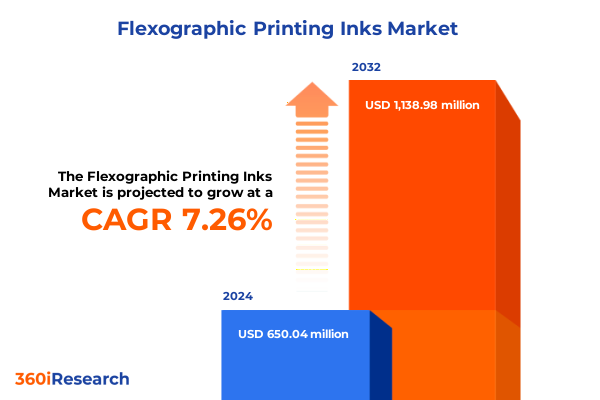

The Flexographic Printing Inks Market size was estimated at USD 689.76 million in 2025 and expected to reach USD 737.88 million in 2026, at a CAGR of 7.42% to reach USD 1,138.97 million by 2032.

Illuminating the Vital Role of Cutting Edge Flexographic Printing Inks in Modern Packaging and Sustainable Production Practices

Flexographic printing inks occupy a pivotal position in the modern packaging industry, serving as the visual and protective medium that brings brands to life across a wide spectrum of consumer goods. As global demand for high-quality, sustainable packaging intensifies, ink formulators have risen to the challenge by pioneering novel chemistries that balance performance with environmental stewardship. The evolution of substrate technologies, coupled with shifting regulatory frameworks and consumer preferences for ecofriendly materials, has propelled flexographic inks to the forefront of materials innovation. Consequently, stakeholders along the value chain-from raw material suppliers and ink manufacturers to converters and brand owners-must navigate a complex interplay of technical requirements, cost pressures, and sustainability targets to maintain competitiveness.

This executive summary distills the critical trends, shifts, and strategic imperatives shaping the flexographic printing inks sector. By exploring transformative technological advancements, assessing the impact of recent trade tariffs, and unpacking nuanced segmentation dynamics, this analysis provides a cohesive overview that supports informed decision-making. Each section of this summary offers targeted insights into essential market dimensions, from regional demand patterns to key player strategies, culminating in actionable recommendations designed to align business objectives with market realities. With this foundation, industry leaders can chart a path toward innovation, efficiency, and sustainable growth.

Exploring the Transformational Shifts Redefining Flexographic Ink Technologies Ecofriendly Formulations and Digital Integration Pathways

In recent years, the flexographic printing inks landscape has undergone a profound transformation driven by advancements in cure technologies, formulation science, and digital integration. Traditional solvent-based systems have seen growing competition from UV curable and water-based alternatives, sparked by stringent air quality regulations and an industry-wide push for lower volatile organic compound emissions. Energy-efficient UV LED systems have gained traction, offering rapid curing cycles and reduced heat stress on sensitive substrates, while electron beam curable inks have emerged as a high-throughput solution with minimal photoinitiator requirements. Parallel to these developments, digital tools and automation platforms have begun to reshape production workflows, enabling real-time monitoring of ink viscosity, color consistency, and press performance metrics.

Moreover, sustainability considerations now permeate every stage of the ink lifecycle, from raw material sourcing to end-of-life disposal. Formulators are increasingly incorporating bio-based resins and renewable solvents to lessen carbon footprints, while also exploring recyclable ink chemistries that facilitate circular packaging models. This shift has catalyzed partnerships between chemical suppliers and technology providers, resulting in novel hybrid systems that combine the robustness of solvent formulations with the ecofriendly profile of water-based alternatives.

Looking ahead, the industry’s trajectory will be defined by the convergence of environmental mandates, digital capabilities, and customer-driven customization. As brands seek faster time-to-market and heightened design flexibility, ink manufacturers must couple advanced chemistries with integrated data analytics to deliver precision, consistency, and sustainability at scale.

Unpacking the Cumulative Impact of United States 2025 Tariffs on Flexographic Printing Ink Supply Chains Raw Material Costs and Regulatory Compliance

The introduction of new tariff measures by the United States in early 2025 has reverberated across the flexographic printing inks ecosystem, exerting upward pressure on raw material costs and disrupting established supply chains. These duties target critical input categories such as specialized resins, alcohol-based solvents, and select photoinitiators, prompting formulators to reassess sourcing strategies in North America. While some suppliers have absorbed a portion of these incremental costs to maintain customer relationships, many converters now face higher ink procurement expenses that squeeze margins or necessitate price adjustments.

In response, ink producers are exploring alternative supply sources in Asia-Pacific and Europe, leveraging free trade agreements to offset tariff exposure. Simultaneously, strategic stockpiling of key intermediates has become a short-term mitigation tactic, although it introduces working capital constraints and inventory management complexities. Regulatory compliance obligations have also intensified, as importers must navigate classification nuances under the Harmonized Tariff Schedule to avoid penalties and delays.

Despite these headwinds, the tariff landscape has catalyzed a broader emphasis on nearshoring and local manufacturing capabilities. By diversifying regional production footprints and fostering closer partnerships with domestic resin and solvent suppliers, industry players aim to bolster supply chain resilience. Ultimately, the cumulative impact of these 2025 tariff adjustments underscores the importance of agile procurement frameworks and proactive regulatory engagement to sustain operational continuity and competitive positioning.

Illuminating Critical Insights into Market Segmentation by Ink Type Application End Use and Ink Form to Drive Targeted Strategy Development

A nuanced understanding of market segmentation reveals the diverse needs that flexographic printing inks must satisfy. Segmentation by ink type highlights four principal categories, including electron beam curable systems prized for their rapid cure speeds and environmental profile, solvent based formulations which encompass both alcohol derived and hydrocarbon variants, UV curable technologies that span conventional UV to advanced UV LED cure modalities, and water based options renowned for low VOC emissions. Each class presents distinct performance attributes and cost considerations, driving targeted R&D priorities across the supplier community.

When viewed through the lens of application, the market divides into solutions tailored for corrugated fibers, flexible packaging substrates, folding cartons, and pressure-sensitive labels. Ink chemistries designed for corrugated demand robust adhesion and high laydown to obscure fibrous textures, while flexible packaging inks must balance barrier compatibility and tactile finish. Folding carton formulations require precise color registration at high press speeds, and label inks prioritize rapid curing under variable press conditions to support short-run customization.

End use segmentation further refines these categories, aligning ink attributes with sector-specific criteria. Food and beverage applications necessitate stringent regulatory compliance and minimal odor profiles, healthcare and pharmaceutical markets demand high chemical resistance and sterilization compatibility, household and cleaning goods focus on durability in moist environments, and personal care segments call for premium aesthetics and safety certifications.

Considering ink form segmentation, liquid systems remain the industry workhorse for general-purpose printing, paste variants address heavy deposit needs in specialty applications, and powder formats enable solvent-free processes with improved recyclability. This layered segmentation approach enables manufacturers and brand owners to craft targeted offerings that resonate with technical requirements and end-user expectations.

This comprehensive research report categorizes the Flexographic Printing Inks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ink Type

- Application

- End Use

- Ink Form

Discerning Regional Dynamics Shaping Flexographic Printing Ink Demand Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert a profound influence on flexographic ink demand, beginning with the Americas where North America leads in high-performance UV and electron beam curable systems driven by stringent environmental regulations and advanced packaging sectors. The United States remains a focal point for innovation, supported by a robust network of chemical suppliers and press manufacturers. In Latin America, cost competitiveness and expanding consumer goods markets foster growing adoption of solvent based and water based inks, as converters seek to balance affordability with evolving sustainability mandates. Transitional market landscapes in the region also present opportunities for technology transfer and joint ventures with global ink producers.

Across Europe, Middle East, and Africa, diverse regulatory regimes shape ink formulation preferences and supply chain strategies. The European Union’s rigorous REACH chemical registration and ongoing VOC reduction targets underpin a swift shift toward UV curable and water based alternatives in key markets such as Germany and the United Kingdom. In the Middle East, emerging packaging hubs leverage free zones to attract investments in specialized ink production, catering to sectors like food processing and pharmaceuticals. African markets, while nascent, demonstrate growing interest in flexible packaging solutions, stimulating demand for mid-range solvent based formulations.

In the Asia-Pacific region, the rapid expansion of e-commerce and consumer goods manufacturing drives robust ink consumption. China leads in domestic resin production and digital flexo integration, whereas Southeast Asian converters prioritize cost-effective water based and conventional UV curable inks. Japan and South Korea remain at the forefront of high-precision ink technologies, focusing on UV LED innovation and custom coatings. This regional mosaic underscores the need for tailored market entry strategies and localized support networks to capture growth across varied economic and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Flexographic Printing Inks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Insights into Leading Flexographic Printing Ink Manufacturers Innovations Partnerships and Competitive Positioning

A review of leading industry participants reveals a competitive landscape characterized by relentless innovation, strategic alliances, and targeted investments in sustainability. One prominent global ink manufacturer has accelerated its development of bio-based resin technologies, pairing those efforts with strategic partnerships to scale production of low-VOC solvent alternatives. Another key player has secured an alliance with a major equipment provider to co-develop integrated press systems featuring real-time ink monitoring and automated viscosity adjustments, strengthening its position in high-speed rigid and flexible packaging segments.

In addition, a specialist ink supplier renowned for its electron beam cure expertise has expanded its footprint through the acquisition of a regional water based ink producer, enhancing its capacity to serve both mature and emerging markets. Simultaneously, a traditional pigment dispersions leader has invested heavily in R&D to produce nano-dispersed colorants that deliver sharper images and improved opacity at reduced ink film weights. These moves reflect a broader trend toward vertical integration and collaborative innovation.

Meanwhile, several mid-tier companies capitalize on niche capabilities by focusing on personalized service models and rapid-response technical support. These firms cultivate close relationships with brand owners requiring short-run custom designs, enabling them to differentiate through agility rather than scale. Collectively, the competitive positioning of these market participants underscores the importance of aligning product portfolios with evolving regulatory drivers, customer expectations, and sustainability objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexographic Printing Inks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Chimigraf Ibérica

- DuPont de Nemours, Inc.

- E.T. Gleitsmann Farbenfabriken GmbH

- Elementis plc

- Evonik Industries AG

- Flint Group Holdings, S.A.

- Fujifilm Holdings Corporation

- Hubergroup Holding SE

- INX International Ink Co.

- Jiangmen Toyo Ink Co., Ltd.

- Nazdar Company, Inc.

- Nazdar Corporation

- Ruco Druckfarben A.M. Ramp & Co. GmbH

- Sakata INX Corporation

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical Corporation

- T&K Toka Co., Ltd.

- Taiyuan Coates Lorilleux Inks Chemical Ltd.

- Tercel Ink Group

- Toyo Ink Co., Ltd.

- Wikoff Color Corporation

- XSYS Print Solutions (Shanghai) Ltd

- Zhongshan DIC Colour Co., Ltd.

Crafting Actionable Strategic Recommendations to Capitalize on Emerging Trends Technological Innovations and Regulatory Shifts in Flexographic Printing Inks

To thrive in this dynamic environment, industry leaders must adopt a multifaceted strategic approach. First, investment in advanced formulation research will be critical; allocating resources toward water based and low-energy UV LED chemistries can address both environmental mandates and operational efficiency goals. Concurrently, developing modular manufacturing lines capable of flexibly switching between solvent based, UV curable, and water based ink production will enhance responsiveness to shifting demand patterns.

Second, forging deeper collaborations with equipment suppliers and digital platform providers will unlock the potential of data-driven process optimization. By integrating IoT sensors and predictive analytics into production workflows, companies can minimize downtime, ensure color consistency, and reduce waste. In parallel, establishing strategic sourcing partnerships with resin and photoinitiator suppliers in tariff-free jurisdictions can mitigate the impact of ongoing trade tensions.

Third, refining customer engagement models by offering tailored application laboratory services and digital color matching platforms will bolster brand loyalty. Providing converters and brand owners with co-innovation workshops, regulatory compliance toolkits, and sustainability roadmaps can differentiate suppliers as solutions partners rather than mere ink vendors. Finally, proactive regulatory monitoring and participation in standards committees will ensure early alignment with emerging VOC limits, chemical registration updates, and packaging circularity directives, safeguarding market access and reputational integrity.

Detailing Rigorous Research Methodology Encompassing Data Collection Analysis Techniques and Validation Processes for Flexographic Printing Ink Market Insights

The research methodology underpinning these insights is founded on a rigorous blend of qualitative and quantitative approaches. Primary research comprised in-depth interviews and structured discussions with senior executives across the value chain, including ink formulators, press equipment manufacturers, packaging converters, and brand marketing professionals. These engagements provided first-hand perspectives on technological adoption barriers, sustainability priorities, and the operational impact of evolving trade policies.

Complementing the primary data, extensive secondary research was conducted through analysis of industry publications, regulatory databases, and technical white papers. Information from chemical registries, environmental agencies, and trade associations was triangulated to validate key trends in VOC regulations, tariff schedules, and substrate innovations. Statistical techniques were applied to harmonize disparate data sources, ensuring consistency in the characterization of product categories and regional consumption patterns.

Throughout the process, data validation protocols, including cross-referencing supplier disclosures and third-party audit reports, ensured the accuracy and reliability of findings. Expert review sessions with materials scientists, sustainability advisors, and market strategists further refined the analysis, contributing to a comprehensive and robust examination of the flexographic printing inks landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexographic Printing Inks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexographic Printing Inks Market, by Ink Type

- Flexographic Printing Inks Market, by Application

- Flexographic Printing Inks Market, by End Use

- Flexographic Printing Inks Market, by Ink Form

- Flexographic Printing Inks Market, by Region

- Flexographic Printing Inks Market, by Group

- Flexographic Printing Inks Market, by Country

- United States Flexographic Printing Inks Market

- China Flexographic Printing Inks Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings from Technological Innovations Market Dynamics and Regulatory Impacts to Chart the Future Path for Flexographic Printing Inks

The convergence of technological innovation, regulatory pressures, and global trade dynamics has set a transformative agenda for flexographic printing inks. Sustainability imperatives continue to elevate the importance of UV curable and water based formulations, while emerging cure technologies such as UV LED and electron beam present avenues for enhanced productivity and reduced environmental impact. Simultaneously, the 2025 tariff adjustments have underscored the necessity of supply chain agility, prompting a reevaluation of sourcing strategies and regional manufacturing footprints.

Segmentation analysis highlights the criticality of tailoring ink chemistries and form factors to specific substrate applications, end-use requirements, and performance benchmarks. Regional insights emphasize the heterogeneous nature of market demand, with mature markets advancing high-performance solutions and growth regions prioritizing cost-effective, compliant systems. Leading companies differentiate through innovation ecosystems, strategic alliances, and customer-centric service models, setting the stage for a competitive landscape defined by both scale and specialization.

Collectively, these findings chart a clear path forward: by embracing advanced chemistries, digital integration, and proactive regulatory engagement, stakeholders can navigate market complexities and capture the next wave of growth in flexographic printing inks.

Partner with Ketan Rohom Associate Director Sales and Marketing to Unlock Exclusive Flexographic Ink Market Research Insights

If you are ready to gain a competitive edge and harness the insights outlined here, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of the comprehensive flexographic printing inks market research report. Engage with Ketan to discuss custom data requirements, strategic applications of these findings, and tailored advisory services that align with your business objectives. By partnering directly with Ketan Rohom, you can ensure direct access to expert guidance and the latest intelligence needed to optimize procurement strategies, accelerate product innovation, and navigate regulatory complexities with confidence. Contact him today to transform these insights into actionable plans and capitalize on emerging opportunities in the flexographic inks landscape

- How big is the Flexographic Printing Inks Market?

- What is the Flexographic Printing Inks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?