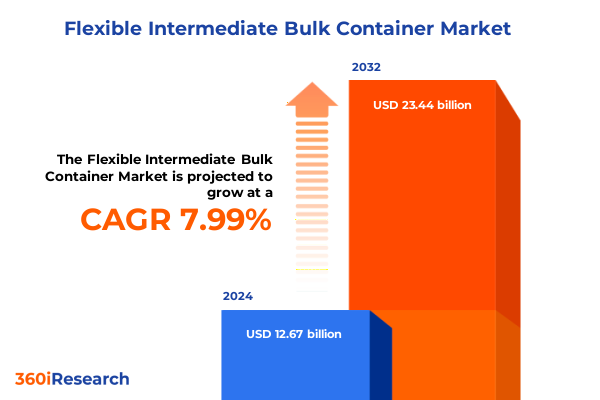

The Flexible Intermediate Bulk Container Market size was estimated at USD 13.64 billion in 2025 and expected to reach USD 14.69 billion in 2026, at a CAGR of 8.03% to reach USD 23.44 billion by 2032.

How Flexible Intermediate Bulk Containers Are Revolutionizing Global Commodity Handling and Enabling Agile, Sustainable, and Cost-Efficient Supply Chain Solutions

Flexible intermediate bulk containers, commonly referred to as FIBCs, have emerged as a cornerstone of modern logistics, offering a versatile and resilient solution for bulk transport. Constructed from high-strength woven fabrics, these containers combine structural flexibility with robust load-bearing capability, enabling seamless handling of powders, granules, and other bulk materials. Their design accommodates a wide range of weight capacities, which has catalyzed their adoption across industries that demand efficient material movement. As the global economy tightens its focus on operational efficiency and cost management, FIBCs provide a compelling alternative to traditional packaging methods by reducing handling times and lowering the frequency of container replacements.

In addition to operational advantages, these containers contribute to environmental sustainability by minimizing material usage and enabling product reuse cycles. Advances in materials science and manufacturing processes have driven enhancements in durability, leading to longer service life and improved return on investment. This evolution has been further accelerated by stringent environmental regulations and a rising corporate emphasis on circular economy principles. Consequently, supply chain stakeholders-from producers and distributors to end users-are increasingly recognizing the strategic value of FIBCs in balancing cost, performance, and sustainability objectives.

Rapid urbanization and expanding infrastructure projects worldwide are further elevating adoption across sectors such as mining, construction, and chemicals. The surge in e-commerce-driven bulk distribution for products like grains, resins, and minerals has intensified demand for containers that combine strength with cost-effective transport. Collaboration between logistics providers and manufacturers is facilitating tailored solutions that align with the specific handling equipment and safety protocols of end users. This collaborative approach is critical in emerging economies, where investments in port expansion and intermodal connections are unlocking new market opportunities for flexible bulk containers.

Emerging Innovations and Market Forces Reshaping the Flexible Bulk Container Landscape with a Focus on Sustainability, Automation, and Digital Integration

Recent years have witnessed a remarkable convergence of innovation and market demand that is fundamentally reshaping the flexible bulk container arena. Material science breakthroughs have produced next-generation woven fabrics that enhance tear resistance and UV stability, while novel coating technologies improve barrier performance against moisture and contaminants. These technical advancements are complemented by growing regulatory emphasis on sustainability, driving manufacturers to develop recyclable and bio-based container options. As a result, organizations are pursuing circular design strategies that extend container lifecycle and reduce waste streams, reinforcing commitments to environmental stewardship.

Parallel to material innovation, the integration of digital technologies has transformed how stakeholders monitor and optimize container usage. Internet of Things sensors now embedded within containers provide real-time visibility into load weight, location, and environmental conditions, enabling predictive maintenance and minimizing downtime. Automation in handling processes, combined with advanced data analytics, empowers decision-makers to dynamically allocate resources and adapt to fluctuating demand patterns. Additionally, global supply chain disruptions have underscored the necessity for resilient packaging systems, prompting companies to collaborate closely with container manufacturers to co-develop solutions tailored to specific logistical challenges. This collaborative ethos is catalyzing new service models that blend product design with digital platforms, setting the stage for the next generation of intelligent bulk handling solutions.

Globally, evolving regulatory frameworks and international certification standards have played a central role in shaping container innovation. Standards established by the United Nations for the transport of hazardous materials and ISO guidelines for load stability have raised performance benchmarks, prompting manufacturers to invest in compliance testing and quality assurance systems. Despite the advancements, adoption challenges remain, as stakeholders must navigate diverse local regulations and ensure that warehouse personnel are trained in proper handling protocols. Suppliers addressing this gap by offering training programs and digital tutorials help clients realize the full value proposition of modern container solutions.

Assessing the Complex Impacts of 2025 United States Tariff Adjustments on Flexible Bulk Container Trade Dynamics and Supply Chain Resilience

The implementation of new tariff measures in the United States during 2025 has exerted significant pressure on the flexible bulk container industry, especially where supply chains rely on imported raw materials. Heightened duties on polyethylene and polypropylene inputs have elevated production costs for domestic container manufacturers, prompting many to reevaluate their sourcing strategies. Some producers have shifted to alternative suppliers in Southeast Asia and the Middle East to mitigate cost increases, while others have invested in expanded domestic polymer production capacity. These adjustments are not merely transactional; they reflect broader risk management responses to evolving trade policies and geopolitical volatility.

Moreover, distributors and end users have had to navigate price volatility that stems from these tariff interventions, influencing procurement cycles and inventory management practices. In certain cases, companies have renegotiated contractual terms to share the burden of elevated input costs, fostering closer partnerships across the value chain. Supply chain resilience has become an operational imperative, with organizations investing in diversified logistics networks and back-up storage capabilities to avoid disruptions. Ultimately, the cumulative effect of the 2025 tariff landscape is accelerating a strategic shift toward supply chain agility and transparent cost structures, reshaping how stakeholders plan for both short-term market fluctuations and long-term capacity investments.

Furthermore, the strategic pivot toward nearshoring-particularly in North America-has altered supply chain geographies, with many producers relocating manufacturing closer to end markets in Mexico and Canada. This proximity minimizes transit times and tariff exposure but requires substantial capital investment in localized production lines. Smaller container suppliers have faced consolidation pressures as scale advantages become more prominent under the new tariff regime. Consequently, mergers and acquisitions activity has intensified, driving consolidation in regional markets and influencing competitive dynamics across the value chain.

Uncovering Segmentation Drivers in Flexible Bulk Containers with Capacity Ranges, Material Choices, Distribution Channels, Application Areas, and End-Use Sectors

Diverse capacity requirements and material selection represent fundamental drivers that shape the usage patterns of flexible bulk containers. Demand for containers rated between 500 kilograms and 1000 kilograms has surged among medium-scale producers who seek the optimal balance between payload efficiency and handling convenience. In parallel, small load segments below 500 kilograms cater to niche industrial applications where precise batch control is paramount, while configurations exceeding 1000 kilograms address high-volume operations such as large-scale agricultural processing. Material considerations also play a pivotal role, as the choice between polyethylene and polypropylene influences factors like chemical compatibility, tensile strength, and recyclability. Polyethylene variants offer enhanced flexibility and moisture resistance, making them well-suited for food-grade and fine-chemical applications, whereas polypropylene’s higher temperature tolerance aligns with sectors handling heat-sensitive bulk materials.

Distribution pathways and application contexts further refine market dynamics by dictating service models and logistical requirements. Direct sales channels foster close collaboration between manufacturers and end users, enabling tailored product configurations and technical support, while retail outlets provide more standardized offerings for smaller or emergent end users. In terms of functional deployment, containers utilized for packaging and transportation prioritize load security and intermodal compatibility, whereas those engineered for storage emphasize stackability, UV protection, and long-term material integrity. Finally, end-use sectors such as agriculture, chemicals and pharmaceuticals, construction, food and beverages, mining and metals, and plastic and rubber each impose unique performance criteria that inform container design and certification standards.

Interplay between segmentation dimensions underscores the importance of integrated portfolio strategies. For example, containers designed for high-capacity loads above 1000 kilograms with polypropylene construction find strong uptake in mining and metals sectors, while polyethylene-based units under 500 kilograms are preferred in food and beverage applications for their superior hygiene properties. Retail sales channels often stock standardized container types, but direct sales interactions enable co-development of specialized solutions that combine storage and transport features for industries like chemicals and pharmaceuticals. Recognizing these interdependencies allows market participants to optimize product roadmaps and align production with shifting demand profiles.

This comprehensive research report categorizes the Flexible Intermediate Bulk Container market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Design Type

- Material

- End- Use Industry

- Distribution Channel

Uncovering How Regional Growth Drivers and Market Dynamics Diverge across the Americas, Europe Middle East Africa, and Asia Pacific for Flexible Bulk Containers

Regional market trajectories of flexible bulk containers are influenced by distinct economic, regulatory, and infrastructure factors across the Americas, Europe Middle East and Africa, and the Asia Pacific. In the Americas, large-scale agricultural and petrochemical industries continue to propel steady demand, supported by well-established distribution networks and modern logistics corridors. Investments in rail and port infrastructure have streamlined intercontinental shipping, while sustainability mandates in key states have encouraged adoption of recycled-content solutions. Collaborative initiatives between container suppliers and major crop producers exemplify how targeted partnerships can optimize supply chain efficiency and reduce environmental impact.

Conversely, Europe Middle East and Africa present a diverse regulatory mosaic, where stringent environmental standards drive rapid uptake of reusable and certified containers in Western Europe, while emerging economies within the region reflect a growing emphasis on cost-effective bulk handling solutions. North Africa and parts of the Middle East are experiencing infrastructure expansions that facilitate greater intra-regional trade, creating new avenues for container deployment. In the Asia Pacific, booming manufacturing hubs in Southeast Asia, coupled with thriving commodity processing in Australia and India, fuel robust container consumption. Price sensitivity remains a key consideration, prompting suppliers to balance premium features with competitive cost structures. Such regional nuances necessitate tailored go-to-market strategies that align product attributes with localized requirements and market maturity levels.

Successful market entry requires adapting pricing models and service offerings to regional nuances. In the Americas, value-added services such as just-in-time delivery and on-site technical inspections have become differentiators. In Europe Middle East and Africa, leveraging established distribution partnerships and compliance consulting services accelerates market penetration. Within the Asia Pacific, joint ventures with local fabricators and investment in regional R&D centers enable faster customization cycles, catering to rapid industrialization trends. Aligning go-to-market tactics with local customer expectations and regulatory landscapes is essential for sustained growth.

This comprehensive research report examines key regions that drive the evolution of the Flexible Intermediate Bulk Container market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Manufacturers Driving Innovation, Quality Enhancements, and Strategic Alliances in the Global Flexible Bulk Container Industry

Major players in the flexible bulk container arena have distinguished themselves through continuous investment in research and development, strategic collaborations, and global capacity expansions. Industry leaders have focused on refining fabric technologies to enhance load integrity and moisture barriers, thereby meeting the evolving specifications of chemical, food, and pharmaceutical sectors. Strategic acquisitions and joint ventures have expanded geographic footprints, enabling these manufacturers to service high-growth markets with localized production. Additionally, partnerships with technology firms have facilitated the integration of digital tracking and sensor systems into container designs, improving supply chain visibility and operational efficiency for end users.

These companies are also spearheading sustainability initiatives, exemplified by commitments to increase the proportion of recycled and bio-based polymers in their product lines. By establishing take-back and recycling programs, they have created circular economy models that extend product lifecycles and reduce waste. Robust quality management frameworks, backed by international certifications and real-time monitoring protocols, ensure consistent performance across global operations. Investments in flexible manufacturing lines allow rapid adaptation to custom order requirements, while dedicated technical support teams collaborate with customers to optimize container selection and handling processes. This multifaceted approach to product and service excellence solidifies the competitive positioning of leading manufacturers and sets benchmarks for performance in the broader market.

Notwithstanding the dominance of established global players, a cohort of agile innovators has emerged, focusing on niche segments such as antistatic liners for sensitive electronics and integrated temperature-monitoring pouches for perishable goods. These specialized entrants challenge incumbents by offering rapid prototyping and pilot programs that address highly specific client requirements. Collaboration between larger manufacturers and these nimble firms through licensing or co-development agreements can accelerate the diffusion of specialized container technologies, enriching the market ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Intermediate Bulk Container market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ameriglobe LLC

- Berry Global Group, Inc.

- Bulk Corp International

- Commercial Syn Bags Ltd.

- Halsted Corporation

- Hebei FIBC Manufacturing Co.

- Intertape Polymer Group Inc.

- LC Packaging International BV

- Mauser Packaging Solutions

- Minibulk Inc.

- Mondi PLC

- Packem Umasree Private Limited

- Palmetto Industries International Inc.

- Pyramid Technoplast Ltd.

- Rapid Packaging

- RDA Bulk Packaging Ltd.

- RDB Rasayans Limited

- Rishi FIBC Solutions Pvt Ltd.

- Schütz GmbH & Co. KGaA

- SIA Flexitanks Limited

- Sonoco Products Company

- Super Sack Bag, Inc.

- Taihua Group

- The International Paper Company

- Yixing City Changfeng bulk bag Co.

Strategic Imperatives for Flexible Bulk Container Stakeholders to Leverage Sustainability, Technological Advances, and Agile Supply Chain Strategies

To maintain competitive advantage, stakeholders should prioritize development of eco-friendly container options that align with emerging regulatory and customer sustainability expectations. By adopting high-recycled-content polymers and exploring bio-based alternatives, manufacturers can address environmental concerns and differentiate their offerings. Implementing closed-loop recycling schemes and partnering with waste management providers will further extend container usage cycles and demonstrate commitment to circular economy principles, thereby enhancing brand reputation and customer loyalty.

Concurrently, embracing digital transformation is paramount. Integrating Internet of Things sensors into container designs delivers real-time insights into material condition, shipment progression, and warehouse inventory levels. Leveraging predictive analytics on this data enables proactive maintenance scheduling and optimized routing decisions, reducing downtime and preventing product spoilage. Collaboration with software providers to develop user-friendly dashboards will facilitate rapid adoption among end users, strengthening value propositions and supporting service-based revenue models.

Moreover, supply chain agility must be reinforced through diversified sourcing strategies and strategic alliances. Engaging with multiple raw material suppliers in different regions can mitigate exposure to tariff fluctuations and geopolitical risks, while establishing regional distribution hubs ensures quicker response to demand surges. Industry participants should actively engage with policymakers and standards organizations to influence regulations in favor of practical, performance-based container certifications. Such proactive engagement underscores industry leadership in shaping a stable, transparent, and resilient market environment.

In addition, organizations should invest in workforce training and certification programs to ensure safe and efficient container handling. Structured training modules on loading protocols, inspection criteria, and emergency response procedures not only reduce liability risks but also enhance operational productivity. Implementing robust monitoring systems and regular audits will help maintain compliance with evolving global standards, fostering trust among stakeholders and reinforcing brand credibility.

Methodological Framework Combining Primary Industry Engagements and Comprehensive Secondary Analysis to Deliver Robust Flexible Bulk Container Market Intelligence

The research methodology underpinning this analysis blends rigorous primary data collection with exhaustive secondary research to ensure accuracy and depth. Primary engagements entailed structured interviews with senior executives at container manufacturing firms, supply chain specialists, and end users across key industries. These discussions provided qualitative insights into emerging trends, customer preferences, and operational challenges. Complementing these interviews, targeted surveys were conducted among logistics providers and distributors to validate quantitative drivers and capture sentiment on technological adoption and regulatory impact.

Secondary research involved systematic review of industry reports, trade publications, regulatory documents, and academic journals to contextualize primary findings within broader market developments. Data on raw material pricing, tariff schedules, and regional infrastructure investments were extracted from reputable government and industry databases. The collected information was then triangulated, reconciling qualitative perspectives with quantitative indicators to build a coherent narrative. Analytical frameworks such as SWOT analysis and Porter’s Five Forces were applied to assess competitive dynamics and external influences. Quality assurance processes, including data validation checks and expert peer reviews, were implemented at each stage to guarantee the reliability of insights presented.

The study adheres to a defined timeline, with primary and secondary data collection phases scheduled to capture real-time market developments. Data validation checkpoints and periodic update cycles ensure that insights remain current, while transparent disclosure of research limitations and assumptions provides context for strategic interpretation. An advisory panel of industry experts conducted peer reviews at each milestone, reinforcing the integrity and applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Intermediate Bulk Container market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Intermediate Bulk Container Market, by Design Type

- Flexible Intermediate Bulk Container Market, by Material

- Flexible Intermediate Bulk Container Market, by End- Use Industry

- Flexible Intermediate Bulk Container Market, by Distribution Channel

- Flexible Intermediate Bulk Container Market, by Region

- Flexible Intermediate Bulk Container Market, by Group

- Flexible Intermediate Bulk Container Market, by Country

- United States Flexible Intermediate Bulk Container Market

- China Flexible Intermediate Bulk Container Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Market Dynamics and Strategic Insights to Guide Decision-Makers in the Competitive Flexible Bulk Container Landscape

The flexible bulk container market is currently navigating a period of rapid transformation driven by advancements in materials technology, an intensified focus on sustainability, and evolving trade policies. These converging forces are reshaping procurement strategies and operational models, compelling stakeholders to reassess traditional approaches to container sourcing and management. Segmentation insights reveal that capacity preferences, material selections, distribution structures, application functions, and end-use industries each demand nuanced solutions. Regional analyses underscore how localized factors-from regulatory frameworks in Western Europe to manufacturing growth in Asia Pacific-influence market behavior and adoption rates.

Looking ahead, industry leaders who harness digital tools, cultivate circular economy collaborations, and proactively adapt to policy shifts will secure a strategic edge. The ability to anticipate tariff impacts and diversify supply chains will be essential as geopolitical landscapes evolve. Ultimately, the interplay between innovation, sustainability, and operational resilience will define competitive positioning. Organizations that integrate these strategic imperatives into their decision-making frameworks will be best positioned to capitalize on emerging opportunities and drive long-term value in the dynamic flexible bulk container ecosystem.

Looking forward, the market is poised for further transformation as next-generation materials such as composite fabrics and nanocoatings enter scalability testing. Harmonization of regulatory standards across major trading blocs and the emergence of blockchain-enabled supply chain transparency tools are likely to streamline cross-border container movements. Companies that incorporate these forward-looking considerations into their strategic planning will unlock new avenues for differentiation and competitive advantage.

Connect with Ketan Rohom (Associate Director, Sales & Marketing) to Access the Flexible Bulk Container Market Report and Empower Your Strategic Growth

For a comprehensive exploration of the trends, drivers, and opportunities shaping the flexible bulk container landscape, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure a copy of the full market research report. This in-depth analysis will equip your organization with actionable intelligence on segmentation dynamics, regional nuances, supply chain strategies, and competitive benchmarks. Engage with Ketan to discuss how this report can support your strategic planning, optimize procurement decisions, and drive sustainable growth in an increasingly complex market environment.

To explore sample chapters and discuss customized research options, reach out to Ketan to arrange a briefing. Equip your team with the strategic insights necessary to navigate market complexities and seize growth opportunities in the flexible bulk container sector.

- How big is the Flexible Intermediate Bulk Container Market?

- What is the Flexible Intermediate Bulk Container Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?