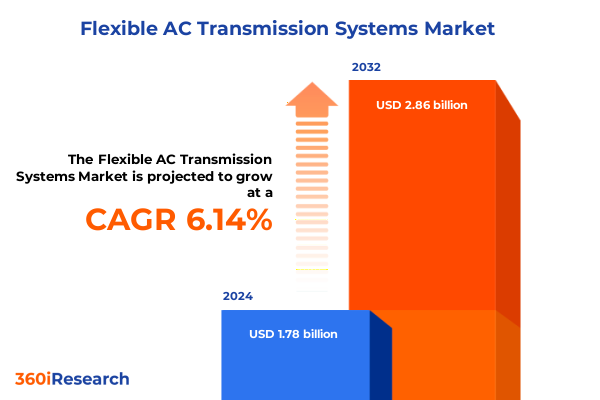

The Flexible AC Transmission Systems Market size was estimated at USD 1.78 billion in 2024 and expected to reach USD 1.88 billion in 2025, at a CAGR of 6.14% to reach USD 2.86 billion by 2032.

Discover How Flexible AC Transmission Systems Are Revolutionizing Power Networks with Efficiency and Grid Stability in a Transitioning Energy Landscape

Flexible AC transmission systems represent a breakthrough in managing modern power grids that are increasingly stressed by unpredictable loads and intermittent renewable generation. By integrating state-of-the-art power electronics with high-voltage transmission infrastructure, these systems enable real-time control of power flows, voltage profiles, and reactive compensation. This approach provides grid operators with the flexibility to address thermal overloads, dynamic voltage stability issues, and system oscillations without relying solely on new line construction.

Uncover the Transformative Technological and Regulatory Shifts Redefining the Landscape of Flexible AC Transmission Systems on a Global Scale

In recent years, technological innovation has driven a fundamental reshaping of the FACTS landscape. Modular multilevel converter topologies and advanced semiconductor devices have enhanced the reliability and performance of controllers such as STATCOMs and UPFCs. Concurrently, the convergence of digital automation, real-time data analytics, and artificial intelligence has enabled smarter monitoring and control of these devices, allowing utilities to predict and mitigate grid disturbances with unprecedented speed.

Alongside these technical strides, regulatory momentum toward decarbonization has accelerated FACTS integration. Incentives for renewable energy curtailment management and grid resilience programs have created new pathways for financing projects, while stricter interconnection requirements have compelled network operators to adopt solutions capable of maintaining power quality under fluctuating generation patterns. Together, these technological and policy developments are charting a course toward more resilient, efficient, and sustainable power systems worldwide.

Analyze the Cumulative Impact of 2025 United States Trade Tariffs on Component Costs and Supply Chain Dynamics for Flexible AC Transmission Systems

The implementation of new trade measures in 2025 has introduced a significant layer of complexity for FACTS suppliers and end users. Tariffs applied to imported power electronic components, critical semiconductors, and structural materials have elevated input costs by up to 25 percent in certain categories. This change has compelled manufacturers to reevaluate supply chain strategies, prompting a shift toward diversified sourcing and strategic stockpiling of key parts.

As these cost pressures have materialized, project developers have responded by bridging procurement timelines and renegotiating contract terms to accommodate longer lead times. Some stakeholders have accelerated collaborations with domestic fabricators of steel and aluminum to mitigate exposure to levies on raw materials. Concurrently, partnerships with regional converter module assemblers have gained traction, reducing transit risk and inching deployment schedules back on track.

Despite these headwinds, end-user adoption has maintained forward momentum, driven by the imperative to integrate more renewables and fortify grid reliability. Utilities are opting for hybrid financing models that blend traditional capital expenditure with performance-based contracts, enabling balanced risk distribution. In parallel, equipment vendors are incorporating tariff-resilient design practices, such as standardized sub-assemblies, to optimize cost structures and ensure project viability under the new trade regime.

Gain Key Insights into Market Segmentation Across Technologies, Installation Models, End User Verticals, and Application Domains Shaping FACTS Deployment

A nuanced view of the FACTS market emerges when assessing its composition by technology, installation model, end user segment, and application type. Within power electronics technologies, modular multilevel devices like STATCOMs and UPFCs have gained prominence for their granular control capabilities, while legacy static var compensators and thyristor-based series capacitors remain in use for stability reinforcement on older transmission corridors.

Differentiating by installation context reveals a clear delineation between greenfield deployments on new lines and retrofit upgrades to existing assets. In regions with aging transmission infrastructure, operators are choosing retrofits to extend asset life and avoid the permitting challenges associated with new right-of-way. Conversely, emerging grid projects in resource-rich areas often integrate FACTS modules from the outset to optimize corridor capacity.

From an end-user perspective, utilities account for the bulk of demand, driven by large-scale grid modernization initiatives. Industrial operators prioritize power quality and reactive compensation to safeguard sensitive processes, whereas commercial entities seek voltage regulation solutions to maintain uptime across distributed facilities. Application-wise, the imperative to direct power flows to high-demand zones underpins uptake of power flow control devices, while ancillary services for reactive power compensation and voltage regulation are increasingly outsourced to flexible transmission assets.

This comprehensive research report categorizes the Flexible AC Transmission Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Compensation Type

- Component

- Controller Type

- Installation

- Application

- End User

Examine Regional Nuances in FACTS Adoption and Infrastructure Development Spanning the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional characteristics are shaping the pace and nature of FACTS adoption across the globe. In the Americas, grid operators are embedding advanced controllers within major transmission corridors to handle surges in renewable output, with pilot projects demonstrating successful integration of solar and wind farms into previously constrained networks. North American utilities are also leveraging performance-based incentive structures to offset initial capital burdens.

In Europe, Middle East & Africa, regulatory mandates for grid stability have accelerated investments in reactive power compensation and voltage support. Western European nations leading on decarbonization are replacing series capacitors with more versatile SSSC units, while utility interconnects in the Gulf region emphasize high-temperature, high-reliability designs. Sub-Saharan Africa is viewing FACTS solutions as a pathway to enhance grid resilience against frequent load fluctuations and expand access to power.

Asia-Pacific continues to be the largest theater for FACTS expansion, as fast-growing economies install controllers to meet surging demand and balance the intermittency of large-scale renewable parks. In China and India, national grid modernization campaigns are integrating FACTS at both transmission and distribution levels, with an emphasis on hybrid application scenarios that combine power flow control and voltage regulation within a single installation.

This comprehensive research report examines key regions that drive the evolution of the Flexible AC Transmission Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore the Competitive Landscape with Key Profiles of Leading Manufacturers and Innovators Driving Advancements in Flexible AC Transmission Systems Technology

A cadre of established global suppliers underpins the FACTS industry, each bringing differentiated strengths to the market. Long-standing incumbents have robust portfolios that span converter modules, ancillary software, and full turnkey solutions, while newer entrants are carving niches through specialized digital twins and diagnostics offerings.

Leading power equipment manufacturers are deepening their value propositions by embedding cloud-based analytics into control platforms, enabling predictive maintenance and remote parameter tuning. Strategic alliances between converter vendors and system integrators have emerged to deliver end-to-end solutions, blending hardware prowess with grid-scale software expertise. Meanwhile, regional players in Asia-Pacific are leveraging cost-effective local production capabilities to address tariff volatility and expedite project timelines.

Beyond technology, service models have become a competitive differentiator. Providers offering outcome-based maintenance contracts, tailored lifecycle management, and rapid-response field support are setting new benchmarks for customer engagement. This pivot toward services is accelerating the shift from traditional procurement to performance-oriented partnerships that align vendor incentives with grid reliability objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible AC Transmission Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Superconductor Corporation

- Arteche Group

- Beijing Sifang Automation Co., Ltd.

- Bharat Heavy Electricals Limited

- China XD Group Co., Ltd.

- Eaton Corporation plc

- Electranix Corporation

- GE Vernova Group

- Hitachi Energy Ltd

- Hyosung Heavy Industries

- Ingeteam S.A.

- JEMA Energy S.A. by Irizar Group

- LS ELECTRIC Co., Ltd.

- Merus Power Oyj

- Mitsubishi Electric Corporation

- NARI Technology Co., Ltd.

- Rongxin Power Electronic Co., Ltd.

- Schneider Electric SE

- Shanghai Electric Group

- Siemens AG

- Sieyuan Electric Co., Ltd.

- Toshiba Corporation

- Vi Microsystems Pvt. Ltd.,

- XJ ELECTRIC CORPORATION

Implement Strategic Recommendations to Navigate Market Complexities and Capitalize on Emerging Opportunities in the Flexible AC Transmission Systems Sector

Industry leaders should prioritize modularity in product design to accommodate the wide spectrum of transmission architectures and minimize integration hurdles. By standardizing key sub-assemblies across STATCOMs, UPFCs, and SVCs, suppliers can streamline manufacturing workflows and cushion against component cost fluctuations caused by tariffs.

Strengthening regional supply chains is equally critical. A balanced mix of local and global sourcing partnerships will reduce exposure to trade uncertainties and shorten delivery cycles. Collaborative frameworks with domestic fabricators and converter assemblers can help secure priority access to critical materials and semiconductors, while joint ventures in key markets can unlock co-investment opportunities.

Operators can also leverage digital twin models to simulate FACTS performance under diverse grid scenarios before capital deployment. Such predictive insights support informed ROI analyses and enable agile adjustments to control parameters post-commissioning. Finally, developing outcome-based service packages that tie compensation to uptime metrics and efficiency gains will foster deeper alignment between vendors and end users, promoting long-term sustainability.

Understand the Rigorous Research Methodology Employed to Deliver Comprehensive Market Analysis and Ensure Data Integrity in FACTS Industry Reporting

This analysis synthesizes findings from comprehensive desk research and direct consultations with power utilities, equipment manufacturers, and industry experts. Secondary sources included technical standards, white papers, and public filings from leading vendors, which provided foundational data on installed bases and product specifications.

Primary research comprised structured interviews with grid operators across key markets to assess deployment drivers, procurement strategies, and tariff impacts. Insights from these conversations were cross-verified through triangulation against trade data, project announcements, and regulatory filings. Supplementary validation sessions with an advisory panel of transmission engineers and energy economists enriched the contextual understanding of regional and application-specific dynamics.

Data integrity was ensured through iterative feedback loops and reconciliation of divergent viewpoints. Quality checks included consistency reviews against historical deployment trends and technical feasibility assessments for emerging converter topologies. The resulting methodology delivers a balanced, multi-dimensional perspective on the FACTS industry, grounded in both quantitative evidence and qualitative expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible AC Transmission Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible AC Transmission Systems Market, by Compensation Type

- Flexible AC Transmission Systems Market, by Component

- Flexible AC Transmission Systems Market, by Controller Type

- Flexible AC Transmission Systems Market, by Installation

- Flexible AC Transmission Systems Market, by Application

- Flexible AC Transmission Systems Market, by End User

- Flexible AC Transmission Systems Market, by Region

- Flexible AC Transmission Systems Market, by Group

- Flexible AC Transmission Systems Market, by Country

- United States Flexible AC Transmission Systems Market

- China Flexible AC Transmission Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Conclude with a Concise Synthesis of Core Findings and Strategic Implications Guiding Stakeholders in the Flexible AC Transmission Systems Domain

In synthesizing the core themes of this analysis, it becomes clear that flexible AC transmission systems are at the heart of the next-generation grid. Technological advances are marrying power electronics with digital intelligence to solve enduring challenges in stability, voltage control, and renewable integration. Simultaneously, the landscape is being reshaped by regulatory imperatives and trade dynamics that demand new supply chain strategies and collaborative financing models.

Segment-level insights highlight the diversity of applications and installation approaches, underscoring the need for modular offerings that serve both new transmission corridors and retrofit projects. Regional perspectives reveal differentiated adoption patterns, driven by local policy frameworks, infrastructure priorities, and resource endowments. Leading suppliers are responding with integrated solution sets and performance-oriented service packages that align directly with utility objectives.

Ultimately, stakeholders that embrace design flexibility, digitalization, and resilient sourcing will be best positioned to navigate tariff pressures and evolving grid requirements. The collective momentum toward a more interconnected and renewable-driven power ecosystem makes the strategic deployment of FACTS more essential than ever.

Take Definitive Action Today by Contacting Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Flexible AC Transmission Systems Market Report

Ready to elevate your strategic decision-making with unparalleled insights into the flexible AC transmission systems sector? Contact Ketan Rohom, Associate Director of Sales & Marketing, to obtain your tailored market report that delivers actionable intelligence across technologies, regional markets, and company landscapes. His expertise in guiding organizations through complex energy infrastructure challenges ensures that you receive a customized analysis aligned with your strategic priorities. Reach out today to secure comprehensive research that will empower your team to stay ahead of technological advances and regulatory shifts in the FACTS industry.

- How big is the Flexible AC Transmission Systems Market?

- What is the Flexible AC Transmission Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?