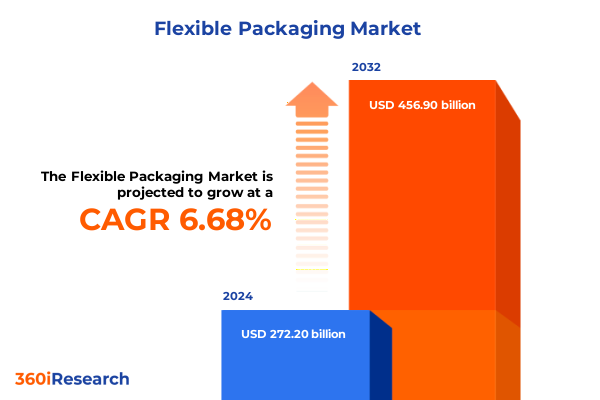

The Flexible Packaging Market size was estimated at USD 288.61 billion in 2025 and expected to reach USD 306.91 billion in 2026, at a CAGR of 6.78% to reach USD 456.90 billion by 2032.

Setting the Stage for the Flexible Packaging Market's Next Era by Capturing Key Drivers and Emerging Growth Opportunities Across Industries

The flexible packaging market stands at the cusp of a transformative era characterized by a convergence of sustainability imperatives, technological breakthroughs, and shifting end-use demands. In this dynamic environment, stakeholders across the value chain must clarify emerging priorities and frame strategic objectives that capitalize on evolving opportunities. Against this backdrop, this executive summary provides a concise yet comprehensive orientation to the key trends, influences, and market dynamics shaping the trajectory of flexible packaging globally.

By contextualizing the most significant market drivers alongside critical regulatory and trade developments, the introduction establishes a holistic foundation that prepares readers to navigate the complexities ahead. It also underscores the urgency for manufacturers, brand owners, and supply chain partners to align innovation pipelines and investment decisions with both environmental stewardship and operational efficiency goals. Ultimately, this opening section sets the stage for a structured analysis of transformative shifts, trade impacts, segmentation insights, regional nuances, competitive landscapes, and actionable recommendations, ensuring that industry leaders can anticipate disruption, inform strategy, and capture long-term value.

Uncovering Transformative Industry Shifts That Are Redefining Flexible Packaging Solutions and Elevating Sustainability Performance Globally

A profound shift toward sustainable materials and circular business models has become the defining theme in the flexible packaging landscape. Consumers and regulators alike are demanding reduced environmental footprints, prompting innovation in bio-based polymers, mono-material structures, and recyclable laminates. These developments are not merely incremental; they herald a fundamental reimagining of packaging design criteria and value chain configurations.

Simultaneously, digital printing technologies are enabling unprecedented levels of customization and short-run flexibility, reducing lead times and waste while enhancing brand storytelling. Flexographic and gravure printing processes are also evolving, incorporating advanced drying systems and energy-efficient inks that align with corporate sustainability objectives.

Furthermore, the integration of smart packaging solutions-such as printed sensors, QR-enabled traceability, and active barrier systems-illustrates how technology is transforming packaging into a dynamic platform for consumer engagement and supply chain transparency. Taken together, these converging trends represent a seismic transformation in how packaging is conceived, manufactured, and utilized, setting the stage for a more resilient, responsive, and responsible sector.

Analyzing the Cumulative Impact of United States Tariffs Implemented in 2025 on Supply Chains, Cost Structures, and Competitive Dynamics in Flexible Packaging

In 2025, the United States introduced a spectrum of tariffs targeting select raw materials and intermediate goods used extensively in flexible packaging, creating ripple effects across the industry. Higher input costs have compelled manufacturers to reassess sourcing strategies, with many accelerating nearshoring efforts to mitigate exposure to import duties. This recalibration has altered traditional supply chain footprints, driving investment in domestic production capacity and fostering partnerships with local material suppliers.

The resulting cost pressures have also intensified competitive dynamics, particularly among small and mid-sized converters that face narrower margins. In response, many players are pursuing process optimization, lean manufacturing practices, and strategic procurement alliances to offset tariff-induced expenses. Additionally, some forward-looking organizations have leveraged innovation programs to develop alternative material blends that are not subject to the new duties.

Looking across the value chain, brand owners have adjusted pricing strategies and explored pass-through mechanisms, while policymakers are engaging in dialogue with industry coalitions to advocate for exemptions and modifications. Collectively, these measures illustrate the cumulative impact of U.S. tariffs in reshaping production geographies, cost structures, and collaborative frameworks within the flexible packaging ecosystem.

Revealing Critical Segmentation Insights That Illuminate Product, Material, Technology, Closure, End-User, and Distribution Channel Dynamics

A nuanced examination of market segmentation reveals critical insights into product, material, technology, closure, end-user, and distribution channel dynamics that collectively drive demand patterns and innovation priorities. By product type, the landscape spans both bags and pouches: bags include flat bottom, side gusset, and stand up variants, while pouches encompass retort, spouted, and zipper & slider designs. Each format addresses distinct application requirements, from retail merchandising to high-barrier food packaging, and influences converter equipment investments and format-specific R&D.

Material segmentation further clarifies competitive positioning: aluminum is available in foil and laminates, bioplastics are represented by PHA, PLA, and starch blends, paper includes greaseproof, kraft, parchment, and sulfate grades, and plastics consist of BOPP, PE, PET, PP, and PVC. These material choices reflect trade-offs among barrier performance, recyclability, cost, and sensory attributes, thus shaping material sourcing strategies and end-user preferences.

Technological segmentation highlights the growing penetration of digital printing alongside established flexographic, gravure, and offset processes, each offering unique advantages in run lengths, label quality, and ink compatibility. Closure type segmentation underscores the importance of seals, spouts, and zippers in offering convenience, convenience-factors that drive consumer engagement and brand differentiation. Within end-user domains, applications range from food & beverage-which includes beverages, dairy products, and snacks-to healthcare with medical devices and pharmaceuticals, household products covering cleaning and laundry goods, and personal care featuring cosmetics and grooming products. Distribution channels span offline and online pathways, each shaped by e-commerce growth trajectories and retail network strategies. Collectively, this segmentation framework equips decision makers with a granular understanding of where growth, innovation, and competitive pressures are most concentrated.

This comprehensive research report categorizes the Flexible Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Packaging Type

- Technology

- Structure

- End-User

- Distribution Channel

Dissecting Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific to Unveil Unique Growth Drivers and Market Challenges

Regional dynamics within the flexible packaging market underscore the diversity of growth drivers, regulatory frameworks, and consumer preferences that define each geography. In the Americas, momentum is driven by strong demand from the food & beverage sector, particularly in North America where sustainability targets have spurred adoption of recyclable mono-material pouches and post-consumer resin integration. Latin American markets exhibit increasing interest in cost-effective packaging solutions that balance barrier performance with economic feasibility, prompting local converters to enhance manufacturing capabilities and forge joint ventures.

Europe, Middle East, and Africa (EMEA) represent a tapestry of regulatory rigor and innovation leadership. The European Union’s stringent single-use plastics directive and ambitious circular economy goals have catalyzed pilot projects in compostable and chemically recyclable laminates, while Middle Eastern investments in advanced packaging infrastructure are supporting export-oriented growth. In Africa, small-scale markets are gradually embracing standardization and quality certifications to integrate into global supply chains.

Asia-Pacific remains a powerhouse of both production and consumption, with China and Southeast Asia at the forefront of high-speed packaging lines and digital print installations. Consumer demand for convenience and premiumization in markets such as Japan, South Korea, and Australia is driving the adoption of resealable and retort pouch formats. Simultaneously, emerging economies in South Asia are witnessing accelerated use of film laminates and low-cost paper alternatives. These regional insights map the contours of opportunity and risk, guiding stakeholders to the most attractive investments and collaborative initiatives.

This comprehensive research report examines key regions that drive the evolution of the Flexible Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Landscape and Strategic Initiatives of Leading Flexible Packaging Companies Driving Innovation and Market Expansion Strategies

Leading companies in the flexible packaging sector are distinguished by a strategic focus on R&D collaboration, vertical integration, and sustainability leadership. Multinational film and pouch converters are forging alliances with resin producers to secure feedstock availability, while smaller innovators are carving specialized niches through proprietary barrier technologies and bespoke printing solutions. Many incumbents are also leveraging digital platforms to enhance customer engagement, offering virtual sampling, rapid prototyping services, and data-driven run optimization tools.

Strategic acquisitions and joint ventures continue to reshape the competitive landscape, as organizations seek to expand geographic footprints and material portfolios. Recent investments in extruder capacity, laminator upgrades, and advanced printing presses reflect a dual emphasis on scalability and flexibility. The pursuit of environmental certifications, such as ISO 14001 and chain-of-custody endorsements, has become a baseline requirement for tier-one brand partnerships. Moreover, leading players are piloting programs for closed-loop recycling and chemical recovery, reinforcing their commitments to circularity.

Through these initiatives, top companies are not only enhancing operational resilience but also positioning themselves as partners of choice for brands seeking to navigate the complex intersection of regulatory compliance, consumer expectations, and supply chain agility. This corporate dynamism underscores the importance of strategic foresight and collaborative innovation in sustaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACTEGA GmbH

- Amcor PLC

- BBC CELLPACK Packaging Illfurth SAS

- C-P Flexible Packaging, Inc.

- CCL Industries Inc.

- Constantia Flexibles International GmbH

- Coveris Management GmbH

- Dai Nippon Printing Co., Ltd.

- Exxon Mobil Corporation

- Goglio S.p.A.

- Graphic Packaging Holding Company

- Hood Packaging Corporation

- Huhtamäki Oyj

- Jindal Poly Films Limited

- Microplast – Coldeplast

- Mitsui Chemicals, Inc.

- Mondi PLC

- Novolex Holdings, LLC

- Pactiv Evergreen Inc.

- PPC Flexible Packaging LLC

- Printpack, Inc.

- ProAmpac Intermediate, Inc.

- SCG Packaging Public Company Limited

- Schur Flexibles Holding GesmbH

- Sealed Air Corporation

- Sonoco Products Company

- Südpack Holding GmbH

- Taghleef Industries LLC

- The Dow Chemical Company

- TOPPAN Inc.

- Transcontinental Inc.

- UFlex Limited

- WestRock Company by Smurfit Kappa Group PLC

- Winpak Ltd.

Delivering Actionable Recommendations for Industry Leaders to Navigate Market Disruptions, Accelerate Innovation, and Capitalize on Emerging Opportunities

Industry leaders must adopt a multifaceted approach to surmount current challenges and harness emerging opportunities in the flexible packaging arena. First, investing in next-generation materials that align with circular economy principles will unlock long-term competitive advantages while mitigating regulatory risks. Prioritizing research investments in bio-based polymers and chemically recyclable laminates can create sustainable differentiation and reduce exposure to volatile petrochemical pricing.

Second, enhancing digitalization across the value chain-from customer engagement platforms to Industry 4.0 manufacturing systems-will improve responsiveness, reduce waste, and enable predictive maintenance frameworks. Embracing digital printing for shorter runs and customization can attract premium brand contracts and minimize inventory obsolescence.

Third, cultivating strategic partnerships with logistics providers, resin manufacturers, and recycling ecosystem stakeholders will strengthen supply chain resilience and foster closed-loop solutions. By co-developing circular initiatives and aligning incentives across the chain, organizations can share risk and accelerate material recovery processes.

Finally, embedding agility into organizational structures-through cross-functional teams, real-time data analytics, and streamlined decision-making protocols-will empower leaders to respond swiftly to tariff fluctuations, raw material disruptions, and shifting consumer preferences. These actionable recommendations, when executed cohesively, will position industry participants to thrive amid uncertainty and secure sustainable growth trajectories.

Outlining Rigorous Research Methodology Employed to Ensure Data Integrity, Comprehensive Market Analysis, and Unbiased Insights in This Flexible Packaging Study

This study employs a rigorous, multi-step research methodology to ensure robust, unbiased insights into the flexible packaging market. Primary research served as the cornerstone, consisting of in-depth interviews with C-level executives, technical experts, and procurement managers across converters, brand owners, and raw material suppliers. These qualitative dialogues were complemented by a comprehensive survey of market participants, capturing both strategic perspectives and operational metrics.

Secondary research included exhaustive reviews of company reports, industry journals, regulatory databases, and patent filings. Publicly available information was cross-validated against proprietary databases to confirm accuracy and completeness. The research team leveraged a triangulation approach, reconciling data points from multiple sources to minimize potential biases.

A detailed segmentation framework-encompassing product type, material type, technology, closure type, end-user, and distribution channel-guided the analysis of demand drivers and competitive intensity. Regional breakdowns across Americas, EMEA, and Asia-Pacific allowed for granular assessment of regulatory impacts and growth catalysts. Combined with expert panel reviews, this methodology underpins the credibility and depth of the findings presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Packaging Market, by Material Type

- Flexible Packaging Market, by Packaging Type

- Flexible Packaging Market, by Technology

- Flexible Packaging Market, by Structure

- Flexible Packaging Market, by End-User

- Flexible Packaging Market, by Distribution Channel

- Flexible Packaging Market, by Region

- Flexible Packaging Market, by Group

- Flexible Packaging Market, by Country

- United States Flexible Packaging Market

- China Flexible Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Concluding Executive Summary with Key Strategic Takeaways and Imperatives for Stakeholders in the Evolving Flexible Packaging Landscape

In conclusion, the flexible packaging market is undergoing a period of rapid transformation driven by sustainability mandates, technological innovation, and geopolitical factors. As environmental and regulatory pressures intensify, the imperative to develop circular solutions and adopt advanced manufacturing processes has never been greater. At the same time, digital printing and smart packaging functionalities are redefining value propositions, enabling brands to deliver enhanced consumer experiences and supply chain transparency.

The cumulative impact of U.S. tariffs in 2025 has reshaped supply chain strategies, compelling stakeholders to balance cost considerations with operational resilience. Detailed segmentation and regional analyses reveal where the most promising growth avenues lie, whether in high-barrier applications, emerging markets, or digitally enhanced service models. Competitive insights underscore the strategic importance of R&D partnerships, vertical integration, and sustainability certifications.

By integrating the key findings and actionable recommendations outlined herein, decision makers can position their organizations to navigate uncertainty, accelerate innovation, and capitalize on evolving market dynamics. This executive summary offers a strategic blueprint for stakeholders committed to achieving long-term success in the dynamic world of flexible packaging.

Engage with Ketan Rohom to Access Tailored Flexible Packaging Intelligence That Drives Strategic Growth and Informed Decision Making

Engaging with Ketan Rohom as your strategic partner empowers decision makers to access tailored market intelligence that addresses specific challenges and opportunities within the flexible packaging landscape. By initiating a direct dialogue with the Associate Director of Sales & Marketing, stakeholders can secure in-depth briefings, exclusive data insights, and custom research deliverables designed to facilitate evidence-based decision making. Reaching out to Ketan Rohom ensures timely guidance on leveraging the latest trends, technological advancements, and regulatory developments, thereby accelerating go-to-market strategies and enhancing competitive positioning. To embark on this journey toward actionable intelligence and transformative growth, contact Ketan Rohom today and discover how bespoke research solutions can elevate your organization’s strategic planning and operational excellence in the flexible packaging sector

- How big is the Flexible Packaging Market?

- What is the Flexible Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?