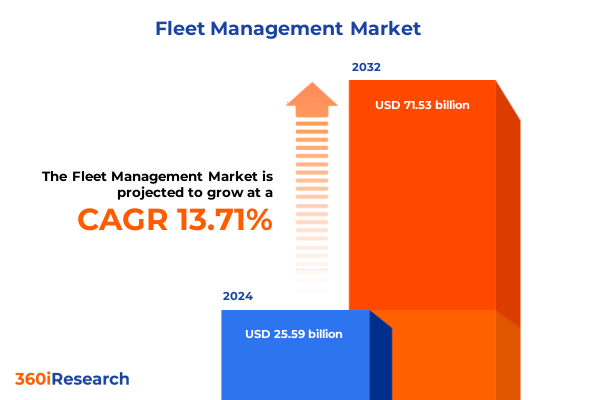

The Fleet Management Market size was estimated at USD 28.98 billion in 2025 and expected to reach USD 32.90 billion in 2026, at a CAGR of 13.77% to reach USD 71.53 billion by 2032.

Setting the Stage for Evolution in Fleet Management with Unprecedented Operational Complexity and Digital Transformation Challenges

Fleet management has transitioned from a purely operational discipline to a strategic imperative, driven by the convergence of advanced telematics, data analytics, and rigid regulatory requirements. Organizations now rely on connected sensors, real-time tracking, and predictive algorithms to optimize routes, maximize uptime, and enforce compliance with environmental and safety mandates. This technological transformation not only elevates efficiency but also demands a holistic approach to change management, workforce training, and cross-functional collaboration. As the industry pivots toward end-to-end visibility, executives must reconcile legacy infrastructure with modern digital tools, striking a balance between innovation and risk mitigation.

In today’s landscape, fleet operators face mounting pressure to reduce carbon footprints, control rising fuel and maintenance expenses, and improve driver safety without compromising service quality. These imperatives are underscored by volatile fuel prices, evolving emissions standards, and heightened public scrutiny of corporate sustainability practices. Consequently, leaders must cultivate agility in procurement, operations, and strategic planning to navigate disruption. With the pace of technological evolution accelerating, this report sets out to define key drivers, emerging threats, and best practices that will shape the next frontier of fleet management excellence.

Unveiling the Groundbreaking Technological and Regulatory Shifts Redefining Fleet Management Strategies and Competitive Dynamics

Fleet management is experiencing a profound metamorphosis as new technologies and regulatory frameworks reshape every link in the supply chain. The adoption of artificial intelligence and machine learning in telematics analytics is enabling fleets to predict maintenance needs, detect anomalous driving patterns, and derive actionable insights from terabytes of operational data. Meanwhile, 5G connectivity and edge computing are dissolving latency constraints, empowering instantaneous decision-making and seamless integration with smart city infrastructures.

Regulatory bodies are also exerting transformative influence, mandating stricter emissions targets and safer in-cab protocols that accelerate the retirement of older vehicles and incentivize the deployment of alternative drivetrains. These shifts compel fleet operators to re-evaluate asset lifecycles, total cost of ownership considerations, and ecosystem partnerships. The convergence of digital, regulatory, and environmental forces is fostering new business models-such as Mobility-as-a-Service and subscription-based telematics-that challenge traditional ownership paradigms. As fleet leaders navigate this fluid environment, strategic agility and technology ecosystem orchestration become indispensable.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Supply Chains Service Providers and Equipment Costs

In 2025, the United States implemented a series of tariff escalations targeting critical hardware components commonly used in fleet management solutions. These measures recalibrated the cost structures for cameras, onboard units, and sensor arrays by imposing duties on imports from key manufacturing hubs. As a result, equipment providers and integrators have faced increased input costs, prompting many to reassess their supplier networks and negotiate volume-based rebates to preserve margin integrity.

The ripple effects extend to software and service segments, where integration fees and consulting rates have marginally increased to offset hardware cost inflation. Vehicle manufacturers and parts suppliers are realigning production schedules, favoring onshore assembly or nearshore partnerships to circumvent duty burdens. In parallel, some technology firms have accelerated R&D efforts to redesign components with domestically sourced materials or alternative chipsets that fall outside the tariff regime. Collectively, these adjustments have spurred a wave of supply chain diversification and inventory buffering strategies, elevating the importance of transparent end-to-end visibility and collaborative forecasting between manufacturers, distributors, and fleet operators.

Decoding Critical Segmentation Insights to Illuminate Varied Fleet Management Solutions Across Offerings Propulsion Connectivity and Industry Verticals

Fleet management solutions now span a comprehensive spectrum of offerings, from hardware to software and professional services, each addressing distinct operational challenges. Within hardware, dashcams, rear view cameras, and advanced sensing cameras capture rich visual data streams, while onboard units consolidate sensor inputs and transmit real-time location signals. Sensors for tire pressure, load weight, and engine diagnostics complement these platforms to enable granular monitoring. On the service front, consulting engagements guide strategic roadmap development, system integration ensures native interoperability, and support and maintenance services uphold system reliability across the asset lifecycle.

Meanwhile, software solutions have matured to encompass real-time tracking that empowers dispatchers with live visibility, route optimization engines that curtail fuel consumption and drive times, and telematics analytics tools that convert raw data into predictive insights. When examining fleet propulsion, electric powertrains are gaining traction for urban fleets aiming to meet stringent emissions targets, hybrids serve as transitional solutions for long-haul operators balancing range and efficiency, and internal combustion engines remain predominant in regions with limited charging infrastructure.

Fleet size plays a decisive role in technology adoption: large enterprises deploy end-to-end platforms with advanced analytics, medium fleets prioritize modular solutions that can scale, and smaller operators often seek cost-effective, plug-and-play systems. Connectivity choices further influence solution design; cellular networks provide ubiquitous coverage for regional operations, whereas satellite links ensure uninterrupted connectivity in remote corridors. Cloud-based deployment equips organizations with rapid provisioning and seamless updates, while on-premise installations appeal to customers with stringent data sovereignty and latency requirements.

End-use industries reveal distinct usage patterns. Construction firms leverage ruggedized hardware and predictive maintenance to minimize downtime on worksites; government agencies demand compliance with security protocols and support multi-jurisdictional deployments; oil and gas operators focus on hazardous environment certifications and remote monitoring; and transportation and logistics players, spanning last mile delivery to long haul, optimize for cost reduction and end-to-end transparency. Applications such as driver behavior monitoring foster safety culture, fuel management systems clamp down on wastage, route planning modules streamline workflows, and maintenance management-both predictive and preventive-proactively tackles unplanned failures.

These interlocking segmentation layers underscore the importance of a tailored approach: one size does not fit all, and understanding the interplay between offerings, propulsion type, fleet size, connectivity, deployment mode, end-use industry, and application is crucial for crafting solutions that unlock maximum operational value.

This comprehensive research report categorizes the Fleet Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Propulsion Type

- Connectivity Type

- Pricing Model

- Ownership Model

- Fleet Size

- Fleet Type

- Application

- End Use Industry

Revealing Key Regional Dynamics and Growth Drivers Spanning the Americas Europe Middle East Africa and Asia Pacific Powerhouse Markets

Regional dynamics cast a significant imprint on fleet management strategies and growth trajectories. In the Americas, a combination of robust infrastructure investment and progressive emissions regulations has fueled rapid uptake of electric fleets in metropolitan areas while sustaining demand for advanced telematics in long-haul trucking corridors. Large logistics operators have been early adopters of end-to-end visibility platforms to streamline cross-border freight movement and manage driver hours under complex multinational regulations.

Across Europe, the Middle East, and Africa, disparate regulatory landscapes and infrastructure maturity levels dictate a hybrid approach. Western European nations exhibit high penetration of cloud-based fleet solutions paired with green mobility incentives, whereas emerging markets in Eastern Europe and the Middle East prioritize low-cost connectivity solutions and durable hardware suited for challenging terrains. Africa’s telematics landscape is characterized by cellular connectivity hubs in major cities and increasing interest in satellite-enabled monitoring for mining and extractive operations.

In the Asia-Pacific region, fleet operators navigate a tapestry of dense urban centers, sprawling megacities, and off-grid industrial zones. Japan and South Korea lead with integrated smart city deployments that align fleet telemetry with traffic management systems. Southeast Asian countries show accelerated adoption of subscription-based models to lower upfront investment barriers. Australia’s vast geography underlines the critical importance of satellite-backed communications and predictive maintenance to support remote operations. China’s stringent emissions policies continue to drive electrification, while India’s expanding e-commerce sector is catalyzing demand for scalable last mile delivery solutions.

This comprehensive research report examines key regions that drive the evolution of the Fleet Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Fleet Management Vendors with Strategic Moves Financial Health and Innovation Roadmaps Shaping Industry Competition

A handful of global and regional players are steering the competitive landscape through differentiated portfolios, strategic partnerships, and targeted innovation. Leading vendors are investing heavily in AI-driven analytics to enhance route efficiency and maintenance forecasting, while forging alliances with telecom providers to bundle connectivity services. These companies are also expanding their professional service arms to address bespoke integration challenges, particularly in industries with specialized compliance requirements.

Strategic acquisitions have become commonplace as firms seek to complement their core offerings with niche capabilities such as advanced computer vision, carbon footprint tracking, or multi-modal logistics orchestration. Investment in cybersecurity has surfaced as a board-level priority to safeguard connected vehicles against emerging threats. Additionally, partnerships with original equipment manufacturers enable deeper integration at the vehicle assembly stage, reducing time-to-value for end customers.

Financially, these vendors demonstrate resilient revenue streams from recurring service contracts and software subscriptions, offsetting cyclicality in hardware sales. Their innovation roadmaps prioritize modular architectures, open APIs, and no-code development environments to empower customers to tailor solutions without extensive IT overhead. As the competitive stakes heighten, differentiation is increasingly derived from the quality of data insights, ease of implementation, and the vendor’s ability to support cross-fleet interoperability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fleet Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Verizon Communications Inc.

- Solera

- Bridgestone Corporation

- Samsara Inc.

- Trimble Inc.

- Robert Bosch GmbH

- Geotab Inc.

- Siemens AG

- Scania CV AB by Volkswagen Group

- Continental AG

- Cisco Systems, Inc.

- International Business Machine Corporation

- Michelin Group

- JLG Industries, Inc. by Oshkosh Corporation

- Oracle Corporation

- Denso Corporation

- Wheels, LLC

- Powerfleet, Inc.

- Chevin Fleet Solutions

- Ford Motor Company

- GPS Insight

- Netradyne

- Octo Group S.p.A

- Pidge Technologies Private Limited

- Rarestep, Inc.

- Roadz

- Tenna LLC

- Zenmov Inc

Actionable Roadmap for Industry Leaders to Drive Operational Excellence Sustainability and Digital Transformation in Fleet Management Ecosystems

To thrive amid intensifying competition and technological disruption, industry leaders should embark on a strategic roadmap that intertwines operational excellence with sustainability and digital maturity. First, organizations must centralize their telematics and sensor data within a unified analytics platform that delivers actionable insights through intuitive dashboards and automated alerts. By breaking down data silos, teams can accelerate decision cycles and empower frontline managers with real-time performance metrics.

Next, companies should adopt a phased electrification strategy that aligns with regional charging infrastructure and total cost of ownership analyses. Piloting electric vehicles in urban delivery routes where duty cycles and charging windows are predictable can yield quick wins, while hybrid solutions can bridge the transition for mixed-fleet operators. Simultaneously, embedding predictive maintenance capabilities will reduce unscheduled downtime by leveraging machine learning models trained on historical engine and component performance.

Leadership must also foster an innovation culture by establishing cross-functional centers of excellence. These hubs should collaborate with IT, operations, and external technology partners to prototype and scale proof-of-concepts rapidly, whether for advanced driver assistance systems or carbon tracking modules. Finally, network resilience requires developing multi-tiered connectivity strategies that combine cellular, satellite, and edge caching to ensure uninterrupted data flow, particularly in remote corridors and critical infrastructure projects.

Transparent and Rigorous Research Methodology Unveiling Data Sources Analytical Framework and Validation Strategies for Maximum Credibility

This research leverages a robust methodology centered on triangulating primary interviews, secondary data, and validation protocols to ensure comprehensive coverage and high confidence in findings. Primary data was gathered through in-depth discussions with fleet managers, telematics providers, and regulatory experts, offering firsthand perspectives on adoption hurdles, technology efficacy, and organizational priorities.

Secondary research drew on industry white papers, patent filings, corporate filings, and transportation authority publications to quantify trends and map technology roadmaps. The analytical framework integrates qualitative and quantitative matrices, enabling cross-segmentation comparisons and scenario analysis. Key performance indicators were defined across operational, financial, safety, and sustainability dimensions, providing a multi-lensed assessment of vendor and solution performance.

To bolster accuracy, findings underwent a multi-stage validation process, including expert panel reviews and client workshops. This iterative feedback ensured alignment with real-world operational constraints and strategic objectives. The research process is fully documented, with transparent disclosure of data sources, assumptions, and analytical models, delivering a repeatable and auditable framework for future studies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fleet Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fleet Management Market, by Offering

- Fleet Management Market, by Propulsion Type

- Fleet Management Market, by Connectivity Type

- Fleet Management Market, by Pricing Model

- Fleet Management Market, by Ownership Model

- Fleet Management Market, by Fleet Size

- Fleet Management Market, by Fleet Type

- Fleet Management Market, by Application

- Fleet Management Market, by End Use Industry

- Fleet Management Market, by Region

- Fleet Management Market, by Group

- Fleet Management Market, by Country

- United States Fleet Management Market

- China Fleet Management Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3657 ]

Compelling Conclusions Synthesizing Key Findings Strategic Implications and Next Steps to Navigate the Future of Fleet Management

The convergence of advanced telematics, evolving regulatory mandates, and disruptive technologies has irrevocably reshaped the fleet management horizon. By dissecting transformative shifts, tariff impacts, segmentation nuances, and regional dynamics, this report delivers a multifaceted view of the competitive landscape. Stakeholders now possess the strategic clarity required to align investments with their operational and sustainability objectives.

Key takeaways underscore the importance of unified data platforms, supply chain diversification in response to tariff volatility, and targeted deployment strategies that account for fleet size, connectivity preferences, and industry-specific requirements. Moreover, regional insights reveal that tailored approaches-whether electrification in Europe, hybrid models in North America, or satellite-backed monitoring in remote Asia Pacific corridors-are essential to capturing maximum value.

As fleet operators and vendors chart their next moves, embracing an agile methodology and fostering ecosystem partnerships will differentiate the leaders from the followers. This conclusion sets the stage for decisive action: prioritizing innovation, reinforcing resilience, and committing to sustainable practices that propel fleet management into its next evolutionary chapter.

Empowering Decision Makers to Secure Comprehensive Fleet Management Intelligence with Personalized Support from Associate Director Ketan Rohom

To explore a tailored fleet management solution and gain direct insights into the latest intelligence report, please connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings deep expertise in articulating how strategic data and analytics can resolve complex fleet challenges, and he can guide your team through the report's findings. Reach out to discuss customization options, detailed cost breakdowns, and implementation support tailored to your organization’s unique operational requirements. Secure your competitive advantage today by engaging with Ketan for a personalized consultation that will accelerate your decision-making and ensure seamless integration of proven best practices into your fleet management strategy.

- How big is the Fleet Management Market?

- What is the Fleet Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?