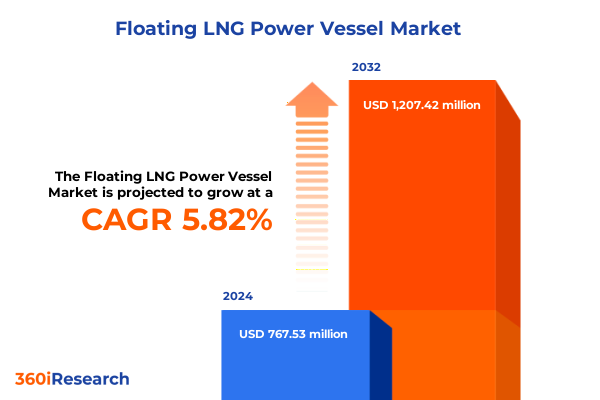

The Floating LNG Power Vessel Market size was estimated at USD 811.49 million in 2025 and expected to reach USD 859.42 million in 2026, at a CAGR of 5.84% to reach USD 1,207.41 million by 2032.

Charting the Strategic Emergence of Floating LNG Power Vessels as Flexible Maritime Solutions for Contemporary Off-grid and Supplementary Energy Demands

The maritime energy sector has witnessed a paradigm shift as floating liquefied natural gas (LNG) power vessels emerge as versatile platforms for addressing remote, off-grid, and supplementary power demands. Unlike traditional land-based plants, these vessels deliver high-efficiency gas-to-electricity conversion with minimal environmental footprint, leveraging the inherent mobility and modularity of marine assets. Stakeholders across oil and gas operations, utilities, and government entities are increasingly drawn to floating LNG power vessels due to their rapid deployment timelines, reduced capital expenditure on civil works, and the capacity to leverage existing LNG infrastructure at port terminals.

As global energy markets confront volatility, regulatory tightening on carbon emissions, and the need to electrify offshore drilling rigs and isolated industrial hubs, floating LNG power vessels offer a strategic bridge between conventional generation and renewables integration. Their dual-role capabilities enable operators to serve high-demand offshore drilling platforms while repositioning rapidly to support onshore grids facing peak load surges or temporary generation shortfalls. This emerging class of maritime infrastructure combines proven gas turbine and dual-fuel engine technologies with hull designs optimized for stability and safety in harsh environments. By synthesizing operational flexibility, environmental compliance, and cost-efficiency, floating LNG power vessels are reshaping the economics of remote electrification and reinforcing energy security in frontier markets.

Examining the Paradigm-shifting Technological Innovations and Market Drivers Reshaping the Landscape of Floating LNG Power Vessels in the Energy Sector

The floating LNG power vessel landscape is undergoing transformative shifts driven by advancements in propulsion technologies, digital integration, and evolving regulatory frameworks. Innovations in dual fuel engines now support seamless transition between liquid and gaseous fuels under varying load conditions, drastically improving fuel efficiency and reducing methane slip. Concurrently, next-generation gas turbine models feature enhanced combustion systems that minimize nitrogen oxide emissions, aligning vessel operations with tightening environmental standards in multiple jurisdictions. Digital twins and remote monitoring platforms have also become integral, enabling real-time performance optimization, predictive maintenance, and remote troubleshooting by shore-based operations centers.

Meanwhile, the market is shaped by the confluence of competing drivers: the decarbonization mandates of major economies, the pursuit of energy independence by island nations, and the increasing electrification of offshore oil and gas assets. Financing structures are adapting as well, with project sponsors offering innovative contracting mechanisms that share performance risks and align incentives across vessel owners, charterers, and end users. The emergence of hybrid renewable integration solutions-such as onboard solar arrays and battery energy storage systems-has positioned floating power vessels as part of broader microgrid strategies. These technological and market-driven shifts collectively redefine the role of floating LNG power, transforming it from stopgap generation into a strategic asset class for resilient, low-carbon energy systems.

Assessing the Cumulative Economic and Operational Implications of United States Tariffs on Floating LNG Power Vessel Deployment through 2025

Since the imposition of renewed United States tariffs on key maritime equipment and steel imports in early 2025, stakeholders in the floating LNG power vessel market have faced escalating procurement costs and extended lead times for specialized components. These cumulative duties, introduced under both Section 232 and Section 301 frameworks, have specifically targeted pressure vessels, turbines, and imported steel grades, resulting in a 12 to 15 percent increase in overall fabrication expenditures. The compounding effect of layered tariffs has also influenced the global supply chain, as shipyards headquartered in South Korea and China recalibrated sourcing strategies to offset additional duties, often passing costs downstream to vessel owners and charterers.

Operational budgets for floating power projects have been repriced to account for tariff-driven capital uplift, prompting many project developers to explore domestic manufacturing alliances and localized assembly hubs. While this approach has partially mitigated tariff exposure, it has introduced complexity in quality assurance and logistics. Furthermore, long-term contractual agreements have been renegotiated to incorporate escalation clauses specific to tariff fluctuations, ensuring that project stakeholders share the risk of future policy shifts. As a result, procurement timelines have extended by an average of eight to ten weeks for tariff-impacted components, necessitating more robust project planning and contingency allocations. In sum, the cumulative impact of US tariffs through 2025 has compelled the industry to adopt more adaptable sourcing models, refine contractual terms, and deepen collaboration between shipbuilders and technology vendors to sustain project viability.

Uncovering Targeted Growth Prospects through Propulsion Capacity Application End Use Contractual Models and End User Segmentation for Floating LNG Power Vessels

In dissecting the floating LNG power vessel market through the lens of propulsion system, it becomes clear that dual fuel engines are gaining prominence for their operational flexibility, enabling seamless switching between natural gas and liquid fuels under variable load profiles, whereas traditional steam turbines remain valued for their reliability in continuous high-capacity applications. Gas turbines continue to strike a balance, offering rapid ramp-up times that are critical for peak load support. Capacity segmentation reveals distinct use cases: vessels below 100 megawatts excel in supporting isolated offshore drilling platforms or small island networks, capacity bands between 100 and 200 megawatts cater to medium-sized industrial parks and urban microgrids, and power ships exceeding 200 megawatts are prioritized for large-scale utility substitution or regional grid stabilization projects.

Application-driven demand is equally nuanced. Offshore drilling power vessels navigate complex regulatory waters and environmental scrutiny to ensure uninterrupted energy supply to deepwater rigs, while onshore supplementary units back-fill grid shortfalls during maintenance outages or seasonal peak demand. Remote area electrification has emerged as a high-impact use case in frontier markets, leveraging vessel mobility to address critical infrastructure gaps. When viewed through the end-use prism, industrial power consumers prioritize baseload reliability and contractual certainty, residential power off-takers focus on price stability and environmental performance, and utility power companies integrate floating units into broader capacity portfolios. Contractual models range from long-term power purchase agreements that underpin project financing to short-term contracts and spot charters that deliver high flexibility but require dynamic pricing mechanisms. Lastly, end users spanning government entities, industrial conglomerates, oil and gas operators, and utility providers each present tailored procurement criteria, shaping vessel design, service offerings, and financing structures in this highly segmented market.

This comprehensive research report categorizes the Floating LNG Power Vessel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion System

- Capacity

- Contract Type

- Application

- End User

Analyzing Regional Dynamics and Investment Ecosystems across the Americas Europe Middle East Africa and Asia Pacific for Floating LNG Power Vessel Adoption

Regional market trajectories for floating LNG power vessels exhibit significant variation driven by local energy policies, infrastructure readiness, and capital availability. In the Americas, the United States and Brazil lead adoption efforts, leveraging extensive offshore oil and gas platforms and sprouting onshore grid support projects along coastal regions. Incentive mechanisms in select Latin American countries are also catalyzing remote area electrification, harnessing vessel redeployment to islands and riverine communities with limited grid connectivity. Financial structures in North America often involve public-private partnerships that share risk among federal agencies, utilities, and vessel operators, streamlining regulatory approvals and reducing capital hurdles.

Europe, the Middle East, and Africa present a diverse mosaic of opportunities. In Europe, strict decarbonization targets have driven innovation in low-emission vessel designs, while North African markets benefit from proximate LNG import terminals and growing industrial demand. The Middle East’s deepwater hydrocarbon operations and ambitious renewable energy agendas make floating power vessels an attractive transitional solution. Across these regions, regulatory alignment with environmental directives and streamlined permitting processes are critical success factors. Meanwhile, Asia-Pacific stands at the forefront of vessel deployment, with major LNG importers such as Japan, South Korea, and India integrating floating plants into national energy strategies. Southeast Asia’s archipelagic geography accelerates demand for mobile power solutions, and China’s growing shipbuilding capacity offers competitive vessel construction options. Overall, regional distinctions in market maturity, regulatory frameworks, and financing models underscore the need for customized go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Floating LNG Power Vessel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Operators and Engineering Providers Shaping the Competitive Landscape of Floating LNG Power Vessels with Strategic Alliances and Differentiation

The competitive arena for floating LNG power vessels is shaped by a mix of established maritime engineering firms, energy conglomerates, and specialized technology providers. Leading shipyards have forged partnerships with turbine and engine manufacturers to deliver integrated solutions that blend hull design, propulsion systems, and emissions controls. Strategic alliances with infrastructure developers and chartering companies further differentiate offerings, allowing some vendors to provide turnkey power-as-a-service models. In parallel, energy technology companies are refining combustion systems, adding modular battery storage, and developing digital platform services to optimize asset performance and reduce operational expenditure.

Amidst this competitive tapestry, select operators have secured early-mover advantages through pioneering project deployments, setting benchmarks for vessel reliability and interface management with grid operators. Others have distinguished themselves by offering flexible contracting frameworks that align vessel utilization with off-take profiles, thereby minimizing stranded asset risk for end users. A small cohort of engineering specialists focuses on customization, addressing niche operational challenges such as arctic conditions or ultra-low temperature performance. Meanwhile, financing partners are emerging as crucial enablers, structuring project debt and equity tranches that reflect the unique cash flow profiles of floating power projects. Ultimately, this intricate interplay among shipbuilders, technology providers, operators, and financiers defines an increasingly sophisticated competitive landscape that continuously raises the bar for technical innovation and commercial agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Floating LNG Power Vessel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BW LNG Ltd

- Exmar NV

- Flex LNG Ltd

- Golar LNG Limited

- Höegh LNG Holdings Ltd

- Modec, Inc. by MITSUI E&S Co., Ltd.

- New Fortress Energy Inc

- Power Barge Corporation

- Samsung Heavy Industries Co., Ltd.

- SBM Offshore N.V.

- Shell plc

- Siemens AG

- Waller Marine Inc.

- Wison Group

- Wärtsilä Corporation

- Yinson Holdings Berhad

Outlining Actionable Strategies for Industry Leaders to Capitalize on Technological Advances Regulatory Shifts and Market Opportunities in Floating LNG Power Vessels

To capitalize on the opportunities presented by floating LNG power vessels, industry leaders must adopt integrated strategies that span technology optimization, risk management, and stakeholder alignment. Prioritizing investment in dual fuel and high-efficiency gas turbine platforms will enable operators to deliver enhanced fuel flexibility and lower emissions profiles, positioning them favorably amid tightening environmental regulations. Establishing collaborative supply chain partnerships with regional shipyards and equipment manufacturers can mitigate the financial impact of tariffs and lead-time variability, while joint ventures with local utilities or government bodies can streamline permitting and reduce entry barriers.

Moreover, embracing digitalization through advanced monitoring systems and predictive analytics will optimize vessel availability, reduce unplanned downtime, and support performance-based contracting models. Organizations should design flexible commercial frameworks, balancing long-term power purchase agreements for revenue certainty with spot and short-term contracts that capture premium rates during peak demand periods. Engaging end users early in the project lifecycle and co-creating service-level agreements tailored to specific operational requirements can further strengthen market positioning. Finally, leadership teams should conduct scenario planning around tariff policy evolution and geopolitical risks, ensuring robust financial modelling and contingency reserves. By executing these actionable recommendations, industry stakeholders can deliver competitive, resilient, and sustainable floating LNG power solutions.

Detailing the Rigorous Multi-dimensional Research Methodology Employed to Illuminate Market Trends Technology Assessments and Geopolitical Influences on Floating LNG Power Vessels

This analysis draws on a rigorous research methodology designed to capture the multifaceted dynamics of the floating LNG power vessel market. Primary research included in-depth interviews with vessel operators, shipyard engineers, equipment manufacturers, and regulatory experts across key geographical markets. These qualitative insights were supplemented by secondary data collection from public filings, industry white papers, technical journals, and government reports. Quantitative analysis involved compiling tariff schedules, equipment cost databases, and vessel deployment records to model the financial and operational impacts of policy changes and technological adoption rates.

Advanced analytical frameworks such as Porter’s Five Forces and PESTEL assessments provided structured evaluation of competitive intensity and macro-environmental factors. Segmentation matrices were constructed to assess performance differentials by propulsion system, capacity band, application, end use, contract type, and end user category. Regional market models incorporated regulatory timelines, strategic incentives, and LNG terminal capacities to forecast deployment hotspots. Finally, scenario analysis was applied to stress-test assumptions around tariff adjustments, fuel price volatility, and demand fluctuations. Throughout the research process, data triangulation and expert validation ensured the robustness of findings, while continuous peer review maintained methodological integrity and mitigated bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Floating LNG Power Vessel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Floating LNG Power Vessel Market, by Propulsion System

- Floating LNG Power Vessel Market, by Capacity

- Floating LNG Power Vessel Market, by Contract Type

- Floating LNG Power Vessel Market, by Application

- Floating LNG Power Vessel Market, by End User

- Floating LNG Power Vessel Market, by Region

- Floating LNG Power Vessel Market, by Group

- Floating LNG Power Vessel Market, by Country

- United States Floating LNG Power Vessel Market

- China Floating LNG Power Vessel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Takeaways and Strategic Insights to Reinforce the Value Proposition and Future Trajectory of Floating LNG Power Vessels in Global Energy Infrastructure

In synthesizing the key insights from this study, it is evident that floating LNG power vessels have transcended their initial role as temporary energy stopgaps to become strategic assets in global energy infrastructure. Technological advancements in dual fuel engines, gas turbines, and digital integration underpin a new era of mobile, low-emission power generation capable of addressing the complexities of offshore operations and remote electrification. The cumulative impact of United States tariffs through 2025 has prompted the industry to refine sourcing strategies and contractual models, fostering greater resilience in supply chains and project financing arrangements.

Segmentation and regional analyses reveal clear pathways for targeted deployment, whether through small-scale vessels powering isolated drilling platforms in Africa, mid-capacity units stabilizing urban grids in Latin America, or large-scale installations supporting energy transition mandates in Asia-Pacific. Competitive landscapes are shaped by strategic alliances among shipbuilders, technology providers, and financiers, while actionable recommendations highlight the importance of digitalization, partnership ecosystems, and flexible contracting to navigate evolving market conditions. By adhering to a transparent research methodology and embracing data-driven decision frameworks, stakeholders can unlock new value propositions and refine long-term strategies. Overall, floating LNG power vessels stand poised to bridge critical energy gaps, enhance grid resilience, and advance decarbonization objectives across diverse markets.

Engaging Decision Makers with a Persuasive Invitation to Connect with Ketan Rohom to Secure Comprehensive Floating LNG Power Vessel Market Intelligence Report

To unlock the full potential of floating LNG power vessels for your organization’s strategic energy needs, reach out to Ketan Rohom, Associate Director Sales & Marketing. With deep domain expertise and tailored insights, Ketan can guide you through our comprehensive market intelligence report that illuminates critical trends, tariff analyses, and technological innovations shaping the future of maritime power generation. Engage directly to explore customized data packages, discuss specific vessel configurations, and receive exclusive early access to our latest findings. Elevate your decision-making with actionable intelligence and position your enterprise at the forefront of floating LNG power adoption by connecting with Ketan today

- How big is the Floating LNG Power Vessel Market?

- What is the Floating LNG Power Vessel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?