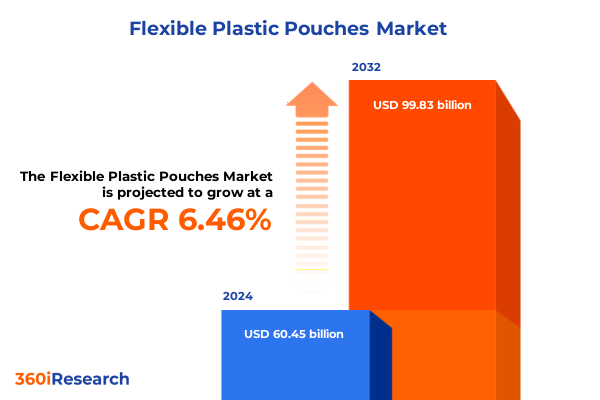

The Flexible Plastic Pouches Market size was estimated at USD 63.85 billion in 2025 and expected to reach USD 67.45 billion in 2026, at a CAGR of 6.59% to reach USD 99.83 billion by 2032.

Comprehensive Introduction to Pioneering the Future of Flexible Plastic Pouches Through an Insightful Overview of Market Dynamics and Growth Catalysts

Introduction

This executive summary opens with a broad yet focused overview of the flexible plastic pouch market, setting the stage for a deeper exploration of evolving dynamics and emerging growth drivers. It outlines how shifting consumer preferences toward convenience and sustainability have propelled flexible pouches into prominence across multiple end-use domains. By tracing foundational developments from basic packaging solutions to sophisticated multilayer laminates, the introduction establishes a narrative of continuous innovation. Moreover, it emphasizes the pivotal role of regulatory frameworks and global supply chain adjustments in shaping industry trajectories, underscoring the resilience and adaptability of market participants.

Transitioning from historical context to present-day relevance, the introduction highlights how rapid advancements in materials science and manufacturing technologies have enabled producers to meet rising demands for lightweight, durable, and recyclable pouches. It directs attention to the symbiotic relationship between consumer expectations and technological progress, illustrating how brands leverage these packaging formats to enhance product shelf appeal and extend shelf life. Ultimately, this section provides a clear foundation for understanding the subsequent in-depth analyses of tariff impacts, segmentation revelations, regional performance, and strategic imperatives.

Examining the Transformative Forces Redefining the Flexible Plastic Pouch Industry from Cutting-Edge Technology to Holistic Sustainability Initiatives

Transformative Shifts in Industry Dynamics

In recent years, the flexible plastic pouch landscape has undergone sweeping transformations fueled by innovations in sustainable materials and digital manufacturing techniques. The advent of bio-based polymers and advanced extrusion lamination processes has significantly reduced dependency on traditional petrochemical resins, fostering heightened environmental stewardship. At the same time, the integration of digital printing technology has revolutionized branding opportunities, allowing for rapid customization and shorter production runs that cater to niche market segments.

Meanwhile, heightened consumer consciousness regarding recyclability and carbon footprints has driven packaging designers to pursue circular economy principles. As a result, numerous manufacturers have invested in recyclable monolayer films and compostable structures, presenting viable alternatives to multi-component laminates. Concurrently, the proliferation of intelligent packaging-featuring QR codes, RFID chips, and freshness indicators-has elevated pouches from passive containers to interactive consumer touchpoints. These parallel shifts toward material innovation, sustainability mandates, and digital engagement collectively redefine competitive parameters, ensuring that only agile, forward-thinking stakeholders will thrive in the evolving ecosystem.

Looking forward, the ongoing convergence of functionality and environmental responsibility promises to reshape product portfolios and supply chain configurations. Organizations that strategically leverage these transformative forces will secure leadership positions, setting new benchmarks for performance and ecological impact alike.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Raw Material Costs Manufacturability and Competitive Dynamics in Flexible Pouch Markets

Cumulative Impact of United States Tariffs 2025

The introduction of new United States tariffs in early 2025 has exerted multifaceted effects on the flexible plastic pouch sector, reverberating across raw material procurement, manufacturing costs, and competitive positioning. These levies, targeting a range of imported polyamide, polyester, polyethylene, and polypropylene resins, have translated into immediate cost pressures for domestic producers. As a result, manufacturers reliant on lower-cost foreign feedstocks have faced steep increases in input prices, prompting a re-evaluation of supply chain strategies and sourcing alternatives.

In response, several leading converters have forged closer partnerships with domestic resin suppliers to mitigate tariff-driven volatility. While this approach has delivered more predictable cost structures, it has also constrained material innovation, as smaller resin producers may lack the R&D capabilities of global giants. Furthermore, a subset of companies has turned to material substitution-shifting from higher-tariff polyamide and polyester blends toward HDPE and LLDPE films-to optimize cost-efficiency. These adaptations underscore a broader trend of strategic agility, as manufacturers balance regulatory compliance with performance requirements.

Moreover, the tariff environment has catalyzed consolidation within the industry, accelerating mergers and acquisitions aimed at capturing economies of scale. By uniting production capacities and negotiating leverage, larger entities seek to offset the detrimental impact of import duties. Despite these challenges, the imposed tariffs have also stimulated innovation in material science, as stakeholders invest in advanced monolayer solutions and local compounders ramp up capacity to meet evolving demands.

Revealing Nuanced Segmentation Insights That Drive Diverse End Uses Materials Product Forms and Advanced Lamination Technologies in the Market

Segmentation Insights Illuminating Diverse Market Dimensions

An in-depth segmentation analysis reveals how distinct product categories and material compositions drive specialized applications and competitive differentiation. When exploring end-use verticals, the Food and Beverage domain emerges as a leading segment, encompassing beverage, confectionery, dairy, and snack foods applications that prioritize barrier protection and visual appeal. Simultaneously, industrial applications, spanning agricultural and chemical sectors, demand pouches engineered for chemical resistance and secure sealing. Personal care formulations, including hair and skin care items, have gravitated toward pouches designed for precise dispensing and premium aesthetics. Pet food packaging, encompassing both dry and wet formulations, requires robust structures to preserve freshness and prevent leakage, while pharmaceutical liquids, powders, and tablet or capsule formats necessitate stringent compliance with regulatory and hygiene standards.

Material-based segmentation underscores the prevalence of polyethylene, particularly HDPE, LDPE, and LLDPE, which balance cost-effectiveness and performance attributes. Polypropylene variants deliver enhanced stiffness and clarity for high-end consumer brands, whereas polyester and polyamide films offer superior barrier properties essential for moisture-sensitive goods. In terms of product form, stand-up pouches with and without zippers have captured significant market share due to their shelf presence and resealability, while spout pouches, available with screw caps or snap-on closures, cater to on-the-go convenience. Vacuum pouches serve niche segments requiring oxygen exclusion for extended shelf life, and flat pouches provide economical solutions for single-use applications.

Lamination type further distinguishes packaging configurations, with mono layer offerings gaining traction for streamlined recycling, and multilayer constructs-adhesive and extruded laminates alike-delivering customized barrier and mechanical performance. This layered analysis underscores the critical interplay between end use, material selection, product architecture, and lamination strategy in shaping market opportunities.

This comprehensive research report categorizes the Flexible Plastic Pouches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Form

- Lamination Type

- End Use

Illuminating Regional Nuances Shaping the Flexible Plastic Pouch Market Trajectories Across Americas Europe Middle East Africa and Asia-Pacific Landscapes

Key Regional Insights Shaping the Global Flexible Pouch Ecosystem

Regional performance analysis highlights the Americas as a powerhouse of innovation and capacity, underpinned by mature infrastructure, advanced manufacturing technologies, and stringent environmental regulations. North American producers have led the charge in commercializing recyclable monolayer films and digital printing capabilities that cater to dynamic retail landscapes. Latin America, in turn, has experienced steady growth driven by rising consumer demand for packaged foods, even as infrastructure constraints and import tariffs shape supply chain strategies.

Across Europe, the Middle East, and Africa, regulatory mandates such as extended producer responsibility schemes and plastic taxes have accelerated the shift toward sustainable packaging alternatives. European converters are at the forefront of bio-based polymer adoption and chemical recycling initiatives. Meanwhile, Middle Eastern and African markets exhibit growing interest in flexible pouches for bottled water and edible oil applications, with local manufacturers scaling up to meet regional consumption patterns.

In the Asia-Pacific region, an expanding middle class and urbanization trends have fueled skyrocketing demand for convenient, portable, and shelf-stable packaging formats. Southeast Asian economies, characterized by strong agricultural and snack food sectors, have become hotbeds for pouch adoption. At the same time, established markets like Japan and Australia maintain high standards for barrier performance and brand differentiation, driving continuous technological upgrading. Collectively, these regional nuances underscore a fragmented yet deeply interwoven global industry landscape.

This comprehensive research report examines key regions that drive the evolution of the Flexible Plastic Pouches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Innovators Shaping Product Development Sustainability and Competitive Strategies in Flexible Pouch Manufacturing

Strategic Profiles of Leading Companies and Emerging Innovators

Market leadership in flexible plastic pouches is defined by a blend of production scale, material innovation, and sustainability credentials. Established players leverage vertically integrated operations to streamline resin sourcing and downstream conversion, enabling rapid response to shifting demand patterns. These incumbents consistently invest in state-of-the-art extrusion laminators, high-speed form-fill-seal equipment, and sophisticated printing presses to maintain cost competitiveness and product differentiation. Their R&D pipelines often center on novel barrier coatings, antimicrobial additives, and lightweight structures that reduce material consumption without sacrificing performance.

Concurrently, a wave of agile newcomers and specialized converters is reshaping market dynamics by focusing on niche applications and sustainable solutions. These innovators prioritize partnerships with chemical recyclers and bio-polymer producers to bring compostable or chemically recyclable pouches to market. By emphasizing transparency and traceability, they cater to brand owners seeking to reinforce environmental claims on-pack. Additionally, digital-native enterprises are harnessing e-commerce distribution models to offer shorter lead times and customized packaging options, challenging traditional bulk production paradigms.

The competitive interplay between established conglomerates and disruptive start-ups propels continuous advancement. Ultimately, companies that balance scale economies with localized customization and demonstrable ecological performance will define leadership trajectories moving forward.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Plastic Pouches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Constantia Flexibles GmbH

- Coveris Holdings S.A.

- ePac Holdings, LLC

- Huhtamaki Oyj

- Klöckner Pentaplast Group

- Lacerta Group LLC

- Mondi plc

- ProAmpac

- Sealed Air Corporation

- Sonoco Products Company

- Uflex Limited

Delivering Actionable Strategic Recommendations to Drive Operational Excellence Sustainability and Market Expansion in the Flexible Plastic Pouch Ecosystem

Actionable Recommendations for Strengthening Competitive Position and Sustainability Footprint

To capture growth opportunities and mitigate emerging risks, industry leaders should accelerate investments in recyclable monolayer and bio-based polymer technologies that align with evolving regulatory frameworks. This strategic shift will not only address consumer sustainability demands but also simplify end-of-life processing and recycling infrastructure engagement. Simultaneously, strengthening relationships with resin suppliers through long-term offtake agreements can stabilize raw material costs in an increasingly tariff-sensitive environment.

Embracing digital transformation across the value chain is equally critical. Companies should adopt Industry 4.0 principles, integrating IoT-enabled manufacturing equipment and predictive analytics to optimize production efficiency and minimize downtime. Leveraging digital print capabilities will enhance on-demand customization and reduce inventory obsolescence, catering to fast-moving consumer trends. Furthermore, advancing transparent packaging through QR codes and blockchain-enabled traceability can reinforce brand credibility and foster consumer trust.

Collaborative ventures between incumbents, start-ups, and research institutions will catalyze groundbreaking material breakthroughs. By pooling resources in precompetitive consortiums, stakeholders can share risk and accelerate commercialization of next-generation barrier films or compostable structures. Finally, developing agile go-to-market strategies-such as modular production cells and nearshoring facilities-will enable rapid response to regional shifts and protective tariff regimes, ensuring resilient supply chains and sustained profitability.

Detailing Rigorous Research Methodology Combining Qualitative and Quantitative Techniques to Ensure Robust Data Integrity and Insightful Analysis

Rigorous Research Methodology Ensuring Validity and Reliability of Market Intelligence

This analysis is grounded in a robust research framework that melds qualitative insights with quantitative rigor. Primary research included in-depth interviews with packaging engineers, sustainability officers, and procurement specialists across leading brand owners and converters. These conversations provided nuanced perspectives on technology adoption, regulatory compliance, and emerging consumer preferences. Complementing these discussions, secondary research encompassed a thorough review of public filings, patent landscapes, and regulatory documents to map historical trends and forecast potential disruptions.

Data triangulation was employed to validate findings, cross-referencing input from resin manufacturers, equipment suppliers, and industry associations. Where discrepancies arose, follow-up consultations and data verification ensured the integrity of the insights. Additionally, material characterization studies and lab-scale performance evaluations informed assessments of barrier efficacy, recyclability potential, and mechanical properties. This technical validation was essential for aligning market demand projections with real-world application requirements.

Finally, competitive benchmarking and scenario analysis techniques were used to stress-test strategic recommendations under various tariff and regulation scenarios. By simulating cost structures and market responses, the research methodology provides stakeholders with resilient strategies that account for both current conditions and potential future states, delivering a comprehensive foundation for data-driven decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Plastic Pouches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Plastic Pouches Market, by Material

- Flexible Plastic Pouches Market, by Product Form

- Flexible Plastic Pouches Market, by Lamination Type

- Flexible Plastic Pouches Market, by End Use

- Flexible Plastic Pouches Market, by Region

- Flexible Plastic Pouches Market, by Group

- Flexible Plastic Pouches Market, by Country

- United States Flexible Plastic Pouches Market

- China Flexible Plastic Pouches Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Drawing Insightful Conclusions on Market Dynamics Sustainability Trends and Strategic Imperatives to Guide Stakeholder Decision-Making in Flexible Packaging

Comprehensive Conclusions Integrating Market Dynamics Sustainability Developments and Strategic Imperatives

This executive summary consolidates key findings to offer a cohesive view of the flexible plastic pouch market’s trajectory. It underscores how technological advancements in sustainable materials and digital manufacturing are setting new benchmarks for performance and environmental impact. The analysis of recent tariff introductions highlights the importance of strategic supply chain management and material diversification. Segmentation insights reveal the nuanced interplay between end-use requirements, material selection, product form innovations, and lamination strategies, illuminating pathways for value creation.

Regional assessments emphasize the distinct growth drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific, illustrating the need for localized strategies that respect regulatory landscapes and consumer expectations. Company profiles and competitive mapping further delineate how incumbents and challengers are shaping industry norms through scale economies and disruptive innovation. The actionable recommendations presented advocate for sustainable technology adoption, digital transformation, and collaborative research partnerships to foster resilience and unlock new growth avenues.

Ultimately, the conclusion articulates a strategic imperative: stakeholders must embrace a holistic approach that weaves together environmental responsibility, operational excellence, and market agility. Such integration will define market leaders in an industry poised for continued evolution and expansion.

Engage with Associate Director Ketan Rohom to Secure Your Comprehensive Flexible Plastic Pouch Market Research Report and Unlock Strategic Growth Insights

Unlock unparalleled market intelligence and align your strategic initiatives with expert guidance. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to obtain your definitive research dossier on flexible plastic pouches. This comprehensive report distills critical industry trends, tariff implications, segmentation analyses, and key regional perspectives into actionable insights. Engage with an industry veteran to tailor the findings to your organization’s objectives and drive competitive advantage with confidence. Begin the journey toward data-driven decision-making and sustained growth by securing your copy today

- How big is the Flexible Plastic Pouches Market?

- What is the Flexible Plastic Pouches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?