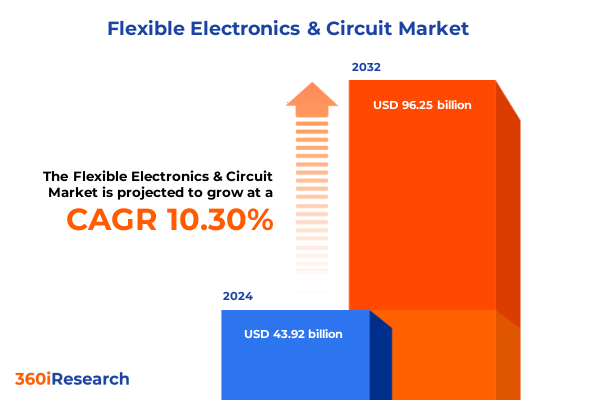

The Flexible Electronics & Circuit Market size was estimated at USD 48.37 billion in 2025 and expected to reach USD 53.27 billion in 2026, at a CAGR of 10.32% to reach USD 96.25 billion by 2032.

Exploring the Emergence of Flexible Electronics and Circuit Innovation Shaping Tomorrow’s Advanced Connectivity and System Integration

Flexible electronics and circuitry have rapidly emerged at the forefront of technological innovation, driving a shift in how electronic systems are designed, manufactured, and deployed across multiple industry verticals. Innovations in stretchable substrates, printable conductive inks, and ultra-thin semiconducting layers are converging to enable devices that bend, fold, and conform to a variety of form factors. As consumer demand for wearables intensifies and industrial sectors seek smarter, more adaptive sensors, the importance of lightweight, resilient electronic architectures continues to grow.

The broader implications of this movement extend to a vast array of applications, from medical diagnostics that wrap around biological tissues to automotive interfaces integrated seamlessly into cabin interiors. Early deployments have demonstrated significant advantages in both space savings and user experience, setting a precedent for next-generation smart systems. Moreover, the rise of additive and roll-to-roll manufacturing techniques complements these material advances, providing scalable production pathways that reduce waste and accelerate time-to-market. Against this backdrop of technical progress and market enthusiasm, flexible electronics are poised to redefine connectivity, ushering in a new paradigm of system integration and intelligent design.

Revealing the Parallel Advances in Material Innovation and Manufacturing Techniques That Are Accelerating the Flexible Electronics Revolution

Over the past decade, the landscape of flexible electronics has undergone transformative shifts fueled by parallel breakthroughs in materials science and manufacturing technology. Conventional rigid boards are steadily giving way to hybrid systems that consolidate printed sensors and flexible circuitry in a unified platform. As a result, development cycles that once spanned years have been condensed through modular prototyping, enabling rapid iteration and real-world validation.

Simultaneously, emerging materials such as organic semiconductors and silver-nanoparticle inks have matured from laboratory curiosity to production-ready components, affording designers new degrees of freedom. These innovations have catalyzed the integration of foldable displays and embedded energy-harvesting elements, bridging the gap between electronic functionality and mechanical adaptability. Furthermore, standardization efforts and open platform initiatives are harmonizing interfaces across different manufacturer ecosystems, paving the way for interoperable solutions. Consequently, flexible electronics have evolved from a niche concept into a versatile technology foundation that spans consumer products, industrial instrumentation, and medical devices alike.

Analyzing the Evolving Tariff Environment and Its Multifaceted Effects on Flexible Electronics Supply Chains and Production Strategies

In 2025, a series of revisions to United States tariff policies on electronic components and semiconductors introduced new complexities across global supply chains. Tariffs applied to key materials-including flexible substrates, conductive inks, and thin-film encapsulants-triggered immediate cost pressures for manufacturers reliant on overseas production. This environment prompted many companies to reassess logistics strategies, moving toward supplier diversification and nearshoring to mitigate the impact of import duties.

Concurrently, organizations accelerated investments in in-country production capabilities, forging partnerships with regional foundries and contract manufacturers equipped to process advanced flexible materials. While this shift has reduced exposure to external tariff fluctuations, it has also required accelerated workforce training and capital deployment. In parallel, technology providers have responded by reformulating inks and adhesives to incorporate more domestically sourced inputs, thereby qualifying for tariff exemptions or reduced duty rates. Taken together, these adaptations underscore a broader trend toward building resilient, localized ecosystems capable of sustaining growth amid evolving trade regulations.

Unveiling the Comprehensive Segmentation Landscape That Illuminates Application Areas, Material Innovations, and Manufacturing Pathways Driving Market Adoption

A nuanced view of the flexible electronics market emerges by examining it through multiple segmentation lenses, beginning with application domains. Aerospace implementations span avionics and cabin systems, where the emphasis is on weight reduction and durability under extreme conditions, while automotive uses encompass powertrain monitoring and interior interfaces that demand robust performance in high-temperature environments. Consumer electronics continue to dominate entry-level adoption, with smartphones, tablets, televisions, and wearables increasingly leveraging bendable displays and embedded biosensors for richer user experiences. Healthcare applications, particularly in diagnostics and medical devices, highlight the critical role of conformal sensors and patient-friendly monitoring solutions. Industrial automation and monitoring integrate flexible circuits into robotics and process control, enabling real-time data acquisition in harsh factory settings.

Turning to product types, flexible batteries-both lithium-ion and next-generation solid-state-are enabling energy storage within unconventional form factors, while printed flexible displays such as electrophoretic variants and OLEDs bring vibrant visuals to foldable devices. RFID technologies encompassing NFC and UHF components underpin contactless identification systems, and various biosensors, pressure sensors, and temperature sensors facilitate granular data capture. Flexible solar cells, spanning organic photovoltaics and thin-film constructs, offer lightweight energy-harvesting solutions for self-powered devices. Material classifications reveal distinct growth pathways: composite and inorganic substrates, including metal oxides and silicon, augment thermal stability, whereas organic materials such as polymers and small molecules enable lightweight, cost-effective designs. Substrate choices extend from metal foil alternatives like aluminum and copper to plastics including PET, PI, and polycarbonate, as well as textile-based solutions in nonwoven and woven formats. Manufacturing technologies range from advanced coating methods-blade and slot die processes-to laser patterning, lithography, and printed electronics using inkjet and screen techniques. Additionally, end-user profiles mirror application segments, further illustrating the diversity of market engagement. Lastly, conductive material innovations leverage aluminum, carbon nanotubes, and graphene alongside conventional copper and silver to tailor electrical performance, while device thickness variations-from less than 0.1 mm to greater than 0.5 mm-address both flexibility and mechanical strength requirements.

This comprehensive research report categorizes the Flexible Electronics & Circuit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Substrate Type

- Manufacturing Technology

- Conductive Material

- Thickness

- Application

- End-User

Examining Geographic Variations in Market Drivers, Regulatory Frameworks, and Industrial Readiness Across Key Global Regions

Regional dynamics in the flexible electronics market are shaped by varying economic drivers, regulatory environments, and adoption rates. In the Americas, particularly the United States, government incentives and strategic investments in advanced manufacturing have fostered growth in sectors such as healthcare, aerospace, and automotive. The presence of leading research institutions and defense contractors accelerates technology commercialization, while reshoring initiatives driven by tariff considerations further strengthen local ecosystems. Transitioning toward harmonized standards and certification processes has also reduced time-to-market for new products.

Within Europe, Middle East, and Africa, a combination of supportive industrial digitization programs and sustainability mandates is catalyzing broader deployment of bendable sensors and energy-harvesting devices. German and Scandinavian manufacturing hubs are at the forefront of integrating flexible circuitry into smart factory platforms, while regulatory frameworks in the Middle East and Africa emphasize robust connectivity for critical infrastructure. Across this region, collaborative consortiums between academia and private enterprises are advancing materials research, establishing clear pathways from laboratory breakthroughs to commercial-scale production.

Asia-Pacific remains the largest adopter, driven by extensive consumer electronics manufacturing in countries such as China, South Korea, and Japan. High-volume roll-to-roll fabs and rapidly evolving fabless startup ecosystems support a continuous infusion of new form-factors into the market. Government subsidies for electric vehicles and renewable energy applications are driving demand for flexible batteries and solar cells, while regional trade agreements underpin cross-border collaboration and investment.

This comprehensive research report examines key regions that drive the evolution of the Flexible Electronics & Circuit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Alliances, Disruptive Innovators, and Industry Consolidation That Are Shaping Competitive Leadership in Flexible Electronics

The competitive landscape of flexible electronics is defined by a blend of established material suppliers, emerging technology pioneers, and system integrators forging strategic alliances. Leading specialty chemical and polymer producers are expanding their portfolios to include tailored conductive inks and encapsulants compatible with additive manufacturing processes. Display manufacturers are forging joint development agreements with semiconductor foundries, aiming to integrate ultra-thin processing techniques into mass production of foldable screens. Meanwhile, dedicated flexible circuit providers are investing in pilot lines to validate roll-to-roll printing methodologies at scale.

Concurrently, a new wave of startups is challenging incumbents by introducing disruptive material formulations-such as graphene-enhanced conductors and biodegradable substrates-that address sustainability concerns. Partnerships between electronics giants and niche innovators are accelerating technology maturity and de-risking large-volume deployments. Strategic acquisitions of specialized IP by multinational corporations are further consolidating key capabilities, enabling end-to-end solutions that cover design, prototyping, and commercial manufacturing. As a result, the industry is witnessing a dynamic interplay between scale, innovation, and sustainability efforts that will define the next chapter of market development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Electronics & Circuit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BOE Technology Group Co., Ltd.

- Corning Incorporated

- E Ink Holdings Inc.

- EverDisplay Optronics Co., Ltd.

- Fujikura Ltd.

- LG Display Co., Ltd.

- Nippon Mektron, Ltd.

- Plastic Logic Limited

- Royole Corporation

- Samsung Electronics Co., Ltd.

- Thin Film Electronics ASA

- Tianma Microelectronics Co., Ltd.

- Zhen Ding Technology Holding Limited

Formulating Integrated Strategies Combining Localized Manufacturing, Collaborative Innovation, and Sustainable Practices for Market Leadership

To thrive in this evolving market, industry leaders should prioritize integrated strategies that align technological capabilities with resilient supply chains. Investing in localized production hubs will mitigate exposure to trade uncertainties and reduce logistical lead times, while co-development partnerships with material innovators can accelerate the adoption of next-generation conductive inks and substrates. Embracing modular design principles across product lines will enable rapid customization and lower upfront development costs.

Furthermore, maintaining a proactive stance on sustainability through the incorporation of eco-friendly materials and closed-loop recycling initiatives will strengthen brand reputation and meet emerging regulatory requirements. Leaders should also engage in standardization forums to influence interoperability guidelines, ensuring broad compatibility across devices and platforms. Lastly, cultivating multidisciplinary talent through specialized training in flexible manufacturing techniques and materials science will secure long-term innovation capacity and support continuous improvement initiatives.

Detailing the Rigorous Multi-Method Research Framework That Underpins Objective Analysis and Trend Validation in the Flexible Electronics Domain

This report’s findings are grounded in a robust methodology that synthesizes insights from primary and secondary research avenues. Primary research consisted of in-depth interviews with senior executives, materials scientists, design engineers, and supply chain managers across leading original equipment manufacturers, contract manufacturers, and research institutions. These conversations provided firsthand perspectives on technological adoption, cost structures, and pilot production challenges.

Secondary research encompassed an exhaustive review of industry publications, patent filings, regulatory frameworks, and academic journals. Manufacturer white papers and standards body reports were analyzed to map process trends and interoperability hurdles. Data triangulation techniques ensured consistency between anecdotal insights and documented evidence, while thematic analysis distilled key drivers, barriers, and strategic priorities. Finally, cross-validation workshops with external experts were conducted to refine assumptions and validate emerging trends, resulting in a comprehensive, multi-dimensional view of the flexible electronics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Electronics & Circuit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Electronics & Circuit Market, by Product Type

- Flexible Electronics & Circuit Market, by Material Type

- Flexible Electronics & Circuit Market, by Substrate Type

- Flexible Electronics & Circuit Market, by Manufacturing Technology

- Flexible Electronics & Circuit Market, by Conductive Material

- Flexible Electronics & Circuit Market, by Thickness

- Flexible Electronics & Circuit Market, by Application

- Flexible Electronics & Circuit Market, by End-User

- Flexible Electronics & Circuit Market, by Region

- Flexible Electronics & Circuit Market, by Group

- Flexible Electronics & Circuit Market, by Country

- United States Flexible Electronics & Circuit Market

- China Flexible Electronics & Circuit Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 4293 ]

Synthesizing Market Forces, Technological Breakthroughs, and Strategic Imperatives That Will Drive the Next Wave of Flexible Electronics Adoption

Flexible electronics and circuitry are at a pivotal juncture, where advances in materials, manufacturing, and application integration are converging to enable unprecedented capabilities across industries. As global trade dynamics evolve and regional production strategies adapt, organizations that embrace agile supply chains and collaborative innovation will be best positioned to capitalize on emerging opportunities. The complexity of segmentation-from application and product type to material composition, substrate choices, and manufacturing technologies-underscores the necessity of a holistic market perspective.

Armed with insights into regional variances, competitive positioning, and strategic imperatives, decision-makers can navigate uncertainties and chart pathways toward sustainable growth. The transformative promise of flexible electronics extends beyond technical novelty to encompass better patient outcomes, enhanced user experiences, and more efficient industrial processes. Ultimately, the ability to integrate adaptable circuitry into design at scale will define the next wave of competitive differentiation within the global electronics ecosystem.

Unlock Comprehensive Insights and Strategic Foresight by Connecting with Ketan Rohom to Secure Your Copy of the Flexible Electronics Market Research Report

To uncover the full breadth of analysis, strategic foresight, and in-depth evaluation presented throughout this market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Guided by a thorough understanding of technology trajectories and market dynamics, Ketan will tailor a consultation to your organization’s unique needs. Capitalize on this opportunity to gain a competitive advantage by accessing proprietary insights into flexible electronics and circuitry. Engage now to secure your copy of the report

- How big is the Flexible Electronics & Circuit Market?

- What is the Flexible Electronics & Circuit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?