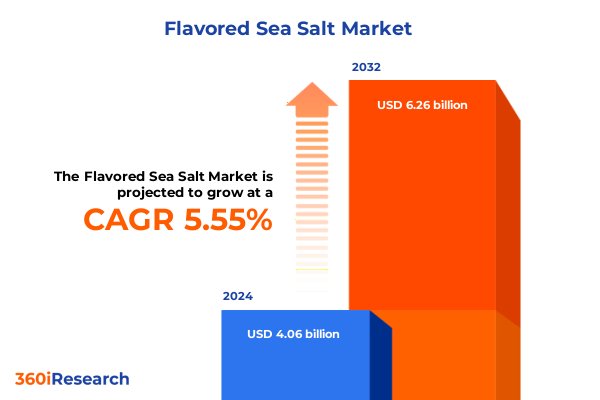

The Flavored Sea Salt Market size was estimated at USD 4.28 billion in 2025 and expected to reach USD 4.51 billion in 2026, at a CAGR of 5.59% to reach USD 6.26 billion by 2032.

Emerging taste revolutions are driving consumer fascination and elevating flavored sea salt far beyond today’s culinary trends

In kitchens from home countertops to Michelin-starred restaurants, flavored sea salt has transcended its humble origins to become a culinary mainstay. Once perceived as a niche artisanal product, it now enjoys prominent placement on supermarket shelves, online marketplaces, and specialty boutiques. This surge in visibility reflects the modern consumer’s desire for elevated taste experiences that blend simplicity with sophistication. As global palates expand, flavor-infused sea salts have emerged as a canvas for experimentation, unlocking new dimensions of aroma, texture, and visual appeal across both savory and sweet applications.

Driving this phenomenon is a convergence of health-focused trends and gourmet curiosity. Discerning diners seek clean-label alternatives to artificial seasonings, favoring natural extracts, botanical essences, and spice blends anchored in wholesome ingredients. Concurrently, the premium food movement incentivizes producers to innovate with exotic flavor pairings and heritage salt varieties, catering to consumers who view quality seasoning as an essential ingredient in their wellness journey. In this environment, the art of salt blending has evolved from simple seasoning to a legitimate area of product differentiation and storytelling.

Moreover, digital platforms and social media have accelerated the rise of flavored sea salt, transforming recipe sharing into a dynamic two-way dialogue between brands and their audiences. From livestreamed cooking demos featuring truffle-infused flakes to user-generated videos showcasing citrus-zested finishing salts, social engagement has become integral to product discovery. Looking ahead, these digital ecosystems will continue to shape consumer expectations, encouraging greater personalization, interactive branding experiences, and cross-category collaborations that redefine the boundaries of seasoning innovation.

Uncover unprecedented shifts in sourcing, production innovations and evolving consumer behavior reshaping the flavored sea salt market dynamics

Over the past five years, sourcing strategies for flavored sea salt have undergone a profound transformation. Artisanal producers increasingly collaborate directly with coastal harvesters and boutique salt farmers, securing traceability and provenance that resonate with ethical consumers. At the same time, technological advances in flavor infusion-such as ultrasonic misting and cold-press extraction-enable manufacturers to embed delicate botanicals, citrus oils, and smoke essences without compromising crystal integrity. These innovations have effectively expanded the palette of viable flavors while ensuring consistency and shelf stability.

On the production front, the divide between small-batch handcrafted operations and scaled industrial facilities has blurred. Mid-sized processors leverage modular equipment to deliver both volume and bespoke flavor profiles, streamlining costs without sacrificing artisanal cachet. Packaging has also evolved in response to consumer demands for freshness and convenience. Resealable glass jars, single-serve sachets, and eco-friendly pouches now accompany traditional grinders and bulk containers, reflecting a nuanced understanding of usage occasions ranging from travel-friendly spices to high-end gifting.

Concurrently, consumer behavior has shifted toward experiential seasoning. No longer satisfied with passive application, modern home cooks and professional chefs alike consider the finishing salt as a final flourish-an interactive ingredient that invites tactile engagement and flavor layering. This trend dovetails with a broader appetite for culinary education, where online classes, recipe apps, and influencer-led challenges empower audiences to explore emerging flavor pairings. As a result, brands that combine product excellence with immersive storytelling stand to capture the largest share of this rapidly maturing category.

Analyzing the cumulative impact of 2025 United States import tariffs on supply chains, pricing strategies and competitive positioning in flavored sea salt

In early 2025, the United States implemented new import tariffs on certain gourmet salts and flavor concentrates, aiming to bolster domestic producers and offset trade imbalances. While these measures target a narrow range of high-value ingredients, their ripple effect has been felt across the broader flavored sea salt segment. Import costs for Mediterranean harvests, Himalayan crystal salts, and specialized flavor extracts have climbed, compelling distributors and retailers to reevaluate long-standing supplier relationships in favor of cost-effective alternatives.

The reconfigured supply chain has prompted many stakeholders to source locally or regionally, shifting emphasis to domestic saltworks that can deliver competitive pricing and reduced transit times. This localization not only mitigates tariff exposure but also aligns with the consumer preference for transparent origin stories. However, smaller salt producers outside traditional import corridors must now scale up operations and refine their flavor-infusion processes to meet growing demand.

Pricing strategies have adapted accordingly. Premium brands have absorbed a portion of the cost increases to maintain accessible retail price points, while economy-tier offerings have consolidated flavor portfolios to streamline procurement. In some cases, value brands have introduced hybrid blends that combine domestic sea salt with minimal imported specialty crystals, preserving perceived quality while controlling unit costs. Meanwhile, private label lines have leveraged their bargaining power to secure volume discounts, intensifying competition among branded products.

Competitive positioning has also shifted. Domestic innovators now tout tariff-resilient sourcing as a brand differentiator, underscoring freshness and supply-chain agility. Legacy importers are exploring forward-hedging agreements and strategic partnerships to secure stable input prices. Ultimately, this recalibration underscores the category’s resilience and adaptability, as both incumbents and newcomers navigate a landscape shaped by regulatory change and evolving consumer priorities.

Deep dive into flavor, distribution and usage segmentation revealing nuanced consumer preferences driving flavored sea salt innovation

An in-depth look at flavor typologies reveals that citrus variants-driven by lemon, lime and orange infusions-continue to attract health-oriented consumers seeking bright, tangy accents. Meanwhile, herb-infused blends featuring basil, oregano, rosemary and thyme appeal to both home cooks and chefs aiming to replicate garden-fresh complexity. Smoked profiles, leveraging apple wood, hickory and mesquite essences, cater to aficionados of barbecue culture and rustic fare. Spiced salts enriched with chili, garlic and pepper have gained traction among those desiring bold heat, and the indulgent truffle segment-encompassing black and white truffle infusions-maintains its premium positioning by lending earthy luxury to simple dishes.

Distribution channels mirror this diversity in flavor. Online retailers continue to expand, with brand websites offering direct-to-consumer exclusives and e-commerce platforms delivering convenient assortment across multiple brands and sub-labels. Specialty stores differentiate themselves through curated assortments and in-store sampling experiences, while supermarket hypermarkets leverage promotional end-caps to introduce new flavor drops alongside household staples.

Application segments also diverge in their purchase motivations. Within foodservice, chefs and culinary professionals seek bulk packaging that facilitates cost-effective flavor experimentation at scale. Conversely, household consumers prioritize single-unit formats that offer versatility for at-table finishing or cooking. Packaging innovation addresses both needs, with refillable glass jars standing alongside sachets designed for one-time use.

Form factor continues to shape consumer choice. Flakes deliver an immediate textural impact, grinders offer on-demand freshness, and powder forms mix seamlessly into marinades and sauces. Pricing tiers span economy offerings that rely on straightforward seasoning blends to premium lines that justify higher points by emphasizing exotic salt origins and organic certification. Together, these segmentation insights illuminate the multi-dimensional consumer ecosystem fueling continued innovation in the flavored sea salt category.

This comprehensive research report categorizes the Flavored Sea Salt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Flavor Type

- Packaging Type

- Form

- Price Tier

- Distribution Channel

- Application

Exploring regional distinctions across the Americas, EMEA, and Asia-Pacific that influence flavored sea salt market trajectories and consumer behaviors

North and South America together form a landscape where both heritage and innovation intersect. In the United States and Canada, an established gourmet culture underpins demand for premium finishing salts, while Latin American markets contribute dynamic growth driven by traditional applications such as empanadas and ceviche. Consumers across the Americas demonstrate a pronounced interest in tangy citrus blends and herbaceous infusions that complement both regional barbecue and emerging plant-based cuisines. As retail giants and e-commerce platforms expand their seasoning portfolios, smaller artisan brands leverage local storytelling and community engagement to cultivate loyal followings and regional niche appeal.

Across Europe, the Middle East and Africa, historical salt production centers in the Mediterranean and North African coast continue to influence flavor offerings. European consumers exhibit a penchant for clean-label, single-origin salts, particularly those infused with Mediterranean herbs or smoked in traditional kilns. In the Middle East, flavors that incorporate sumac and chili resonate alongside household staples, while African markets increasingly explore indigenous botanicals and spice blends that reflect local culinary heritage. Retailers in these regions balance imported specialty salts with domestically sourced varietals, tailoring assortments to diverse palates and fluctuating economic conditions.

Asia-Pacific encompasses a mosaic of taste preferences, from Japan’s affinity for umami-forward seasonings to Australia’s appetite for artisanal gourmet trends. In emerging markets across Southeast Asia and India, value-oriented consumers favor spiced sea salts that enhance street-food staples and home cooking alike. Meanwhile, urban centers in Australia and New Zealand report growing uptake of truffle and herb-infused salts within fine-dining and upscale home cooking segments. Distribution in Asia-Pacific is characterized by rapid e-commerce penetration and a growing number of specialty importers catering to an increasingly adventurous consumer base.

This comprehensive research report examines key regions that drive the evolution of the Flavored Sea Salt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling strategic moves, innovation focus and market positioning of leading flavored sea salt companies shaping the competitive landscape

Leading players in the flavored sea salt arena leverage a blend of heritage expertise and contemporary flair to maintain competitive advantage. Established brands known for traditional salt harvesting have diversified into flavor innovation, applying decades of sourcing knowledge to develop distinctive botanical and spice infusion techniques. These incumbents often partner with small flavor houses to experiment with limited-edition blends, using data from retail pilots and social engagement metrics to refine their offerings.

Artisanal newcomers, meanwhile, capitalize on nimble production models, introducing micro-batches that spotlight rare ingredients and bold flavor combinations. By marketing directly to specialty grocers and online communities, these challengers foster a narrative of exclusivity and craftsmanship. Some have even formed co-op networks that pool sourcing and distribution resources, enabling collective negotiation power and shared promotional activities.

Retail chains and private label suppliers play an increasingly influential role. Supermarket chains with in-house spice brands leverage vertical integration to offer competitive pricing, while inviting local producers to create region-specific flavored salt blends under the retailer’s banner. Simultaneously, digital-native companies experiment with subscription models, delivering curated seasoning collections alongside recipe partnerships and influencer-endorsed tutorials. Together, these strategies underscore a competitive landscape defined by rapid product cycles, collaborative innovation and omnichannel engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flavored Sea Salt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cargill, Incorporated

- J.Q. Dickinson Salt-Works, LLC

- Jacobsen Salt Co., LLC

- K+S Aktiengesellschaft

- Larmon Pty Ltd

- Maldon Salt Company Limited

- McCormick & Company, Incorporated

- Morton Salt, Inc.

- Redmond Real Salt, LLC

- SaltWorks, Inc.

- Tata Chemicals Limited

- The Spice Lab, Inc.

- WBM International, LLC

Empowering industry leaders with actionable strategies to optimize innovation pipelines, supply chain resilience and go-to-market success

To secure a leadership position in the flavored sea salt market, companies should prioritize agile research and development processes that can rapidly translate emerging consumer insights into viable products. By forming cross-functional innovation teams that integrate culinary experts, flavor scientists and supply chain analysts, organizations can accelerate flavor prototyping and streamline pathways from concept to shelf. This approach not only drives first-mover advantage but also fosters a culture of experimentation that resonates with trend-seeking consumers.

Diversifying sourcing portfolios is critical to mitigating tariff impacts and supply disruptions. Industry leaders should cultivate relationships with domestic harvesters while maintaining strategic partnerships with international producers. Such a dual-sourcing model enhances pricing flexibility and supply resilience. Embedding sustainability principles-through eco-friendly packaging, carbon-offset sourcing and transparent traceability-further differentiates brands in a value-driven marketplace.

Optimizing go-to-market execution requires an omnichannel orientation. Leaders must balance legacy retail presence with robust direct-to-consumer capabilities, leveraging data analytics to tailor promotions, personalize subscription offerings and optimize digital storefronts. Collaborations with culinary influencers and chefs can amplify brand stories and demonstrate product versatility, while experiential pop-up events allow consumers to engage firsthand with novel flavor pairings.

Finally, companies should adopt a segmented marketing framework that aligns product attributes, price tiers and packaging formats with distinct target audiences. By leveraging consumer analytics and pilot-scale rollouts, industry leaders can refine launch strategies, minimize market cannibalization and maximize return on investment across both established and emerging channels.

Outlining rigorous mixed-method research approaches ensuring comprehensive insights into flavored sea salt market dynamics and consumer trends

The research methodology underpinning this report employed a rigorous blend of secondary and primary research to ensure depth, accuracy and relevancy. Secondary research began with an extensive review of academic journals, trade publications and publicly available regulatory filings, providing foundational context on salt production, seasoning trends and global trade policies. This phase established a comprehensive baseline of existing knowledge and identified key areas for targeted primary investigation.

Primary research encompassed both qualitative and quantitative techniques. Retail audits conducted across leading supermarkets, specialty grocers and e-commerce platforms offered real-time visibility into product assortments, pricing strategies and packaging innovations. In parallel, in-depth interviews with salt producers, flavor houses and culinary experts yielded nuanced perspectives on emerging technologies, operational constraints and consumer engagement tactics. To quantify market perceptions, structured surveys were fielded among professional chefs, foodservice operators and household consumers, capturing usage patterns, purchase motivations and flavor preferences.

Triangulation of these data sources ensured robust validation of findings. Analytical frameworks synthesized qualitative insights with survey metrics, while trend extrapolation techniques highlighted inflection points in consumer behavior and supply dynamics. This mixed-method approach provided a holistic view of the flavored sea salt landscape, equipping stakeholders with actionable intelligence to inform strategic planning and innovation roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flavored Sea Salt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flavored Sea Salt Market, by Flavor Type

- Flavored Sea Salt Market, by Packaging Type

- Flavored Sea Salt Market, by Form

- Flavored Sea Salt Market, by Price Tier

- Flavored Sea Salt Market, by Distribution Channel

- Flavored Sea Salt Market, by Application

- Flavored Sea Salt Market, by Region

- Flavored Sea Salt Market, by Group

- Flavored Sea Salt Market, by Country

- United States Flavored Sea Salt Market

- China Flavored Sea Salt Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Summarizing essential insights and underscoring the strategic importance of flavored sea salt innovation for future market differentiation

The comprehensive analysis of flavored sea salt has revealed a market characterized by dynamic innovation, resilient supply chains and evolving consumer preferences. Transformative shifts in sourcing and infusion technologies are expanding the flavor repertoire available to producers, while 2025 tariff adjustments have accelerated localization strategies and price-tier optimization. Segmentation insights highlight the multifaceted nature of consumer demand, spanning flavor type, distribution channels, applications, packaging formats, forms and pricing tiers.

Regional nuances underscore the importance of tailored strategies: the Americas’ established gourmet foundations contrast with EMEA’s blend of heritage production and emerging botanical trends, while Asia-Pacific markets balance traditional seasoning practices with rapid premiumization. Competitive landscapes reflect a symbiotic relationship between legacy salt brands, artisanal startups and omnichannel private-label players, all vying to differentiate through provenance, product performance and storytelling.

Industry leaders have clear pathways to seize growth opportunities: agile innovation frameworks, dual-sourcing models, omnichannel go-to-market execution and segmented marketing strategies will drive sustained differentiation. The depth and rigor of research methodologies employed in this study ensure that these recommendations rest on a solid evidentiary base.

As the flavored sea salt market continues to mature, companies that embrace data-driven decision-making and collaborative innovation will be best positioned to capitalize on emerging taste trends and shifting regulatory landscapes. By weaving together technological prowess, sustainability commitments and consumer-centric narratives, forward-thinking brands can redefine seasoning experiences and capture premium positioning in this vibrant category.

Secure exclusive flavored sea salt market insights today by connecting with Associate Director of Sales & Marketing to unlock strategic growth opportunities

If you’re ready to transform your strategic approach with unparalleled market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in gourmet ingredients and commercial partnerships will guide you through the unique findings and growth levers identified in this comprehensive study. By initiating a conversation, you gain direct access to tailored insights, custom data breakdowns, and best-in-class advisory support aimed at elevating your competitive edge. Explore how these strategic revelations can streamline your product launches, optimize pricing frameworks, and uncover untapped consumer segments. Don’t let shifting supply dynamics and evolving consumer palettes pass you by; connect with Ketan today to secure your exclusive flavored sea salt market report and start driving tangible results.

- How big is the Flavored Sea Salt Market?

- What is the Flavored Sea Salt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?