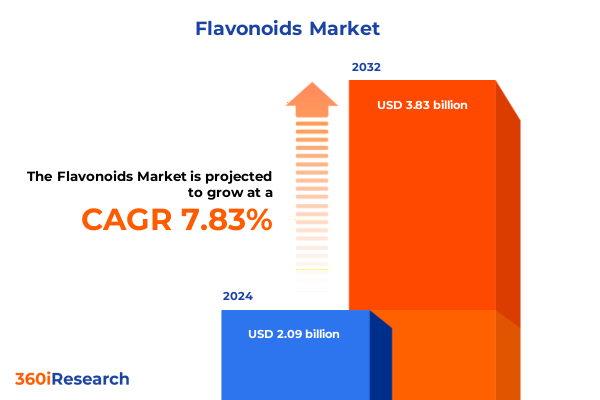

The Flavonoids Market size was estimated at USD 2.25 billion in 2025 and expected to reach USD 2.43 billion in 2026, at a CAGR of 7.85% to reach USD 3.83 billion by 2032.

Establishing the Foundation and Strategic Importance of Flavonoids as Multifunctional Bioactive Compounds Driving Market Growth and Cross-Sector Innovation

Flavonoids represent a broad class of naturally occurring polyphenolic compounds that contribute vibrant pigmentation, potent antioxidant properties, and diverse biological activities across a range of organisms. These compounds emerge in plants as secondary metabolites, serving critical roles in defense mechanisms against ultraviolet radiation and pathogenic attack while simultaneously enhancing pollinator attraction through striking hues. As a result, flavonoids have garnered intense interest from multiple industries, including nutrition, cosmetics, pharmaceuticals, and food and beverage. In nutritional applications, the unique health-promoting attributes of flavonoids-including anti-inflammatory and cardioprotective effects-have elevated them to flagship ingredients within dietary supplement formulations. In parallel, cosmetic innovators have harnessed flavonoid-rich extracts to develop advanced skinbrightening serums and robust antiaging haircare systems. From a pharmaceutical perspective, targeted investigation of specific flavonoid subclasses is yielding promising leads in neurology and oncology research. This burgeoning crosssector appeal underscores the strategic importance of understanding flavonoid composition, sourcing pathways, and functional performance.

Building on the multifaceted relevance of flavonoids, this executive summary offers a highlevel exploration of market dynamics, industry transformations, and actionable insights. It lays out the key drivers and disruptors reshaping supply chains and trade frameworks, including the implications of recent tariff measures in the United States. Detailed segmentation analysis reveals how application, compound type, physical form, source origin, and distribution channels each carve distinct opportunity spaces. Regional nuances and competitive benchmarks are examined to guide investment priorities, while structured recommendations point toward sustainable innovation and operational excellence. Designed for decisionmakers and strategic planners, this overview sets the stage for informed choices as stakeholders navigate an increasingly complex flavonoids ecosystem.

Examining Technological Breakthroughs Consumer Preferences and Regulatory Developments Reshaping the Flavonoids Industry Landscape in the Post-Pandemic Era

The flavonoids landscape is undergoing rapid transformation driven by technological breakthroughs, shifting consumer preferences, and evolving regulatory frameworks. Advances in extraction and purification methods such as supercritical fluid extraction and membrane separation have significantly enhanced yield and purity, enabling manufacturers to deliver standardized flavonoid formulations with consistent bioactivity. At the same time, innovative encapsulation technologies are redefining application possibilities by improving solubility, stability, and controlled release profiles, thereby expanding opportunities in both oral delivery systems and topical solutions. As these technical enhancements mature, they are unlocking new markets for flavonoid-enriched products across supplement, cosmetic, and pharmaceutical pipelines.

Concurrently, consumers are gravitating toward cleanlabel formulations that emphasize natural origins and transparent sourcing. This shift is propelling demand for plantderived flavonoids and is prompting companies to adopt traceability tools such as blockchain and isotopic fingerprinting to validate authenticity. On the regulatory front, agencies in major markets are refining guidelines for flavonoid classification, permissible dosage, and health claims, which is fostering a more standardized global framework. Together these forces are reshaping competitive dynamics: agile innovators with robust supply chain integration and a clear regulatory strategy are best positioned to capitalise on emerging niches. In turn, the confluence of technology, demand, and policy heralds a new era of accelerated growth and intensified innovation across the flavonoids industry.

Assessing the Combined Effects of 2025 United States Tariff Measures on Flavonoid Supply Chains Cost Structures and Global Trade Competitiveness

Recent tariff adjustments enacted by the United States government in early 2025 have introduced significant shifts in the economics of flavonoid imports, prompting stakeholders to reassess sourcing strategies and cost models. These measures, aimed at bolstering domestic production and reducing reliance on foreign supply, have raised import duties on key flavonoid-rich botanical extracts and intermediates. As a consequence, landed costs for imported raw materials have climbed, exerting pressure on the margins of manufacturers who continue to depend on overseas suppliers for highpurity anthocyanins and flavanols. This scenario has accelerated conversations around nearshoring and vertical integration to mitigate exposure to tariff volatility.

In response, some forwardlooking companies are reconfiguring their supply chains to favour domestic or regional extraction facilities, supported by partnerships with agricultural producers cultivating high-yield crops such as berries and tea leaves. Although switching to local sourcing can incur higher cultivation costs, it also offers resilience against trade disruptions and the ability to leverage government incentives aimed at stimulating agricultural innovation. Moreover, the increased cost base is driving downstream players to optimize formulations, reducing overall flavonoid loadings through synergy with complementary bioactives. Consequently, the cumulative impact of U.S. tariff measures is catalyzing a strategic realignment of procurement, production, and formulation practices-one that balances cost efficiency with supply chain security in an increasingly protectionist trade environment.

Uncovering Market Dynamics Through Application Form Type Source and Distribution Channel Segmentation for Comprehensive Strategic Insights in Flavonoid Sectors

A nuanced segmentation framework reveals that flavonoid applications span across diverse end uses, each with its own performance and formulation requirements. Within the animal feed segment, demand is driven by subcategories such as cattle, poultry, and swine, where flavonoid additives contribute to improved livestock health and feed conversion ratios. In cosmetics, the spectrum extends from color cosmetics that harness pigmentstabilizing anthocyanins to haircare systems enriched with proanthocyanidins and skincare serums formulated with potent flavones. Dietary supplements represent another crucial segment unpacked into capsules for targeted delivery, powders designed for functional beverages, and tablets optimized for standardized dosage. The food and beverage vertical encompasses bakery applications that benefit from oxidative stability, beverages ranging from functional waters to botanical teas, confectionery products leveraging natural color enhancement, and dairy innovations fortified with flavanols. Finally, pharmaceutical outlets leverage flavonoids in cardiovascular therapeutics, neurology research pipelines exploring neuroprotective profiles, and oncology adjuncts focusing on bioactive synergy.

Parallel to application segmentation, market insight emerges through the lens of compound type. Anthocyanins, subdivided into cyanidin, delphinidin, and pelargonidin, dominate color and antioxidant applications, while flavanols such as catechins, epicatechins, and proanthocyanidins anchor cardiovascular and neuroprotective studies. Flavanones and flavones continue to garner interest for anti-inflammatory and dermatological indications, whereas isoflavones-including daidzein, genistein, and glycitein-highlight the intersection of plant estrogenicity and hormonal balance. Neoflavonoids round out the compound landscape, representing emerging niches in specialized research. Examining physical form segmentation underscores additional dynamics: capsules remain the preferred modality for precision dosing, gummies offer consumer appeal in nutraceuticals, liquid concentrates enable rapid bioavailability, powders serve flexible formulation needs, and tablets continue to anchor mainstream supplement portfolios. Source classification distinguishes between natural extracts prized for clean label credentials and synthetic analogues engineered for consistency and cost control. Lastly, distribution channels bifurcate into offline retail, where experiential shopping drives discovery, and online retail, which leverages e-commerce growth and direct-to-consumer subscription models. Together, these segmentation insights paint a comprehensive strategic blueprint for targeting and optimizing the flavonoids value chain.

This comprehensive research report categorizes the Flavonoids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Source

- Application

- Distribution Channel

Evaluating Regional Growth Trends Consumer Demand Patterns and Regulatory Landscapes Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional analysis of the flavonoids market reveals distinctive growth drivers and regulatory landscapes across the Americas, Europe Middle East & Africa, and Asia Pacific, each shaped by unique consumer behaviors and industry practices. In the Americas, a surge in preventive healthcare trends is elevating demand for dietary supplements enriched with flavonoids, fueled by wellnessdriven consumers and a strong tradition of nutraceutical innovation. Regulatory clarity in the United States and Canada regarding health claims is enabling more assertive marketing strategies, which in turn amplifies competitive intensity. Additionally, strategic partnerships between ingredient suppliers and major food and beverage brands are fostering coinnovation initiatives that integrate flavonoid extracts into mainstream functional products.

By contrast, the Europe Middle East & Africa region is characterized by stringent regulatory frameworks governing novel food ingredients and health claims, particularly under the European Food Safety Authority’s purview. This has placed a premium on robust clinical evidence and standardized extract profiles, driving manufacturers to invest in advanced analytical capabilities. Within the Middle East and African markets, growth is buoyed by rising consumer interest in natural and traditional remedy ingredients, creating opportunities for locally adapted formulations that blend flavonoids with indigenous botanicals. Trade alliances and harmonized regulations among member states are also facilitating crossborder product launches.

In the Asia Pacific region, rapid urbanization and increasing disposable incomes are stimulating a dual demand for modern dietary supplements and heritage botanical products. Countries such as China, Japan, and South Korea lead in flavonoid extraction technologies, supported by largescale cultivation of tea and berry crops. Moreover, the prevalence of traditional medicine systems in the region underpins innovation in synergistic formulations, combining flavones and isoflavones with established herbal practices. E-commerce proliferation further accelerates market penetration, as digital platforms empower consumers to access international flavonoid brands alongside local offerings. Collectively, these regional insights underscore the necessity of bespoke market strategies that align with regulatory requirements, consumer mindsets, and channel dynamics in each geography.

This comprehensive research report examines key regions that drive the evolution of the Flavonoids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Competitive Positioning and Innovation Offerings from Leading Flavonoid Producers and Emerging Market Entrants

Leading participants in the flavonoids landscape are demonstrating a spectrum of strategic initiatives-ranging from capacity expansion and R&D partnerships to portfolio diversification and digital channel optimization. Major legacy players are intensifying collaboration with academic institutions to accelerate clinical validation of flavonoid efficacy in cardiovascular and neurological contexts. Such alliances not only bolster regulatory submissions but also enrich the scientific narrative that underpins highvalorized extract premiums. Simultaneously, agile startups are carving specialized niches through novel delivery formats-such as microencapsulated flavanone powders that enable rapid assimilation and enhanced stability in beverage applications.

Competitive positioning is increasingly defined by end-to-end supply chain integration. Several vertically integrated firms have established captive cultivation programs for key source crops, securing reliable access to highflavonoid raw materials while guaranteeing traceable quality. This upstream investment is complemented by downstream expansion into direct-to-consumer channels, where subscription models and personalized nutrition platforms offer recurring revenue streams and deeper consumer engagement. Meanwhile, players with a strong presence in color cosmetics are leveraging proprietary extraction patents to introduce multifunctional pigments that deliver both aesthetic and bioactive benefits.

Innovation offerings continue to differentiate market leaders from emerging entrants. Whereas established ingredient houses emphasize highpurity fractions targeting pharmaceutical pipelines, emerging specialists focus on coformulations that combine multiple flavonoid subclasses for synergistic health effects. Digital technologies such as AIenabled predictive modeling are informing compound selection and formulation design, enabling faster time to market and costeffective product development. In this dynamic competitive environment, the ability to balance scientific rigor, cost efficiency, and consumer appeal will determine longterm leadership in the global flavonoids arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flavonoids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alchem International Pvt. Ltd.

- Bioriginal Food & Science Corp.

- Biosynth Carbosynth

- Bordas S.A.

- Cayman Chemical Company, Inc.

- Conagen, Inc.

- Delacon Biotechnik GmbH

- DSM Nutritional Products AG

- EXTRASYNTHESE

- Givaudan S.A.

- Hunan Yuantong Pharmaceutical Co., Ltd.

- Indena S.p.A.

- INDOFINE Chemical Company, Inc.

- Ingredients by Nature, LLC

- J&K Scientific, Ltd.

- Kemin Industries, Inc.

- Layn Natural Ingredients Corp.

- Merck KGaA

- Morre-Tec Industries, Inc.

- Nacalai Tesque, Inc.

- Nans Products, Inc.

- Quercis Pharma AG

- Santa Cruz Biotechnology, Inc.

- Yaan Times Biotech Co., Ltd.

Formulating Targeted Strategic Actions and Best Practices to Strengthen Market Position Optimize Supply Chains and Drive Innovation in Flavonoids

To capitalize on the expanding opportunities within the flavonoids sector, organizations should adopt a series of targeted strategies aimed at strengthening market presence and enhancing operational resilience. First, companies must prioritize supply chain diversification by establishing partnerships with multiple cultivation hubs and processing facilities across different climates and jurisdictions. This approach not only mitigates tariff exposure but also safeguards raw material availability against climatic and geopolitical risks. At the same time, optimizing procurement through integrated demand forecasting and inventory management systems will minimize cost overruns and improve responsiveness to market fluctuations.

In parallel, investing in advanced formulation capabilities-such as nanoencapsulation and coacervation technologies-will enable differentiated products with superior bioavailability and stability. Such technical differentiation should be matched with robust clinical research programs that substantiate health claims and support premium positioning, particularly in highly regulated markets. Moreover, companies can leverage digital marketing platforms and consumer insights analytics to tailor product messaging, harnessing data from e-commerce and social media channels to refine targeting and optimize conversion rates.

Finally, embracing sustainability and circular economy principles throughout the value chain will resonate with environmentally conscious stakeholders and unlock new financing avenues. This includes adopting green extraction methods, integrating organic certified crops, and implementing waste valorization initiatives for residual biomass. By combining strategic supply diversification, innovative formulation, evidencebased validation, and sustainability leadership, industry players will be well positioned to navigate evolving market dynamics and deliver enduring competitive advantage.

Detailing the Structured Research Framework Data Collection Techniques and Analytical Approaches Underpinning the Flavonoids Market Assessment

This market assessment is grounded in a structured research framework that integrates both secondary and primary data sources to ensure comprehensive coverage and analytical rigor. The secondary research phase encompassed an extensive review of scientific literature, patent filings, regulatory archives, and industrywhite papers to map technological advancements and regulatory benchmarks. In parallel, proprietary databases and trade publications were consulted to capture historical trends, competitive landscapes, and key transactional developments within the global flavonoids ecosystem.

Primary research was conducted through in-depth interviews and surveys with stakeholders spanning raw material suppliers, ingredient manufacturers, formulators, and end users. These interactions provided qualitative insights into supply chain challenges, innovation priorities, and end-market adoption barriers. Additionally, ontheground consultations with regional regulatory experts offered nuanced perspectives on compliance requirements and emerging policy shifts. Quantitative validation was achieved through crossreferenced shipment data and trade flow statistics, enabling triangulation of key market dynamics.

Analytical approaches included scenario modeling to evaluate the impact of tariff changes and sensitivity analysis to assess formulation cost drivers under varying raw material price assumptions. Cluster analysis was applied to segmentation dimensions-such as application, compound type, form factor, source origin, and distribution channel-to identify highpotential opportunity pockets. The culmination of these methods ensures that this report delivers robust, actionable intelligence, balancing methodological transparency with strategic depth.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flavonoids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flavonoids Market, by Type

- Flavonoids Market, by Form

- Flavonoids Market, by Source

- Flavonoids Market, by Application

- Flavonoids Market, by Distribution Channel

- Flavonoids Market, by Region

- Flavonoids Market, by Group

- Flavonoids Market, by Country

- United States Flavonoids Market

- China Flavonoids Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Stakeholders Through Evolving Opportunities and Challenges in the Flavonoids Ecosystem

Through rigorous analysis, several overarching themes emerge as critical for stakeholders navigating the flavonoids market. Technological innovation in extraction and formulation stands out as a primary driver of product differentiation and entry barrier expansion, emphasizing the need for continued investment in R&D. Meanwhile, the evolving regulatory environment-particularly tariff adjustments and health claim guidelines-demands dynamic compliance strategies and supply chain agility. Strategic segmentation insights underline that one size does not fit all; tailoring approaches by application, compound type, physical form, source, and distribution channel creates more precise value propositions.

Regional dynamics further illustrate the necessity of localized strategies that align with consumer preferences, regulatory regimes, and channel structures unique to the Americas, Europe Middle East & Africa, and Asia Pacific markets. Competitive benchmarking highlights that integrated supply chains and evidencebased validation are fast becoming table stakes, while emerging players can gain traction through niche coformulations and digital engagement models. Finally, sustainability considerations are transitioning from optional to foundational, influencing everything from sourcing decisions to packaging design and waste management.

Together, these findings converge to form a strategic roadmap that balances innovation, operational resilience, regulatory acumen, and sustainability. Stakeholders equipped with this holistic insight will be empowered to make informed decisions, mitigate risk, and seize highvalue opportunities in an industry poised for continued expansion and sophistication.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Secure Your Comprehensive Flavonoids Market Research Report and Unlock Actionable Insights

To explore how this in-depth intelligence can sharpen your competitive edge and guide strategic decisions, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Ketan’s expertise in translating complex market data into actionable growth strategies will ensure you acquire the right insights and support tailored to your organization’s objectives. Engage now to secure your comprehensive market research deliverable and elevate your planning, innovation, and commercial execution in the dynamic flavonoids landscape

- How big is the Flavonoids Market?

- What is the Flavonoids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?