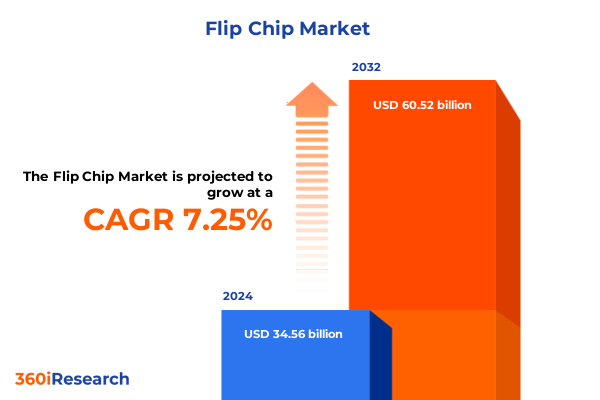

The Flip Chip Market size was estimated at USD 36.90 billion in 2025 and expected to reach USD 39.46 billion in 2026, at a CAGR of 7.32% to reach USD 60.52 billion by 2032.

Revolutionary Breakthroughs in Flip Chip Technology Are Redefining Advanced Semiconductor Packaging for Next-Generation Performance and Miniaturization

The flip chip paradigm has emerged as a pivotal force reshaping the semiconductor packaging domain, ushering in unprecedented levels of performance, miniaturization, and thermal efficiency. By reversing the conventional chip orientation and directly interfacing the die to the substrate, flip chip technology minimizes interconnect lengths, thereby reducing electrical resistance and enhancing signal integrity. This architecture has become indispensable as industries demand ever-faster data processing and more compact form factors. Transitioning from traditional wire-bond approaches, flip chip solutions now underpin critical advances in high-performance computing, mobile devices, and automotive electronics, meeting stringent requirements for power density and reliability.

As global semiconductor roadmaps evolve toward smaller nodes and heterogeneous integration, flip chip applications have broadened beyond central processing units to encompass system-on-chips and advanced memory architectures. This shift has been fueled by innovations such as fine-pitch copper pillar bumping and fan-out wafer-level packaging, which collectively enable greater chiplet density and improved thermal management. Consequently, organizations across sectors-from consumer electronics to defense-are integrating flip chip designs to deliver enhanced system performance in edge AI accelerators, 5G network components, and next-generation sensors. The rise of multi-die interposers further highlights the transformative potential of this technology, poised to redefine the boundaries of semiconductor packaging.

Emerging 5G and AI-Driven Integration Combined with Eco-Friendly Materials Are Shaping the Next Wave of Flip Chip Innovation

Flip chip packaging has endured a dynamic evolution, marked by successive technological leaps and the emergence of new performance benchmarks. The proliferation of 5G infrastructure has accelerated demand for packaging solutions capable of handling high-frequency signals with minimal losses. Flip chip’s inherent short-path interconnects and superior impedance control have rendered it the optimal choice for radio frequency front ends, base station modules, and millimeter-wave transceivers. Concurrently, advanced artificial intelligence workloads have necessitated packaging architectures that efficiently dissipate heat from densely packed die arrays. The advent of 2.5D and 3D integration-with silicon interposers and through-silicon vias-ushers in a new era of chip stacking, enabling massive bandwidth connections within a compact footprint.

Parallel to these performance-driven advances, the emphasis on sustainability has catalyzed the development of lead-free bump alloys and organic substrates designed to lower carbon footprints and facilitate recycling. The transition toward eco-friendly materials dovetails with global regulatory mandates, prompting suppliers to refine processes and reduce hazardous substances. Moreover, the increasing convergence of heterogeneous components-combining processors, memory, and analog sensors-has spurred innovations in substrate materials and bonding techniques to ensure mechanical robustness and signal fidelity. As digital transformation accelerates across automotive, healthcare, and industrial automation sectors, flip chip technology stands at the forefront, offering a versatile foundation for future semiconductor ecosystems.

Comprehensive Analysis of the Economic and Operational Consequences of 2025 U.S. Tariffs on Flip Chip Supply Chains

In early 2025, the United States government extended Section 301 tariffs on imported semiconductors, encompassing flip chip assemblies and related equipment. These measures have triggered a cascade of cost increases across the supply chain, as manufacturers in Taiwan, South Korea, and China adjust pricing to offset duty burdens. An analysis published by the Information Technology and Innovation Foundation estimates that a 25 percent tariff on semiconductor imports would reduce U.S. economic growth by 0.18 percent in the first year, potentially worsening to a 0.76 percent contraction by the tenth year if sustained, culminating in a $1.4 trillion GDP decline over a decade. The direct ramifications for flip chip sourcing manifest in elevated unit costs and extended lead times, compelling OEMs to reevaluate their procurement strategies and inventory buffers.

Furthermore, tariff-induced margin pressures are prompting leading packaging firms to accelerate onshore investments. Companies like Intel and Samsung have announced expansions of domestic wafer bumping and advanced packaging fabs, partly incentivized by the CHIPS and Science Act subsidies. While this shift augments U.S. manufacturing capacity, it also introduces transitional complexities as the ecosystem adapts to new operational footprints. Supply chain diversification has become a strategic imperative, with many stakeholders exploring alternative partners in allied regions and increasing vertical integration to retain cost competitiveness. Ultimately, the cumulative impact of tariffs is reshaping global flip chip networks, underlining the necessity of agile sourcing and flexible manufacturing models to navigate evolving trade landscapes.

In-Depth Exploration of Flip Chip Segmentation Reveals Critical Technology-Application Intersections Driving Market Dynamics

Segmentation analysis uncovers nuanced performance attributes and adoption trends across diverse flip chip technologies. Regarding packaging technology, the shift from conventional 2D configurations toward advanced 2.5D interposers and full 3D IC stacking has accelerated, driven by requirements for ultra-high bandwidth and superior thermal pathways. In bumping technology, copper pillar solutions are increasingly favored over traditional gold and solder bump architectures due to their finer pitch capabilities and improved electrical conductivity. Wafer size segmentation highlights the predominance of 300 mm substrates, balancing cost efficiency and high-volume throughput, while the emergence of 450 mm wafers is monitored for future scaling potential.

Assembly type distinctions reveal that fan-out wafer-level packaging is gaining traction for consumer and IoT devices, whereas flip chip BGA and chip-scale packages remain the mainstay in high-performance computing and automotive applications. When considering solder bump typologies, lead-free formulations align with global sustainability directives, whereas leaded bumps persist in legacy systems requiring proven reliability. Substrate materials, encompassing ceramic, organic boards, and silicon interposers, are selected based on thermal and signal integrity demands. Application segmentation underscores growth in CMOS image sensors and graphics processors, while end-user industries such as automotive electronics and telecommunications drive volume adoption. This holistic segmentation framework illuminates the critical intersections between technology choices and application-specific performance outcomes.

This comprehensive research report categorizes the Flip Chip market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Technology

- Bumping Technology

- Wafer Size

- Assembly Type

- Solder Bump Type

- Substrate Material

- Application

- End-User Industry

Comparative Regional Analysis Highlights Divergent Drivers of Flip Chip Adoption in Americas, EMEA, and Asia-Pacific Markets

Regional disparities in flip chip adoption reflect distinct technology priorities and investment climates. In the Americas, aggressive rollout of electric vehicles and advanced driver-assistance systems has catalyzed demand for flip chip packages tailored to powertrain controllers and sensor modules. Concurrently, substantial R&D funding and incentives under the CHIPS and Science Act have bolstered domestic packaging capabilities, fostering an environment conducive to innovation in interposer and wafer-level processes.

Conversely, the Europe, Middle East & Africa region emphasizes reliability and environmental compliance, with stringent RoHS and REACH regulations guiding material selection and manufacturing practices. Automotive electrification initiatives spearheaded by German OEMs have spurred local partnerships with packaging foundries, ensuring proximity to tier-one integrators. Meanwhile, Asia-Pacific remains the epicenter of flip chip production, dominated by large-scale manufacturing hubs in Taiwan, South Korea, and China. This region benefits from integrated supply networks encompassing wafer fabrication, bumping services, and assembly operations, enabling rapid scale-up for high-volume applications in consumer electronics, telecommunications infrastructure, and emerging AI accelerators.

This comprehensive research report examines key regions that drive the evolution of the Flip Chip market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Partnerships and Capacity Expansions by Leading Flip Chip Suppliers Are Shaping the Competitive Landscape

Major players in the flip chip ecosystem are pursuing strategic investments to secure technological leadership and scale. Leading assembly providers are expanding capacity for copper pillar bumping and fan-out wafer-level packaging to meet growing demand for fine-pitch, high-density interconnects. Equipment suppliers are innovating lithography and inspection tools optimized for sub-micron bump pitches, targeting both legacy and advanced packaging segments.

Key foundries are integrating flip chip capabilities within their 7 nm and 5 nm process nodes, offering turnkey solutions that streamline die-to-substrate assembly. Several tier-one semiconductor companies are collaborating with substrate manufacturers to co-develop tailored interposer materials that enhance thermal dissipation and signal integrity. Consolidation trends have also emerged, as strategic acquisitions bring together complementary expertise in solder materials, underfill compounds, and test-to-packaging services, enabling end-to-end offerings that accelerate time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flip Chip market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Micro Devices, Inc.

- AEMtec GmbH

- AGC Inc.

- ALTER TECHNOLOGY TÜV NORD, S.A.U.

- Amkor Technology, Inc.

- Analog Devices, Inc.

- ASE Technology Holding Co, Ltd.

- AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

- China Resources Microelectronics Limited

- DuPont de Nemours, Inc.

- Fujitsu Limited

- Henkel AG & Co. KGaA

- Heraeus Group

- Honeywell International Inc.

- IBIDEN Co., Ltd.

- Indium Corporation

- Intel Corporation

- JCET Group Co., Ltd.

- JSR Corporation

- KCC Corporation

- KOA Corporation

- Kyocera Corporation

- LG Chem Ltd.

- Merck KGaA

- Microchip Technology Inc.

- Nan Ya PCB Co. Ltd.

- NXP Semiconductors N.V.

- Parker-Hannifin Corporation

- Powertech Technology Inc.

- Samsung Electronics Co., Ltd.

- Shin Etsu Chemical Co., Ltd.

- STMicroelectronics International N.V.

- Sumitomo Chemical Co., Ltd.

- Taiwan Semiconductor Manufacturing Company Limited

- TANAKA PRECIOUS METAL GROUP Co., Ltd.

- Texas Instruments Incorporated

- The Dow Chemical Company

- Tokyo Ohka Kogyo Co., Ltd.

- Toray Industries, Inc.

- Unimicron Technology Corp.

- United Microelectronics Corporation

Proactive Strategies Including R&D Investment Collaboration and Supply Chain Diversification Can Propel Flip Chip Adoption and Mitigate Trade Risks

Industry leaders must adopt a proactive stance to harness flip chip technology as a strategic enabler. Investing in advanced packaging R&D-particularly in heterogeneous multi-die integration and novel substrate materials-can unlock performance gains and differentiate product portfolios. By forging collaborative alliances with equipment vendors, semiconductor designers can co-innovate bumping and inspection solutions that meet evolving fine-pitch requirements.

Moreover, diversifying supply chains across tariff-advantaged regions and strengthening domestic manufacturing partnerships will mitigate trade-related risks. Implementing flexible production models, such as modular foundry services and shared capacity ecosystems, enables rapid throughput adjustments in response to demand fluctuations. Finally, embedding sustainability metrics into process development-through lead-free materials adoption and energy-efficient manufacturing practices-will align operations with global environmental standards, enhancing brand reputation and regulatory compliance.

Robust Mixed-Method Research Featuring Expert Interviews Patent Analytics and Supply Chain Data Underpins Comprehensive Industry Insights

This research integrates both primary and secondary data sources to ensure comprehensive coverage of the flip chip market landscape. Primary insights were obtained through structured interviews with packaging engineers, supply chain executives, and end-user OEMs to validate technology adoption drivers and operational challenges. Secondary research encompassed a thorough review of industry publications, technical whitepapers, and regulatory filings to document material innovations and tariff policy developments.

Quantitative analysis leveraged company financial reports, patent databases, and customs import data to map capacity expansions, technology investments, and trade flow shifts. Qualitative assessments were informed by expert panel discussions and peer-reviewed journal articles, facilitating triangulation of emerging trends such as 3D IC stacking and sustainability initiatives. The methodology emphasizes transparency and reproducibility, documenting all data sources and analytical assumptions to support robust decision-making by market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flip Chip market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flip Chip Market, by Packaging Technology

- Flip Chip Market, by Bumping Technology

- Flip Chip Market, by Wafer Size

- Flip Chip Market, by Assembly Type

- Flip Chip Market, by Solder Bump Type

- Flip Chip Market, by Substrate Material

- Flip Chip Market, by Application

- Flip Chip Market, by End-User Industry

- Flip Chip Market, by Region

- Flip Chip Market, by Group

- Flip Chip Market, by Country

- United States Flip Chip Market

- China Flip Chip Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Conclusive Synthesis on How Flip Chip Packaging Defines Next-Generation Device Performance Miniaturization and Sustainable Integration

Flip chip packaging has transcended its traditional role, emerging as an essential pillar of modern semiconductor ecosystems. Its capacity to enable high-density interconnects, superior thermal dissipation, and compact form factors has fueled its adoption in applications ranging from artificial intelligence accelerators to advanced driver-assistance systems. The confluence of performance demands, sustainability imperatives, and trade policy dynamics underscores the strategic significance of flip chip solutions in navigating an increasingly complex technological landscape.

As 5G deployments expand, AI workloads intensify, and environmental regulations tighten, the flip chip market will continue to evolve, shaped by innovations in interposer materials, bumping chemistries, and assembly processes. Organizations that strategically invest in advanced packaging capabilities, foster collaborative ecosystems, and maintain agile supply chains will secure a decisive advantage. Ultimately, flip chip technology stands poised to redefine semiconductor packaging, driving next-generation device performance and unlocking new frontiers in miniaturization and system integration.

Contact Our Associate Director to Elevate Your Strategic Decisions with the Definitive Flip Chip Market Research Report

Unlock unparalleled insights and seize a competitive edge with our comprehensive flip chip market research report. Connect with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch, to explore how detailed analysis of cutting-edge packaging technologies, tariff impact assessments, and region-specific strategies can inform your strategic decisions. Reach out today to secure your access to this indispensable resource and drive innovation in your organization.

- How big is the Flip Chip Market?

- What is the Flip Chip Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?