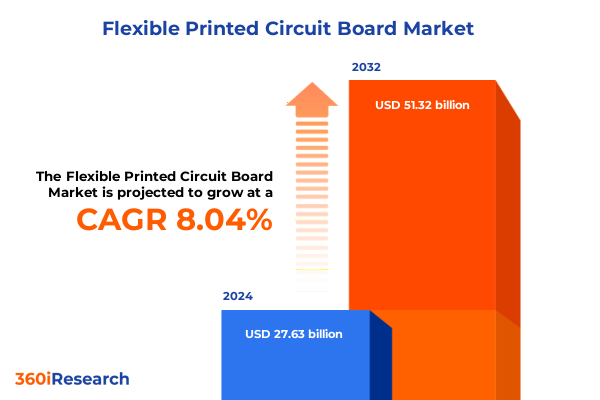

The Flexible Printed Circuit Board Market size was estimated at USD 29.76 billion in 2025 and expected to reach USD 32.07 billion in 2026, at a CAGR of 8.09% to reach USD 51.32 billion by 2032.

Exploring the dynamic evolution and critical role of flexible printed circuit boards in powering next-generation electronics and complex system integrations

Flexible printed circuit boards represent an extraordinary leap in interconnect technology, marrying material innovation with precise engineering to deliver unparalleled design flexibility and performance. Originating as an evolution of rigid board solutions, these circuits employ thin, bendable substrates that accommodate three-dimensional layouts, reduce weight, and enable intricate form factors that were previously unattainable. As device miniaturization accelerates across sectors such as wearables, smartphones, and medical instrumentation, flexible circuits have transitioned from niche applications to foundational enablers of modern electronics. Furthermore, their inherent ability to conform to curved surfaces and absorb mechanical stress addresses reliability challenges in dynamic operating environments, making them indispensable across both consumer and industrial ecosystems.

In recent years, continuous improvements in dielectric materials and conductor patterning have elevated signal integrity and thermal management capabilities, catalyzing broader acceptance in high-frequency and high-power applications. Moreover, advancements in surface mount technology and component integration have streamlined assembly workflows and reduced labor intensity, fostering cost competitiveness against traditional rigid boards. Consequently, original equipment manufacturers and design houses are integrating flexible circuit technologies earlier in the concept phase, recognizing that early adoption can unlock value through weight reduction, assembly consolidation, and enhanced product aesthetics. This convergence of technical merit and design-level benefits underscores the strategic importance of flexible printed circuits for organizations intent on delivering differentiated, next-generation products.

Uncovering the transformative technological shifts redefining the flexible printed circuit board market landscape across sectors and use cases

The flexible printed circuit board landscape is being reshaped by a confluence of technological breakthroughs and shifting end-market requirements. High-speed data transmission demands driven by 5G networks and next-generation wireless standards have placed rigorous requirements on substrate materials and conductor geometries, compelling manufacturers to adopt finer line widths and advanced multilayer structures. Simultaneously, the electrification of automotive platforms has stimulated the development of hybrid rigid-flex solutions designed to withstand temperature extremes and mechanical vibration in electric vehicle (EV) power modules and battery management systems. These transformative shifts emphasize materials innovation and precision engineering in pursuit of both performance and reliability.

Additionally, the rapid proliferation of wearable devices and portable healthcare monitors has underscored the need for ultrathin, stretchable circuitry that maintains functionality under repeated flex cycles. Researchers and suppliers are increasingly exploring polyimide blends and adhesive enhancements to deliver circuits capable of withstanding rigorous user interactions without compromising electrical continuity. On the production side, the integration of additive manufacturing processes alongside traditional photochemical etching has begun to improve throughput for complex geometries, accelerating the transition from prototyping to mass production. By reevaluating manufacturing modalities, the industry is adopting a more agile approach to capacity scaling and design iteration, ensuring that new applications can be brought to market with greater speed and precision.

Examining the cumulative repercussions of 2025 United States tariffs on sourcing strategies cost structures and supply chain resilience in the FPCB industry

The imposition of additional United States tariffs in early 2025 has had a cascading effect on global supply chains and cost structures within the flexible printed circuit board sector. While the primary objective of these measures was to protect domestic manufacturing and address trade imbalances, the resultant increase in import duties has introduced notable inflationary pressure on raw materials sourced from key Asian suppliers. Consequently, many North American electronics firms have faced elevated input costs, prompting a reevaluation of offshore dependencies and exploration of nearshore manufacturing options to mitigate tariff burdens.

Moreover, the uncertainty surrounding potential future tariff adjustments has created hesitancy in long-term procurement commitments, leading to increased volatility in order volumes and lead times. In response, strategic buyers are adopting more flexible sourcing frameworks that prioritize multi-sourcing agreements and dynamic contract structures. These shifts have, in turn, accelerated investments in domestic capacity expansion and strategic partnerships with local fabricators. Ultimately, the cumulative impact of United States tariffs is driving a gradual restructuring of regional value chains, with stakeholders balancing cost optimization against supply security and responsiveness in an increasingly complex trade environment.

Diving into the critical segmentation dimensions that reveal nuanced market preferences types materials technologies applications and distribution channels for FPCBs

A nuanced understanding of market segmentation reveals critical insights into where growth and innovation intersect within the flexible printed circuit board ecosystem. When examining circuit type, single-sided variants continue to dominate simpler form factors used in consumer electronics, whereas double-sided configurations enable denser component integration for compact devices. Multi-layer architectures are gaining traction in applications demanding high signal fidelity and space efficiency, such as advanced driver assistance systems and data center interconnects. Such differentiation underscores the importance of aligning board complexity with end-use performance requirements.

Material selection further shapes design possibilities and cost profiles. Polyester substrates offer affordability for mainstream consumer applications, while polyimide films deliver superior thermal stability and chemical resistance essential for aerospace, defense communications, and medical imaging equipment. Adhesive systems bridge the gap between performance and manufacturability, with the choice of bonding agents influencing both fabrication yield and long-term reliability under thermal cycling. In parallel, technology choices between additive manufacturing and traditional etching processes inform both design flexibility and production throughput, as additive methods enable rapid prototyping and material conservation while etching maintains precise trace geometries at scale.

Applications span a broad spectrum, from avionics and satellite systems in aerospace to battery management and infotainment modules in automotive electronics, and from servers in data centers to smart home devices and fitness trackers. Each segment imposes unique electrical, mechanical, and environmental demands, driving specialized design rules and validation protocols. Distribution channels also exhibit distinct dynamics: offline sales through authorized distributors support high-reliability, low-volume industrial orders, whereas online platforms and brand-specific websites accelerate procurement cycles for rapid-turn consumer and telecom applications. Taken together, these segmentation dimensions delineate a market characterized by both diversity of use cases and the imperative for targeted innovation strategies.

This comprehensive research report categorizes the Flexible Printed Circuit Board market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Technology

- Application

- Distribution Channel

Highlighting regional dynamics and demand drivers shaping the flexible printed circuit board sector across Americas EMEA and Asia-Pacific markets

Regional variations in demand for flexible printed circuits reflect the distinct technological priorities and economic drivers of each geography. In the Americas, a robust electronics manufacturing ecosystem underpins growth in medical devices, aerospace avionics, and automotive infotainment systems. Manufacturers benefit from proximity to major OEMs and a well-established supply chain infrastructure, yet ongoing tariff considerations and geopolitical dynamics have prompted increased interest in nearshore fabrication hubs to balance cost and responsiveness.

Europe, the Middle East, and Africa (EMEA) present a diverse mosaic of opportunity, where stringent regulatory standards in sectors such as aerospace and healthcare foster high reliability requirements and premium material adoption. Investment in industrial automation within Germany and France fuels demand for flexible circuits in robotics and power electronics, while telecommunication infrastructure rollouts in the Middle East underscore the need for reliable, high-frequency solutions. Across the region, sustainability mandates are also driving interest in eco-friendly dielectric materials and manufacturing processes that minimize waste and energy use.

The Asia-Pacific landscape remains the epicenter of production scale and technology advancement, with China, Japan, and Taiwan commanding significant manufacturing capacity. Rapid urbanization and the proliferation of 5G networks are propelling demand for multilayer and rigid-flex solutions, particularly in smartphones, IoT gateways, and networking equipment. Simultaneously, Southeast Asian emerging economies are attracting capacity investments as companies seek to diversify beyond traditional centers. The interplay of cost advantages, technical expertise, and supportive government initiatives cements this region’s role as a critical fulcrum for global flexible circuit supply.

This comprehensive research report examines key regions that drive the evolution of the Flexible Printed Circuit Board market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Synthesizing strategic initiatives innovations partnerships from leading flexible printed circuit board manufacturers reshaping the competitive field

Leading industry participants are deploying a variety of strategic maneuvers to capture value and sustain competitive differentiation. Key global fabricators have forged collaborative agreements with material innovators to accelerate the qualification of next-generation polyimide blends and advanced adhesive chemistries. Such partnerships reduce time-to-market for high-reliability applications in aerospace and medical imaging. In parallel, prominent manufacturers are expanding capacity through greenfield facilities in Mexico and Eastern Europe to circumvent tariff volatility and enhance service responsiveness for regional customers.

Innovation extends beyond materials, as companies embrace digital transformation initiatives to streamline production planning and quality control. The integration of cloud-based manufacturing execution systems and inline inspection using machine vision has improved yield consistency and reduced scrap rates. Furthermore, select market leaders have established dedicated research centers to explore additive fabrication techniques, demonstrating prototypes that leverage 3D-printed dielectric structures for complex geometries. This forward-looking posture underscores a commitment to marrying process optimization with technological differentiation.

From a market access perspective, high-volume players are consolidating distribution networks and forging alliances with major electronics distributors to broaden reach across offline and online channels. Their efforts focus on delivering turnkey solutions that encompass design support, prototyping services, and volume production. Together, these strategic initiatives illustrate how top-tier companies are orchestrating a balanced approach to growth-one that encompasses materials science, manufacturing agility, and customer-centric service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Printed Circuit Board market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abis Circuits Co., Ltd.

- AirBorn, Inc.

- Alper S.R.L.

- Amphenol Corporation

- AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

- BHflex Co., Ltd.

- ES&S Solutions GmbH

- Eurocircuits GmbH

- ExPlus Co., Ltd.

- Fralock Holdings, LLC

- Fujikura Ltd.

- Ichia Technologies Inc.

- Interflex co.,Ltd.

- Jinghongyi PCB (HK) Co., Limited

- Mekoprint A/S

- Multek Corporation

- Nitto Denko Corporation

- NOK Corporation

- Schweizer Electronic AG

- Shenzhen Kinwong Electronic Co., Ltd.

- Sumitomo Electric Industries Ltd.

- Tech Etch, Inc.

- Tianjin Printronics Circuit Corp.

- TTM Technologies, Inc.

- Würth Elektronik eiSos GmbH & Co. KG

Presenting pragmatic strategies recommendations and best practices for industry leaders to navigate challenges and capitalize on opportunities in the FPCB market

To navigate the evolving challenges and capitalize on emergent opportunities, industry leaders should pursue a multifaceted strategy that balances innovation with resilience. Initially, diversifying the supplier base for critical substrates and adhesives can mitigate the risks associated with tariff fluctuations and regional disruptions. By qualifying multiple sources across Asia-Pacific and nearshore locations, organizations can sustain production continuity while negotiating more favorable contract terms.

Simultaneously, investing in convergent manufacturing capabilities-combining additive and subtractive processes-enables rapid iteration of complex prototypes while preserving volume-production yields. Developing in-house pilot lines for emerging technologies expedites validation cycles and fosters closer alignment between R&D and manufacturing teams. In concert with these technical investments, deploying cloud-enabled analytics and digital twin models can optimize throughput and predict maintenance needs, driving down operational costs and elevating product consistency.

Finally, engaging in collaborative pilot programs with key end users accelerates feedback loops and strengthens relationships across the value chain. By co-innovating on application-specific requirements and establishing joint testing protocols, suppliers can preempt design challenges and reinforce customer loyalty. Collectively, these actionable recommendations equip industry leaders to transform uncertainty into a strategic advantage, laying the groundwork for sustained, profitable expansion.

Detailing the rigorous research methodology approach combining primary expert interviews secondary data sources and data triangulation for robust credibility

This study leverages a rigorous methodology that integrates both quantitative and qualitative research techniques to ensure the robustness and credibility of its insights. Initially, a comprehensive secondary research phase synthesized data from public filings, technical white papers, and industry association publications to establish baseline market trends and technology benchmarks. This foundational layer provided context for subsequent primary investigations and highlighted key variables influencing supply, demand, and pricing dynamics.

The second phase involved in-depth interviews with a cross section of stakeholders, including materials suppliers, contract manufacturers, OEM design engineers, and procurement executives. These expert dialogues offered frontline perspectives on innovation pipelines, capacity constraints, and emerging end-user requirements. Interview insights were systematically coded and validated against secondary findings, creating a rich, evidence-based narrative that reflects both macroeconomic forces and microlevel design considerations.

Finally, data triangulation techniques were applied to reconcile disparate inputs, quantify margin of error, and ensure consistency across diverse sources. Statistical analyses of trade flow data and tariff schedules were cross-referenced with proprietary shipment records to evaluate supply chain shifts. This layered approach guarantees that conclusions and recommendations are grounded in empirical observation, making the report a reliable decision-making tool for stakeholders at every level of the flexible printed circuit board ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Printed Circuit Board market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Printed Circuit Board Market, by Type

- Flexible Printed Circuit Board Market, by Material

- Flexible Printed Circuit Board Market, by Technology

- Flexible Printed Circuit Board Market, by Application

- Flexible Printed Circuit Board Market, by Distribution Channel

- Flexible Printed Circuit Board Market, by Region

- Flexible Printed Circuit Board Market, by Group

- Flexible Printed Circuit Board Market, by Country

- United States Flexible Printed Circuit Board Market

- China Flexible Printed Circuit Board Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding with a comprehensive synthesis of the report findings underscoring strategic imperatives and future pathways for flexible circuit stakeholders

In synthesizing the report’s findings, it becomes evident that flexible printed circuit boards are poised to underpin a new era of electronic innovation characterized by miniaturization, higher performance thresholds, and increasingly stringent reliability standards. The convergence of advanced materials, precision manufacturing, and digital process controls is unlocking opportunities across sectors as diverse as automotive electrification, aerospace communications, and connected health. Moreover, the strategic recalibration of supply chains in response to tariff complexities is fostering a more resilient, geographically balanced production network.

For stakeholders seeking to differentiate, the imperative lies in embracing both innovation and adaptability. Material selection and manufacturing modalities must align closely with evolving application requirements, while strategic partnerships and capacity investments can buffer against external shocks. Regional dynamics will play a determining role, as growth trajectories in the Americas, EMEA, and Asia-Pacific each reflect distinct demand drivers and regulatory frameworks.

Ultimately, success in the flexible printed circuit board market will hinge on an integrated approach that marries technical excellence with agile business models. By leveraging the detailed insights and recommendations provided herein, industry participants can chart a course toward sustained competitiveness, operational resilience, and robust growth in an increasingly complex global landscape.

Empower your strategic planning and market positioning by securing comprehensive flexible printed circuit board insights through a conversation with Ketan Rohom

The path to informed decision-making begins with a direct conversation designed to align your strategic objectives with granular market insights. Engaging with Ketan Rohom, Associate Director of Sales & Marketing, grants your organization privileged access to the comprehensive findings, proprietary analyses, and expert interpretations contained within this report. By initiating a dialogue, you unlock tailored guidance on leveraging flexible printed circuit board developments to accelerate product innovation, optimize supply chains, and outmaneuver competitive pressures. This interaction not only clarifies complex trends but also establishes a clear roadmap for applying research conclusions to your unique organizational context. Positioned at the intersection of market intelligence and strategic advisory, Ketan Rohom will coordinate personalized briefings, data deep dives, and executive workshops that translate broad market perspectives into actionable agendas. To secure your advantage, reach out now and transform high-level market observations into rigorous, evidence-based strategies that propel your next phase of growth and differentiation.

- How big is the Flexible Printed Circuit Board Market?

- What is the Flexible Printed Circuit Board Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?