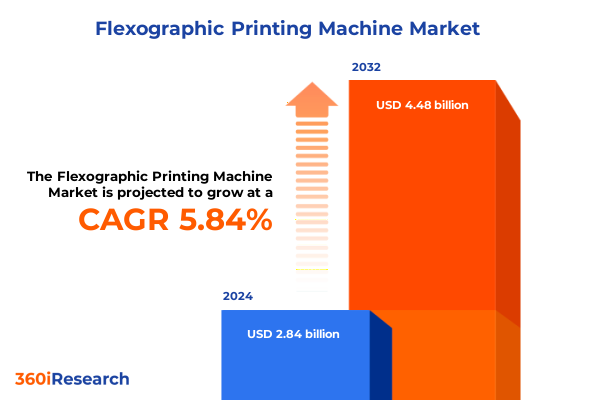

The Flexographic Printing Machine Market size was estimated at USD 3.00 billion in 2025 and expected to reach USD 3.17 billion in 2026, at a CAGR of 5.88% to reach USD 4.48 billion by 2032.

Unveiling the Dynamic Revolution of Flexographic Printing Machines Enhancing Productivity, Sustainability, and Quality Across Packaging and Labeling Landscapes

The rise of flexographic printing machines has fundamentally transformed the packaging and labeling industries by delivering unprecedented efficiencies and product quality. Over recent years, manufacturers have prioritized high-speed, high-resolution printing solutions to meet growing consumer demands for sustainable and visually appealing packaging. As businesses navigate increasingly complex regulatory environments focused on environmental stewardship, flexographic systems have adapted by incorporating eco-friendly solvent alternatives and energy-efficient designs.

In parallel, the integration of digital controls and automated workflows has enabled print shops to reduce downtime and optimize resource utilization. These advancements have also facilitated rapid changeovers between short-run and long-run jobs, allowing brands to embrace personalized printing strategies without sacrificing throughput. Consequently, flexographic printing has cemented its position as a versatile and reliable technology that addresses both cost pressures and the imperative for customization in today’s competitive markets.

Moreover, the machine architecture itself has evolved to support advanced substrate handling and ink delivery systems. By leveraging precision servo drives and closed-loop feedback mechanisms, modern presses consistently achieve tight registration and color accuracy, contributing to superior brand presentation. This blend of mechanical innovation and digital intelligence heralds a new era for flexographic printing, one in which adaptability and sustainability are no longer optional but integral to achieving long-term operational excellence.

Transitioning from these foundational developments, the industry now turns to the broader shifts that are redefining competitive dynamics and technological priorities

Charting the Monumental Technological and Operational Transformations Shaping the Flexographic Printing Industry’s Evolution and Competitive Dynamics Globally

Today’s flexographic printing landscape is undergoing unprecedented metamorphosis driven by automation, digitalization, and sustainability initiatives. Traditional mechanical setups are giving way to fully integrated press lines that combine in-line quality inspection, automated plate mounting, and smart maintenance protocols. These advancements streamline production cycles while minimizing human error and resource waste, empowering converters to respond more rapidly to volatile market trends.

Concurrently, the industry’s embrace of sustainable printing practices has accelerated the adoption of UV-curable and water-based inks, reducing volatile organic compound emissions and lowering carbon footprints. Innovative ink formulations now enable faster curing times and superior adhesion on a diverse array of substrates, supporting both rigid and flexible packaging segments. Furthermore, real-time process monitoring through IoT-enabled sensors has become a critical differentiator, enabling predictive maintenance and continuous optimization of operational parameters to safeguard equipment uptime.

Another pivotal force reshaping the market is the integration of data analytics and cloud-based platforms. By harnessing performance metrics and production analytics, print houses can make informed decisions about capacity planning, job scheduling, and quality control. These digital ecosystems foster collaboration between OEMs, suppliers, and end users, ultimately accelerating innovation cycles and enhancing service offerings. As a result, industry players that effectively blend mechanical prowess with digital intelligence are well-positioned to lead the next generation of flexographic printing excellence.

Transitioning from these sweeping technological and operational shifts, it is essential to consider the evolving policy environment, particularly the influence of tariffs on market dynamics

Analyzing the Far-Reaching Cumulative Implications of 2025 United States Tariffs on Flexographic Printing Equipment Supply Chains and Cost Structures

The introduction of new United States tariffs in 2025 has exerted significant influence on the flexographic printing equipment market, altering supply chain strategies and cost frameworks for both OEMs and end users. Tariff levies applied to imported printing presses and consumables have prompted manufacturers to reassess sourcing approaches, with many seeking to diversify their supplier base across Asia and Europe to mitigate exposure to trade policy fluctuations.

Consequently, cost pressures have increased for converters reliant on imported components, leading to a shift toward domestic production and inventory buffering strategies. These changes have not only affected pricing for capital equipment but have also reverberated through the aftermarket for replacement parts, where supply continuity is paramount. In response, several leading press manufacturers have accelerated investments in localized manufacturing facilities and distribution networks to maintain service quality and safeguard delivery timelines.

Beyond direct cost implications, the tariffs have ignited broader discussions about supply chain resilience and strategic resilience planning. Stakeholders are now placing renewed emphasis on vendor risk assessments and multi-tier supplier visibility, ensuring that potential disruptions can be anticipated and addressed proactively. As the policy environment remains fluid, companies that adopt agile procurement models and cultivate strategic partnerships are better equipped to stabilize operations and capture emerging market opportunities in an era marked by regulatory uncertainty.

Transitioning from trade policy impacts, the following section will explore how market segmentation offers strategic insight into customer preferences and growth drivers

Illuminating the Critical Segmentation Insights Revealing How Type, Technology, Substrate, Ink, Application, and End-Use Industry Shape Market Dynamics

A thorough examination of press configurations such as central impression, in-line, and stack designs reveals distinct competitive advantages and niche applications. Central impression systems, prized for their compact footprint and web tension control, cater to high-quality label production, while in-line configurations offer modular flexibility for integrated converting processes. Stack press architectures, by contrast, excel in cost-efficient web handling for commodity packaging runs. These variances in machinery type underscore how equipment choice directly influences operational workflows and cost-per-unit outcomes.

Delving deeper, the contrast between fully automatic and semi-automatic technologies highlights the trade-off between throughput optimization and capital expenditure. Automatic solutions provide seamless end-to-end production flows, minimizing manual intervention and facilitating high-volume tasks. Semi-automatic systems, while requiring greater operator involvement, deliver more accessible entry points for small- to medium-sized converters seeking balance between performance and investment.

Exploring printable substrates demonstrates a spectrum of requirements, from the lightweight elasticity of foam sheets to the reflective properties of metallic films. Papers remain a universal medium for labels and flexible pouches, whereas polyester and polyethylene films are favored for their moisture resistance and durability. These substrate nuances directly inform ink chemistry choices, whether solvent-based formulations prized for adhesion, UV-curable systems offering rapid curing, or water-based alternatives aligned with stricter environmental standards.

Application-specific demands further refine machinery and ink selections. Labeling operations prioritize resolution and color fidelity, while packaging segments spanning corrugated cardboard and flexible formats emphasize throughput and material compatibility. The end-use industries served by these applications range from food and beverage, where hygiene and compliance are critical, to healthcare and pharmaceuticals, which require traceability. Household and consumer goods converters pursue aesthetic differentiation, logistics operations value durable tagging solutions, and personal care and cosmetics benefit from premium print finishes. Print media also leverages flexography for specialty products. Together, these layered segmentation insights provide a roadmap for strategic equipment investments and product portfolio development.

Transitioning from these segmentation findings, it is essential to examine regional market characteristics that shape global growth patterns

This comprehensive research report categorizes the Flexographic Printing Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Printable Substance

- Ink Type

- Application

- End-Use Industry

Delving into Regional Variations Uncovering How the Americas, Europe Middle East & Africa, and Asia-Pacific Markets Influence Flexographic Printing Growth Patterns

The Americas region exhibits robust demand for advanced flexographic technologies driven by strong consumer packaged goods activity and a growing e-commerce sector requiring dynamic labeling solutions. North American converters are increasingly adopting in-line systems to streamline production, while Latin American markets show rising interest in cost-effective stack presses to address budget constraints. Across these diverse markets, the push for sustainable packaging materials has led to increased uptake of water-based and UV-curable inks, reflecting regional regulatory pressures and corporate environmental commitments.

In Europe, Middle East, and Africa, a complex regulatory tapestry shapes printing equipment procurement and ink selection. European Union directives on chemical safety and waste reduction have catalyzed the transition to low-migration inks for food-contact applications and heightened interest in closed-loop manufacturing processes. Meanwhile, Middle Eastern markets are accelerating infrastructure investments, with converter purchases focused on high-speed central impression presses to support booming consumer goods industries. In Africa, demand remains nascent; however, government-led packaging modernization initiatives are slowly driving interest in semi-automatic press deployments.

The Asia-Pacific landscape stands out for its scale and rapid modernization of printing operations. China, India, and Southeast Asia collectively represent a massive addressable market for both OEMs and component suppliers. Here, price sensitivity drives continued demand for semi-automatic systems, yet the largest converters are swiftly integrating automated and digital inspection capabilities to meet global quality benchmarks. Additionally, regional initiatives in Japan and South Korea around smart manufacturing and Industry 4.0 are pushing the envelope on IoT-enabled press lines that deliver end-to-end traceability and predictive maintenance insights.

This comprehensive research report examines key regions that drive the evolution of the Flexographic Printing Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players and Competitive Innovations Driving Market Leadership and Strategic Partnerships in the Global Flexographic Printing Ecosystem

Leading equipment manufacturers have distinguished themselves through continuous innovation in press architecture and digital integration. Several firms have launched next-generation presses that combine servo-driven registration systems with machine learning-based defect detection, setting new standards for print consistency. Others have formed strategic alliances with ink formulators to co-develop customized chemistries that optimize press performance across a wide substrate range, ensuring that end users can achieve both high quality and regulatory compliance.

Strategic mergers and acquisitions have also played a pivotal role in reshaping the competitive landscape. By acquiring specialized component suppliers and software startups, some market leaders have built comprehensive solutions portfolios that encompass end-to-end production workflows. These integrated offerings not only simplify procurement processes for converters but also create stickier customer relationships by embedding service-level agreements and remote monitoring capabilities.

Furthermore, aftermarket service excellence has emerged as a critical differentiator. Top-tier providers now deliver predictive maintenance packages bundled with 24/7 technical support and spare parts consignment models. This approach reduces equipment downtime and total cost of ownership, reinforcing customer loyalty. As competition intensifies, companies that prioritize collaborative innovation and tailor solutions to regional and application-specific needs will continue to shape the future trajectory of the flexographic printing market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flexographic Printing Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Flexographic Solutions, Inc.

- B&R Flexo Systems GmbH

- BELL-MARK

- BFM S.r.l

- Bobst Group SA

- Comex Group S.p.A.

- Edale Group Ltd.

- Ekofa Flexo Packing Machinery Co., Ltd.

- Erhardt+Leimer GmbH & Co. KG

- Fairprint

- Fuji Machinery Co., Ltd.

- Heidelberger Druckmaschinen AG

- Jiangsu Kunteng Printing Equipment Co., Ltd.

- kete group limited

- Koenig & Bauer AG

- KYMC

- Lohia Corp Limited

- Mark Andy Inc.

- Mark Andy, Inc.

- MPS Systems B.V.

- Nilpeter A/S

- OMET S.r.l

- Omso S.r.l.

- Prakash Machineries Pvt Ltd

- SOMA Engineering s.r.o.

- Taiyo Kikai Co., Ltd.

- Weifang Donghang Machinery Co., Ltd.

- XI’AN Aerospace-Huayang Printing Machinery Co., Ltd.

Implementing Targeted Strategic Actions to Navigate Market Challenges and Capture Growth Opportunities in the Rapidly Evolving Flexographic Printing Sector

Industry leaders must first align technology roadmaps with sustainability objectives by investing in presses compatible with eco-friendly inks and energy recovery systems. Doing so can translate environmental goals into tangible operational improvements and open doors to new markets with stringent regulatory requirements. At the same time, converters should prioritize digital transformation initiatives that leverage data analytics for real-time process optimization and predictive maintenance, thereby reducing downtime and lowering operational costs.

Additionally, organizations would benefit from diversifying supply chains to mitigate risks associated with geopolitical uncertainties and tariff fluctuations. By establishing partnerships with regional component suppliers and considering nearshoring opportunities, businesses can achieve greater supply resilience and faster response times. Simultaneously, developing training programs to upskill machine operators and maintenance personnel will be essential for maximizing the value of advanced press technologies and sustaining workforce engagement.

Lastly, exploring collaborative ventures with packaging designers, brand owners, and material suppliers can foster innovation across the value chain. Co-creation workshops and pilot projects serve as fertile grounds for testing novel substrates, ink systems, and finishing techniques that resonate with evolving consumer preferences. Through such partnerships, industry stakeholders can uncover new value propositions and build differentiated offerings that strengthen market positioning in a highly competitive environment.

Detailing a Rigorous Multi-Method Research Framework Integrating Primary Interviews, Secondary Data, and Triangulation to Ensure Comprehensive Market Insights

This research draws on a hybrid approach, combining in-depth primary interviews with senior executives across equipment manufacturers, converters, ink suppliers, and industry associations. These conversations illuminated strategic priorities, technology adoption barriers, and regional variations in purchasing behavior. Complementing this qualitative input, secondary research encompassed analysis of public financial statements, trade publications, patent filings, and regulatory documents to validate and contextualize emerging trends.

Data triangulation was employed to reconcile insights from multiple sources and enhance the robustness of conclusions. Market participants were surveyed to quantify perceptions of technology performance and pricing dynamics, while select press demonstrations provided hands-on validation of claimed machine capabilities. Additionally, case studies illustrating successful deployments across different application segments offered practical examples of best practices and investment outcomes.

This integrated methodology ensures that the findings reflect both the nuanced realities of on-the-ground operations and the strategic imperatives shaping long-term industry trajectories. By maintaining transparency in data collection and analysis protocols, the research provides a credible foundation for decision-making by stakeholders seeking to navigate the complexities of the flexographic printing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flexographic Printing Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flexographic Printing Machine Market, by Type

- Flexographic Printing Machine Market, by Technology

- Flexographic Printing Machine Market, by Printable Substance

- Flexographic Printing Machine Market, by Ink Type

- Flexographic Printing Machine Market, by Application

- Flexographic Printing Machine Market, by End-Use Industry

- Flexographic Printing Machine Market, by Region

- Flexographic Printing Machine Market, by Group

- Flexographic Printing Machine Market, by Country

- United States Flexographic Printing Machine Market

- China Flexographic Printing Machine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Core Findings and Future Outlook Emphasizing the Strategic Imperatives for Stakeholders in the Expanding Flexographic Printing Landscape

The convergence of automation, digitalization, and sustainability has redefined competitive benchmarks in flexographic printing. Automation-driven process controls and digital inspection systems now represent critical investments for converters aiming to sustain high quality and operational efficiency. Concurrently, the proliferation of eco-friendly ink technologies underscores the industry’s shift toward more sustainable and cost-effective production models, aligning with both regulatory imperatives and corporate social responsibility goals.

Trade policy developments, notably new tariff regimes, have underscored the importance of supply chain resilience and regional diversification. Companies that proactively expanded local manufacturing footprints and forged strategic sourcing partnerships have demonstrated greater stability in cost management and service delivery. Furthermore, segmentation insights reveal that substrate and application-specific requirements demand tailored equipment and ink configurations, reinforcing the value of flexible press platforms that can adapt to evolving market demands.

Looking ahead, the interplay between advanced machine architectures and data-driven decision-making will define the next phase of industry growth. Stakeholders that cultivate cross-industry collaborations and invest in workforce capabilities are best positioned to harness emerging opportunities, particularly in high-growth regional markets and innovative application segments. Ultimately, this research highlights that agility, sustainability, and strategic foresight are the cornerstones of enduring success in the flexographic printing sector.

Secure Your Access to the Comprehensive Flexographic Printing Market Report by Connecting with Ketan Rohom for Strategic Insights and Tailored Recommendations

For organizations seeking to gain a competitive edge in the flexographic printing arena, the full market report offers unparalleled depth and actionable guidance. The comprehensive study delivers detailed analyses of technology trends, tariff impacts, segmentation nuances, regional dynamics, and competitive strategies to support informed decision-making.

To acquire the report and benefit from customized consultation, please reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). With expert insights and tailored recommendations, this engagement will equip your team to capitalize on market opportunities and navigate challenges effectively. Elevate your strategic planning by securing this critical resource today.

- How big is the Flexographic Printing Machine Market?

- What is the Flexographic Printing Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?