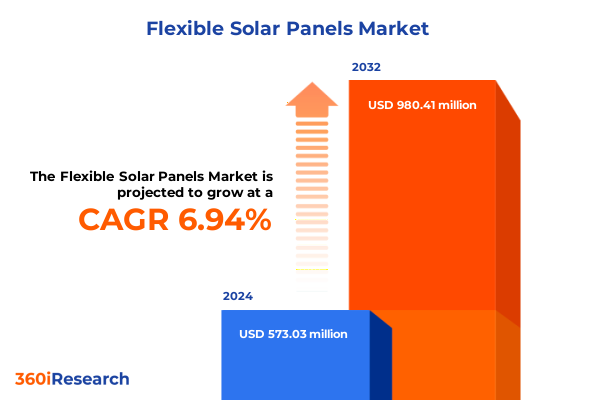

The Flexible Solar Panels Market size was estimated at USD 625.43 million in 2025 and expected to reach USD 665.65 million in 2026, at a CAGR of 6.71% to reach USD 985.68 million by 2032.

Exploring the Evolution and Growing Market Potential of Flexible Solar Panels as a Key Enabler of Next-Generation Renewable Energy Solutions

Flexible solar panels are reshaping the renewable energy landscape by combining advanced materials science with agile manufacturing techniques. Unlike traditional rigid photovoltaic modules, these ultrathin sheets leverage next-generation thin-film processes to deliver unparalleled versatility. They can conform to curved surfaces, integrate seamlessly into building materials, and enable new use cases in portable energy systems. This adaptability positions them at the forefront of a paradigm shift in energy generation, unlocking opportunities across consumer, industrial, and defense sectors.

As research and development efforts escalate, we’re witnessing significant improvements in efficiency, durability, and cost competitiveness. Breakthroughs in materials such as copper indium gallium selenide and cadmium telluride are converging with roll-to-roll production methods to support high-volume, low-cost manufacturing. Investors and solution providers alike are capitalizing on this momentum, recognizing that the unique value proposition of flexible panels can accelerate the global transition to distributed energy resources.

This executive summary synthesizes the critical drivers, market dynamics, and strategic inflection points defining the flexible solar panel industry today. It outlines transformative shifts, assesses the impact of recent trade policies, and delivers actionable insights for stakeholders aiming to harness the full potential of this disruptive technology.

Mapping the Technological Innovations and Market Dynamics That Are Driving Unprecedented Growth in Flexible Solar Panel Deployment and Integration Globally

In recent years, flexible solar panels have surged ahead on the back of multiple technological breakthroughs. Innovations in thin-film deposition, such as advanced sputtering techniques and laser-assisted patterning, have pushed device efficiencies higher while maintaining flexibility. Simultaneously, improvements in encapsulation materials are extending module lifespans, overcoming earlier concerns about durability in harsh environments.

These technical advancements are mirrored by evolving market dynamics. Traditional module manufacturers are expanding their portfolios to include lightweight, bendable formats. New entrants are forging partnerships with consumer electronics and automotive firms, integrating solar harvesting directly into product designs. At the same time, policymakers are incentivizing building-integrated photovoltaics, creating novel regulatory frameworks that reward energy-positive structures rather than merely minimizing negative environmental impacts.

As a result, the competitive landscape is more dynamic than ever. Established players are leveraging vertically integrated supply chains, while agile startups focus on niche applications like wearable charging devices or aerospace power systems. These shifts reflect a broader realignment toward distributed, on-demand energy solutions, fundamentally altering how stakeholders view solar power’s role in resilient infrastructure and sustainable mobility.

Assessing the Comprehensive Effects of New 2025 United States Tariffs on Flexible Solar Panel Supply Chains, Cost Structures, and Competitive Positioning

The introduction of new United States tariffs in early 2025 has created ripple effects throughout the flexible solar panel supply chain. With levies applied to several imported thin-film materials and finished modules, component costs have climbed, prompting manufacturers to reassess sourcing strategies. Vendors reliant on overseas production are now exploring nearshore and domestic options to insulate themselves from tariff-related cost volatility.

Consequently, procurement teams are placing a premium on vertically integrated players with local production footprints. While this shift has increased capital expenditure for some, it also presents an opportunity to strengthen intellectual property protection and reduce transportation risk. At the same time, end customers-particularly in commercial and industrial segments-are negotiating longer-term supply contracts to hedge against further policy changes. This strategic recalibration is fostering a more resilient ecosystem, though it may constrain short-term deployment volumes as stakeholders navigate the new trade environment.

Beyond cost implications, the tariffs have reignited conversations about energy security and domestic manufacturing. Federal and state incentives are now emphasizing local content requirements, reinforcing a trend toward rebuilding advanced manufacturing capacity within the country. These policy adjustments are expected to catalyze additional investment in research, equipment, and workforce training, ultimately reshaping the competitive contours of the flexible solar panel market.

Revealing In-Depth Market Segmentation Perspectives That Highlight Technology, Application, End Use, and Installation Variations in Flexible Solar Panel Demand

A granular view of the flexible solar panel market reveals distinct trajectories across multiple segmentation dimensions. From a technology perspective, amorphous silicon continues to offer cost advantages and mechanical robustness, cadmium telluride brings balanced efficiency with established production pathways, and copper indium gallium selenide stands out for its superior energy conversion potential and flexibility in form factor. Each of these thin-film chemistries addresses unique performance and cost trade-offs, catering to divergent end-use requirements.

Application segmentation further clarifies market dynamics. Building-integrated photovoltaics are gaining traction as developers seek energy-generating façades, while off-grid applications target remote electrification projects and emergency relief scenarios. Portable systems combine lightweight construction with rapid deployment, serving campers, military units, and event organizers needing resilient power on demand.

End-use segmentation intersects with emerging demand patterns in aerospace and defense, where weight savings and stealth capabilities are paramount; automotive OEMs exploring rooftop and hood integration; consumer electronics firms embedding power generation into chargers and wearables; and marine applications requiring corrosion-resistant, pliable arrays. Installation type also matters: ground-mounted arrays benefit from scale efficiencies, portable modules emphasize modularity and quick setup, and rooftop deployments prioritize seamless architectural integration. These overlapping segmentation layers underscore the multifaceted opportunity landscape in flexible solar solutions.

This comprehensive research report categorizes the Flexible Solar Panels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cell Technology

- Substrate Material

- Form Factor

- Power Rating

- Efficiency Tier

- Application

- Sales Channel

- Customer Type

- Mounting

Highlighting Strategic Growth Trajectories and Regional Nuances Shaping Opportunities Across the Americas, EMEA, and Asia-Pacific Flexible Solar Markets

Regional analysis underscores markedly different growth drivers and adoption curves. In the Americas, strong government incentives in North America have fueled early commercial-scale projects, while Latin American countries are increasingly leveraging off-grid solutions to electrify rural communities. The United States focus on domestic manufacturing and strategic supply chain security is fostering clustered innovation hubs in key states.

Europe, the Middle East, and Africa present a broad spectrum of policy landscapes. Europe’s aggressive decarbonization targets are driving widespread adoption of building-integrated flexible panels on both public and private infrastructures. In the Middle East, abundant sunlight and ambitious renewable capacity goals are spawning pilot projects for solar-integrated facades. Meanwhile, Africa’s vast rural expanses and inconsistent grid access have created high demand for standalone portable solutions, often supported by international development funds.

Asia-Pacific remains a powerhouse for both production and deployment. China’s economies of scale in manufacturing have reduced costs globally, while Japan and South Korea lead in high-efficiency cell development and smart integration. India’s decentralized energy programs are accelerating off-grid installations, and Southeast Asia’s emerging markets are exploring hybrid solar solutions for telecom towers and mini-grid networks. These regional nuances highlight the importance of localized strategies for market entry and expansion.

This comprehensive research report examines key regions that drive the evolution of the Flexible Solar Panels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Key Strategic Moves by Prominent Companies Steering the Competitive Flexible Solar Panel Sector Forward

The competitive environment in the flexible solar panel sector is characterized by a blend of established powerhouses and agile innovators. Legacy solar manufacturers are expanding into thin-film technologies through strategic acquisitions and joint ventures, reinforcing their downstream distribution networks. At the same time, startups with deep expertise in materials science are advancing niche applications, securing patents for novel deposition methods and proprietary encapsulants.

Collaborations between module producers and OEMs in adjacent industries-such as automotive, marine, and consumer electronics-are driving the integration of flexible panels into new product lines. Moreover, several key players have launched pilot manufacturing lines employing roll-to-roll printing to enhance throughput and cost efficiency. These moves not only position them to address tariff-driven cost pressures but also to capture early mindshare in emerging application segments.

Investor activity is also on the rise, with venture capital and corporate funding targeting companies that demonstrate both technical differentiation and scalable production plans. Mergers, strategic equity investments, and cross-industry alliances are creating a more interconnected ecosystem, where access to supply chain partnerships and distribution channels is as critical as technological leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexible Solar Panels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Hanergy Holding Group Ltd.

- PowerFilm Solar, Inc.

- Solbian Energie Alternative Srl

- Sunflare Inc.

- Ascent Solar Technologies, Inc.

- Heliatek GmbH

- RNG International, Inc.

- Apollo Power Ltd.

- SunPower Corporation

- Anker Innovations Limited

- Jackery Inc.

- Shenzhen Sungold Solar Co., Ltd.

- Solara GmbH

- EcoFlow Inc.

- Goal Zero, LLC

- ALLPOWERS Industrial International Co., Ltd.

- X-DRAGON Technology Co., Ltd.

- Voltaic Systems, LLC

- BioLite, Inc.

- Instapark Inc.

- Shenzhen ECEEN Technology Co., Ltd.

- Polysolar Ltd.

- Suntactics LLC

- Ambient Photonics, Inc.

- Maxeon Solar Technologies, Ltd.

- Waaree Energies Ltd.

- NanoFlex Power Corporation

- OPES Solutions Ltd.

- Shenzhen Xiangxinrui Solar Energy Co., Ltd.

- Virte Solar Oy

Delivering Forward-Looking Recommendations for Industry Leaders Aiming to Capitalize on Flexible Solar Panel Market Shifts and Emerging Opportunities

Industry leaders seeking advantage in the flexible solar panel domain should prioritize investments in high-efficiency thin-film research, particularly in copper indium gallium selenide and advanced encapsulation. By enhancing power output while preserving mechanical flexibility, companies can command premium pricing in differentiated application niches. Simultaneously, exploring partnerships with building materials suppliers and OEMs in automotive and consumer electronics can unlock integrated design wins and accelerate time to market.

Given recent tariff shifts, establishing or expanding nearshore manufacturing is critical to minimize exposure to import levies and transportation disruptions. Leaders should evaluate joint-venture models with local partners to streamline capital requirements and benefit from regional incentives. At the same time, diversified procurement of raw materials and strategic stockpiles can mitigate short-term supply constraints and ensure production continuity.

Finally, stakeholder engagement through policy advocacy and standards development will shape favorable market conditions. Participating in industry consortia to define testing protocols for flexible photovoltaics can reduce technical barriers and instill buyer confidence. By pursuing these targeted actions, industry leaders will be well-positioned to navigate evolving market dynamics and capture growth in the flexible solar panel ecosystem.

Outlining the Comprehensive Research Framework and Methodological Rigor Ensuring the Credibility and Depth of Flexible Solar Panel Market Analysis

This research employs a multi-phase methodology to ensure comprehensive coverage of the flexible solar panel market. Primary research included in-depth interviews with executives, engineers, and procurement specialists across module manufacturers, tier-one suppliers, and end-user organizations. These dialogues provided insight into technology roadmaps, supply chain strategies, and commercial deployment experiences.

Secondary research encompassed the analysis of academic publications, patent filings, industry white papers, and policy documents. Proprietary data tracking global shipments, manufacturing capacity trends, and tariff classifications were synthesized to inform segmentation frameworks. Data triangulation was achieved by cross-referencing multiple independent sources and applying consistency checks to eliminate anomalies.

Finally, an expert panel review brought together thought leaders in photovoltaics, regulatory affairs, and energy economics to validate findings and refine strategic recommendations. Quality assurance processes, including peer review and methodological audits, underpin the credibility of this study, ensuring that stakeholders receive actionable intelligence grounded in robust analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexible Solar Panels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexible Solar Panels Market, by Cell Technology

- Flexible Solar Panels Market, by Substrate Material

- Flexible Solar Panels Market, by Form Factor

- Flexible Solar Panels Market, by Power Rating

- Flexible Solar Panels Market, by Efficiency Tier

- Flexible Solar Panels Market, by Application

- Flexible Solar Panels Market, by Sales Channel

- Flexible Solar Panels Market, by Customer Type

- Flexible Solar Panels Market, by Mounting

- Flexible Solar Panels Market, by Region

- Flexible Solar Panels Market, by Group

- Flexible Solar Panels Market, by Country

- United States Flexible Solar Panels Market

- China Flexible Solar Panels Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3816 ]

Synthesizing Core Market Insights into a Cohesive Perspective That Prepares Stakeholders for the Future Trajectory of Flexible Solar Panel Technologies

Drawing together the key insights from this study, it is clear that flexible solar panels are at a pivotal juncture. Technological advances are bridging the performance gap with rigid modules while introducing form-factor innovations that open new markets. Market segmentation analysis highlights differentiated opportunities across technology chemistries, application scenarios, end uses, and installation types, each demanding tailored strategies.

The recent imposition of 2025 tariffs in the United States has reshaped supply chain considerations and prompted a strategic pivot toward localized manufacturing. Regional analyses reveal that while mature economies prioritize architectural integration, emerging markets chase portable and off-grid applications. The competitive landscape is increasingly defined by partnerships, manufacturing scale, and intellectual property leadership.

Looking ahead, organizations that marry deep technical expertise with agile go-to-market approaches will lead the charge. The recommendations outlined herein offer a roadmap to navigate trade dynamics, optimize production footprints, and engage in collaborative platforms. Ultimately, stakeholders who leverage these insights can help accelerate the global adoption of flexible solar technologies, driving both sustainable outcomes and commercial success.

Engage with Ketan Rohom for Customized Insights and Premium Flexible Solar Panel Market Intelligence to Drive Strategic Decision-Making

To access the full depth of competitive intelligence, granular segmentation analysis, and forward-looking market insights in the flexible solar panels arena, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in tailored market solutions will ensure you receive a bespoke package that addresses your organization’s unique decision-making needs. Engage directly with him to explore customized research deliverables, discuss licensing options, and secure early access to strategic data that can drive your next investment or product launch. Commit to an informed path forward by partnering with a dedicated research leader who can align industry-leading analytics with your growth objectives.

- How big is the Flexible Solar Panels Market?

- What is the Flexible Solar Panels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?