacturer relationships, create a comprehensive perspective on how market participants tailor offerings to specific operational environments.

This comprehensive research report categorizes the Flat Panel Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Architecture Type

- Frequency Band

- Mounting

- Distribution Channel

- Application

- End User

Unearthing Distinct Regional Dynamics Shaping Demand Adoption and Innovation across the Americas EMEA and Asia Pacific Markets

Regional dynamics play a defining role in shaping flat panel antenna innovation, deployment, and adoption. Across the Americas, robust investment in defense and broadband infrastructure drives significant demand for both hemispherical and steerable flat panel systems. North American service providers are accelerating trials of satellite-backed 5G extensions, while Latin American operators focus on bridging the digital divide through VSAT implementations in underserved areas. The synergies between government initiatives and private sector partnerships have fostered an environment where advanced flat panel solutions can be rapidly validated and scaled.

In Europe, the Middle East, and Africa, regulatory harmonization efforts and pan-regional satellite initiatives create a fertile ground for diverse antenna applications. Programs aimed at enhancing connectivity across remote parts of Africa and linking energy infrastructure installations in the Middle East underscore the role of flat panel antennas in critical communications. Meanwhile, the Asia-Pacific region stands out for its aggressive rollout of 5G networks and burgeoning satellite constellation projects. High-growth markets in Southeast Asia and India are demanding agile, cost-effective antenna solutions, whereas established economies such as Japan and South Korea continue to invest in cutting-edge phased array technologies for next-generation defense and commercial use cases.

This comprehensive research report examines key regions that drive the evolution of the Flat Panel Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Competitor Moves and Innovations Driving Competitive Positioning among Leading Flat Panel Antenna Manufacturers

A competitive landscape characterized by rapid innovation has emerged among leading flat panel antenna manufacturers, each leveraging unique strategies to strengthen market positioning. Developers of electronically steered modules are forging partnerships with semiconductor firms to integrate beamforming capabilities into next-generation transceiver chips, while others are collaborating with satellite operators to validate performance in real-world environments. These alliances not only accelerate time-to-market but also foster co-development initiatives that align product roadmaps with evolving service provider requirements.

Concurrently, certain companies are differentiating through specialized product lines focused on extreme environmental resilience for defense and maritime applications, emphasizing features such as temperature tolerance and EMI shielding. Others are prioritizing modular architectures that enable rapid field upgrades and customization for diverse frequency bands. As competition intensifies, those players who can combine a broad portfolio of frequency-optimized solutions with adaptive beamforming techniques will likely capture greater wallet share. By continuously enhancing product interoperability, streamlining supply chains, and refining go-to-market strategies, these firms aim to establish sustainable competitive advantages in a market defined by technological convergence and shifting regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flat Panel Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALCAN Systems GmbH

- Ball Aerospace & Technologies Corp.

- C-COM Satellite Systems Inc.

- China Starwin Science & Technology Co., Ltd.

- Cobham plc

- General Dynamics Satcom Technologies

- Gilat Satellite Networks Ltd.

- Hanwha Phasor Ltd.

- Hughes Network Systems, LLC

- Isotropic Systems Limited

- KVH Industries, Inc.

- Kymeta Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- MTI Wireless Edge Ltd.

- NXT Communications Corporation

- Raytheon Company

- SatCube Ltd.

- ST Engineering Ltd.

- Thales S.A.

- ThinKom Solutions Inc.

- TTI Norte S.L.

Empowering Industry Leadership through Targeted Strategies for Innovation Supply Chain Resilience and Market Expansion in Flat Panel Antennas

Industry leaders can accelerate growth and mitigate risk by embracing targeted strategies that align with evolving market imperatives. First, prioritizing investment in advanced research and development of digital beamforming and electronic scanning architectures will ensure that product offerings remain at the cutting edge of performance and reliability. This approach not only addresses the rising demand for high-throughput links in 5G backhaul and satellite networks but also reduces the reliance on mechanically steered counterparts, thereby minimizing long-term maintenance costs.

In parallel, organizations should pursue supply chain diversification to buffer against geopolitical uncertainties and tariff volatility. Establishing localized manufacturing partnerships, exploring alternative material sources, and qualifying multiple vendors for critical components will foster resilience. Furthermore, forging collaborative agreements with satellite constellation operators and telecommunication service providers can expedite deployment cycles and co-create solutions tailored to specific network topologies. Lastly, a focused go-to-market strategy that segments customers by application and geography-coupled with value-added services such as system integration and post-installation support-will drive deeper market penetration and revenue diversification.

Clarifying the Rigorous Multi Layered Research Approach Underpinning Comprehensive Analysis of the Flat Panel Antenna Landscape

This analysis is grounded in a rigorous, multi-layered research approach designed to deliver a clear, actionable view of the flat panel antenna landscape. Secondary research formed the foundation, encompassing a review of technical standards, patent filings, regulatory frameworks, and industry publications. These sources provided broad visibility into emerging trends, material innovations, and spectrum allocation developments, setting the context for a more granular investigation.

Building upon this desk research, primary interviews were conducted with a diverse array of stakeholders, including product engineers, supply chain managers, satellite network architects, and defense procurement specialists. These conversations yielded nuanced perspectives on real-world performance, deployment challenges, and strategic priorities. To validate findings, data triangulation methods were applied, cross-referencing insights from interviews, public financial disclosures, and field trial reports. All information underwent peer review by subject matter experts to ensure accuracy, consistency, and relevance to decision-makers navigating the complexities of flat panel antenna adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flat Panel Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flat Panel Antenna Market, by Architecture Type

- Flat Panel Antenna Market, by Frequency Band

- Flat Panel Antenna Market, by Mounting

- Flat Panel Antenna Market, by Distribution Channel

- Flat Panel Antenna Market, by Application

- Flat Panel Antenna Market, by End User

- Flat Panel Antenna Market, by Region

- Flat Panel Antenna Market, by Group

- Flat Panel Antenna Market, by Country

- United States Flat Panel Antenna Market

- China Flat Panel Antenna Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Critical Insights and Strategic Imperatives Steering the Future Trajectory of the Flat Panel Antenna Ecosystem

The flat panel antenna market stands at the nexus of technological innovation, geopolitical dynamics, and evolving connectivity demands. Key transformative shifts in beamforming techniques, material science, and modular design frameworks are redefining the scope of applications across telecommunications, defense, aerospace, and maritime sectors. Meanwhile, the cumulative effects of 2025 tariff measures underscore the necessary balance between cost optimization and domestic manufacturing resilience.

Segmentation insights reveal the intricate tapestry of applications, end-user requirements, architectural preferences, frequency band allocations, mounting configurations, and distribution channels that influence product development and go-to-market strategies. Regional analyses highlight the distinct drivers shaping activity in the Americas, EMEA, and Asia-Pacific, while competitive intelligence underscores the importance of strategic partnerships and agile innovation. Collectively, these findings offer a strategic blueprint for organizations seeking to navigate the complexities of the flat panel antenna ecosystem, prioritize investment, and capture emerging opportunities.

Engage Directly with Our Associate Director to Secure In-Depth Flat Panel Antenna Market Intelligence and Drive Strategic Advantage

Engaging with the flat panel antenna market demands access to the most comprehensive and actionable intelligence available. To equip your organization with a complete and nuanced understanding of the competitive landscape, regional dynamics, tariff implications, and segmentation strategies outlined in this executive summary, secure direct dialogue with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating complex market research into pragmatic business insights will guide your team in making informed, confident decisions as you navigate the evolving opportunities within satellite communications, 5G backhaul, defense applications, and emerging maritime and consumer electronics use cases.

Reach out today to arrange a personalized briefing tailored to your strategic priorities, gain access to the full market research report, and explore bespoke advisory services designed to accelerate your growth trajectory. Partnering with the report’s associate director ensures you benefit from expert interpretation of the data, deep sector knowledge, and a clear roadmap for harnessing innovation, mitigating tariff impacts, and capitalizing on shifting regional trends. Don’t leave critical market decisions to chance-connect with Ketan Rohom now to transform insights into action and secure your competitive edge in the flat panel antenna domain.

- How big is the Flat Panel Antenna Market?

- What is the Flat Panel Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?