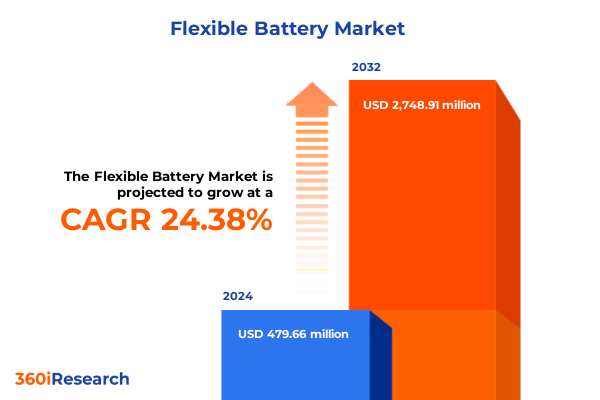

The Flexible Battery Market size was estimated at USD 591.26 million in 2025 and expected to reach USD 729.32 million in 2026, at a CAGR of 24.54% to reach USD 2,748.90 million by 2032.

Exploring the Rapid Emergence of Next-Generation Flexible Battery Technologies Amid Increasing Demand for Ultra-Thin, Conformal, and Versatile Energy Solutions

Flexible battery technologies represent a paradigm shift in energy storage, enabling power sources that conform to unconventional shapes, flex under stress, and integrate seamlessly into a new generation of electronic devices. Unlike traditional rigid cells, these ultra-thin constructs leverage innovative substrates and novel chemistries to deliver reliable performance while accommodating bending, twisting, and even folding. By transcending conventional design constraints, flexible batteries unlock possibilities for form factors that were previously impractical or impossible.

The evolution of flexible battery platforms spans paper-based formats that exploit cellulose matrices, polymer batteries featuring both gel polymer and solid polymer formulations, printed batteries realized through inkjet-printed or screen-printed techniques, and thin-film cells segmented by inorganic or organic thin-film layers. Each of these approaches offers distinct advantages in terms of energy density, mechanical resilience, and manufacturing scalability. Collectively, they form an ecosystem of solutions poised to serve an array of emerging and established applications.

Driven by the accelerating proliferation of connected devices, from IoT sensors to smart textiles, demand for adaptable power sources has never been greater. Wearables, medical diagnostic patches, and next-generation smart cards all rely on batteries that can conform to the human body or to intricate form factors. Meanwhile, consumer electronics and automotive interiors are embracing flexible cells to support slim profiles and enhanced design freedom.

This executive summary lays the groundwork for understanding the forces shaping the flexible battery landscape, setting the stage for detailed analysis of market shifts, tariff impacts, segmentation insights, regional dynamics, competitive positioning, and strategic recommendations.

Unprecedented Innovations Are Redefining Production Methods Materials and Performance Metrics Across the Flexible Battery Sector

Recent breakthroughs in materials science and manufacturing processes have fundamentally altered the trajectory of flexible battery development. Roll-to-roll processing, which was once confined to rigid cells, now extends to polymer and thin-film constructs, allowing continuous production of ultra-thin, uniform films. Innovations in printable inks and advanced electrolytes have enabled both inkjet and screen printing of energy-storage layers, dramatically reducing production complexity and cost.

Simultaneously, solid-state polymer electrolytes and hybrid inorganic–organic thin films are delivering enhanced thermal stability and mechanical durability, addressing long-standing barriers to commercialization. These material advancements are complemented by additive manufacturing techniques that permit on-demand customization of battery shapes and capacities. As a result, designers can embed power sources directly into flexible substrates without sacrificing performance or safety.

Beyond technical innovations, regulatory and environmental considerations are steering research toward greener chemistries and recyclable components. Bio-based polymers and water-processable electrode formulations are gaining traction, reflecting heightened scrutiny of battery lifecycle impacts. This shift aligns with corporate sustainability targets and emerging regulations that mandate reduced carbon footprints and material recoverability.

Through these transformative shifts, the flexible battery landscape is redefining performance metrics, accelerating time to market, and enabling entirely new classes of applications-underscoring the need for stakeholders to stay attuned to the evolving competitive and technological environment.

How Recent U.S. Tariff Policies Introduced in 2025 Are Reshaping Supply Chains Cost Structures and Strategic Sourcing Decisions in Flexible Battery Industry

The introduction of new United States tariff measures in 2025 has had a profound effect on the flexible battery supply chain and cost structure. Components such as current collectors, specialty substrates, and electrolyte precursors-many of which were historically sourced from low-cost producers in the Asia-Pacific region-now attract additional duties. This shift has compelled manufacturers to reassess their procurement strategies and absorb increased input costs or pass them through to downstream customers.

To mitigate tariff pressures, several producers have diversified their sourcing footprints, securing alternative suppliers in tariff-exempt jurisdictions or investing in domestic production capabilities. While reshoring initiatives alleviate exposure to import duties, they also require significant capital investment and time to establish new manufacturing lines. As a consequence, supply chain planning has grown more complex, with firms balancing near-term cost impacts against long-term strategic resilience.

In response to the evolving policy landscape, many organizations have implemented hedging mechanisms and contractual clauses to share tariff risks with tier-one suppliers or contract manufacturers. At the same time, some battery developers are accelerating R&D efforts aimed at substituting restricted materials with locally available alternatives. These efforts not only address immediate tariff challenges but also foster domestic innovation ecosystems.

Going forward, tariff trajectories will remain a critical factor in supply chain decision-making, underscoring the importance of continuous monitoring of trade policies and proactive engagement with regulators to advocate for balanced measures that support industry growth and competitiveness.

Decoding Market Potential Through Comprehensive Analysis of Technology Applications Form Factors Capacity Ranges and End User Verticals in Flexible Batteries

An in-depth look at market segmentation reveals diverse pockets of opportunity across technology platforms, applications, form factors, end-user verticals, and capacity tiers. In the technology dimension, paper-based batteries are prized for their lightweight and biodegradable nature, while polymer batteries deliver a balance of flexibility and energy density through gel polymer and solid polymer variants. Printed batteries are gaining momentum via inkjet-printed and screen-printed processes that enable on-demand customization, and thin-film batteries-split between inorganic thin-film and organic thin-film chemistries-offer ultra-thin profiles suited for integration into compact devices.

Application-driven insights underscore the versatility of flexible cells. The Internet of Things landscape benefits from batteries tailored for low-power sensing, whereas medical devices ranging from diagnostic patches to implantable devices demand biocompatibility and consistent performance. Portable electronics such as laptops, smartphones, and tablets increasingly adopt flexible modules to achieve slimmer form factors, and the smart card market exploits thin, conformal cells to power secure identification features. Wearable electronics-including fitness bands, smart textiles, and smart watches-continue to push the envelope of form factor innovation.

Form factor distinctions further refine growth areas: film substrates enable large-surface designs, while sheet configurations deliver balanced flexibility and strength. Pouch variants, whether single-cell or multi-cell, cater to different energy requirements, and textile-integrated formats merge fabric structures with energy storage. End users from automotive & transportation-covering electric and hybrid vehicles-to consumer electronics, healthcare, and industrial sectors all exhibit distinct demand profiles. Capacity ranges below 100 mAh serve low-power IoT applications, 100–1000 mAh cells address mid-range wearable and portable electronics, and offerings above 1000 mAh are suitable for higher-drain applications across multiple verticals.

This comprehensive research report categorizes the Flexible Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Form Factor

- Capacity Range

- Application

- End User

Regional Dynamics Highlight Distinct Adoption Rates Innovation Ecosystems and Policy Frameworks Driving Flexible Battery Growth Across Key Global Markets

Across the Americas, momentum is strongest in consumer electronics and automotive interiors, where flexible batteries are embedded into wearables, in-vehicle sensors, and supply chain tracking devices. Supportive government grants and private investment in advanced manufacturing facilities have bolstered local production capacity. This region also benefits from proximity to leading electronics OEMs, driving rapid prototyping and early adoption.

In Europe, the Middle East & Africa, stringent environmental regulations and sustainability mandates have spurred innovation in green chemistries and recyclability initiatives. Countries such as Germany and Sweden host vibrant R&D clusters exploring inorganic thin-film recycling, while France and the United Kingdom pilot medical patch applications in partnership with healthcare providers. Meanwhile, Gulf nations are leveraging flexible battery technology for smart infrastructure and defense applications, underpinned by robust funding programs.

Asia-Pacific remains the global manufacturing powerhouse, with China, Japan, and South Korea leading in production volumes and process innovation. Rapid commercialization of polymer gel batteries and printed formats is fueled by partnerships between universities and industry. Government incentives in countries like Singapore and Taiwan further accelerate research projects, positioning the region at the forefront of scalable flexible battery deployment in consumer electronics, IoT ecosystems, and next-generation wearable platforms.

This comprehensive research report examines key regions that drive the evolution of the Flexible Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Reveals Leading Innovators Strategic Partnerships and Emergent Disruptors Shaping the Flexible Battery Market Trajectory

The competitive landscape blends legacy battery manufacturers with agile startups. Leading conglomerates have expanded R&D budgets to develop thin-film modules and polymer cell lines, often through internal research or targeted acquisitions. Meanwhile, specialist startups are distinguishing themselves with proprietary chemistries and manufacturing platforms. Some have secured partnerships with electronics OEMs to co-develop custom solutions, while others license their processes to contract manufacturers seeking differentiation.

In addition, collaborations between material suppliers and device integrators are gaining traction, enabling optimized stacks that balance energy density, mechanical resilience, and cost. Joint ventures are forming to streamline supply chains and accelerate commercialization of next-generation cells. Cross-industry alliances-particularly among healthcare technology firms and battery innovators-are advancing biocompatible designs for implantable devices and smart patches.

New entrants are also reshaping expectations around speed to market, leveraging modular manufacturing cells and digital twins to shorten development cycles. Their disruptive approaches to printing and substrate engineering are challenging traditional methods and compelling established players to reassess strategic priorities. As a result, the market is experiencing convergent innovation, with diverse players competing on performance, scalability, and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Solutions SA

- Blue Spark Technologies, Inc.

- BrightVolt, Inc.

- Cymbet Corporation

- Energy Diagnostics Ltd.

- Enfucell Oy

- Ensurge Micropower ASA

- EVE Energy Co., Ltd.

- FlexEl, LLC

- Front Edge Technology, Inc.

- Fullriver Battery New Technology Co., Ltd.

- Imprint Energy, Inc.

- Jenax Inc.

- LG Energy Solution, Ltd.

- Lionrock Batteries

- Molex LLC

- NEC Corporation

- Panasonic Corporation

- Paper Battery Company, Inc.

- PolyPlus Battery Company

- ProLogium Technology Co., Ltd.

- Sakuu Corporation

- Samsung SDI Co., Ltd.

- STMicroelectronics N.V.

- Ultralife Corporation

Strategic Recommendations Urge Investment in Advanced Materials Collaborative R&D Supply Chain Resilience and Regulatory Engagement for Flexible Battery Growth

Industry leaders should prioritize investment in advanced materials research to unlock next-generation electrolyte and electrode formulations that deliver higher energy density and enhanced cycle life. Establishing collaborative R&D consortia with academic institutions and specialized startups can accelerate innovation while distributing risk. In parallel, reinforcing supply chain resilience through the identification of alternate suppliers for critical substrates and precursors will mitigate exposure to trade policy fluctuations.

Engagement with regulatory bodies and standards organizations is essential to shape guidelines that support safe, reliable deployment of flexible batteries. Proactive participation in standards committees can ensure alignment on testing protocols and certification pathways. Likewise, forging strategic partnerships with system integrators and OEMs will facilitate co-development of tailor-made solutions that meet the rigorous requirements of specific applications, from medical implants to automotive interiors.

Finally, companies should adopt agile manufacturing philosophies, incorporating modular production lines and digital process control to scale operations efficiently. By combining flexible production architectures with data-driven quality assurance systems, organizations can respond rapidly to shifting market demands and optimize cost structures.

Transparent Methodological Framework Combining Primary Interviews Secondary Research Data Triangulation and Rigorous Segmentation to Ensure Insight Accuracy

This market analysis integrates insights from extensive primary and secondary research to ensure robust, data-driven conclusions. Primary interviews with industry executives, technical experts, and end-user representatives have provided qualitative perspectives on emerging trends and strategic priorities. Concurrently, secondary research draws upon peer-reviewed literature, patent filings, and publicly available regulatory filings to ground findings in objective evidence.

Data triangulation techniques were applied to reconcile varying estimates and validate assumptions across multiple sources. The market was segmented across technology platforms-encompassing paper-based, polymer, printed, and thin-film variations-applications spanning IoT to wearable and medical devices, form factors including film, pouch, sheet, and textile integration, end-user verticals from automotive to industrial, and capacity tiers ranging from sub-100 mAh to above-1000 mAh. Each segment underwent rigorous analysis to identify adoption drivers, technical challenges, and competitive dynamics.

The research also incorporated regional assessments across the Americas, Europe, Middle East & Africa, and Asia-Pacific, examining regulatory frameworks, investment landscapes, and manufacturing ecosystems. Validation workshops with subject-matter experts further refined conclusions and ensured accuracy. Collectively, this methodological framework delivers a transparent, repeatable process that underpins the integrity of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Battery Market, by Technology

- Flexible Battery Market, by Form Factor

- Flexible Battery Market, by Capacity Range

- Flexible Battery Market, by Application

- Flexible Battery Market, by End User

- Flexible Battery Market, by Region

- Flexible Battery Market, by Group

- Flexible Battery Market, by Country

- United States Flexible Battery Market

- China Flexible Battery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives Highlight Strategic Imperatives Emerging Trends and the Need for Proactive Engagement with Next-Generation Flexible Power Solutions

In summary, the flexible battery landscape is undergoing a period of rapid transformation driven by material breakthroughs, evolving manufacturing methods, and shifting policy environments. The convergence of high-performance chemistries and scalable production techniques is unlocking applications that span from low-power IoT sensors to high-capacity modules for wearable and automotive use cases. At the same time, regional dynamics and tariff considerations are shaping strategic decisions around sourcing, investment, and partnerships.

By understanding the nuances of technology platforms-from paper and polymer systems to printed and thin-film solutions-and mapping them to key applications and form factors, stakeholders can identify the most promising avenues for growth. Competitive intelligence underscores the importance of both legacy players and nimble startups, each bringing unique strengths to the market. Strategic recommendations emphasize the need for collaborative R&D, supply chain diversification, regulatory engagement, and agile manufacturing to navigate complexity and capture market share.

As flexible batteries transition from niche prototypes to mainstream components, proactive engagement with emerging trends and strategic imperatives will be critical. The insights contained in this executive summary provide a roadmap for decision-makers seeking to harness the potential of next-generation flexible power sources and secure long-term competitive advantage.

Contact Ketan Rohom Associate Director of Sales and Marketing to Secure Comprehensive Flexible Battery Market Research Insights Today

To access the full market research report and gain unparalleled visibility into flexible battery trends, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Leverage his expertise to tailor a solution that meets your organization’s strategic requirements and ensures timely delivery of insights. By connecting with Ketan Rohom today, you will secure a comprehensive analysis complete with deep-dive assessments, segmentation breakdowns, and actionable intelligence designed to guide your next moves in this dynamic space. Begin your journey toward smarter energy innovation-contact Ketan Rohom to transform market data into strategic advantage.

- How big is the Flexible Battery Market?

- What is the Flexible Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?