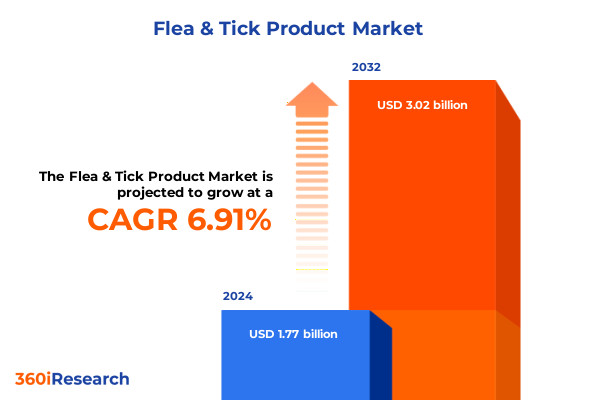

The Flea & Tick Product Market size was estimated at USD 1.89 billion in 2025 and expected to reach USD 2.02 billion in 2026, at a CAGR of 6.93% to reach USD 3.02 billion by 2032.

Emerging Challenges and Opportunities in Flea and Tick Control Products Define the Evolving Pet Health Landscape for Industry Stakeholders

The adult flea and tick preventative space has emerged as a dynamic frontier at the intersection of pet health, consumer convenience, and regulatory complexity. Over recent years, heightened awareness of vector-borne diseases affecting companion animals has propelled demand for efficacious prevention products, while shifting demographics of pet guardians have amplified preferences across product forms and purchase channels. Concurrently, the integration of digital engagement platforms and telehealth consultations with veterinarians has created fresh touchpoints for education and distribution, redefining how manufacturers and retailers communicate value propositions.

Amidst these evolving dynamics, competition has intensified, spurring innovation in sustained-release collars, palatable oral formulations, and advanced topical applications engineered for extended protection. Market participants are challenged to balance efficacy claims, safety profiles, and delivery convenience, even as raw material sourcing becomes more intricate due to global supply chain pressures. To remain at the forefront, stakeholders must cultivate agility in responding to consumer expectations around sustainability, transparency, and cost-effectiveness. This introduction outlines the key forces shaping today’s flea and tick preventative arena, setting the stage for a detailed examination of transformative shifts, trade impacts, segmentation insights, regional nuances, and strategic imperatives that follow.

Innovative Technologies, Regulatory Evolution, and Consumer Behavior Shifts Are Redefining the Flea and Tick Preventative Market Dynamics Globally

The marketplace for flea and tick control is undergoing transformative evolution driven by converging technological, regulatory, and consumer trends. First and foremost, the adoption of connected pet health applications has streamlined prescription renewals and compliance monitoring, enabling digital reminders for monthly spot-on treatments or chewable tablets. Telehealth platforms are also bridging the gap between pet owners and veterinary experts, allowing for more personalized guidance on selecting collars with sustained-release chemistry versus shorter-duration sprays.

On the regulatory side, authorities in the United States and Europe have tightened scrutiny over environmental residues and safety thresholds for active ingredients, prompting manufacturers to reformulate products with next-generation chemistries and biodegradable delivery systems. This shift has catalyzed research collaborations between chemical developers and formulation specialists to optimize wash-resistance in shampoos and dips while mitigating ecotoxicological risk.

Consumer preferences are equally reshaping the landscape; a growing segment of pet owners now seeks holistic wellness solutions, preferring product assortments that address both parasite prevention and skin health. This trend has encouraged cross-category innovation, such as spot-on applicators infused with conditioning agents. Taken together, these developments underscore a market in flux, where agility, innovation, and strategic partnerships are paramount.

Analysis of Recent United States Trade Tariff Adjustments and Their Cumulative Effects on the Flea and Tick Product Supply Chain and Cost Structures in 2025

In 2025, the United States implemented a series of incremental trade tariff adjustments that have notably influenced the cost structure and supply chain resilience of companies in the flea and tick product industry. Key active pharmaceutical ingredients and raw chemical intermediates, many of which are sourced internationally, now carry additional duties imposed under strategic trade measures. These levies have led to a reevaluation of sourcing strategies, with manufacturers exploring alternative suppliers and nearshoring options to offset the burden of import costs.

The cumulative effect of these measures has manifested in a layered impact: production expenses have risen for collar polymers and oral formulation substrates, while packaging materials such as specialized blister packs and UV-protective pouches have also been affected. In response, leading producers have initiated cost-optimization programs within their manufacturing networks, leveraging automation in fill-and-finish processes and renegotiating long-term supply agreements to secure favorable terms.

Furthermore, rising input costs have prompted a strategic repricing exercise across multiple channels, with trade partners in brick-and-mortar outlets absorbing marginal cost increases to maintain retail competitiveness. Simultaneously, several online distributors have introduced tiered subscription pricing models to mitigate the impact on end consumers. This recalibration underscores the critical importance of trade policy vigilance and adaptive procurement planning as vital tools for preserving margin integrity in a tariff-inflationary environment.

Deep Dive into Product, Animal, and Distribution Segmentation Reveals Differential Growth Drivers and Consumer Preferences Across Flea and Tick Solutions

A nuanced look at product type segmentation reveals that demand trajectories vary significantly across delivery formats: collars have captured interest among guardians valuing extended release over time regardless of bathing frequency, whereas oral administration adoption thrives among those seeking ease of dosage accuracy in chewable and tablet forms. At the same time, shampoo and dip solutions continue to play a key role for owners treating severe infestations or preferring topical contact lethality, and spot-on formulations have seen growth fueled by improved dermatological tolerability in recent iterations. Spray applications, while traditionally perceived as less long-lasting, retain a niche among travelers and outdoor enthusiasts requiring rapid-deployment barrier protection.

Turning to the animal type landscape, dogs represent the largest cohort driving innovation and marketing investment, given their heightened outdoor exposure and grooming needs. However, the cat segment has exhibited robust upticks as proprietors prioritize safe, palatable oral chews and low-drip topicals designed for feline coat and skin sensitivities. Behavioral factors such as ease of administration influence these distinctions, encouraging tailored messaging and formulation adjustments for each companion species.

In distribution channel segmentation, offline remains indispensable for immediate point-of-sale advisement through veterinary clinics and pet specialty stores, enabling expert guidance and impulse acquisitions. Conversely, online channels have surged as e-commerce platforms harness subscription services, data-driven reordering algorithms, and loyalty programs to secure repeat purchases. These channel dynamics underscore the importance of integrated omnichannel strategies to capture consumers at various stages of the purchasing journey.

This comprehensive research report categorizes the Flea & Tick Product market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Distribution Channel

Comparative Regional Analysis Uncovers Diverse Drivers in the Americas, Europe Middle East Africa, and Asia Pacific Flea and Tick Product Markets

Across the Americas, the flea and tick preventative ecosystem is characterized by mature market dynamics, with established brand loyalty and a sophisticated veterinary infrastructure that supports premium product tiers. In the United States and Canada, pet guardians exhibit a pronounced preference for scientifically validated formulations and convenience-driven subscription offerings, while Latin American markets demonstrate growing receptivity to value-oriented and multipurpose shampoo formulations.

In the Europe, Middle East and Africa region, regulatory alignment under various health authorities has encouraged harmonization of active ingredient approvals, fostering cross-border brand expansions. Western European countries show strong uptake of eco-friendly collars and contactless spray devices, whereas emerging markets in Eastern Europe and the Middle East are witnessing accelerating demand for cost-effective oral treatments. Meanwhile, African distributors are gradually incorporating both offline veterinary channels and mobile e-commerce solutions to reach underserved communities.

Within Asia-Pacific, the market is propelled by rapidly rising pet adoption rates and an increasing middle-class willingness to invest in premium health offerings. Australia and Japan lead in high-margin chewable tablet uptake, supported by rigorous quality standards, while Southeast Asian nations are seeing a blend of traditional dip treatments and innovative spot-on systems. Across all three regions, digital marketing and localized educational campaigns have been instrumental in driving awareness and fueling category expansion.

This comprehensive research report examines key regions that drive the evolution of the Flea & Tick Product market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Strategies of Leading Global Flea and Tick Product Manufacturers Highlight Innovation and Market Expansion Tactics

The competitive landscape is dominated by several global leaders that combine extensive R&D pipelines with broad distribution networks. One major entity leverages robust chemical synthesis expertise to launch novel active ingredients with reduced environmental persistence, while another focuses on strategic partnerships with veterinary institutions to co-brand educational initiatives and gain preferential formulary listings. A third key participant has differentiated itself through integrated digital platforms that facilitate direct subscription services and telehealth consultations.

Beyond these established manufacturers, emerging specialized players are capturing share through niche positioning, such as collars with integrated GPS and activity monitoring features or organic plant-based sprays that cater to eco-conscious consumers. In parallel, private-label programs with large-scale retailers are gaining traction, offering competitively priced spot-on and chewable alternatives to premium brands. This trend has driven incumbents to enhance brand loyalty through targeted loyalty programs, bundled offerings, and value-added services like free online safety consultations.

Collaborative ventures between chemical innovators, formulation experts, and packaging specialists have also proliferated, fostering co-development agreements that accelerate time-to-market while sharing development risk. These strategic alliances signal a maturing industry that prioritizes cross-functional integration and customer-centric product portfolios over unilateral expansion tactics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flea & Tick Product market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced PetCare of Northern Nevada, Inc.

- Beaphar B.V.

- Boehringer Ingelheim International GmbH

- Central Garden & Pet Company

- Ceva Santé Animale S.A.

- Dechra Pharmaceuticals PLC

- Ecto Development Corporation

- Elanco Animal Health Incorporated

- Eli Lilly and Company

- Godrej Consumer Products Limited

- Heska Corporation

- IDEXX Laboratories, Inc.

- Merck & Co., Inc.

- Merial

- Norbrook Laboratories Limited

- PetIQ, Inc.

- Radio Systems Corporation

- Sergeant’s Pet Care Products, Inc.

- Sogeval S.A.

- Spectrum Brands Holdings, Inc.

- Sumitomo Chemical Co., Ltd.

- The Hartz Mountain Corporation

- Vetoquinol S.A.

- Virbac S.A.

- Wellmark International, Inc.

- Zoetis Inc.

Actionable Strategies for Executives to Enhance Market Position Through Innovation, Channel Optimization, and Regulatory Alignment in Flea and Tick Solutions

To navigate the evolving flea and tick preventative environment, industry leaders should prioritize end-to-end supply chain transparency by investing in digital traceability solutions that monitor raw material provenance and tariff exposure. By integrating procurement analytics with external trade policy feeds, executives can anticipate duty changes and proactively adjust sourcing strategies, maintaining margin resilience without compromising quality.

Simultaneously, companies must enrich consumer engagement through personalized content and digital health tools that support adherence, such as mobile alerts for dosage intervals and veterinarian-endorsed tutorials. Leveraging data from online channels to refine segmentation models will enable tailored product recommendations that increase repeat purchases and brand advocacy. Partnerships with telehealth platforms can further differentiate offerings by delivering professional guidance directly to pet guardians.

On the innovation front, focusing R&D efforts on formulations that combine multi-parasite efficacy with ancillary health benefits-like coat conditioning agents or natural odor neutralizers-will address the holistic wellness trend. To reinforce competitive positioning, organizations should explore co-branding opportunities with leading veterinary networks and lifestyle influencers, bolstering credibility. These strategies, grounded in agility, digital engagement, and product differentiation, will equip leaders to capture opportunities in a fragmented and rapidly changing marketplace.

Comprehensive Research Framework Combining Primary Interviews, Extensive Secondary Data, and Rigorous Analytical Techniques Underpinning the Report Findings

This report’s findings are underpinned by a robust research framework combining primary and secondary data methodologies. Primary research involved in-depth interviews with senior executives from key animal health manufacturers, formulation experts, and procurement leads across supply chain partners. In parallel, structured discussions with practicing veterinarians and channel specialists provided frontline perspectives on adoption hurdles and emerging product preferences.

Secondary research encompassed the analysis of trade data, regulatory filings, patent registries, and scientific literature to chart ingredient approvals and tariff-related policy changes. Comprehensive review of financial disclosures and investor presentations offered insight into investment priorities and growth projections at leading companies. Additionally, web-based consumer behavior tracking and e-commerce analytics were leveraged to quantify online purchasing trends and subscription program performance.

Data triangulation and validation procedures were rigorously applied throughout the process, ensuring consistency between interview outputs and publicly available information. Customized analytical models then synthesized these inputs to reveal segmentation patterns, regional variances, and strategic imperatives that form the core of the report’s actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flea & Tick Product market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flea & Tick Product Market, by Product Type

- Flea & Tick Product Market, by Animal Type

- Flea & Tick Product Market, by Distribution Channel

- Flea & Tick Product Market, by Region

- Flea & Tick Product Market, by Group

- Flea & Tick Product Market, by Country

- United States Flea & Tick Product Market

- China Flea & Tick Product Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Navigating Future Growth Opportunities and Challenges in the Flea and Tick Preventative Market Demands Agility and Collaborative Ecosystem Engagements

As the flea and tick preventative market continues its rapid evolution, stakeholders must embrace a multifaceted approach that integrates supply chain resilience, digital enablement, and product innovation. The convergence of regulatory pressures, shifting consumer expectations, and new trade dynamics compels manufacturers and distributors to maintain vigilant market intelligence and agile operational frameworks.

Companies that successfully harness advanced analytics to anticipate raw material cost fluctuations, tailor offerings to species-specific needs, and cultivate omnichannel engagement will be best positioned to sustain growth. Strategic collaboration across chemical developers, veterinary experts, and distribution partners will accelerate innovation cycles and deepen market penetration. By prioritizing holistic wellness solutions that address both parasite prevention and companion animal health, industry participants can strengthen differentiation and foster long-term customer loyalty.

Ultimately, the capacity to adapt to evolving environmental, regulatory, and behavioral drivers will determine competitive success. This conclusion encapsulates the imperative for continuous scenario planning, cross-functional coordination, and investment in future-proof technologies to navigate complexities and seize emerging opportunities within the dynamic flea and tick preventative landscape.

Unlock Comprehensive Flea and Tick Preventative Market Intelligence Today by Engaging with Our Associate Director for Exclusive Report Acquisition

To access the full breadth of insights and detailed analysis presented in this report, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) who can guide you through the key findings and help you secure the complete market research package tailored to your strategic needs. By initiating a conversation today, you will gain direct support in understanding the report’s unique contributions, exploring custom data deliverables, and identifying the most relevant sections that will drive your business forward. Engaging with Ketan will ensure you capitalize on the latest trends, tariff impact analyses, segmentation perspectives, and actionable recommendations to inform your product development and go-to-market strategies without delay. Don’t miss the opportunity to empower your organization with authoritative intelligence on the flea and tick preventative market; contact Ketan Rohom to begin the process of acquiring the comprehensive report that underpins effective decision-making and long-term competitive advantage.

- How big is the Flea & Tick Product Market?

- What is the Flea & Tick Product Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?