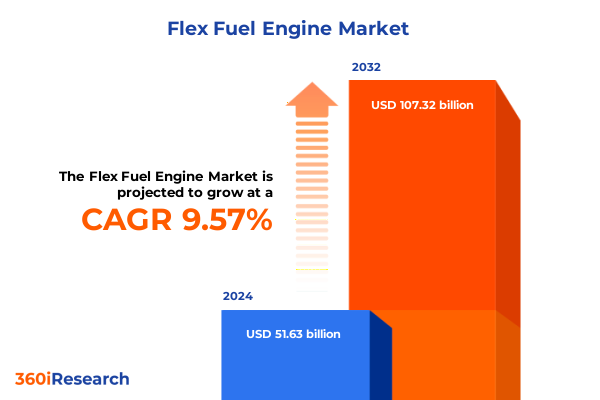

The Flex Fuel Engine Market size was estimated at USD 56.37 billion in 2025 and expected to reach USD 61.56 billion in 2026, at a CAGR of 9.63% to reach USD 107.32 billion by 2032.

Navigating the Horizon of Flex Fuel Engine Innovations and Market Dynamics in an Evolving Energy Ecosystem

The flex fuel engine market stands at a pivotal juncture where technological breakthroughs intersect with shifting energy priorities and evolving regulatory frameworks. In recent years, the drive toward more sustainable and versatile propulsion systems has reshaped how automakers and component suppliers approach engine development. As governments worldwide tighten emissions standards and incentivize the use of renewable fuel blends, manufacturers are accelerating the integration of multi-fuel capabilities into both legacy platforms and new vehicle architectures. This convergence of policy and innovation has created fertile ground for flex fuel engines to emerge as a cornerstone of the broader transition toward decarbonized mobility.

Moreover, changing consumer perceptions regarding environmental impact and fuel economy have further bolstered interest in vehicles capable of operating on ethanol, methanol, and advanced diesel formulations. Particularly in regions where infrastructure for high-blend ethanol fuels is expanding, end users seek powertrains that offer flexibility without compromising performance or reliability. Automotive OEMs are responding by investing in advanced engine control systems, adaptive fuel injectors, and materials engineered to withstand diverse blend chemistries. Consequently, the flex fuel engine market has become a dynamic arena where collaboration between fuel producers, component innovators, and vehicle manufacturers is paramount to achieving technical viability and market acceptance.

In essence, the stage is set for an accelerated deployment of flex fuel technologies across multiple transport segments. These engines not only address the need for reduced greenhouse gas emissions but also enhance energy security by diversifying fuel sources. As such, industry stakeholders must align research and development efforts with emerging policy incentives and consumer demand patterns to capture the full potential of this transformative propulsion solution.

How Regulatory Mandates, Advanced Fuel Systems, and Consumer Demand Are Redefining the Flex Fuel Engine Competitive Landscape

In recent years, the flex fuel engine landscape has undergone transformative shifts driven by stringent global emissions mandates, breakthroughs in alternative fuel formulations, and intensifying competitive pressures among OEMs. Regulatory bodies across North America, Europe, and Asia have enacted advanced standards for tailpipe emissions, compelling manufacturers to develop engines capable of utilizing high-blend ethanol and methanol fuels while maintaining or enhancing efficiency. This regulatory impetus has galvanized investment in adaptive engine management platforms that can seamlessly transition between fuel types based on availability and optimal combustion parameters.

Concurrently, fuel producers have advanced bioethanol and synthetic methanol production pathways, increasing availability of high-purity alcohol fuels that meet or exceed ASTM specifications. These developments have reduced concerns over fuel compatibility and material degradation, thereby lowering barriers to consumer adoption. At the same time, component suppliers have introduced corrosion-resistant coatings and high-precision injectors that enhance durability and maintain engine performance across varying fuel blends. Such innovations underscore a broader shift from single-solution approaches toward integrated powertrain architectures with embedded flex fuel functionality.

Furthermore, evolving consumer preferences highlight a growing appetite for vehicles offering energy choice and resilience against fuel price volatility. In emerging markets, particularly across Latin America and Southeast Asia, increased infrastructure investments in biofuel distribution networks are driving consumer willingness to adopt flex fuel vehicles. This geographic expansion is accompanied by strategic partnerships between automakers and energy companies seeking to lock in fuel supply and streamline distribution. Ultimately, these interactive trends are redefining competitive benchmarks and establishing flex fuel engines as a key pillar in the global pursuit of sustainable mobility.

Analyzing the Strategic Realignment Triggered by United States Tariff Policies and Their Supply Chain Repercussions in 2025

Throughout 2025, the United States has implemented a series of tariffs on imported flex fuel components and fuel blends, resulting in significant realignments within supply chains and procurement strategies. These trade duties, aimed at protecting domestic manufacturing capabilities and stimulating local production of advanced fuel systems, have raised costs for imported injectors, valve assemblies, and specialized sensor technologies. As a direct consequence, OEMs and tier-one suppliers have reevaluated sourcing strategies, shifting toward domestic or regional partners that can meet escalating technical and volume requirements.

These tariff measures have not only impacted procurement but also accelerated investments in onshore manufacturing facilities. Companies with existing U.S. operations have expanded capacity for flex fuel-specific engine components to mitigate elevated import expenses. Moreover, midstream suppliers producing ethanol and methanol blends for fuel distribution have adjusted their logistics networks to prioritize domestic production hubs, thereby reducing exposure to cross-border duties. This reconfiguration has also spurred collaboration between fuel producers and downstream engine manufacturers to harmonize blend specifications and material tolerances, ensuring consistent performance under the new trade environment.

In parallel, OEMs have responded by reinforcing their innovation roadmaps, incorporating tariff-driven cost increases into long-term product portfolio strategies. By leveraging modular engine designs and standardized flex fuel platforms, manufacturers aim to maintain competitive pricing while delivering advanced multi-fuel capabilities. Consequently, the cumulative impact of U.S. tariff policies in 2025 has catalyzed a strategic shift toward localized manufacturing ecosystems and deeper partnerships across the value chain, marking a decisive turning point for the flex fuel engine sector.

Uncovering Critical Segmentation Dimensions That Drive Tailored Flex Fuel Engine Solutions Across Diverse Use Cases

An in-depth look at market segmentation reveals critical distinctions in how flex fuel engine solutions align with diverse operational requirements and customer priorities. Based on fuel type, diesel blend applications emphasize robust torque and longevity for heavy-duty contexts, whereas ethanol blend platforms prioritize higher octane ratings and reduced carbon intensity for passenger vehicles. Methanol blend compatibility emerges as a niche opportunity where lightweight engines can deliver rapid cold-start performance and lower production costs.

Furthermore, engines categorized by blend type from E10 to E25 excel in balancing everyday fuel availability with modest emission reductions, while platforms compatible with E25 to E85 are purpose-engineered for markets with mature ethanol infrastructure and aggressive sustainability mandates. Above E85 systems push the boundaries of flex fuel capabilities, enabling usage of near-pure ethanol for maximal decarbonization scenarios. When considering engine capacity, compact-size units find demand in urban mobility solutions and two-wheeler applications, whereas full-size engines dominate commercial and industrial equipment owing to their higher output capabilities.

Vehicle type segmentation also offers nuanced insights. Commercial vehicles, spanning light and heavy classifications, leverage flex fuel engines to meet fleet-level sustainability commitments and reduce total cost of ownership through alternative fuel discounts. Passenger vehicles benefit from flexible fueling options that address regional fuel availability inconsistencies. Two-wheelers represent a growing segment in densely populated markets where low-cost ethanol blends enhance fuel efficiency and affordability. In addition, the application landscape-ranging from agricultural equipment to marine-demonstrates how flex fuel powertrains adapt to specialized performance criteria under varying environmental and operational stresses.

End-user profiling uncovers further strategic considerations: commercial fleet operators seek standardized engine platforms that simplify maintenance and fueling logistics, government fleets target local fuel mandates to achieve public sector sustainability objectives, and individual consumers look for vehicles that deliver both eco-friendly credentials and day-to-day practicality. Lastly, sales channel differentiation between aftermarket outlets and original equipment manufacturers reflects a dichotomy in customization flexibility versus factory-grade integration. Collectively, these segmentation dimensions inform targeted product development and marketing approaches across the flex fuel engine ecosystem.

This comprehensive research report categorizes the Flex Fuel Engine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Blend Type

- Engine Capacity

- Vehicle Type

- Application

- End User

- Sales Channel

Exploring the Unique Drivers and Infrastructure Profiles Fueling Regional Variations in Flex Fuel Engine Uptake

Regional perspectives underscore divergent growth catalysts and infrastructure readiness levels shaping flex fuel engine adoption worldwide. In the Americas, an established ethanol supply chain in countries like Brazil and growing biofuel mandates in the United States have created a conducive environment for high-blend ethanol engine platforms. North American governments are introducing incentive programs that complement renewable fuel standards, encouraging OEMs to certify vehicles for multi-fuel compatibility. Meanwhile, Latin American markets leverage decades-old ethanol partnerships, channeling robust agricultural feedstock availability into sustainable fuel production and distribution.

Europe, the Middle East & Africa present a mosaic of regulatory frameworks and resource endowments. Within Europe, stringent CO₂ targets and carbon pricing mechanisms are intensifying the case for alcohol-based fuel solutions, particularly in heavy commercial transport corridors. Several MENA countries are exploring synthetic methanol from renewables to decarbonize shipping and inland logistics, thereby opening avenues for methanol-capable flex fuel engines. In Africa, nascent bioethanol initiatives, coupled with expanding agricultural sectors, are laying the groundwork for future flex fuel infrastructure, although current uptake remains limited by distribution challenges.

The Asia-Pacific region emerges as a key battleground for flex fuel engine growth. Southeast Asian governments have introduced mandates for ethanol blending in gasoline, driving demand for vehicles that can navigate varying blend ratios. China’s dual focus on air quality and energy security has translated into pilot programs for methanol-powered buses, while India’s ambitious biofuel targets are fostering public–private collaborations among engine manufacturers and feedstock producers. Across Australia and parts of East Asia, interest in renewable diesel blends and methanol prospects is gaining traction, supported by research consortia and local OEM pilot initiatives. Thus, regional disparities in policy, infrastructure, and resource availability collectively shape a heterogeneous yet promising global landscape for flex fuel technologies.

This comprehensive research report examines key regions that drive the evolution of the Flex Fuel Engine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping How Major OEMs, Component Innovators, and Startups Are Collaborating to Advance Flex Fuel Engine Competitiveness

An examination of leading companies in the flex fuel engine arena reveals strategic investments and collaborative ventures that are redefining competitive positioning. Major OEMs have established dedicated research centers focused on multi-fuel combustion dynamics, integrating advances in artificial intelligence to optimize injection timing and air–fuel mixing for each specific blend. These efforts are supplemented by alliance formations with fuel producers and specialty materials suppliers to secure supply continuity for corrosion-resistant components and high-performance seals.

Component manufacturers have similarly expanded their portfolios to include flex fuel-specific modules, such as adaptive fuel rails, real-time blend sensors, and enhanced thermal management systems. By offering plug-and-play solutions that retrofit existing engine platforms, these suppliers enable tier-one integrators to reduce development timelines and costs. In parallel, fuel companies are investing in distributed production facilities for next-generation bioethanol and green methanol, aligning feedstock sourcing with regional sustainability frameworks and emerging carbon credit schemes.

Startups and technology providers are also making significant inroads, leveraging breakthroughs in nanocoatings and advanced signal processing to extend engine life and diagnostic accuracy. These innovators frequently partner with universities and national laboratories to validate performance under extreme conditions, attracting venture capital that fuels rapid prototyping and pilot deployments. As such, the competitive landscape is characterized by a dynamic interplay between global heavyweights focusing on scale and startup challengers driving niche innovations, collectively advancing the flex fuel engine value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flex Fuel Engine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Jianghuai Automobile Group Co., Ltd.

- Audi AG

- Bajaj Auto Limited

- BMW AG

- BYD Company Limited

- Chery Automobile Co., Ltd.

- Cummins, Inc.

- Daimler AG

- Ford Motor Company

- Geely Automobile Holdings Limited

- General Motors Company

- Great Wall Motor Company Limited

- Groupe PSA

- Groupe Renault

- Hero MotoCorp Limited

- Honda Motor Co. Ltd.

- Kia Corporation by Hyundai Motor Company

- Mahindra & Mahindra Limited

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Mitsubishi Motors Corporation

- Nissan Motor Co. Ltd.

- Robert Bosch GmbH

- SAIC Motor Corporation Limited

- Subaru Corporation

- Suzuki Motor Corporation

- Tata Motors Limited

Implementing Strategic Partnerships, Modular Manufacturing, and Advocacy Efforts to Strengthen Flex Fuel Engine Market Leadership

Industry leaders seeking to capitalize on the momentum of flex fuel engines should prioritize strategic initiatives that align technological development with market demand and regulatory trajectories. First, forging deeper partnerships with renewable fuel producers will ensure consistent access to high-quality ethanol and methanol blends, enabling engine calibrations that maximize performance across varying fuel chemistries. In tandem, investing in digital twin simulations and machine learning–driven engine controls can accelerate time to market by validating multi-blend operations virtually before physical trials.

Additionally, companies should explore flexible manufacturing approaches that permit rapid reconfiguration of production lines to accommodate component variations required for different fuel compatibilities. This modularity not only mitigates the impact of trade policy fluctuations but also reduces downtime associated with engineering change orders. Equally important is the cultivation of aftermarket ecosystems through certified retrofit programs that expand the installed base of flex fuel capabilities, thereby reinforcing brand loyalty and capturing emerging retrofit revenue streams.

Moreover, stakeholders should engage proactively with policymakers to shape fuel quality standards and incentive schemes that reflect the unique advantages of multi-fuel engines. Such advocacy, backed by robust technical data and lifecycle analyses, can unlock subsidies and carbon credit markets that improve total cost of ownership. Lastly, nurturing talent pipelines with cross-disciplinary expertise in engine mechanics, fuel chemistry, and data science will be pivotal for sustaining continuous innovation. By executing these concerted actions, industry participants can not only navigate current challenges but also secure leadership in the next generation of sustainable mobility solutions.

Detailing a Robust Mixed-Methods Research Framework Integrating Expert Interviews, Technical Reviews, and Empirical Data Validation

The research underpinning this analysis blended rigorous primary and secondary methodologies to ensure comprehensive coverage and credibility. Primary research consisted of in-depth interviews with key stakeholders across the flex fuel ecosystem, including senior engineers from leading OEMs, executives at biofuel production facilities, and fleet managers overseeing live deployments of multi-fuel vehicles. These conversations provided first-hand perspectives on technical challenges, procurement strategies, and evolving customer expectations.

Secondary research complemented these insights by examining regulatory filings, technical whitepapers, and industry consortium publications. Peer-reviewed journals offered empirical data on combustion efficiency and emission profiles for various alcohol-gasoline blends, while government databases supplied up-to-date information on incentive programs and tariff schedules. Additionally, case studies of pilot programs were evaluated to assess real-world performance benchmarks and adoption hurdles.

Quantitative data points were triangulated through cross-validation among multiple sources to minimize bias, and qualitative feedback was synthesized using thematic analysis to identify common trends and unique outlier scenarios. Throughout the process, strict validation protocols were observed, including source credibility assessments and methodological transparency. This dual-pronged approach ensures that the findings presented herein stand on a robust evidentiary foundation and provide actionable insights for decision-makers in the flex fuel engine domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flex Fuel Engine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flex Fuel Engine Market, by Fuel Type

- Flex Fuel Engine Market, by Blend Type

- Flex Fuel Engine Market, by Engine Capacity

- Flex Fuel Engine Market, by Vehicle Type

- Flex Fuel Engine Market, by Application

- Flex Fuel Engine Market, by End User

- Flex Fuel Engine Market, by Sales Channel

- Flex Fuel Engine Market, by Region

- Flex Fuel Engine Market, by Group

- Flex Fuel Engine Market, by Country

- United States Flex Fuel Engine Market

- China Flex Fuel Engine Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Drawing Together Regulatory, Technological, and Strategic Insights to Chart the Future Trajectory of Flex Fuel Engines

In synthesizing the diverse insights from regulatory shifts, supply chain realignments, and technological advancements, it is clear that flex fuel engines are poised to occupy a central role in the future of sustainable mobility. The convergence of high-blend biofuels, modular engine platforms, and advanced digital controls has created a powerful value proposition for both OEMs and end users. Across regions, tailored policies and resource profiles will dictate adoption paces, but the underlying momentum remains unequivocally upward.

Corporate strategies that emphasize collaborative innovation, localized production, and policy engagement will be best positioned to harness the opportunities presented by flex fuel technologies. Moreover, as end users increasingly demand versatility and environmental responsibility, the ability to offer vehicles that seamlessly adapt to varying fuel chemistries will become a critical differentiator. Ultimately, the dynamic interplay among industry stakeholders-from fuel producers to engine component suppliers-will determine how swiftly and effectively flex fuel engines achieve mainstream acceptance.

With robust research methods informing this executive summary, stakeholders now have a clear blueprint for navigating the complex landscape. The next phase will involve translating these insights into concrete product roadmaps, operational strategies, and market expansion plans. As the ecosystem matures, the organizations that act decisively and collaboratively will lead the charge toward a more flexible, resilient, and sustainable transportation future.

Unlock Customized Flex Fuel Engine Market Insights by Connecting Directly with Our Expert Associate Director to Drive Your Strategic Growth

For an in-depth exploration of the flex fuel engine market and to unlock tailored insights that address your strategic challenges, reach out to Ketan Rohom who can guide you toward the solutions you need. As the Associate Director of Sales & Marketing, Ketan brings a deep understanding of industry trends and can recommend the most relevant data packages to empower your decision-making process. Whether you seek a comprehensive market analysis or targeted data sets on regional dynamics, technological advancements, or competitive landscapes, initiating a conversation with Ketan will connect you with the expertise required to accelerate your growth trajectory. Don’t miss the opportunity to transform complex data into actionable strategies-engage with Ketan Rohom today to secure your copy of the detailed market research report and take the next step in leading the flex fuel engine revolution

- How big is the Flex Fuel Engine Market?

- What is the Flex Fuel Engine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?