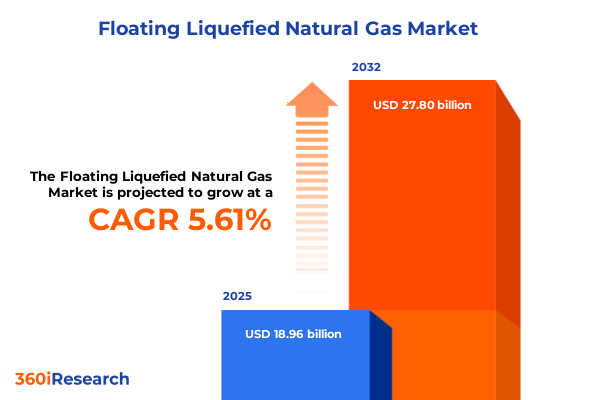

The Floating Liquefied Natural Gas Market size was estimated at USD 18.96 billion in 2025 and expected to reach USD 19.88 billion in 2026, at a CAGR of 5.61% to reach USD 27.80 billion by 2032.

Transforming Global Energy Dynamics with Agile FLNG Platforms to Meet Evolving Demand Patterns and Drive Flexible Offshore Infrastructure Deployment

Floating liquefied natural gas (LNG) has emerged as a pivotal innovation in the global energy sector, bridging the gap between remote natural gas resources and diverse market demands. By leveraging specialized vessels equipped with onboard liquefaction or regasification capabilities, floating LNG platforms overcome the limitations of onshore terminals. This agility offers countries and energy companies an efficient solution to address supply constraints, enhance energy security, and support transitional fuel strategies in the shift toward lower-carbon systems.

The flexibility of floating LNG vessels enables rapid deployment in offshore gas fields, reducing infrastructure lead times and capital intensity associated with traditional land-based projects. These platforms have attracted growing attention from oil majors, independent developers, and utility operators seeking to diversify energy portfolios and mitigate geopolitical risks tied to pipeline dependencies. As global natural gas consumption evolves in response to climate considerations and regional supply-demand imbalances, floating LNG stands at the forefront of a new paradigm for delivering cost-effective, scalable, and resilient energy solutions.

Navigating Disruption in the Floating LNG Sector through Technological Advances and Strategic Market Realignments Driving Industry Transformation

Over the past decade, the floating LNG sector has experienced rapid transformation driven by technological breakthroughs and strategic collaborations. Innovations in mixed refrigerant processes and modular design approaches have enhanced liquefaction efficiency, enabling vessels to process larger volumes of gas with reduced energy intensity. Concurrently, dual mixed refrigerant and single mixed refrigerant cycles have matured, offering operators a choice between optimized performance at varying scales and environmental conditions.

Strategic alliances among marine engineering firms, energy majors, and technology providers have further accelerated capability growth. These partnerships have streamlined vessel construction timelines and facilitated the transfer of advanced materials science solutions for cryogenic containment. Moreover, the integration of digital twin technologies and real-time monitoring systems has improved operational safety and predictive maintenance, reducing downtime and fostering continuous improvement. As a result, the sector is witnessing a shift from pilot-scale deployments to commercially mature projects capable of reshaping global LNG supply chains.

Assessing Comprehensive Impact of 2025 United States Tariffs on Floating LNG Economics Supply Chains and Global Project Viability

In early 2025, the United States government implemented a revised tariff framework on imported LNG equipment and associated components, aiming to protect domestic manufacturing and incentivize local content. While these measures have bolstered the competitiveness of U.S. fabrication yards and cryogenic containment suppliers, they have also introduced upward cost pressures for floating LNG developers that rely on global supply chains. Consequently, project budgets now need to factor in additional import duties on modular plant elements and specialized heat-exchange units.

Despite the initial cost escalation, many stakeholders view the tariffs as a catalyst for reshoring advanced manufacturing capabilities. Domestic shipyards and process skid fabricators are capturing increased order volumes, and investments in automation and workforce training are on the rise. Over the medium term, these shifts may yield supply chain resilience and lower logistical complexity. However, in the interim, developers must navigate lead-time extensions and potential tariff exemptions, applying robust procurement strategies to manage price volatility and maintain financial viability.

Unveiling Deep Market Segmentation Insights across FLNG Vessel Types Containment Systems Technologies and Application Verticals

Floating LNG market segmentation provides critical insights into how varied technologies and vessel configurations meet distinct operational requirements. Containment options, namely membrane and Moss systems, offer trade-offs between cargo capacity, capital cost, and maintenance complexity. Operators selecting membrane designs benefit from incremental storage efficiency, whereas Moss spherical tanks deliver proven reliability under challenging sea conditions. Within vessel typologies, full liquefaction vessels (FLNG), regasification units (FSRU), and storage-only ships (FSU) serve discrete end-use cases, from upstream field development to downstream distribution and strategic storage.

Technological segmentation reveals the significance of liquefaction cycles. C3MR units provide a balanced footprint for medium-scale projects, while propane precooled mixed refrigerant solutions cater to larger throughput requirements with energy intensity optimizations. Further nuances between dual mixed refrigerant and single mixed refrigerant systems influence capital expenditure allocations and operational flexibility. Application-based differentiation spans industrial process feedstock, baseload power generation, marine fuel supply, and peak shaving for gas networks. Storage capacities range from compact up to 100 thousand cubic meters for niche markets to above 180 thousand cubic meters for large-scale export platforms, aligning with project scale and commercial models. Finally, end users-industrial manufacturing, petrochemical complexes, transportation fuels, and utility providers-drive tailored design parameters. Operational status categories, including fully operational, planned developments, and under construction, illustrate the growth trajectory and deployment pipeline for the sector.

This comprehensive research report categorizes the Floating Liquefied Natural Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Containment System

- Vessel Type

- Technology

- Storage Capacity

- Operational Status

- Application

- End User

Examining Regional Dynamics in Americas EMEA and Asia Pacific Shaping Future Trajectory of Floating LNG Market Growth and Partnerships

Regional dynamics in the floating LNG landscape underscore the interplay of resource endowments, regulatory frameworks, and strategic partnerships. Across the Americas, significant offshore discoveries and infrastructure investments in the U.S. Gulf of Mexico and Eastern Caribbean have elevated the region’s profile as both a production hub and a market for FSRU-based regasification. This growth is supported by evolving environmental regulations and private-sector commitments to expand natural gas access as a transition fuel.

In Europe, the Middle East, and Africa, government policies promoting energy diversification are catalyzing FSU and FSRU deployments along the Mediterranean corridor and Western Africa. Robust demand in Southern Europe and the Gulf Cooperation Council states has prompted joint ventures between national oil companies and international operators. These collaborations focus on optimizing supply chain logistics and leveraging existing port infrastructure. Conversely, Asia-Pacific markets remain the largest importers of LNG, driving FLNG vessel construction for offshore gas fields in regions like Australia, Southeast Asia, and East Africa. Strategic investments in vessel fleets and long-term offtake agreements underscore the region’s reliance on floating solutions to enhance energy security and decarbonization goals.

This comprehensive research report examines key regions that drive the evolution of the Floating Liquefied Natural Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Strategic Players and Collaborative Ecosystem Dynamics Driving Innovation and Competitive Positioning in the Floating LNG Industry

The floating LNG sector is shaped by a core group of industry leaders that combine marine expertise with process engineering prowess. These companies drive vessel innovation through proprietary cryogenic containment solutions and modular fabrication capabilities. Their strategic positioning spans the full project lifecycle, from front-end engineering design to long-term operations, enabling seamless integration of emerging technologies. Collaboration between established shipbuilders and specialized licensors has produced next-generation FLNG and FSRU platforms characterized by reduced emissions and enhanced uptime.

Investments in research and development have become a defining characteristic of market incumbents, fostering a competitive environment where technological differentiation hinges on energy efficiency and digital integration. Partnerships with software providers for real-time analytics and condition-based maintenance are increasingly common, reflecting a shift toward data-driven asset management. Moreover, alliances between maritime financiers and vessel operators are unlocking flexible financing models, enabling joint ventures and strategic equity placements that de-risk large capital projects. As smaller innovators enter the space with disruptive concepts, the industry’s competitive landscape is expanding to include consortiums that blend academic research with commercial commercialization pathways.

This comprehensive research report delivers an in-depth overview of the principal market players in the Floating Liquefied Natural Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bechtel Corporation

- BW Group

- Chevron Corporation

- Chiyoda Corporation

- CNOOC

- Eni S.p.A.

- Excelerate Energy Inc.

- Exmar NV

- Exxon Mobil Corporation

- Golar LNG Limited

- Hyundai Heavy Industries Holdings Co. Ltd.

- Höegh LNG

- KBR Inc.

- Mitsubishi Heavy Industries Ltd.

- Mitsui O.S.K. Lines Ltd.

- MODEC Inc.

- New Fortress Energy

- Petronas

- QatarEnergy LNG

- Saipem S.p.A.

- Samsung Heavy Industries Co. Ltd.

- Shell plc

- Technip Energies N.V.

- TotalEnergies SE

- Woodside Energy Group

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Floating LNG Landscape

To capitalize on the evolving floating LNG ecosystem, industry leaders should prioritize investment in modular design standardization to accelerate project delivery and reduce engineering costs. Emphasizing dual mixed refrigerant technologies offers a path to optimize energy consumption and LNG throughput, particularly for medium-scale offshore fields. Simultaneously, executives must cultivate strategic partnerships with regional infrastructure providers, aligning vessel deployment with existing port and pipeline networks to minimize logistical friction.

Furthermore, organizations should develop comprehensive tariff mitigation plans by engaging with policymakers to secure duty exemptions for critical equipment and by establishing local fabrication hubs where feasible. Operational excellence initiatives, including the adoption of digital twin frameworks and advanced condition monitoring, will enhance safety and uptime, delivering tangible returns on investment. Lastly, leadership teams must integrate sustainability metrics into decision-making processes, leveraging carbon capture and renewable integration opportunities to future-proof assets against tightening emissions regulations.

Demystifying Research Methodology for Floating LNG Market Analysis Ensuring Rigorous Data Collection Validation and Analytical Transparency

The research methodology underpinning this analysis integrates qualitative and quantitative data collection techniques to ensure comprehensive coverage of the floating LNG sector. Primary research involved in-depth interviews with senior executives from vessel operators, licensors, and engineering contractors, as well as consultations with regulatory agencies and port authorities. These insights were triangulated with secondary sources, including industry journals, technical papers, and publicly disclosed project documentation, to validate emerging trends and technology evaluations.

Quantitative data were obtained through a structured database of global FLNG, FSRU, and FSU projects, categorized by containment system, vessel type, technology cycle, application segment, storage capacity, end-user profile, and operational status. Data validation processes included cross-referencing proprietary vessel tracking dashboards with developer press releases and third-party industry reports. Analytical frameworks such as SWOT assessment, Porter's Five Forces, and value chain mapping were applied to synthesize strategic insights. Rigorous peer review and fact-checking steps ensured the accuracy and study’s integrity, while ongoing updates to the database maintain relevance amid dynamic market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Floating Liquefied Natural Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Floating Liquefied Natural Gas Market, by Containment System

- Floating Liquefied Natural Gas Market, by Vessel Type

- Floating Liquefied Natural Gas Market, by Technology

- Floating Liquefied Natural Gas Market, by Storage Capacity

- Floating Liquefied Natural Gas Market, by Operational Status

- Floating Liquefied Natural Gas Market, by Application

- Floating Liquefied Natural Gas Market, by End User

- Floating Liquefied Natural Gas Market, by Region

- Floating Liquefied Natural Gas Market, by Group

- Floating Liquefied Natural Gas Market, by Country

- United States Floating Liquefied Natural Gas Market

- China Floating Liquefied Natural Gas Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Concluding Perspectives on Floating LNG Evolution Highlighting Strategic Imperatives and Pathways for Sustainable Offshore Energy Solutions

The evolution of the floating LNG sector reflects a broader transformation in the global energy landscape toward flexible, scalable, and lower-carbon solutions. Technological progress, strategic collaborations, and shifting regulatory environments have converged to position floating LNG as a critical component of future supply chains. As the market matures, stakeholders who leverage modular designs, advanced liquefaction cycles, and digital operational frameworks will gain competitive advantage.

Looking ahead, the balance between cost optimization and sustainability imperatives will define the next wave of growth. Organizations that adopt integrated project delivery models, foster innovation through cross-industry partnerships, and proactively engage with policy developments will be best equipped to navigate tariff headwinds and regional intricacies. Ultimately, floating LNG offers a unique value proposition for meeting energy needs, mitigating infrastructure bottlenecks, and supporting the transition toward cleaner fuels, reinforcing its strategic importance in the decades to come.

Engage with Ketan Rohom to Access In-Depth Floating LNG Market Research Reports and Secure Strategic Insights for Transformative Decisions

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock exclusive access to our comprehensive floating LNG market research report. Engaging directly with Ketan provides you with tailored insights, personalized guidance, and an opportunity to discuss how the report’s findings align with your strategic priorities. His expertise in vessel technologies, global regional dynamics, and emerging tariff implications will ensure you extract maximum value from our analysis.

Reach out to arrange a consultation call, request the full report, or explore customized data packages that suit your organizational objectives. By partnering with Ketan, you can fast-track your decision-making processes, proactively address regulatory shifts, and position your business for long-term growth in the dynamic floating LNG sector. Take the first step towards informed strategic action today.

- How big is the Floating Liquefied Natural Gas Market?

- What is the Floating Liquefied Natural Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?